Hey there! If you're looking for a reliable way to confirm scheduled payments for your beneficiaries, you're in the right place. In this article, we'll walk you through a simple letter template that ensures everyone is on the same page regarding payment details. So, let's dive in and streamline your communication processâread on to discover how you can easily create this essential document!

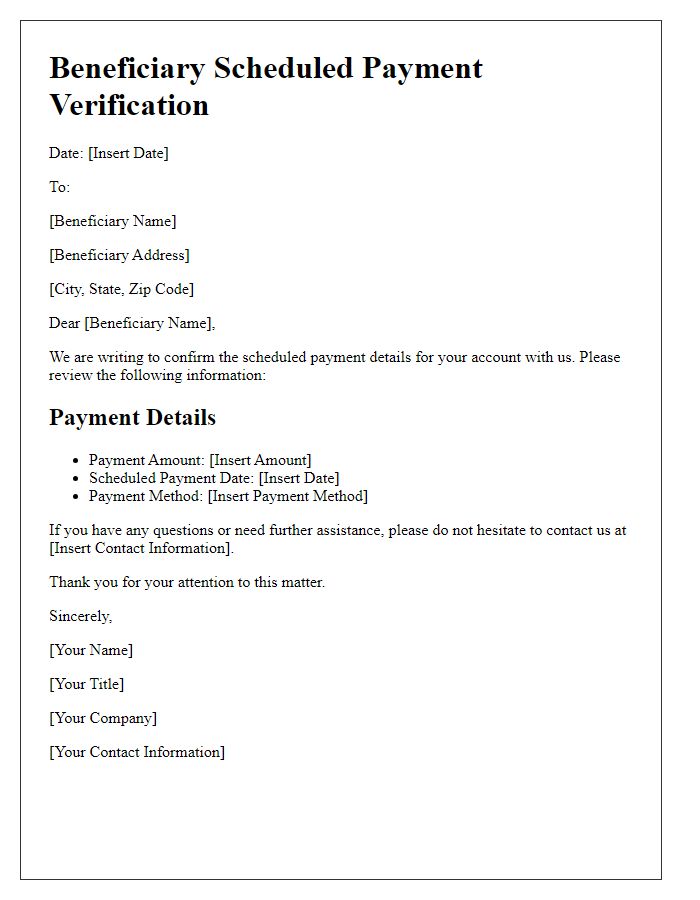

Beneficiary details verification

Beneficiary details verification is a crucial step in the context of scheduled payments within financial transactions. It ensures accuracy and identifies the designated recipient (beneficiary) of funds, typically involving essential information such as full name, banking account number, routing number, and contact details. Verification processes can include validation through secure databases or verification calls to the beneficiary. Discrepancies or inaccuracies in these details can lead to payment delays (such as missed deadlines or misdirected funds). Financial institutions often use stringent protocols to protect against fraudulent activities, enhancing the overall security of the payment process. Regular updates to beneficiary details (especially in cases of account changes or mergers) are also vital to maintain effective communication and timely delivery of funds.

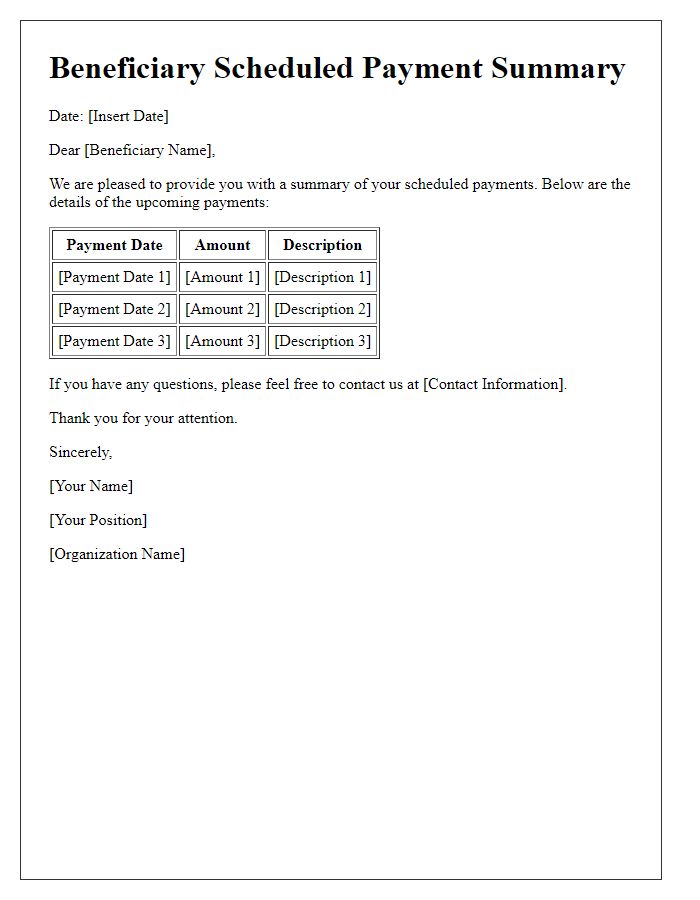

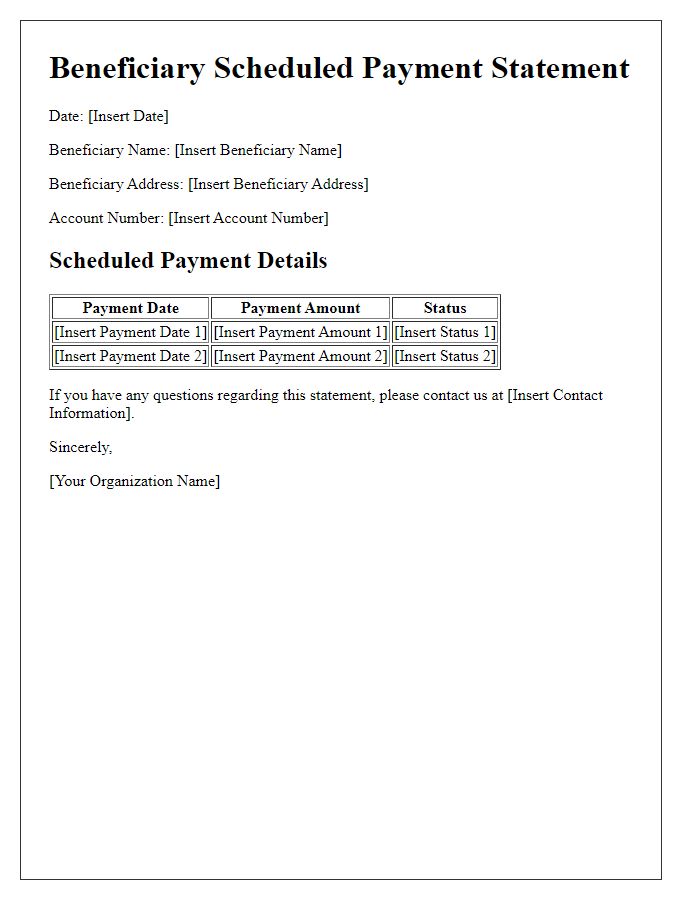

Payment schedule outline

The beneficiary payment schedule outlines important financial transactions, detailing the distribution of funds to recipients. Scheduled payments, occurring bi-weekly on Fridays, amount to $500 for each beneficiary. The first payment executed on November 3, 2023, aims to assist low-income families in the community of Springfield. Each subsequent transaction will occur every other week, concluding with the final payout on March 29, 2024, totaling 12 payments. These disbursements are part of a broader initiative funded by the state budget allocation of $60,000, specifically targeting educational support and essential living expenses for eligible recipients. Each beneficiary will receive direct deposits to their designated bank accounts, ensuring timely access to funds for critical needs.

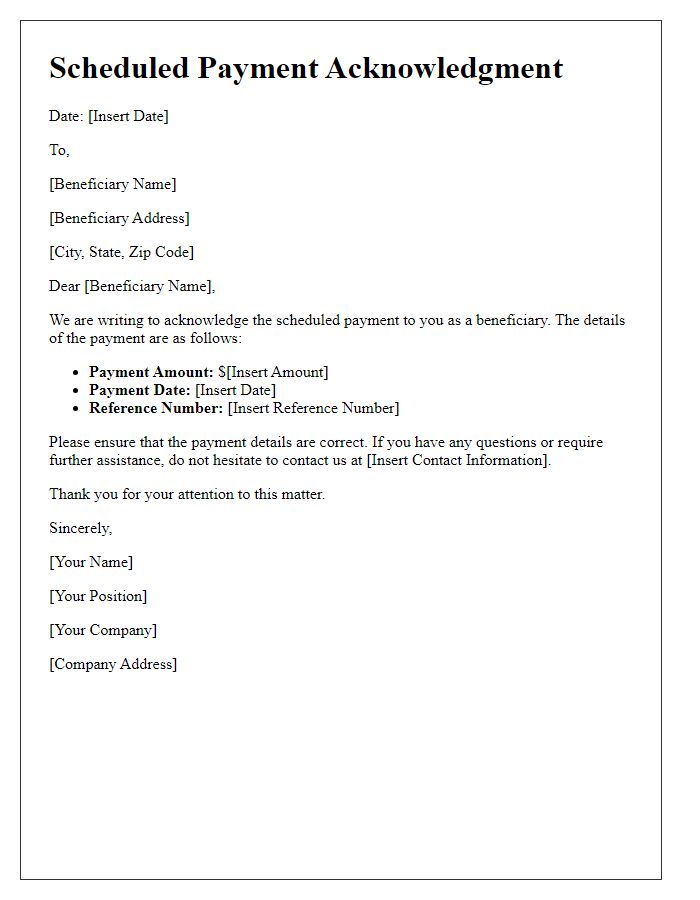

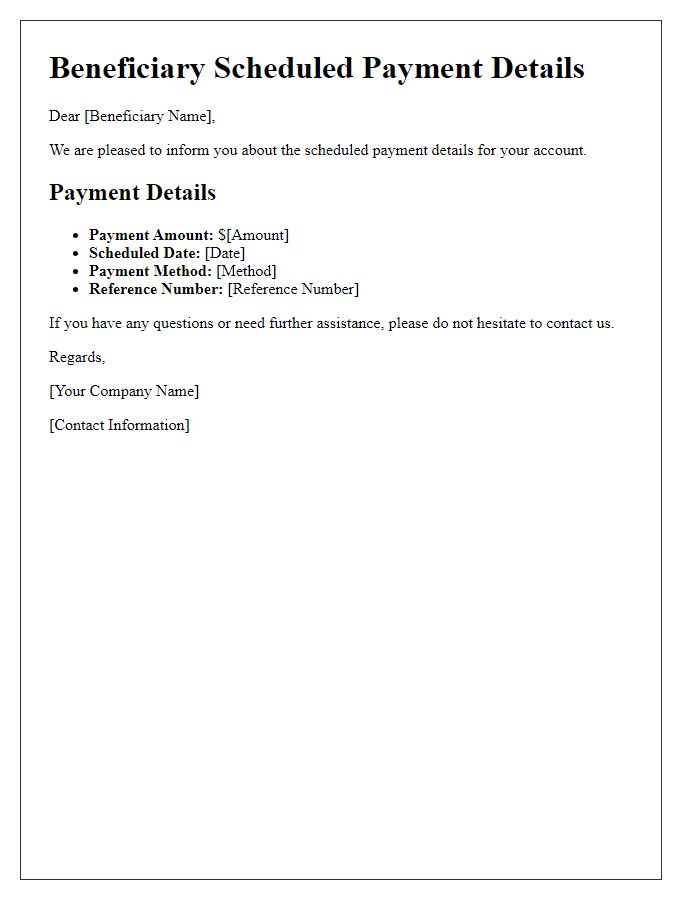

Transaction reference number

Scheduled payments, such as those made to beneficiaries in financial transactions, require confirmation to ensure clarity and security. For instance, a transaction reference number (unique identifier) is assigned to each payment for tracking purposes, allowing both sender and recipient to verify the transaction. This number is crucial in cases of discrepancies or inquiries, enabling customers to quickly resolve issues by providing specific information correlating with that transaction. Payments may involve various amounts and currencies, depending on the agreement and the beneficiaries' financial institutions. Ensuring that all details align correctly, including the payment date and beneficiary's account information, is essential to avoid delays and ensure timely processing.

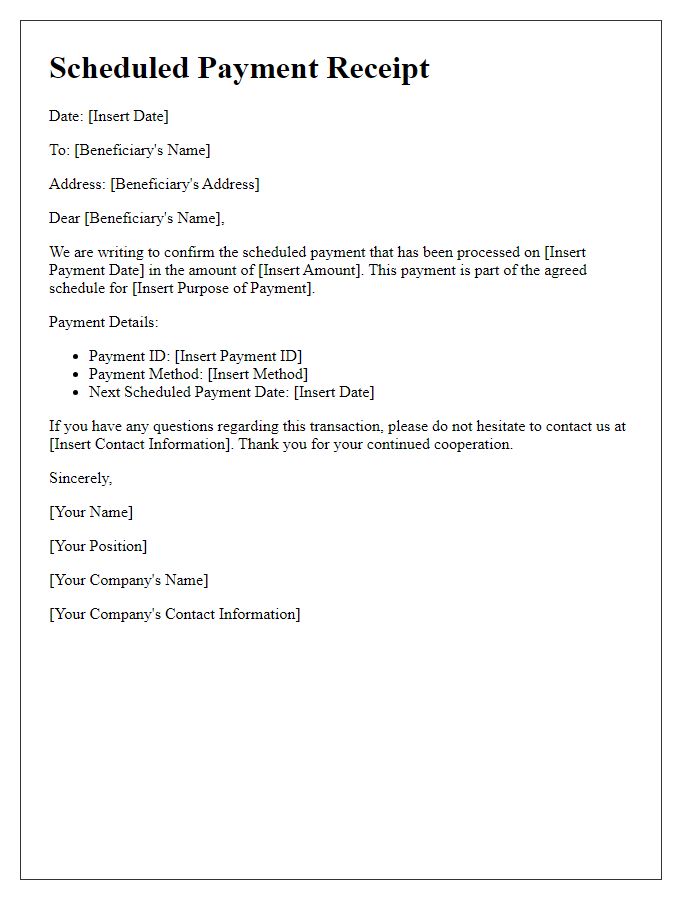

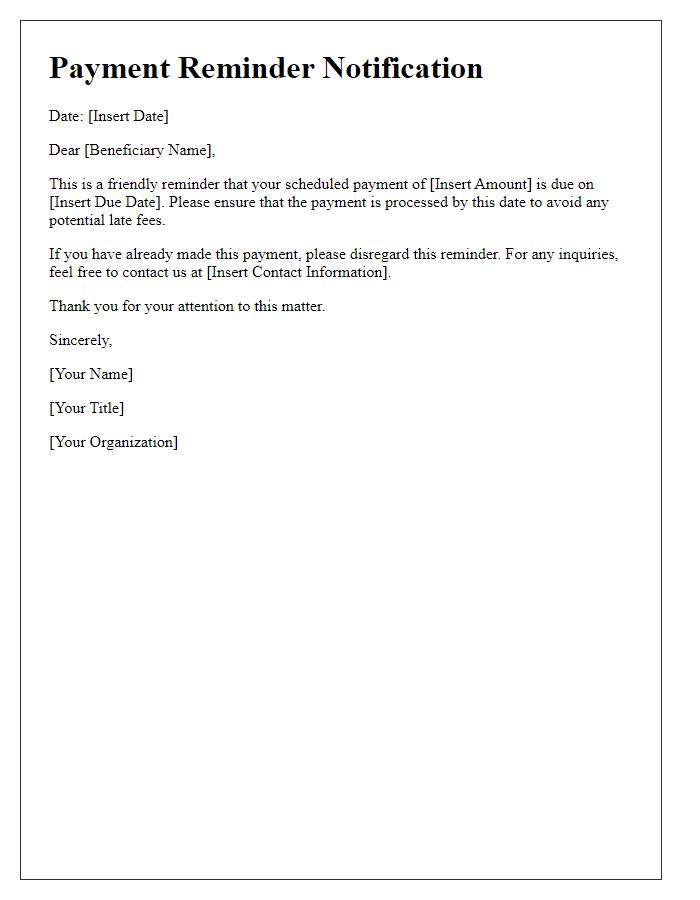

Contact information for queries

Beneficiary scheduled payments require confirmation for processing, essential for accurate financial transactions. Contact information includes email addresses, phone numbers, and office addresses, enabling effective communication for queries. For instance, the customer service hotline (1-800-555-0199) assists users during business hours (9 AM to 5 PM EST). Furthermore, email support at support@example.com provides a written avenue for detailed inquiries. Each contact method ensures beneficiaries can resolve concerns swiftly, promoting transparency and trust within financial operations.

Sign-off with authorization statement

Scheduled payments for beneficiaries often require clear documentation to confirm authorization. A specific document should include details such as the payment amount, payment frequency, beneficiary identification information, and the financial institution's name involved in the transactions. Important dates, such as the initiation date and the expected completion date, should be highlighted. To ensure legitimacy, a signature line for the authorized signatory, along with their title and date of signing, is essential. This document confirms that all parties are aware of and agree to the scheduled payment arrangements, providing transparency and reducing potential disputes.

Comments