Are you looking to create a letter template for a beneficiary charitable trust that captures both professionalism and clarity? Crafting a clear and concise letter ensures that all necessary details regarding the trust are communicated effectively while also establishing a personal connection with the recipient. In this article, we'll guide you through the essential components of a well-structured letter, making it easier for you to navigate the documentation process. Ready to learn more about how to draft a compelling letter for your charitable trust?

Trust Identification and Name

A charitable trust, known as a tax-exempt organization under Internal Revenue Code Section 501(c)(3), must have a unique identification. A trust identification typically includes the official name, registered location, and tax identification number (EIN). For example, "The Helping Hands Charitable Trust," based in San Francisco, California, with EIN 12-3456789, is recognized for its commitment to community aid and educational support. The trust's official documents, such as the Articles of Incorporation, outline its purpose, beneficiaries, and governing structure while ensuring compliance with state and federal regulations. Such documentation is essential for transparency and accountability to donors and grant-making organizations.

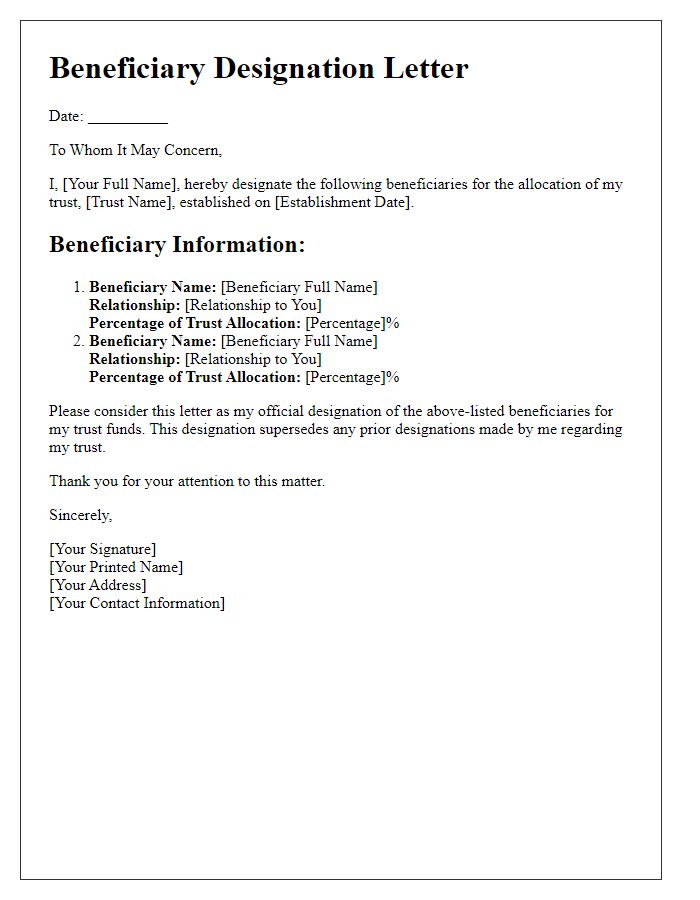

Beneficiary Details and Responsibilities

A beneficiary charitable trust documentation outlines critical information regarding individuals or organizations benefiting from the trust. Beneficiaries may include specific individuals, like named heirs or charitable organizations like the Red Cross or local food banks, designated to receive funds or assets. Responsibilities of such beneficiaries encompass fulfilling certain conditions set within the trust, such as using received funds solely for charitable purposes, providing periodic reports to the trustee, or adhering to specified spending guidelines. Ensuring transparency and proper use of trust assets is paramount, as regulatory bodies may require adherence to legal standards, like IRS regulations for 501(c)(3) organizations, to maintain tax-exempt status. Providing accurate beneficiary details, including names, addresses, and identification numbers, establishes a clear understanding of financial distributions and accountability.

Objectives and Mission Statement

Charitable trusts, such as those established for humanitarian efforts or community development, often focus on objectives that encompass providing assistance to the less fortunate, promoting education, and supporting healthcare initiatives. The mission statement typically emphasizes a commitment to improving lives, fostering social equity, and enhancing community well-being. Beneficiary programs may include outreach services in underserved areas, scholarship opportunities for disadvantaged students, and funding for medical research or local health services. Such trusts aim to create sustainable impact and drive positive change through strategic partnerships and dedicated outreach efforts. Each objective must align with the overall mission, ensuring that resources are utilized effectively to meet the community's needs.

Legal Compliance and Regulations

Beneficiary charitable trusts must carefully adhere to legal compliance and regulations set forth by governing bodies such as the Internal Revenue Service (IRS) in the United States. These trusts, established for philanthropic purposes, must ensure they qualify as tax-exempt entities under Section 501(c)(3). Accurate documentation, including the trust's formation documents, mission statements, and financial records, must be maintained to demonstrate alignment with the trust's charitable objectives. Furthermore, annual reporting, such as Form 990, is required to disclose financial activities and ensure transparency. Non-compliance can lead to serious penalties, including the revocation of tax-exempt status. Engaging with legal counsel or compliance specialists is essential for navigating state-specific regulations which may differ in requirements and reporting deadlines.

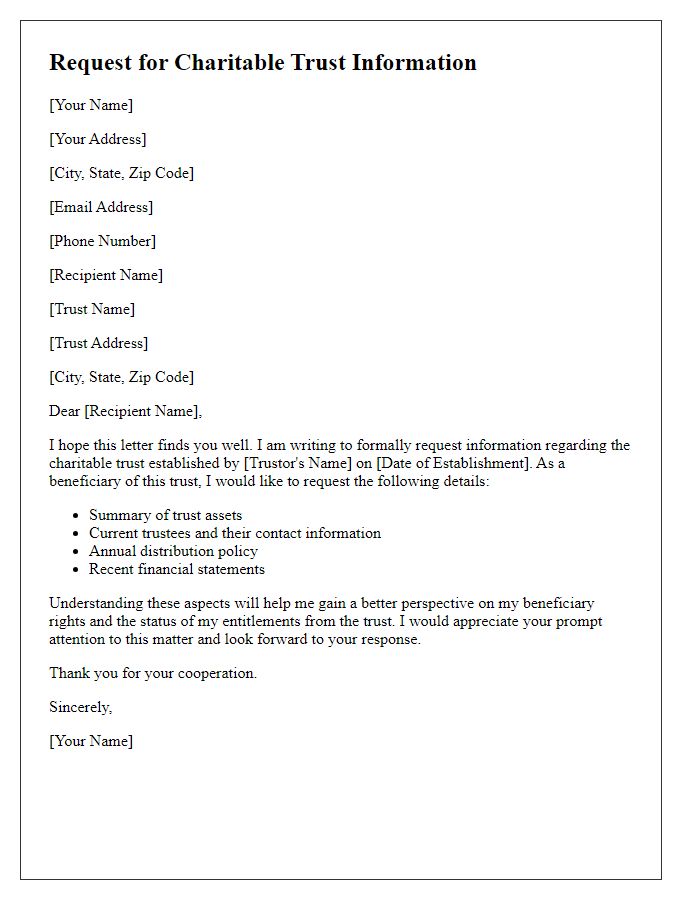

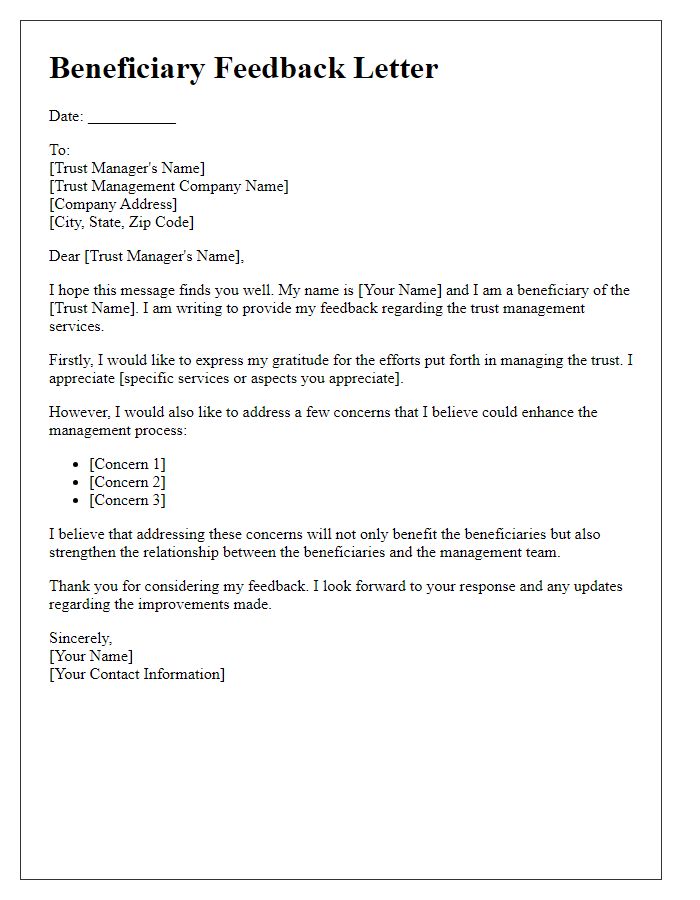

Contact Information and Communication Protocols

A beneficiary charitable trust relies on clear communication protocols to ensure transparency and efficient interaction among trustees, beneficiaries, and stakeholders. Essential contact information includes the legal address (often a registered office) for formal correspondence, email addresses for electronic communication, and dedicated phone numbers for urgent inquiries. The communication protocols outline regular reporting schedules, such as quarterly updates or annual reports on financials and activities. Additionally, protocols should specify preferred methods for disseminating information, ensuring confidentiality and compliance with applicable regulations. In larger trusts, using a secure online platform for document sharing may enhance accessibility and organization for all involved parties.

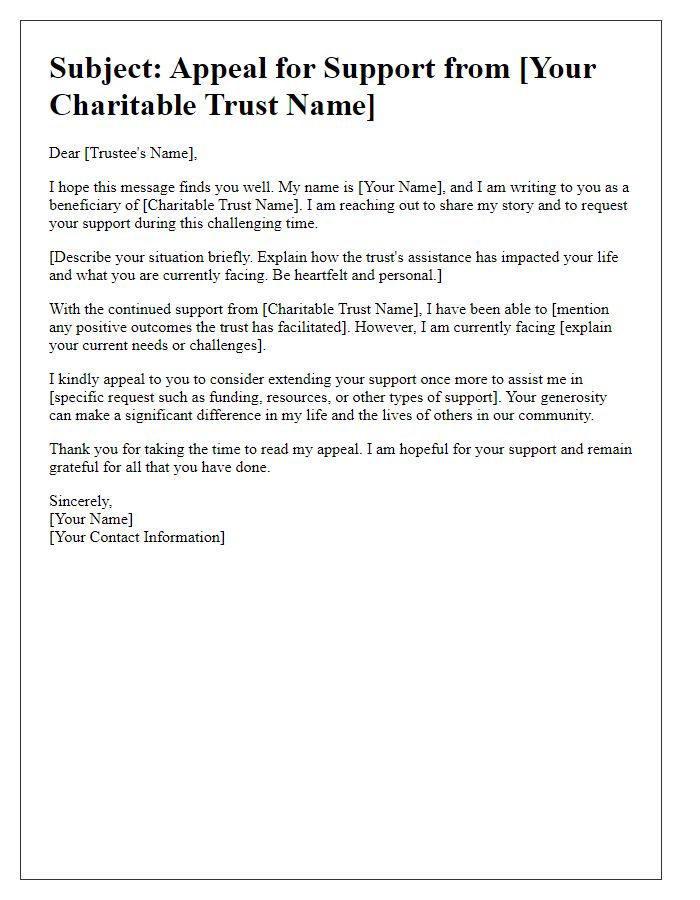

Letter Template For Beneficiary Charitable Trust Documentation Samples

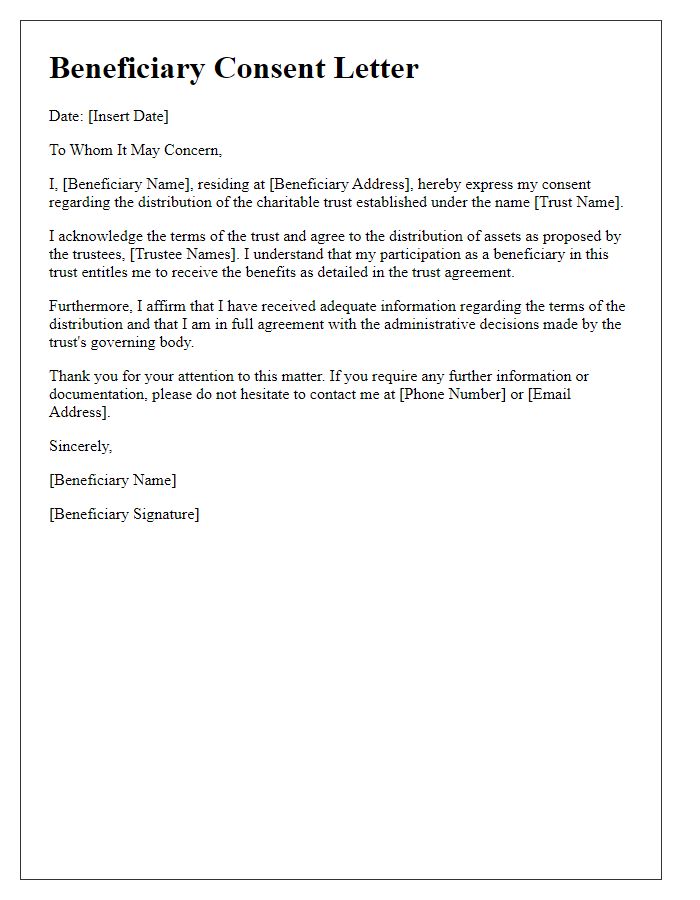

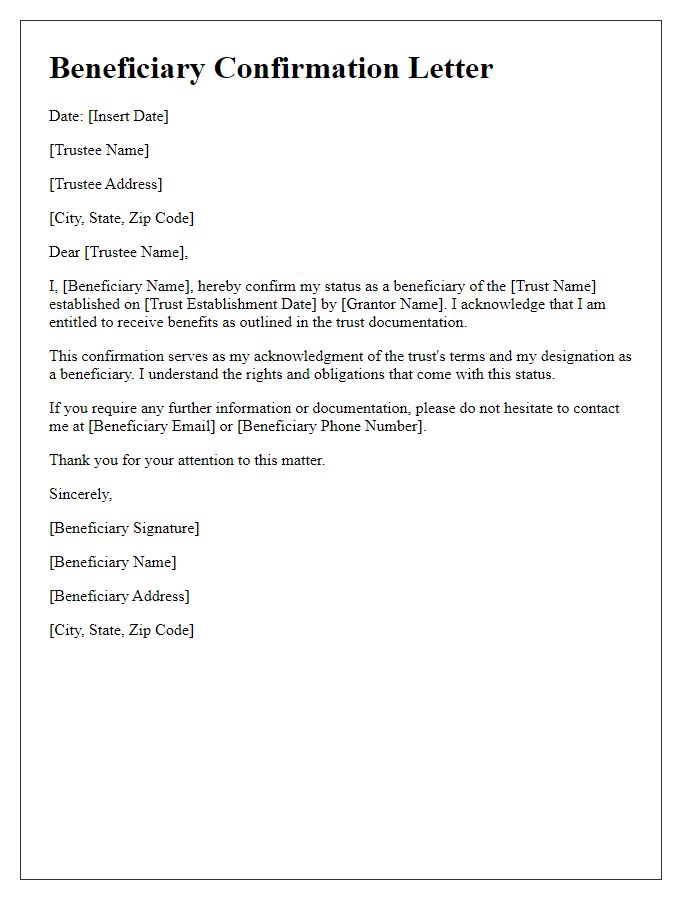

Letter template of beneficiary consent for charitable trust distribution

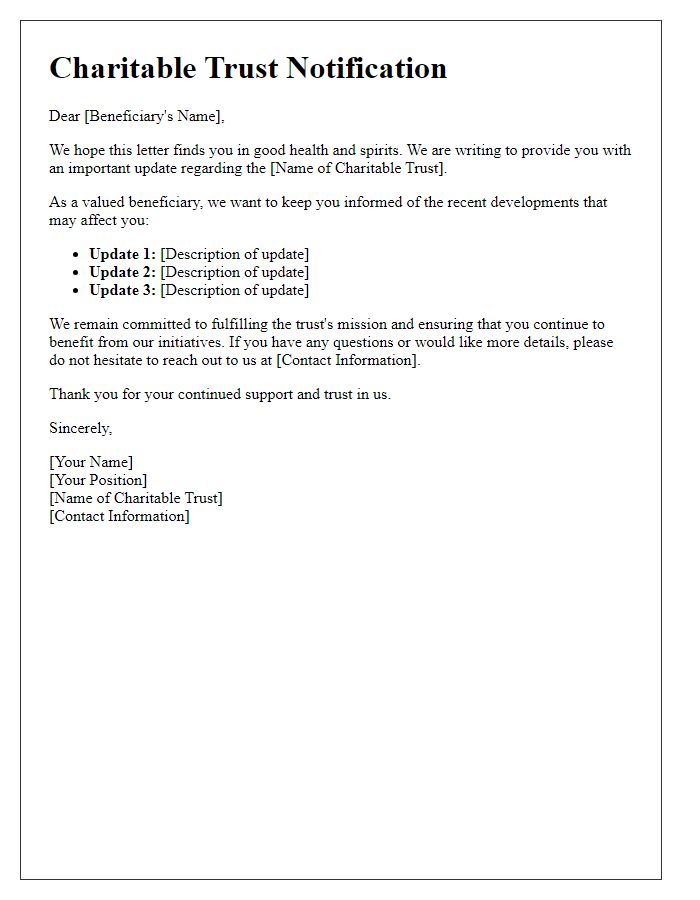

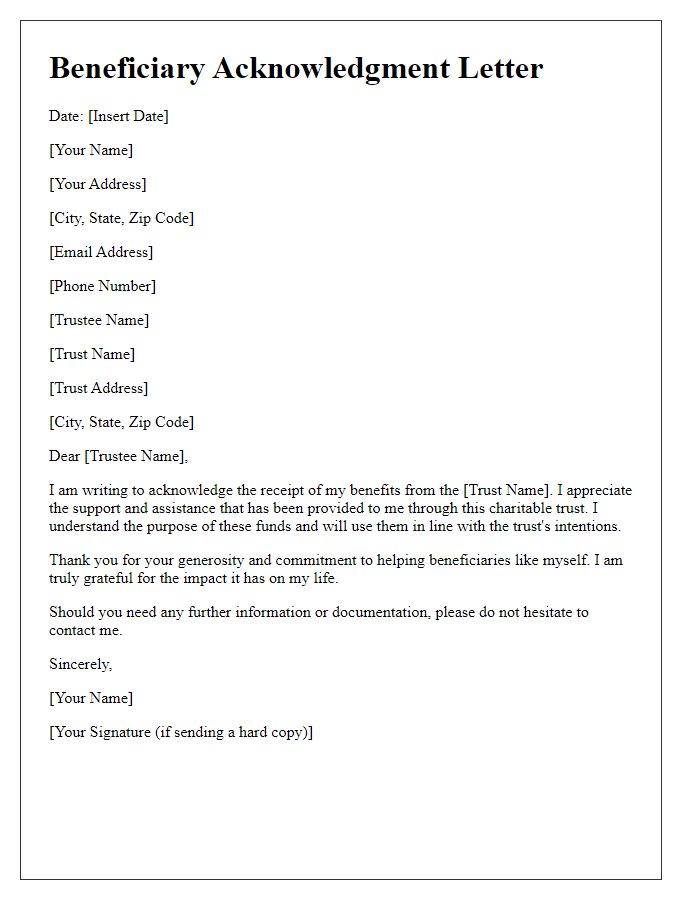

Letter template of beneficiary notification for charitable trust updates

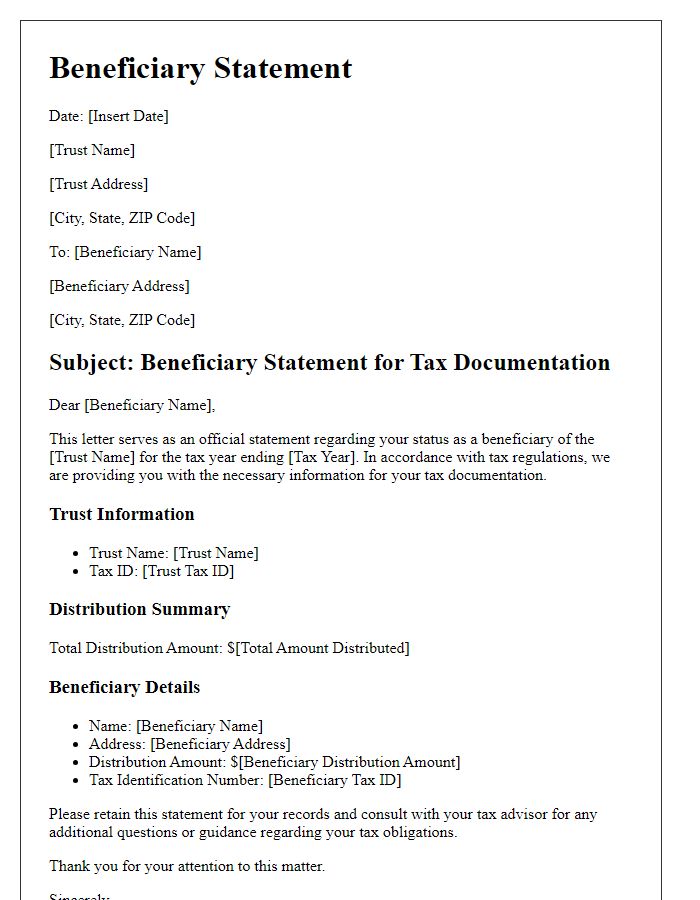

Letter template of beneficiary statement for tax documentation in a trust

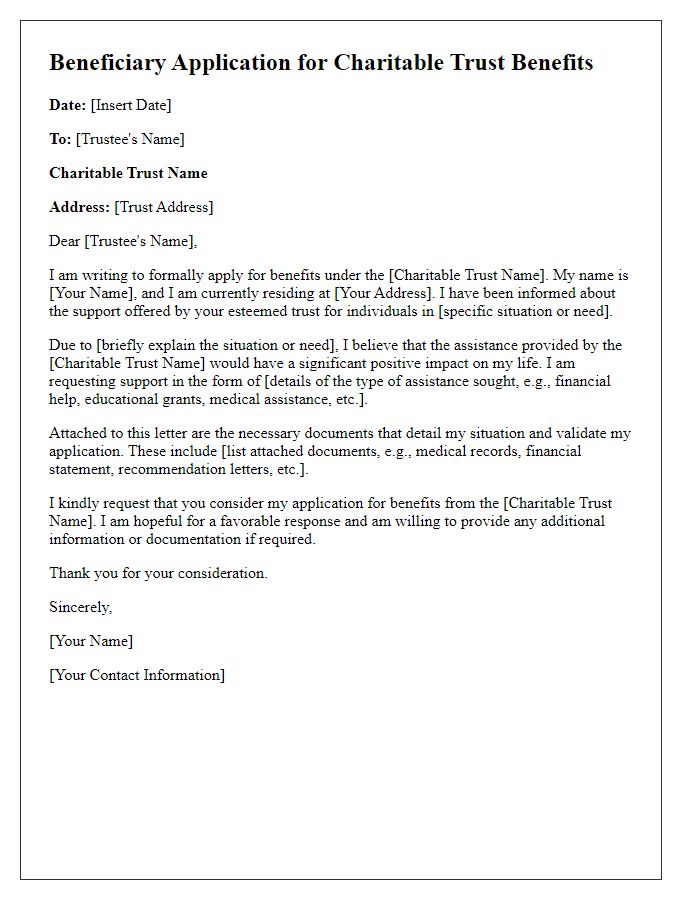

Letter template of beneficiary application for charitable trust benefits

Comments