Are you looking to craft a letter that conveys your promise of payment to a beneficiary? It's essential to strike the right tone, ensuring clarity and warmth while maintaining professionalism. Whether it's for a personal loan, a settlement, or an inheritance, conveying your commitment is key. Join us as we explore a versatile letter template that can help you express this promise effectivelyâread on to learn more!

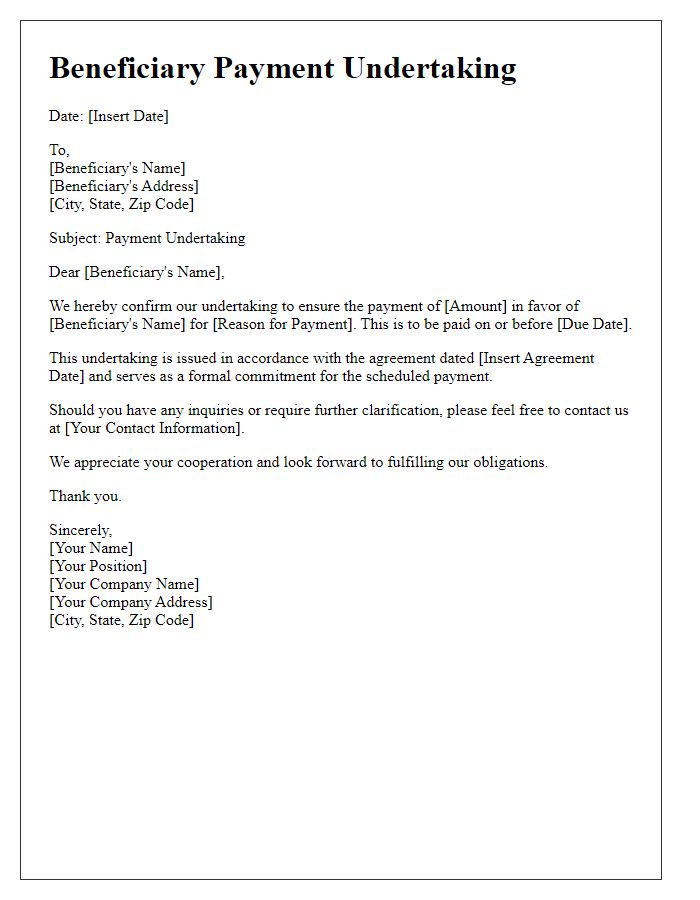

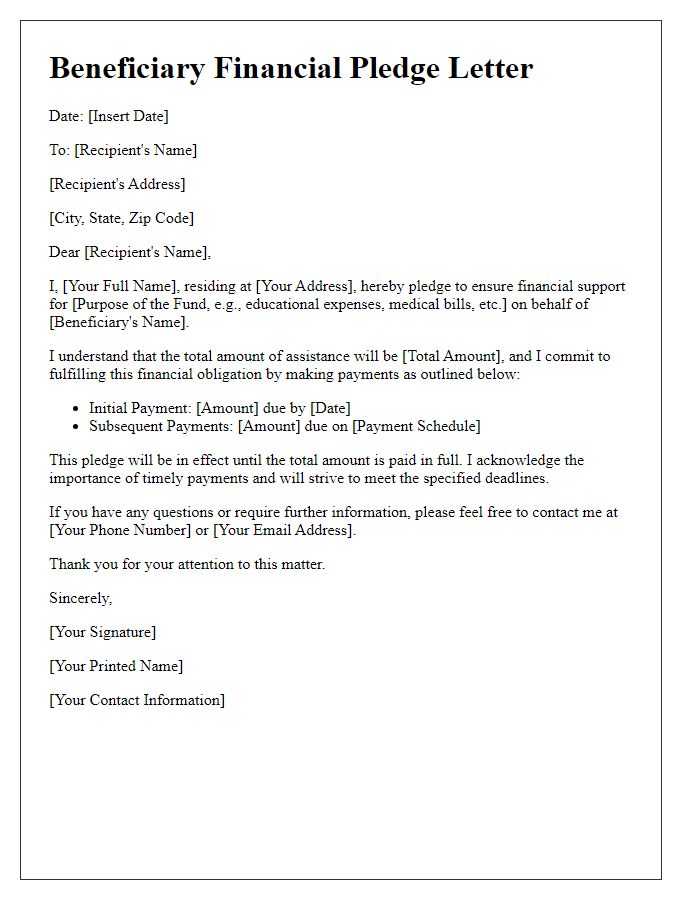

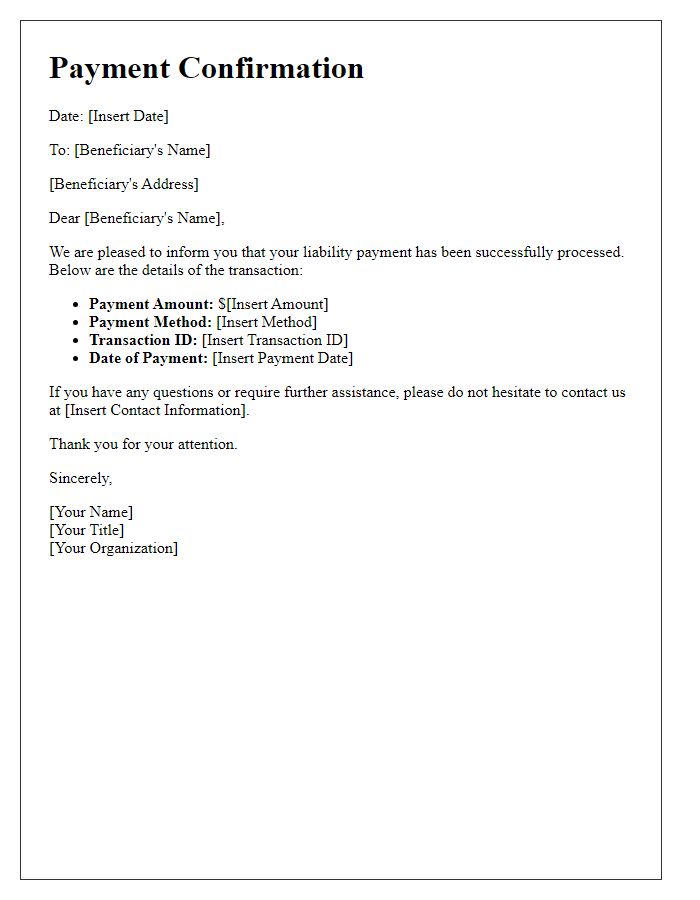

Clarity of Payment Terms

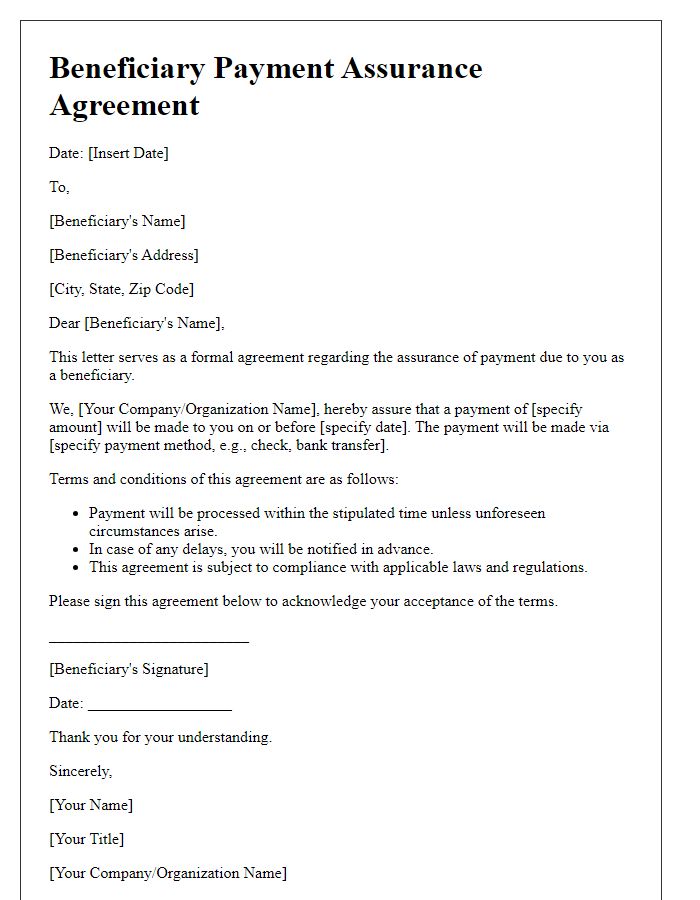

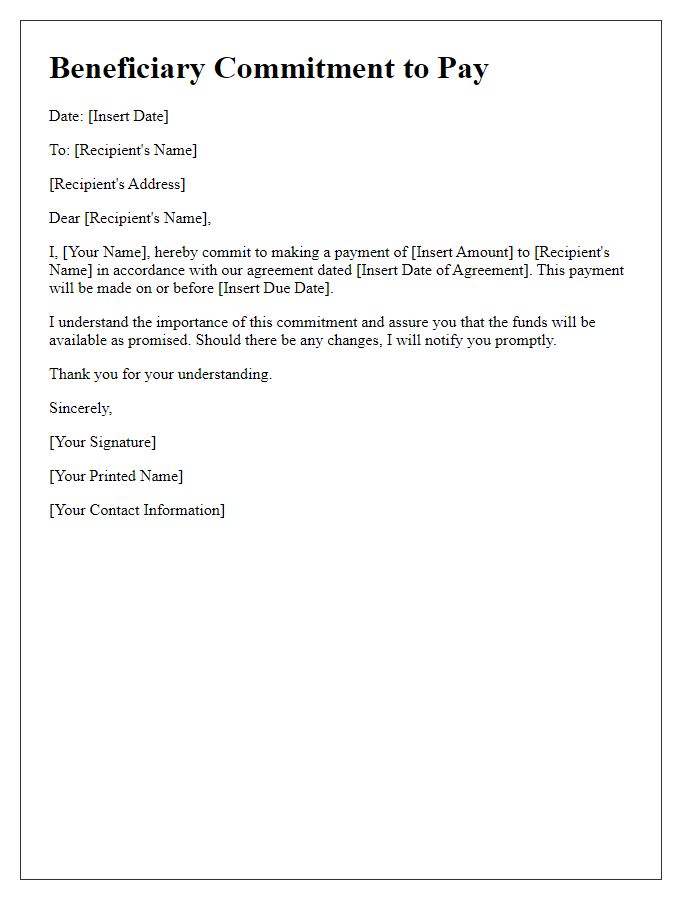

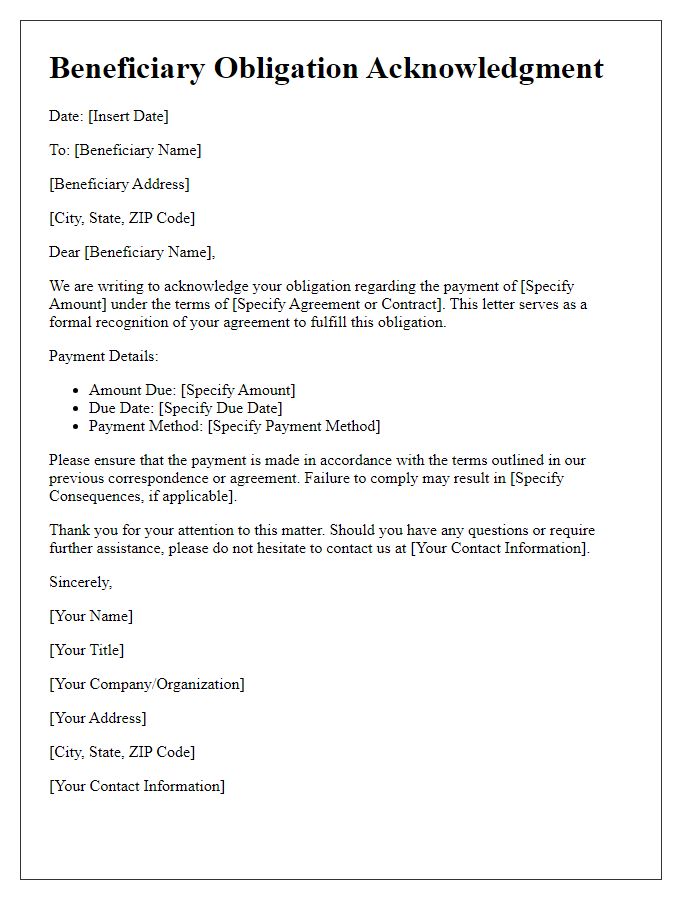

A clearly defined promise of payment is essential in financial agreements, especially in contracts and transactions involving beneficiaries. Financial terms should specify the total sum due (for example, $5,000), payment schedule (such as monthly installments commencing on May 1, 2024), and accepted payment methods (like bank transfer to account number 123456789 at ABC Bank). Specific conditions for payment delays or defaults must be outlined, detailing any applicable late fees or penalties (e.g., $100 fee for payments received more than 15 days late). Furthermore, including the legal jurisdiction (such as New York City) ensures enforceability in case of disputes while establishing a definitive agreement period (for instance, valid until the balance is paid in full). Clear communication in these elements prevents misunderstandings and establishes trust between parties.

Specific Amount and Currency

Beneficiary payment agreements can stipulate clear terms regarding the promised payment of a specific amount in designated currency. For instance, a beneficiary may receive 5,000 USD (United States Dollars) as part of a contractual agreement. The payment specifics should highlight the mode of transfer, such as bank wire or PayPal, to ensure efficient transactions. Additionally, establishing a timeline for payment completion, for example, within 30 days of receiving the invoice, provides clarity. Including terms about potential penalties for late payments reinforces accountability in financial dealings. Such structured arrangements support transparency and trust in financial exchanges.

Legal Obligations and Conditions

A beneficiary promise of payment outlines the legal obligations and conditions regarding financial transactions between parties, establishing clear terms for repayment. Specific provisions may include the total amount due (often specified in monetary figures), the payment schedule (detailing dates for installments), and the interest rate applicable to the outstanding balance (expressed as an annual percentage). Furthermore, legal stipulations may require the promise to be notarized for enforceability, particularly in jurisdictions such as California where contract validation is critical. Additional clauses might specify consequences for default, including late fees or legal action, ensuring that both parties understand their rights and responsibilities under this binding agreement. This document serves not only as a promise but also as a protective measure for both the lender and the borrower within the parameters of the relevant financial laws and regulations.

Contact Information

Beneficiary payment promises involve legal agreements between parties, often detailing financial transactions or commitments. A beneficiary is an individual or entity designated to receive benefits from a particular asset, fund, or policy, while payment promises outline the specific terms under which funds are to be disbursed. Key elements include the amount promised, due dates, interest rates, and consequences of non-payment, influenced by laws governing financial transactions in jurisdictions such as the United States or the European Union. Clarity in contact information, such as names, addresses, phone numbers, and email addresses, ensures communication is streamlined and helps prevent disputes. Proper documentation is crucial, often requiring signatures from all parties involved to validate the agreement legally.

Signature and Date

Beneficiary payment promises typically involve legal and financial terminology, ensuring clarity and accountability. A crucial document might outline the obligations, including the total amount due, the specific payment timeline (e.g., by December 31, 2023), and the signatory's commitment. Important elements such as the beneficiary's name (e.g., John Smith), legal document type (e.g., promissory note), and the involved parties' details must be accurately recorded. Signatures represent consent, while dates indicate when the agreement is formalized, often establishing the start of any grace periods or payment terms outlined in the document.

Comments