Are you navigating the complexities of a beneficiary trust distribution request? Understanding how to communicate effectively in such situations is crucial for ensuring clarity and smooth processing. Whether you're a beneficiary eager to access your rightful distributions or a trustee aiming to fulfill your obligations, crafting the right letter can make all the difference. Join us as we explore essential tips and a well-structured template to help you draft the perfect request letter!

Trustee contact information

Beneficiary trust distribution requests require precise communication regarding the distribution of assets to beneficiaries. The trustee's contact information, including the name of the trustee, mailing address, email address, and phone number, should be clearly stated. Essential beneficiary details, such as the name, Social Security number, and designated share amount, must accompany the request to facilitate a smooth distribution process. Legal documents, including the trust agreement and any necessary identification, should be attached to substantiate the request and ensure compliance with applicable laws. Keeping records of all correspondence is vital for transparency and accountability in the administration of the trust.

Beneficiary contact details

A beneficiary trust distribution request requires clear identification of the beneficiary to ensure accurate and timely processing. Essential details include the beneficiary's full name, physical address (street name, city, state, postal code), and contact number (including country code and area code). It is also beneficial to include an email address for electronic communication. Trust documentation, such as the trust name and date of establishment, should accompany the request to confirm the beneficiary's entitlement. Accurate and complete information streamlines the distribution process and helps avoid potential delays or miscommunication.

Trust account and reference number

Beneficiary trust distribution requests require precise information to ensure proper processing. The trust account number linked to the beneficiary, such as Account Number 12345-678, along with the reference number specific to the distribution request, like Ref #ABCD-9876, is crucial for identification and accuracy. Trust distributions may involve details related to the amount requested, the purpose of the distribution, any applicable tax implications, and specific instructions or documentation required, which may vary based on the trust agreement or state regulations. Beneficiaries must typically provide personal identification details and signature for verification purposes, ensuring that the trust administrators can process requests in accordance with the governing trust documents.

Detailed distribution request

Beneficiary trust distributions require precise documentation to ensure compliance and accuracy. The request should clearly outline beneficiary details, including full names, identification numbers, and current addresses. State the specific trust name, identifier (such as Tax Identification Number), and the total trust value in question. Describe the items requested for distribution, allocating exact amounts or percentages designated for each beneficiary. Include relevant dates, such as the establishment of the trust and the distribution timeline. Attach necessary documents, like trust agreements and financial statements, to support the request. Legal provisions governing trust distributions should also be noted, ensuring all regulations are adhered to during the disbursement process.

Legal and financial compliance acknowledgement

A beneficiary trust distribution request involves detailed legal and financial compliance acknowledgment, ensuring transparency and adherence to fiduciary responsibilities. Documentation must include specific trust identifiers, such as the trust name and date established, alongside the legal names and contact information of all beneficiaries involved. Accurate account statements reflecting the trust's financial status, including asset valuations and distributions made within the past fiscal year, should be attached for clarity. Legal compliance focuses on adherence to state laws governing trust distributions, ensuring that all distributions align with the terms set forth in the trust agreement. Beneficiaries must provide signed acknowledgments confirming understanding of the distribution terms and any potential tax implications associated with their receipt of funds. This process fosters accountability and protects the financial interests of all parties involved.

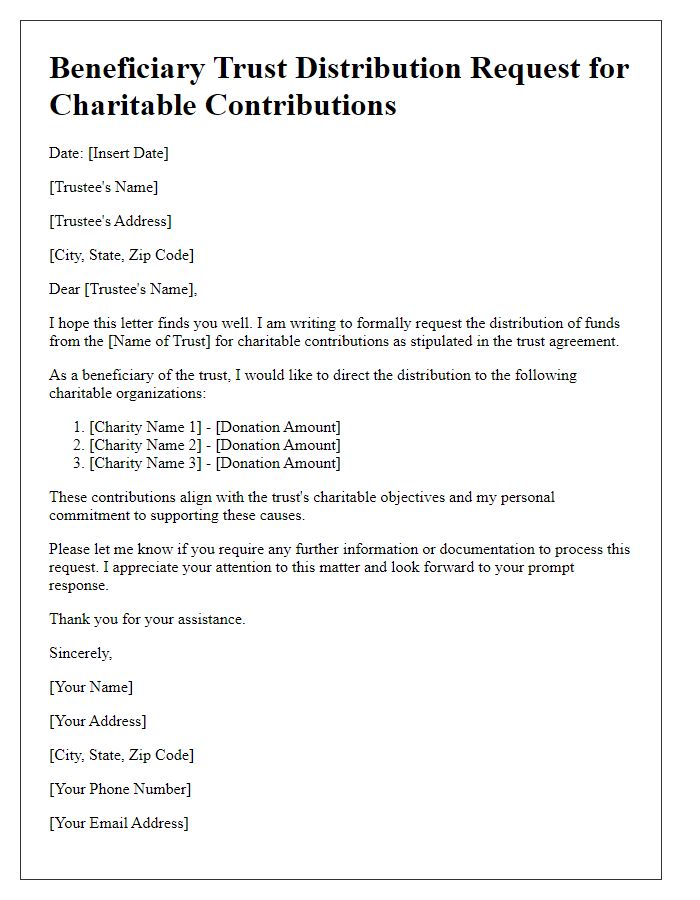

Letter Template For Beneficiary Trust Distribution Request Samples

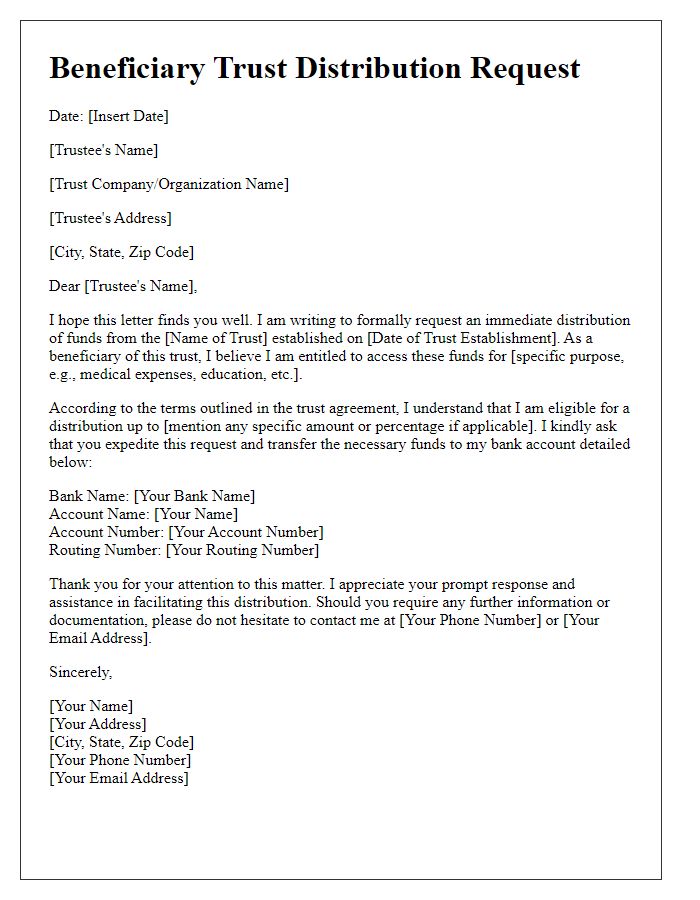

Letter template of beneficiary trust distribution request for immediate funds.

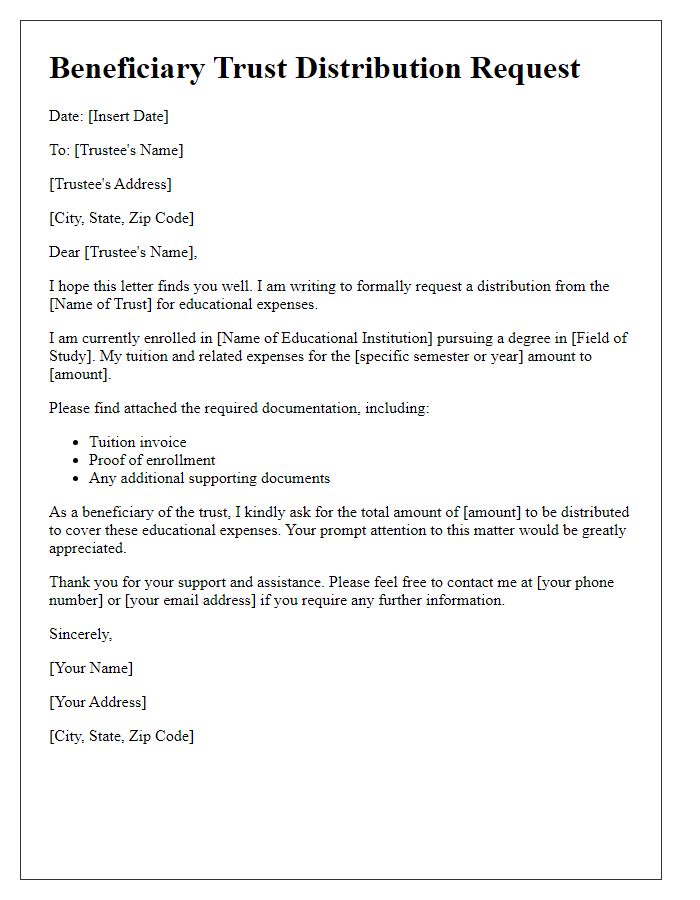

Letter template of beneficiary trust distribution request for educational expenses.

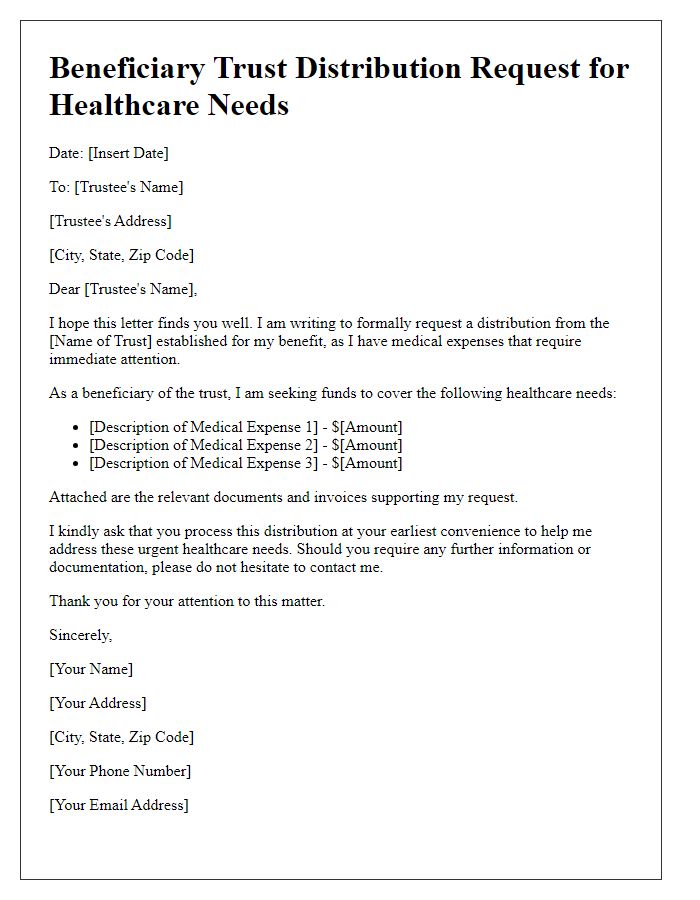

Letter template of beneficiary trust distribution request for healthcare needs.

Letter template of beneficiary trust distribution request for home repairs.

Letter template of beneficiary trust distribution request for investment opportunities.

Letter template of beneficiary trust distribution request for debt repayment.

Letter template of beneficiary trust distribution request for personal emergencies.

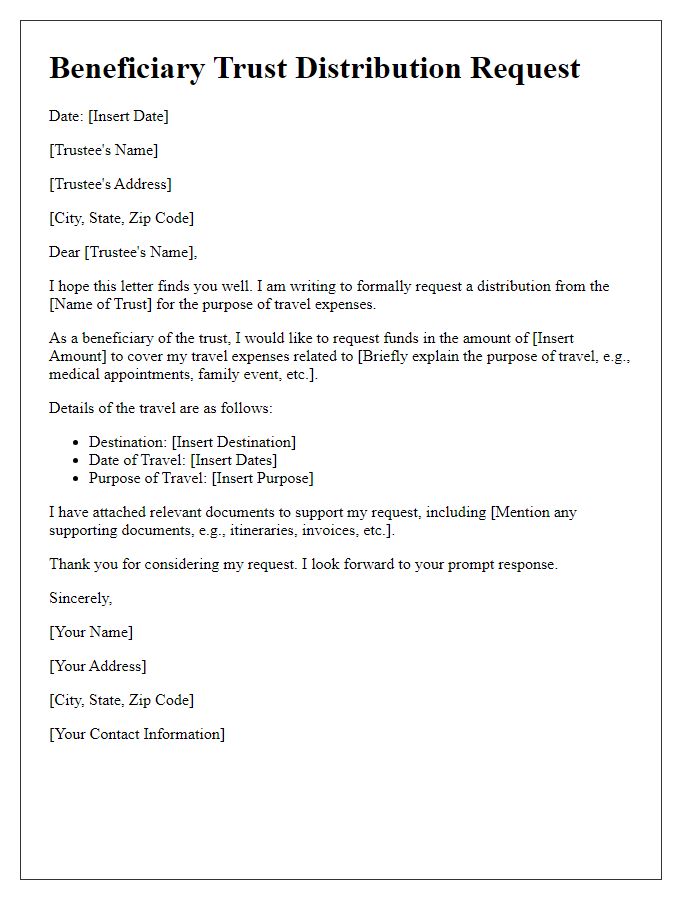

Letter template of beneficiary trust distribution request for travel expenses.

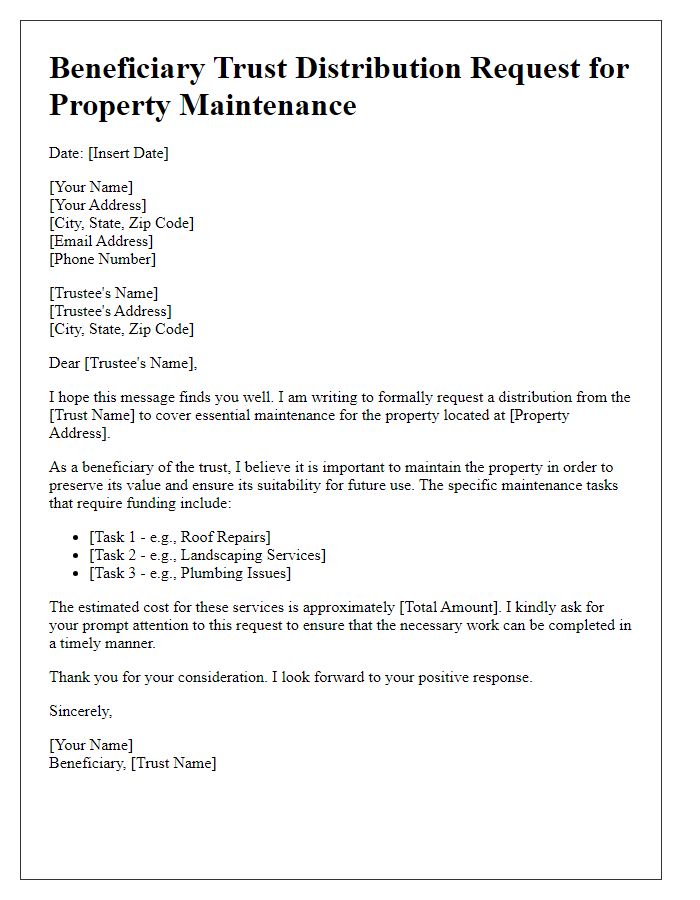

Letter template of beneficiary trust distribution request for property maintenance.

Comments