Are you grappling with the complexities of beneficiary tax liability? Understanding the implications for estates and inheritances can often feel overwhelming. Whether you're a beneficiary trying to navigate your responsibilities or an estate planner looking for clarity, it's essential to grasp the nuances that influence tax outcomes. Join us as we delve deeper into this important topic and unravel the finer details!

Clear identification of all parties involved

In a recent analysis of beneficiary tax liability, clarity on all parties involved is crucial. The primary parties include the grantor (the individual or entity that creates the trust), the beneficiaries (those who receive assets or income from the trust), and the trustee (the person or institution responsible for managing the trust's assets). Specific tax implications arise for the beneficiaries, who must report any income received on their personal tax returns as per IRS regulations. Understanding the distinctions between different types of trusts, such as revocable versus irrevocable, significantly impacts tax liability for both grantors and beneficiaries. Furthermore, regional tax laws within jurisdictions like California or New York can lead to variations in liability. Accurate identification and open communication among all parties ensure compliance with tax obligations and mitigate potential disputes.

Comprehensive breakdown of tax obligations

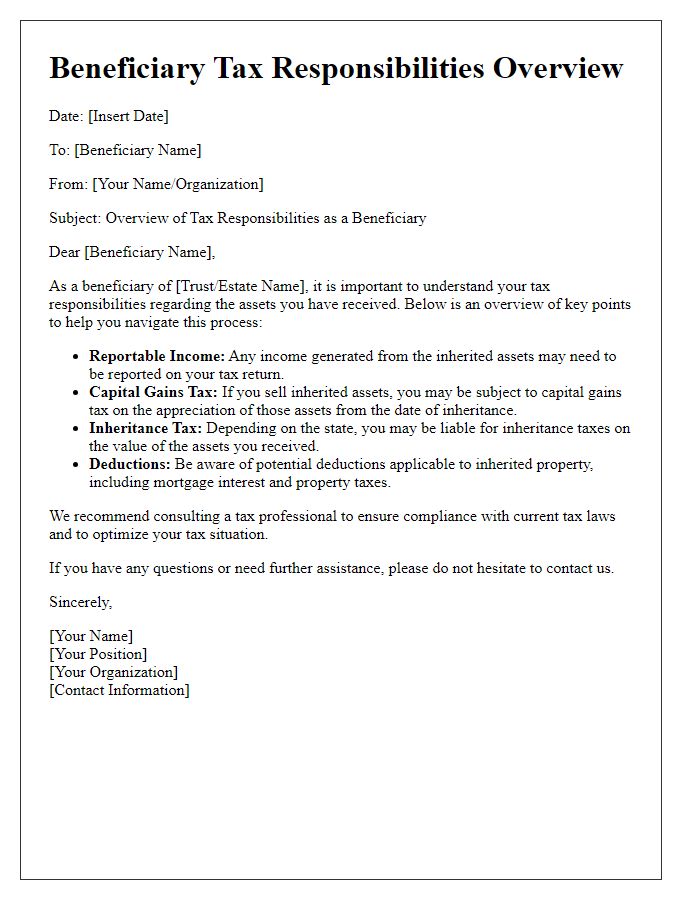

Beneficiary tax liability encompasses various obligations that individuals must adhere to after receiving inheritance or financial gifts, specifically in relation to estate taxes and income generated from the inherited assets. In the United States, the Internal Revenue Service (IRS) requires beneficiaries to understand potential federal estate tax thresholds, currently set at $12.06 million (as of 2022), where estates exceeding this value must file Form 706. Additionally, if the inherited assets include income-generating properties such as real estate or stocks, beneficiaries may face capital gains tax when these assets are sold, which could reach up to 20% for high-income earners. Lastly, certain states impose their own estate or inheritance taxes; for example, New Jersey imposes inheritance tax rates ranging from 11% to 16% based on the relationship to the decedent, further complicating the tax landscape for beneficiaries. Understanding these obligations is crucial for effective financial planning and compliance.

Accurate legal citations and relevant tax laws

The discussion of beneficiary tax liability often centers around the Internal Revenue Code (IRC) and specific legal citations relevant to estate and trust taxation. According to IRC Section 661, beneficiaries must report distributions received from estates or trusts as part of their taxable income. Furthermore, IRC Section 662 lays out the rules regarding taxable income for beneficiaries, indicating that any income distributed to beneficiaries must be reported on their individual tax returns. Estate tax considerations come into play under IRC Section 2001, which addresses the taxation of estates exceeding specific thresholds, currently set at $12.92 million for individuals in 2023. Beneficiaries should also consider the implications of stepped-up basis under IRC Section 1014, which allows inherited assets to be valued at fair market value on the date of the decedent's death, potentially minimizing capital gains tax liabilities. Proper understanding and application of these tax laws are critical for beneficiaries to navigate their tax obligations effectively.

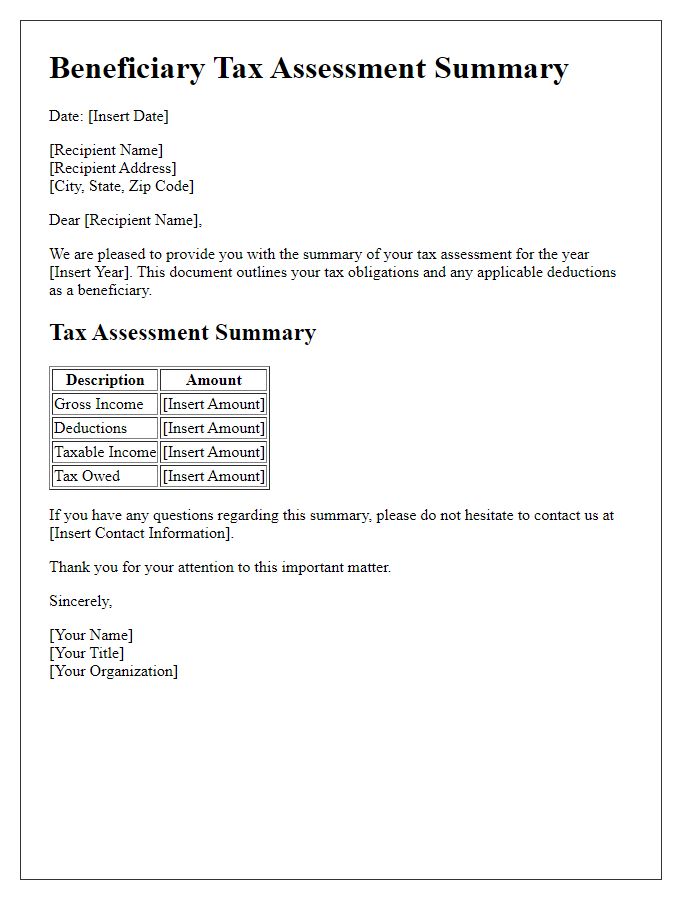

Detailed summary of financial assets and liabilities

A detailed summary of financial assets and liabilities is crucial for beneficiaries assessing tax implications. Financial assets can include items like real estate properties valued at market rates, bank account balances reflecting total holdings, investment portfolios with stock shares and bonds detailing current worth, and any business ownership stakes showing respective valuations. Liabilities may encompass outstanding mortgage balances on properties, credit card debts reflecting current totals, personal loans with accrued interest, and any other financial obligations that could impact net worth. Such summaries facilitate understanding of overall financial health for beneficiaries, enabling informed discussions on potential tax liabilities arising from inheritances or asset transfers, in light of regulations set forth by the Internal Revenue Service or other relevant tax authorities.

Clear instructions on next steps and deadlines

Beneficiary tax liability requires careful consideration to ensure compliance with the Internal Revenue Service (IRS) requirements. The relevant forms, such as IRS Form 1041 for estates or trusts, must be submitted to report income generated by the estate during the tax year. Each beneficiary receiving distributions will receive a Schedule K-1 detailing their share of the estate's income, deductions, and credits. Deadlines are crucial; typically, Form 1041 is due on April 15th of the following year, extending to September 15th with Form 7004 if necessary. Beneficiaries should gather personal tax information and consult tax professionals for clarity on any shared responsibility regarding estate liabilities. Understanding potential tax implications based on distribution amounts and inheritance taxes is essential for minimizing unforeseen tax burdens.

Comments