Navigating the complexities of estate tax exemption applications can feel overwhelming, but it doesn't have to be! Understanding the necessary steps and the importance of proper documentation can make the process much smoother. Whether you're a beneficiary looking to maximize your inheritance or an executor handling estate arrangements, clarity is key. Join us as we delve deeper into essential tips and a comprehensive letter template to aid you in your application journey!

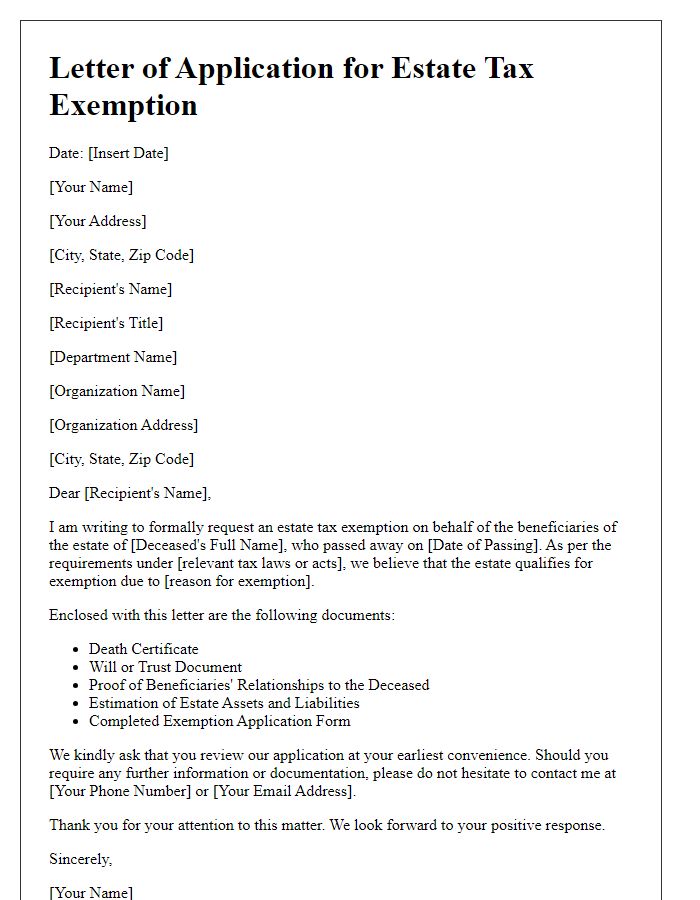

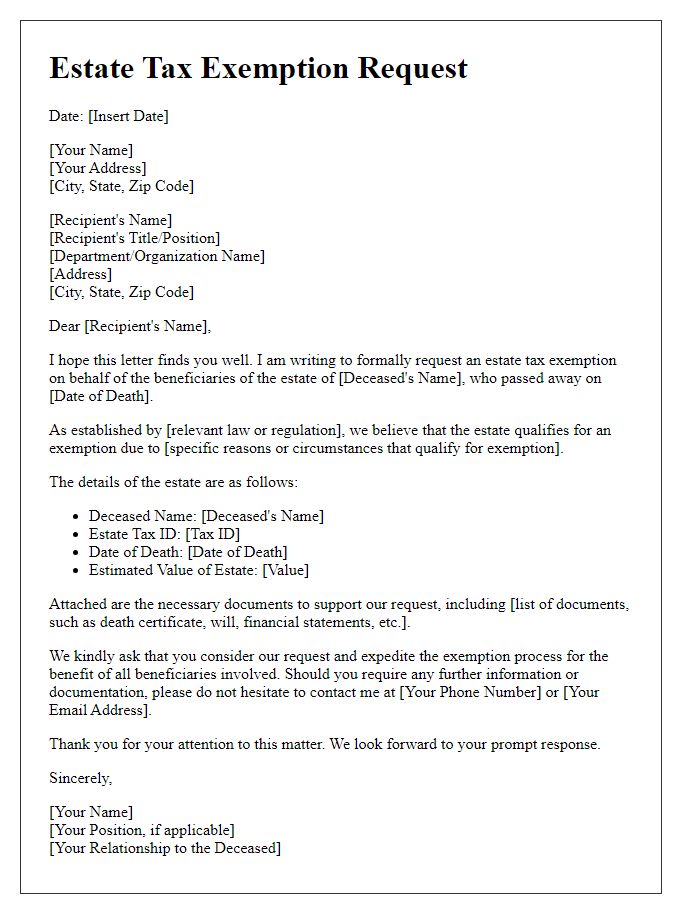

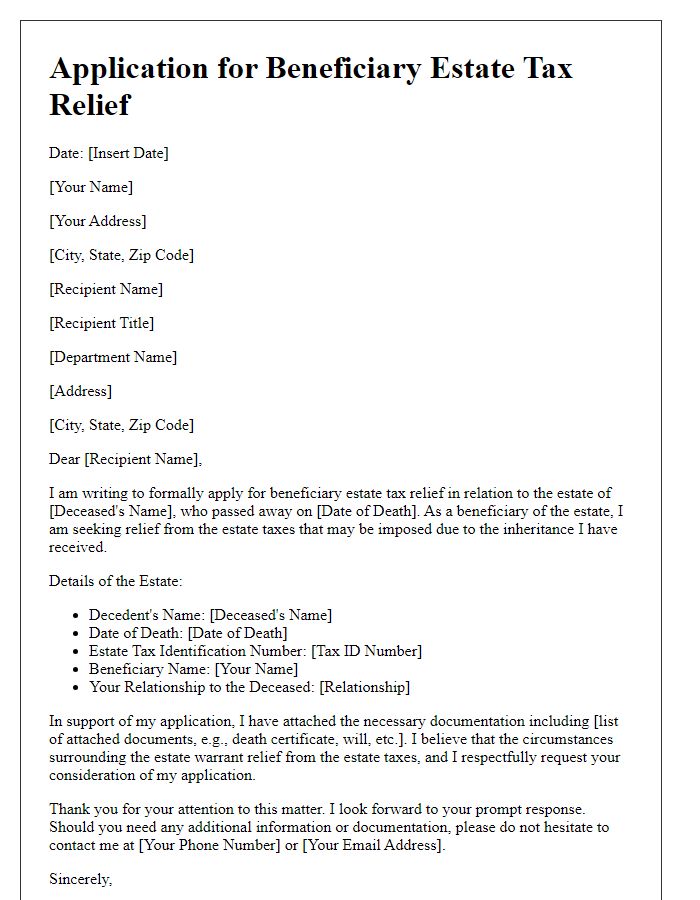

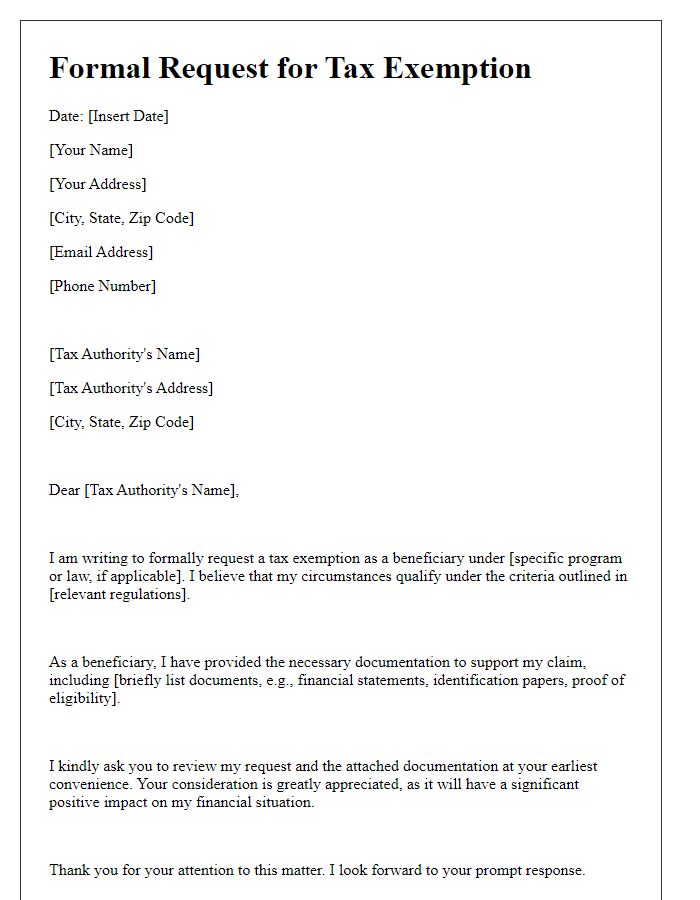

Applicant's Full Name and Contact Information

Creating a comprehensive estate tax exemption application requires attention to detail in the applicant's information. For example, the applicant's full name--Johnathan A. Smith--should be complemented by a contact number (e.g., 555-123-4567) and an email address (e.g., john.smith@email.com). Including the applicant's address is equally important, such as 123 Maple Street, Springfield, IL 62704. This ensures the application is processed without delays, as accurate contact details facilitate communication and resolution of any potential issues. Understanding the nuances of estate tax exemptions, established under the Federal Estate Tax rules, can significantly aid in the successful filing of applications, especially for estates worth over the exemption limit of $12.92 million for individuals as of 2023.

Detailed Description of Estate and Assets

The beneficiary estate tax exemption application requires a comprehensive overview of the estate's components and assets, emphasizing key elements such as real estate properties, financial accounts, and personal belongings. Notable properties include the family residence located at 123 Maple Street, assessed at $500,000, and an investment property situated at 456 Oak Avenue, valued at $300,000. Additionally, the estate encompasses bank accounts with total balances of $150,000 across various financial institutions such as Wells Fargo and Chase. Furthermore, the collection of valuable personal items, including antiques and jewelry appraised at $100,000, contributes significantly to the estate's overall value. Investments in stocks through E*TRADE and Vanguard hold market values totaling $200,000, while retirement accounts maintained with Fidelity and Charles Schwab amount to $250,000, completing the asset portfolio crucial for the tax exemption evaluation.

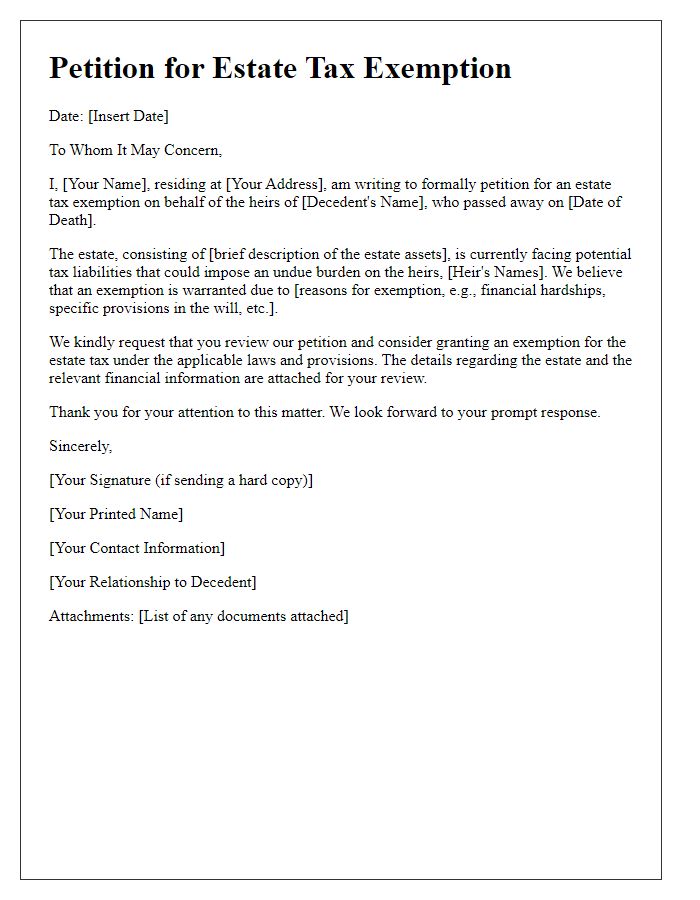

Legal Basis for Tax Exemption Claim

The legal framework governing estate tax exemptions often includes specific codes and regulations such as the Internal Revenue Code (IRC) Section 2056, which addresses marital deductions, or IRC Section 2010 pertaining to the unified credit against estate tax. Jurisdictions may implement their own estate tax exemptions, influenced by local statutes or constitutional provisions, allowing beneficiaries to claim exclusions based on factors like property value thresholds or familial relationships. Noteworthy state-specific provisions, such as New York's estate tax exemption, set limits at $6.1 million as of 2023, providing vital relief to beneficiaries. Additionally, understanding the treatment of life insurance proceeds under IRC Section 2042 is crucial as it can impact the overall value of the estate subject to taxation. Comprehensive documentation, including formal appraisals and IRS forms like Form 706, is essential for substantiating claims.

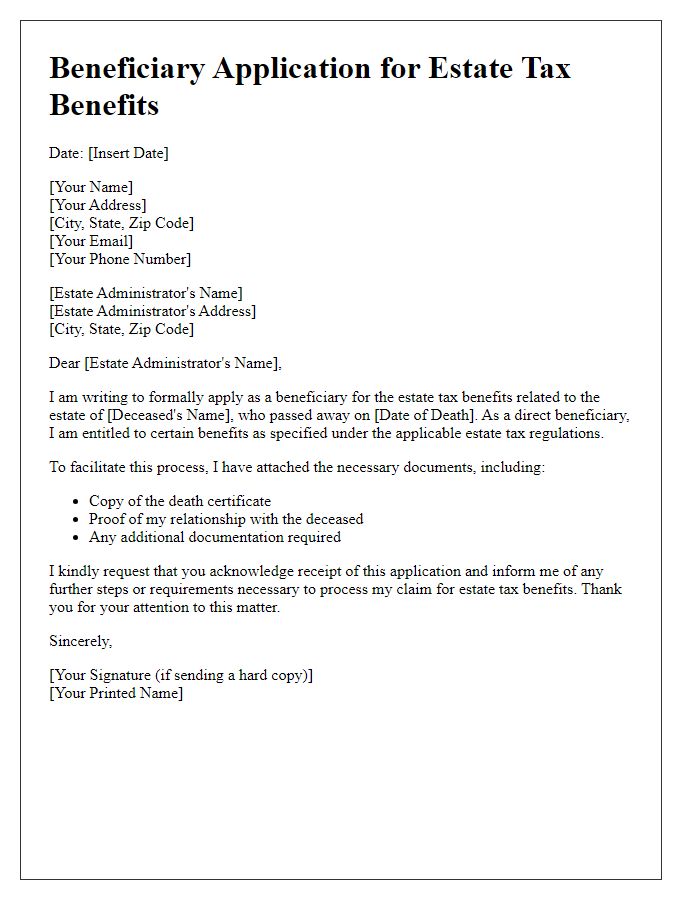

Relevant Supporting Documentation

The estate tax exemption process for beneficiaries involves submitting relevant supporting documentation to substantiate the claim. Key documents include a completed Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return), which provides details about the decedent's assets and liabilities, along with filing requirements for estates exceeding $12.92 million (as of 2023). Additionally, beneficiaries must provide a copy of the death certificate from the local registry, which verifies the date of death necessary for calculating the estate's value. Appraisal reports of real estate and personal property must be included to establish accurate valuations, ensuring compliance with IRS guidelines. Financial documentation such as bank statements, investment account statements, and any outstanding debts or liabilities required for a comprehensive assessment of the estate's net worth also play a crucial role in the exemption application process. Furthermore, beneficiaries should gather any relevant legal documents, such as wills or trust agreements, that outline the distribution of the estate, ensuring clarity in the handling of the estate tax exemption.

Declaration and Signature of Applicant

Beneficiary estate tax exemption applications require accurate declarations regarding the applicant's identity and intent. The applicant must provide personal details such as name, address, and social security number. Additionally, the applicant should state the relationship to the deceased, specifying the estate in question. The form must include declarations affirming the applicant's eligibility under applicable laws, distinguishing between direct heirs and distant beneficiaries. The signature should be accompanied by the date of the declaration, confirming the accuracy of the information provided. This process ensures compliance with estate tax regulations, allowing rightful beneficiaries to claim exemptions efficiently.

Letter Template For Beneficiary Estate Tax Exemption Application Samples

Letter template of application for estate tax exemption for beneficiaries

Comments