When it comes to managing your finances, understanding your beneficiary financial statement is crucial for making informed decisions about your future. In this article, we'll break down what a beneficiary financial statement is, why it matters, and how you can effortlessly request one. Whether you're planning for retirement or ensuring your loved ones are taken care of, having access to clear financial information is key. So, let's dive in and explore the steps to secure your financial peace of mind!

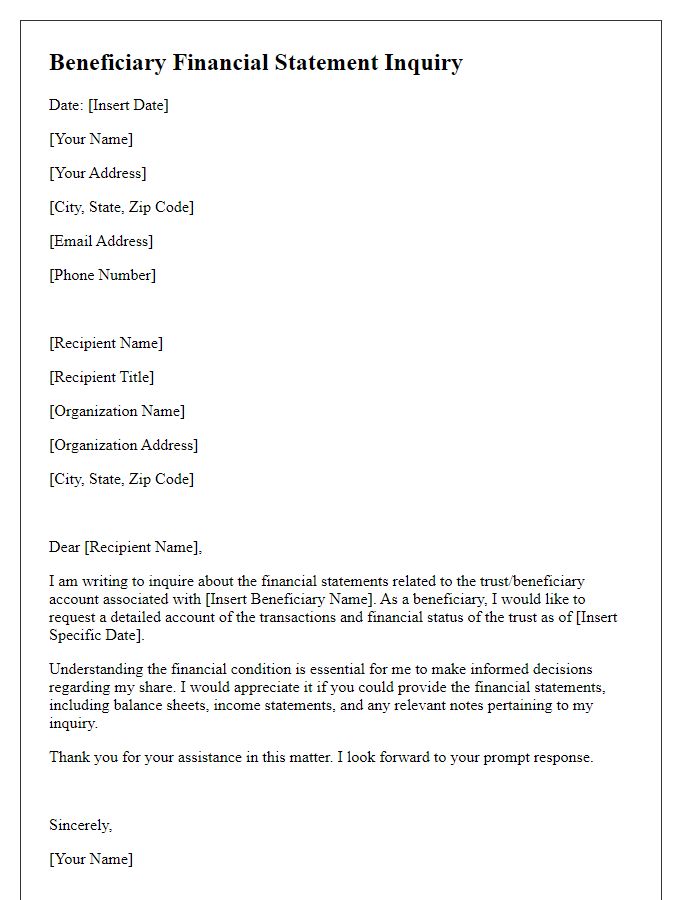

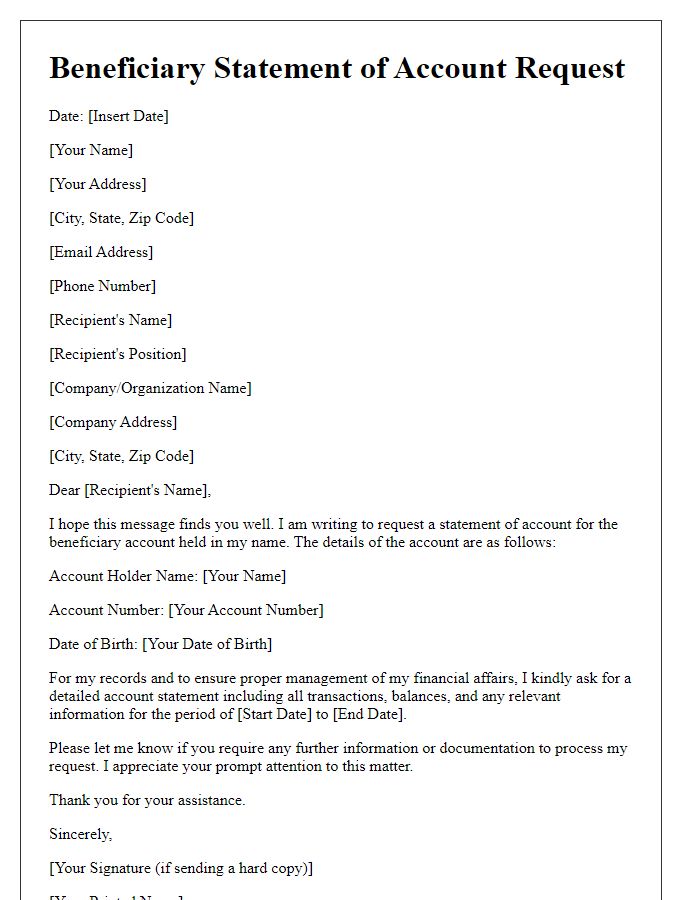

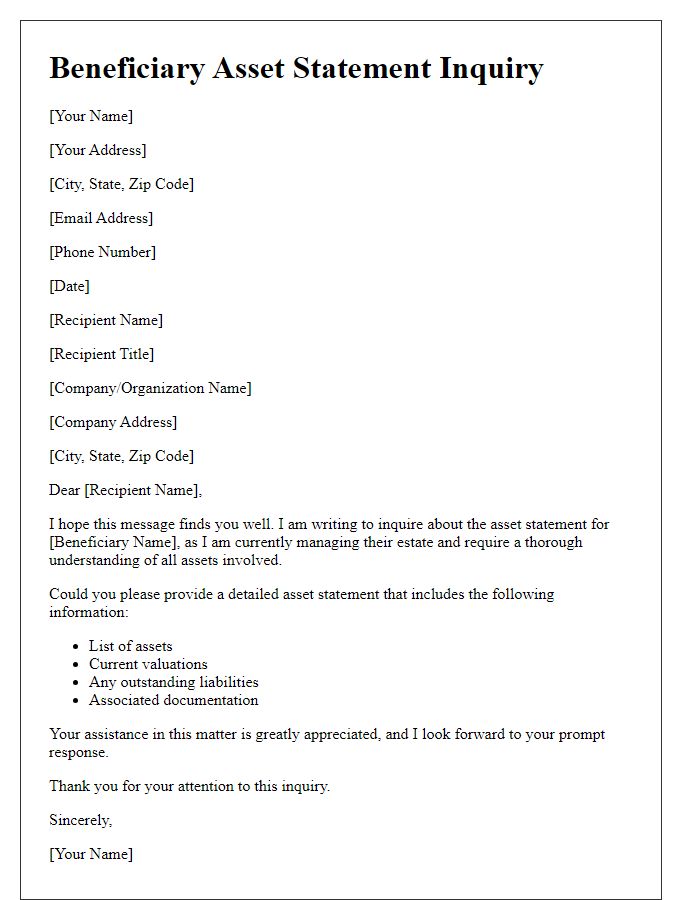

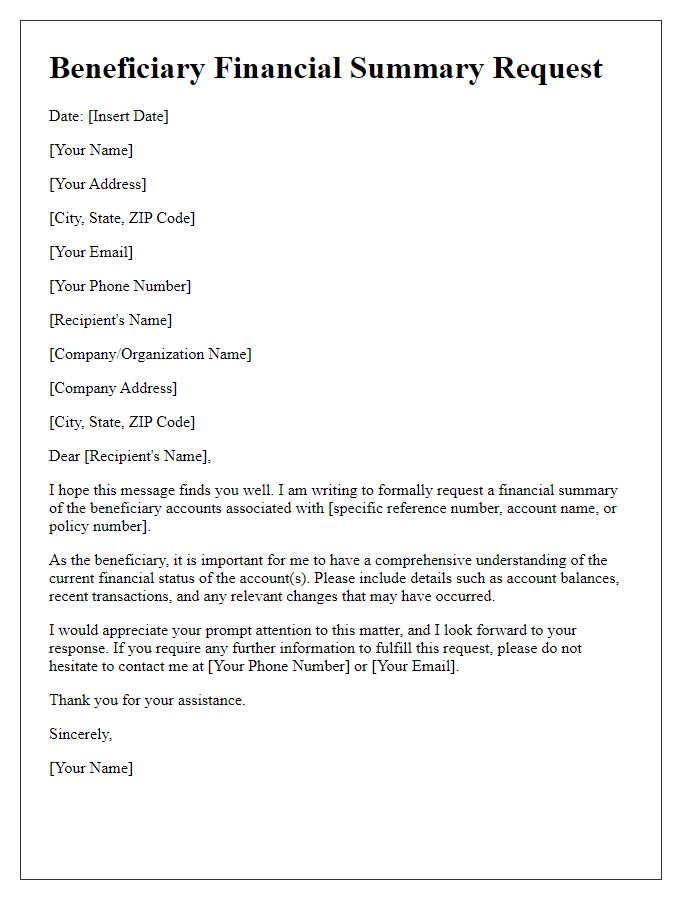

Clear recipient identification

Beneficiary financial statements provide crucial insights into the financial health of individuals receiving monetary support. These documents, typically issued quarterly by financial institutions or grant organizations, outline income sources, expenses, and net balances. Clear identification of the recipient is essential for ensuring accurate processing and timely delivery. This includes full names, addresses, and identification numbers (such as Social Security Numbers) to eliminate any ambiguity. Additionally, specifying the time frame for the requested financial information, such as the last fiscal year or specific months, aids in streamlining the request. Properly identifying the recipient not only ensures compliance with privacy regulations but also facilitates transparency in financial reporting.

Precise request purpose

Beneficiary financial statements provide essential insights into an individual's or organization's financial health. These statements include detailed reports such as balance sheets, income statements, and cash flow statements, relevant for assessing assets, liabilities, revenues, and expenditures. Obtaining these documents is crucial for beneficiaries, especially during critical events such as estate planning, legal audits, or financial reviews. Financial statements help ensure transparency regarding fund distributions, compliance with fiduciary responsibilities, and the evaluation of financial performance. Moreover, understanding these documents can assist beneficiaries in making informed decisions regarding future investments or distributions.

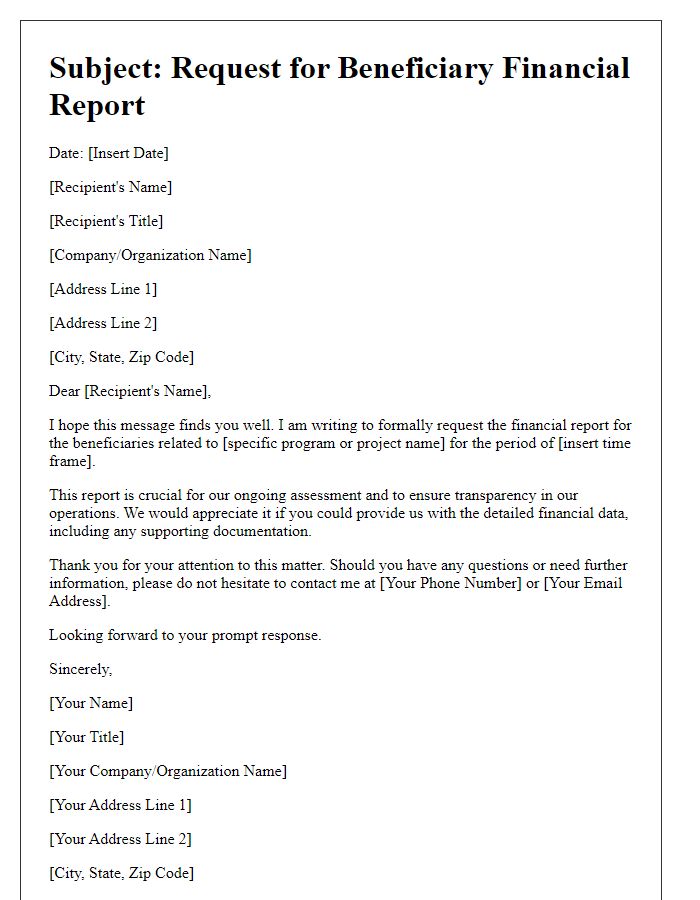

Specific financial details needed

Beneficiary financial statements are crucial in assessing the financial health of organizations or individuals receiving financial aid or support. Detailed information typically includes total income, expenses, assets, and liabilities, reported quarterly or annually, depending on the reporting requirements of entities like nonprofits, government agencies, or private foundations. Accurate revenue information can span various sources such as grants, donations, or investments, while expenditures often cover operational costs, program expenses, and administrative fees. Asset information should include cash, property, and investments, whereas liabilities encompass loans, outstanding debts, and other financial obligations. Providing a clear and comprehensive financial overview enables stakeholders to make informed decisions regarding funding, support, or investment.

Deadline for response

Requests for beneficiary financial statements play a crucial role in maintaining transparency and accountability within financial systems. Beneficiaries, who could be individuals or organizations entitled to receive benefits or funds, require detailed financial information by specific deadlines to ensure compliance and proper financial planning. When requesting statements, clear deadlines facilitate timely responses, ensuring that stakeholders, such as family members, agents, or trustees, have access to accurate and up-to-date financial data. Financial statements, which may include balance sheets, income statements, and cash flow statements, provide essential insights into asset distribution, income sources, and overall financial health. Meeting deadlines empowers beneficiaries to make informed decisions regarding their financial futures and ensures adherence to legal and regulatory requirements.

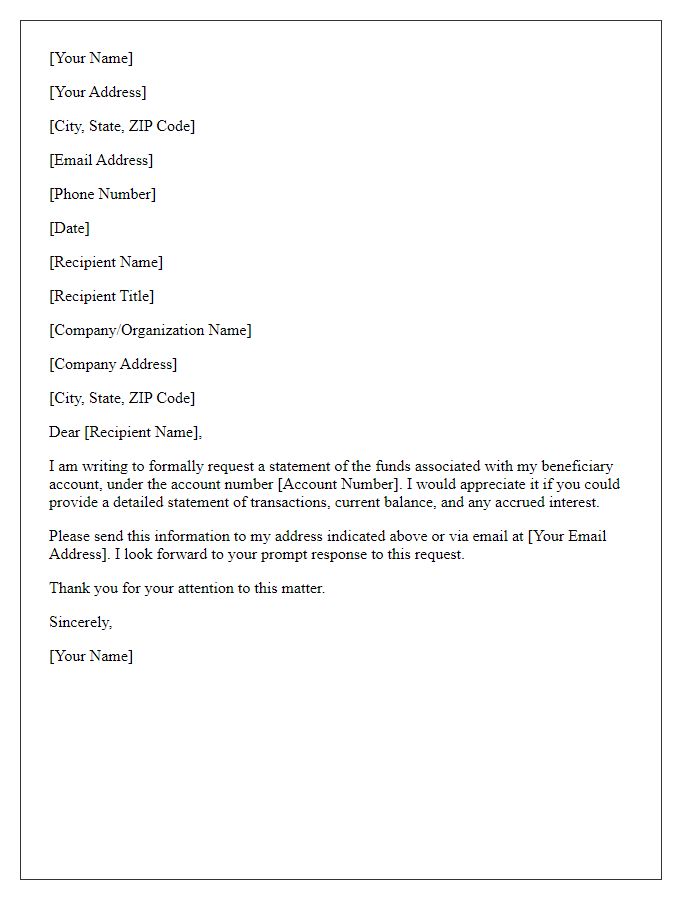

Contact information for follow-up

Contacting the financial institution for beneficiary financial statements can be essential for maintaining transparency and accountability. Ensure to compile essential information, including the beneficiary's full name, account number, and specific request details. Providing a direct phone number, email address, and physical mailing address facilitates efficient follow-up. Keep in mind that response times may vary, with institutions often taking 3 to 5 business days to process such requests. Proper documentation and clear communication will expedite the retrieval of necessary financial statements.

Comments