Are you navigating the complexities of estate distribution and seeking clarity on your beneficiary status? Understanding your rights and responsibilities as a beneficiary can be a daunting task, and many people find themselves uncertain about the process. This article aims to break down the key aspects of estate distribution inquiries, offering insights and practical tips to help you confidently address any questions you might have. So, grab a cup of coffee and let's explore this important topic together!

Clarity and Precision

Beneficiary estate distribution inquiries require clear communication regarding the distribution of assets from a decedent's estate, which may include real estate, financial accounts, personal property, and other relevant items. Beneficiaries often seek information on specific distributions outlined in a will or trust; these documents detail the allocation of assets among family members or designated individuals. Exact timelines for distribution may be specified under probate laws, ranging from several months to over a year, dependent on the jurisdiction, such as California or New York. An understanding of any outstanding debts or taxes owed by the estate is crucial, as these obligations can affect the net amount available for distribution. Communication with the executor or trustee overseeing the estate is essential for obtaining updates and clarifications, ensuring transparency and adherence to legal protocols throughout the distribution process.

Formal Tone

Estate distribution inquiries involve the legal process surrounding the allocation of assets following the passing of an individual, often referred to as the decedent. Such inquiries typically arise within the context of probate court proceedings, where beneficiaries (individuals entitled to receive a share of the estate) seek clarity on the distribution of assets, including real property, financial accounts, and personal belongings. The complexity of estate distributions is influenced by factors such as the size of the estate, the existence of a will, and local laws governing inheritance rights, which can significantly vary from state to state. Additionally, the role of the executor (the individual responsible for managing the estate's affairs) is crucial in ensuring that the assets are distributed according to the decedent's wishes and legal requirements. Clear communication and thorough documentation are essential for resolving any disputes or concerns that may arise during this process.

Specific Recipient Details

Beneficiary estate distribution inquiries require precise documentation regarding the recipients involved. Detailed information about the specific recipient, such as full legal name, relationship to the deceased (e.g., spouse, child, sibling), and contact information, is crucial for accurate processing. Additionally, including the recipient's tax identification number or social security number ensures compliance with legal requirements. Information about the specific estate, including the decedent's name, estate number, and date of death, further clarifies the context. Noting any previous communications or agreements related to the distribution assists in maintaining transparency and streamlining the inquiry process.

Comprehensive Estate Description

The comprehensive estate description of the McAllister estate located in Oak Ridge, Tennessee, encompasses a variety of significant assets accumulated over three generations. The estate includes a 5,000-square-foot colonial-style family home, built in 1995, containing five bedrooms and four bathrooms. There are 15 acres of cultivated land, producing organic vegetables valued at approximately $75,000 annually. Also present is a classic car collection featuring a 1969 Ford Mustang and a 1957 Cadillac Eldorado, valued at nearly $120,000 in total. The estate holds a diverse portfolio of investments, including stocks in Fortune 500 companies and several real estate properties across the southeastern United States, estimated at $450,000. Additionally, there are personal valuables, including rare art pieces and jewelry, appraised at around $200,000. The comprehensive financial documentation must clarify the distribution among the beneficiaries as stipulated in the last will and testament of Harriet McAllister, dated April 15, 2020.

Concise Request for Information

The estate distribution process can often be complex, especially for beneficiaries navigating the legal intricacies of wills and trusts. Beneficiaries, typically family members or close friends, may require clarification regarding the distribution of assets and property from the deceased's estate. Inquiries can revolve around the executor's actions, asset valuations, and timelines for distribution, particularly if significant assets involve real estate or financial accounts. Additionally, specific state laws (such as probate laws in California) may dictate the distribution process, impacting how quickly beneficiaries receive their inheritance. Understanding these factors can elucidate the estate distribution process, ensuring beneficiaries are informed and equipped with the necessary knowledge to address their inquiries effectively.

Letter Template For Beneficiary Estate Distribution Inquiry Samples

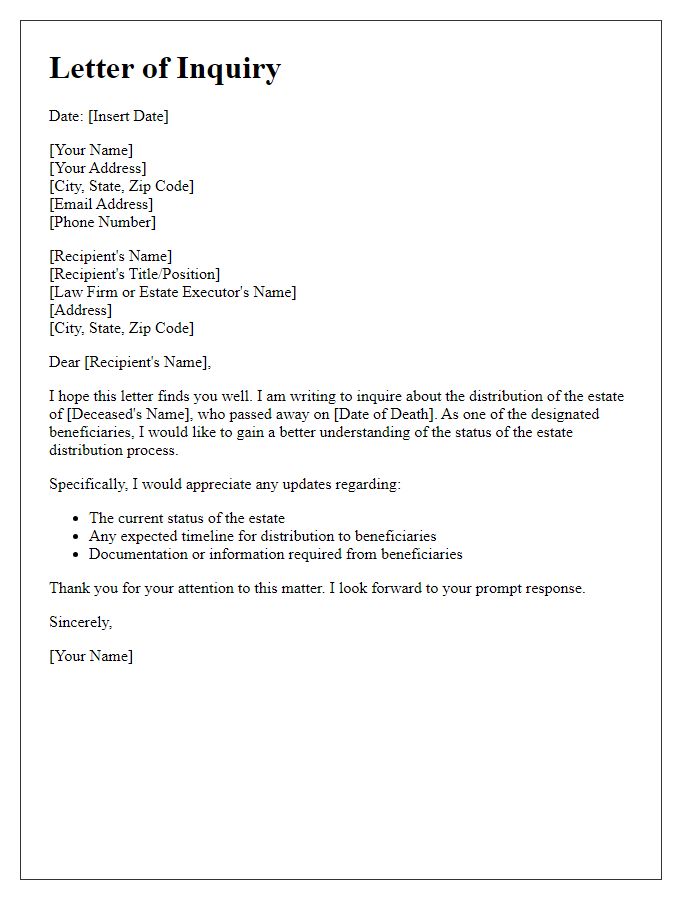

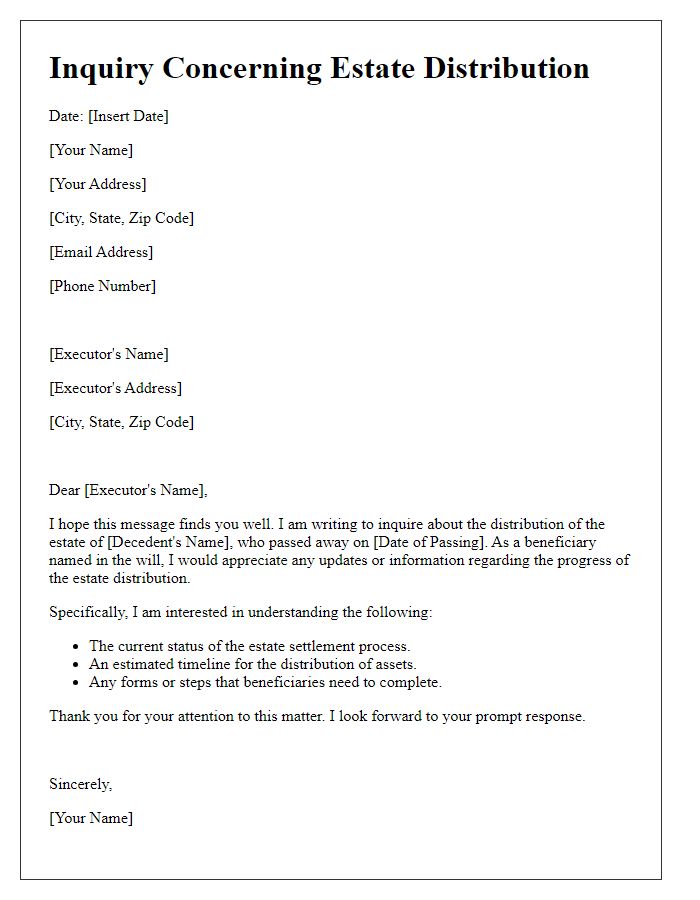

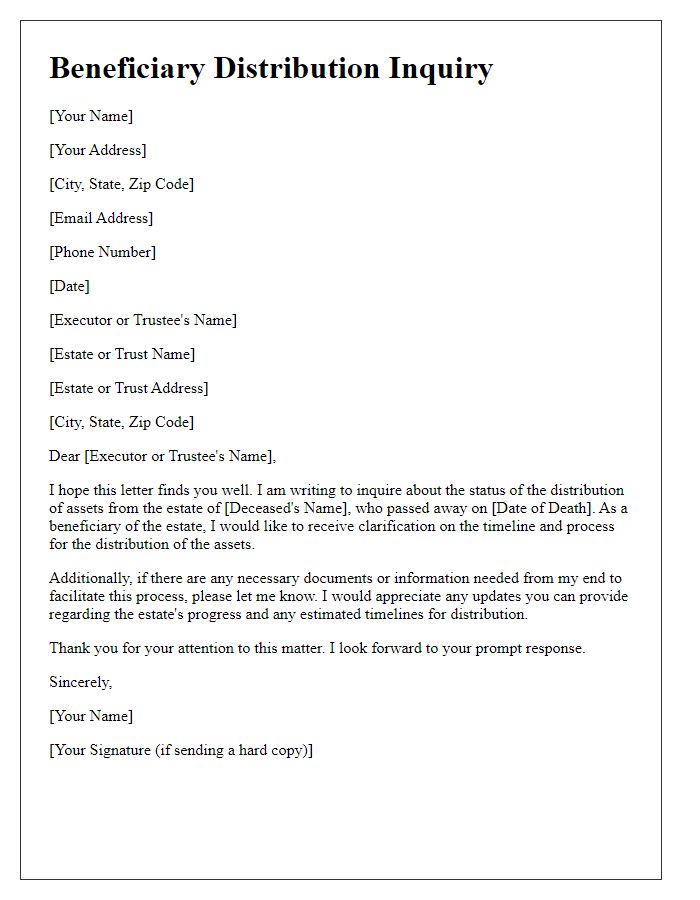

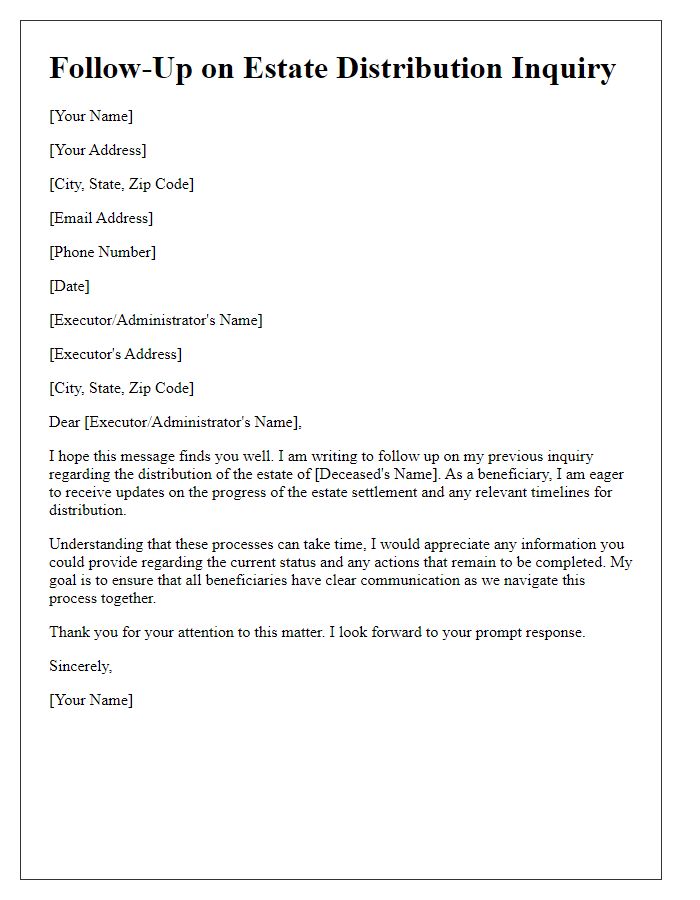

Letter template of inquiry regarding estate distribution for beneficiaries

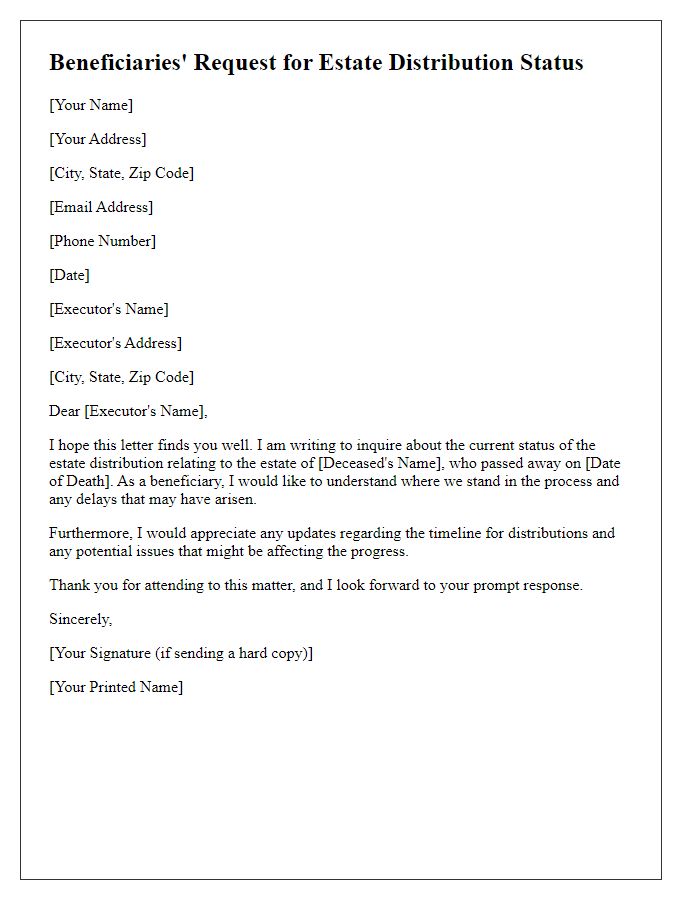

Letter template of beneficiaries' request for estate distribution status

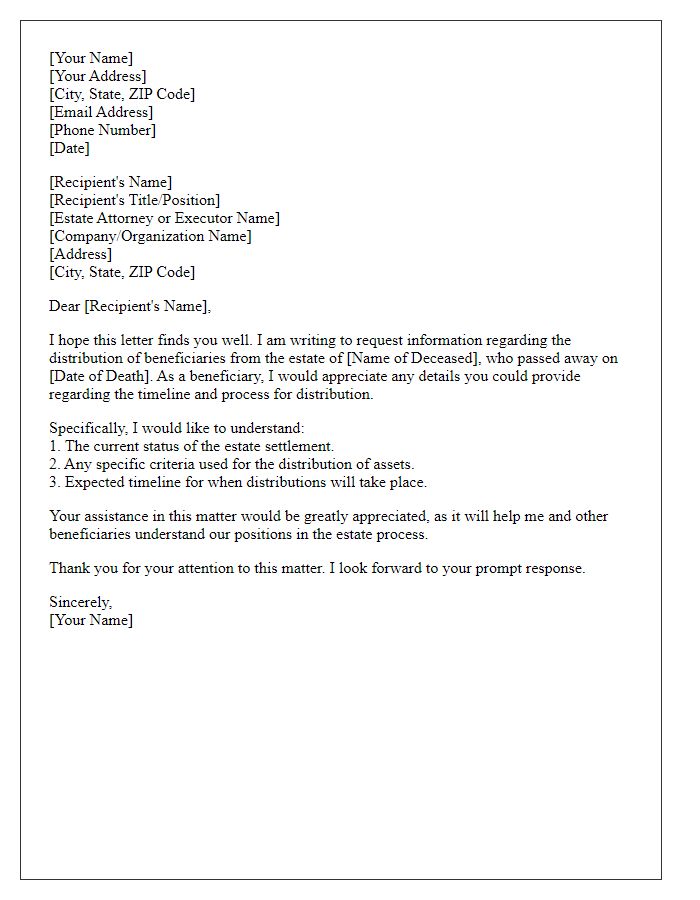

Letter template of request for information on estate beneficiary distribution

Letter template of inquiry about estate parcel distribution for beneficiaries

Letter template of request for details on estate distribution for beneficiaries

Letter template of request for clarification on estate distribution for beneficiaries

Comments