Are you looking to streamline the process of distributing digital assets to your beneficiaries? In today's digital age, ensuring a seamless transition of your digital holdings can be a bit tricky, but it doesn't have to be. By using a well-crafted letter template, you can outline important details and make the distribution process clear and straightforward for your loved ones. Join us as we explore the essential elements of a beneficiary digital asset distribution letter, and learn how to protect your digital legacy.

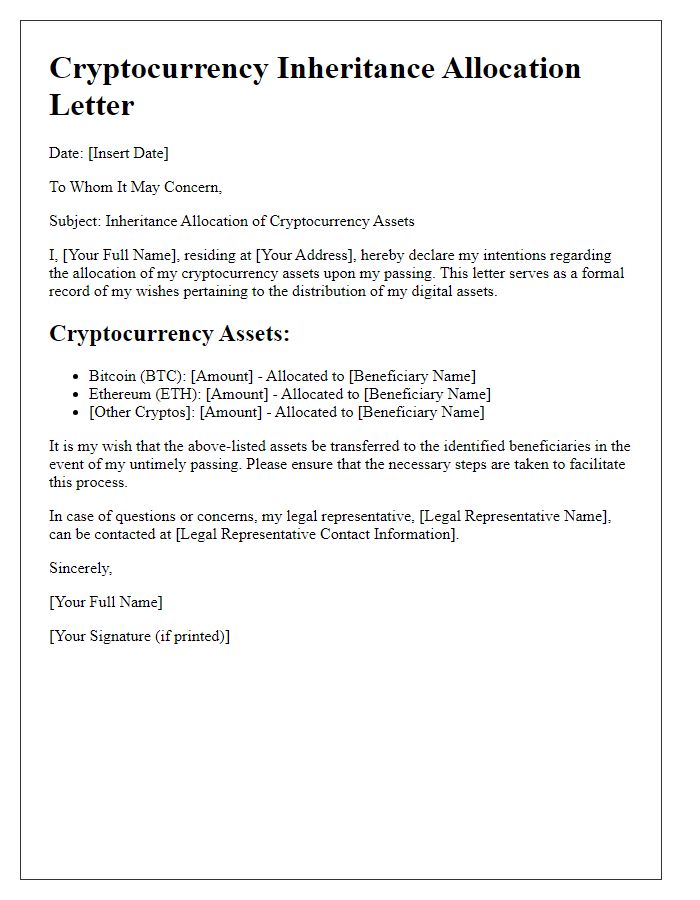

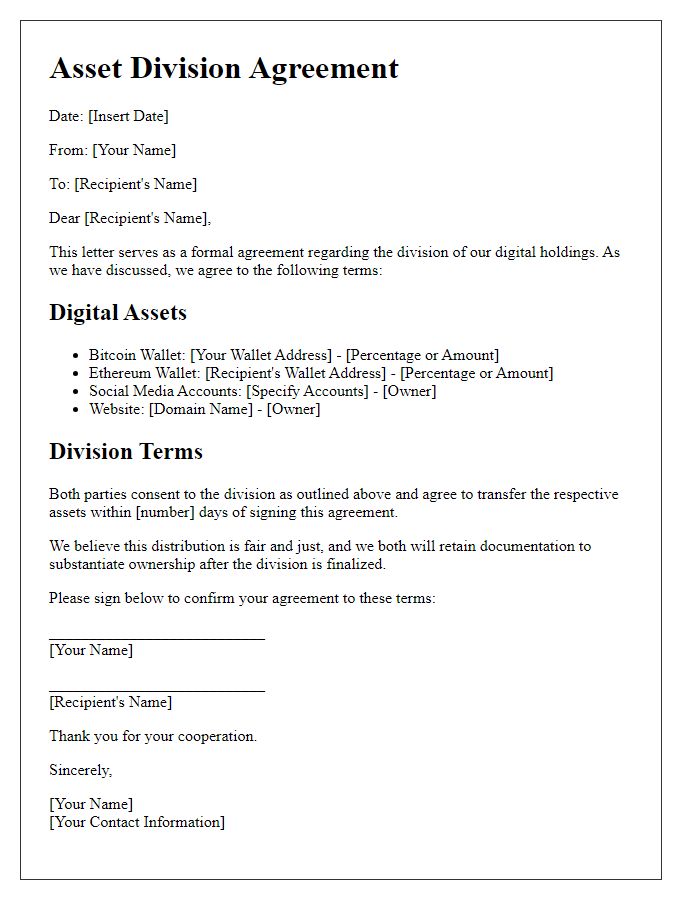

Asset Identification

Digital asset identification requires clear documentation and specification. Notable assets include cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH), both often utilized for investments or transactions. Each asset must be cataloged with unique identifiers like wallet addresses and private keys, ensuring secure access for beneficiaries. Additionally, tokenized assets like Non-Fungible Tokens (NFTs) originating from platforms such as OpenSea or Rarible should be detailed, including their unique token IDs and metadata. Proper classification of digital assets ensures legal compliance and smooth distribution processes following specific events like inheritance or organizational changes.

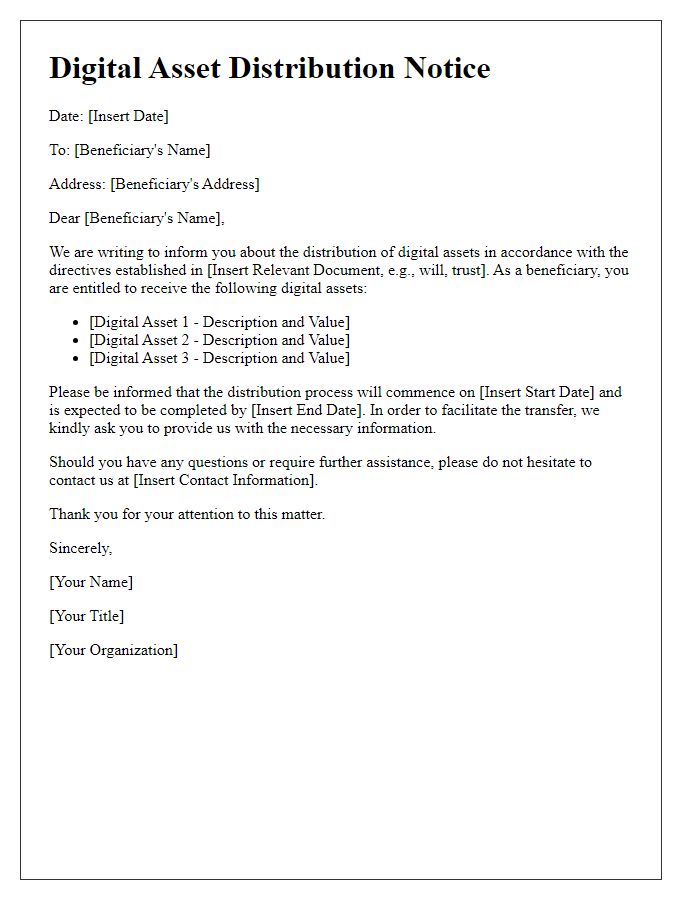

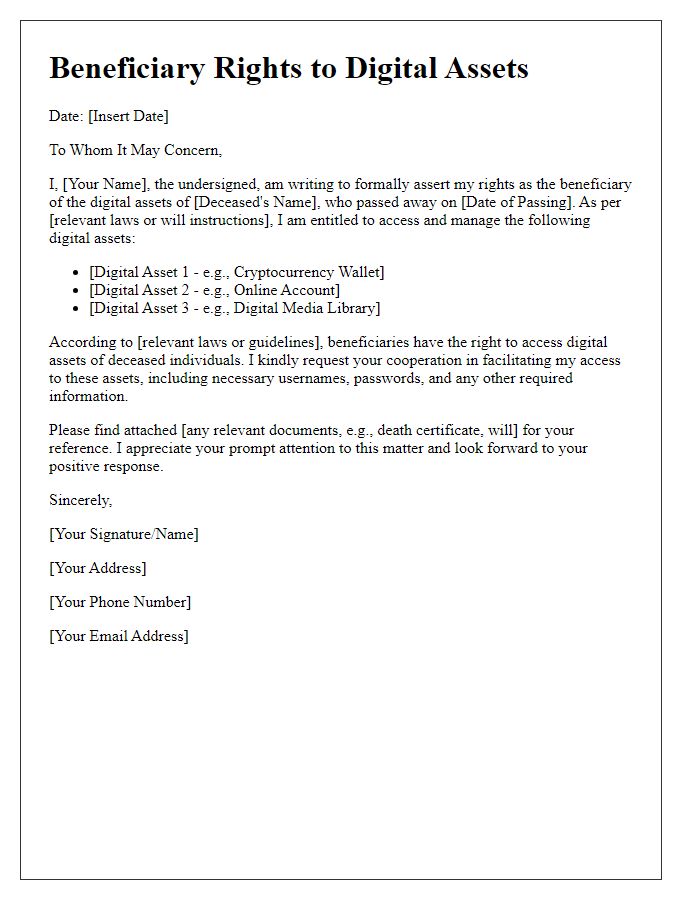

Beneficiary Details

Crafting a digital asset distribution plan for beneficiaries involves meticulous attention to detail, ensuring accurate and secure transfers. Beneficiary details typically include full name, date of birth, and identification numbers, such as Social Security Number (SSN) or Tax Identification Number (TIN), to verify identity. Digital wallets utilized may include platforms like Coinbase or Binance, which require wallet addresses for cryptocurrency transfers. Designating specific assets, such as Bitcoin or Ethereum, safeguards against potential disputes. Additionally, clear instructions regarding distribution percentages or asset allocations are crucial, particularly in cases involving multiple beneficiaries. Documentation should detail legal stipulations or trust agreements to ensure compliance with applicable regulations, particularly in jurisdictions with specific digital asset laws as seen in the European Union's 2020 regulatory framework.

Access Information

The digital asset distribution process requires careful management of access information for beneficiaries. Secure storage solutions, such as encrypted wallets (for example, hardware wallets like Ledger Nano S), ensure that private keys remain confidential. Additionally, clear instructions on accessing decentralized platforms, such as Ethereum-based networks, can facilitate smooth transactions. Beneficiaries must be informed about the importance of safeguarding their private access credentials, which can include alphanumeric phrases known as seed phrases (often consisting of 12 to 24 words). Furthermore, creating a complete inventory of all digital assets, including cryptocurrencies like Bitcoin and NFTs, will provide clarity during the distribution phase, ensuring that each beneficiary receives their rightful share with minimal complications.

Distribution Instructions

Digital asset distribution involves meticulous procedures to ensure beneficiaries receive their rightful allocations. The distribution process typically requires detailed instructions, specifying asset types such as cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH). Notifications are often sent through encrypted communications to maintain security, ensuring privacy throughout the process. Beneficiaries must verify their identities, often necessitating government-issued identification and proof of residence. The distribution might occur via blockchain transactions, which can be tracked and audited for transparency. Timelines are critical, with specific dates set for distribution events to facilitate orderly transfers. Each beneficiary would receive specific amounts, dictated by pre-established stipulations outlined in the trust or will. Additionally, tax implications may arise from these distributions, requiring beneficiaries to consult with financial advisors to properly account for digital asset allocations.

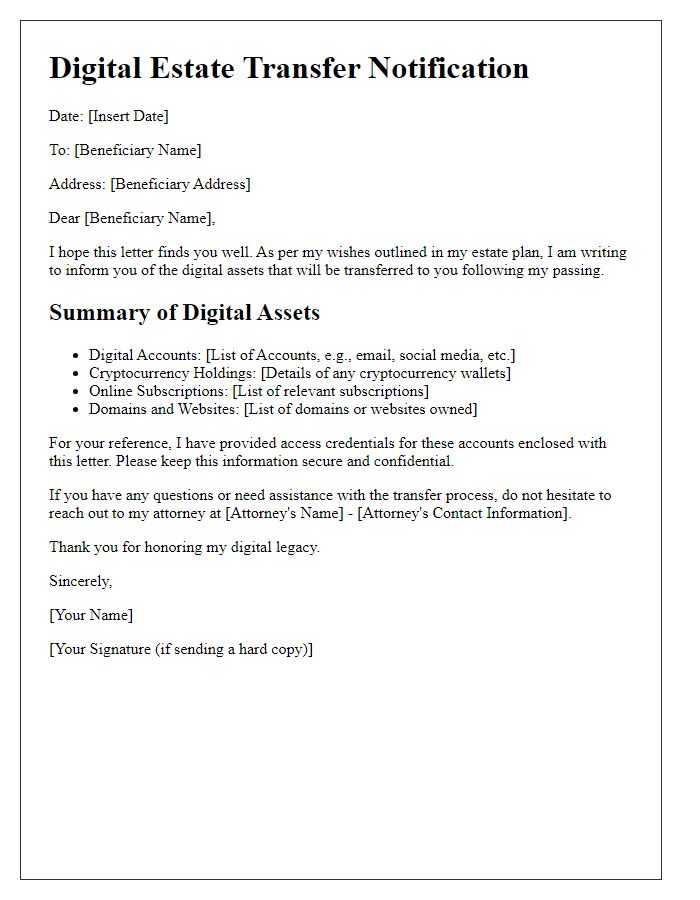

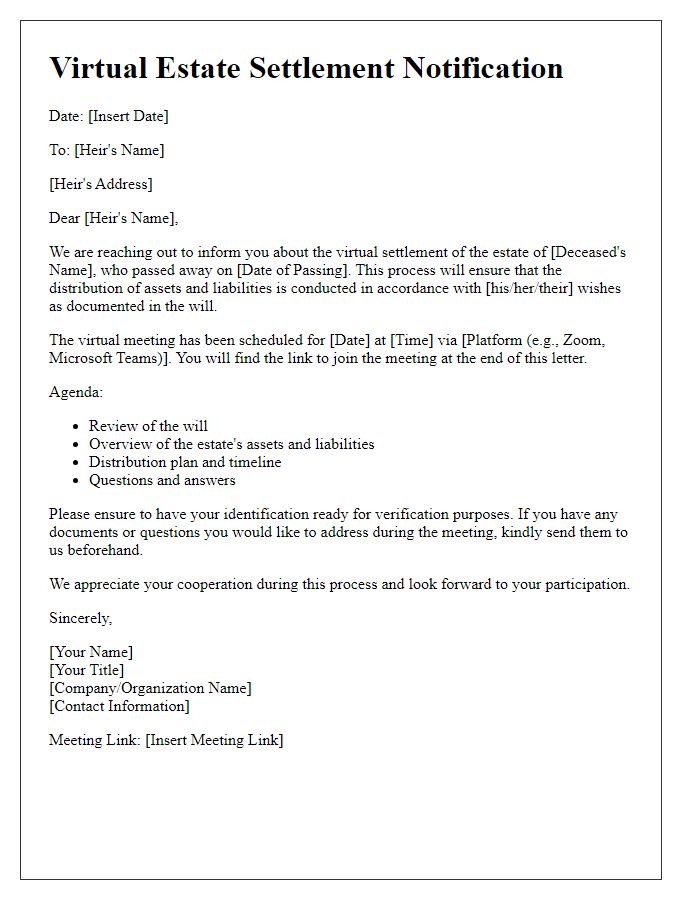

Legal and Compliance Considerations

Digital asset distribution involves numerous legal and compliance considerations, particularly regarding regulatory frameworks. Entities must adhere to governing laws such as the Securities and Exchange Commission regulations in the United States, which classify certain cryptocurrencies as securities. KYC (Know Your Customer) regulations necessitate verifying the identity of beneficiaries, reducing the risk of fraud. Additionally, compliance with AML (Anti-Money Laundering) standards is critical to prevent illicit activities. Jurisdictional variations affect the distribution process; for example, the European Union's MiFID II regulations impose strict guidelines on digital asset transactions. Tax implications must also be considered, including capital gains tax arising from the transfer of digital assets. Proper documentation must be maintained, detailing asset valuation and distribution procedures to ensure transparency and legal protection.

Comments