Are you looking to secure your assets for your beneficiaries while ensuring peace of mind for yourself? Creating a solid asset protection plan is essential for safeguarding your wealth and providing for your loved ones in the long run. In this article, we'll explore the key components of an effective beneficiary asset protection plan and how it can benefit you and your family. So, grab a cup of coffee and join us as we dive into the details!

Clear identification of beneficiary and assets.

A beneficiary asset protection plan ensures that designated individuals, often children or relatives, are clearly identified for asset distribution. Specific assets, such as real estate properties located in Los Angeles County (California) valued at $750,000 and investment portfolios totaling $500,000, must be explicitly listed. Establishing a trust, such as a revocable living trust, can safeguard these assets from probate processes. Additionally, including life insurance policies with a combined coverage of $1 million can provide financial security for beneficiaries in case of unforeseen events. Identifying the executor, an individual responsible for managing the distribution, should also be explicitly noted to ensure clarity and reduce disputes. Proper documentation includes life event details, such as birth dates of beneficiaries, and does not omit any outstanding debts that may impact net asset values.

Detailed instructions for asset management.

The Beneficiary Asset Protection Plan outlines comprehensive strategies for effective asset management targeted towards preserving financial resources from unforeseen events. Key components include a diversified investment portfolio, consisting of stocks, bonds, and real estate, which should be regularly reviewed biannually to assess performance against market benchmarks, such as the S&P 500. The plan emphasizes the importance of establishing a living trust, which allows for seamless transfer of assets while minimizing estate taxes, ensuring beneficiaries receive their inheritance within a stipulated timeframe, ideally within six months of the grantor's passing. Additional strategies involve setting up a power of attorney to manage assets efficiently during incapacitation, and utilizing insurance products, such as umbrella policies, to protect against liability claims. Regular communication with financial advisors is crucial, with meetings scheduled quarterly to adapt to changing economic landscapes or shifts in personal circumstances.

Legal terminology and compliance with relevant regulations.

A beneficiary asset protection plan (BAPP) serves to safeguard the financial well-being of heirs by adhering to legal terminology and compliance with relevant regulations, including the Uniform Transfers to Minors Act and federal estate tax laws. This strategic framework incorporates trust vehicles like irrevocable trusts and family limited partnerships, which offer potential asset shielding against creditors or legal claims. Jurisdictional nuances play a crucial role, with varying regulations in states such as California and New York impacting the effectiveness of different protective mechanisms. Additionally, understanding the implications of the Federal Deposit Insurance Corporation guidelines can aid in structuring bank accounts within the estate to ensure maximum protection for beneficiary funds. Regular reviews of asset valuations and adherence to evolving legal standards ensure continued compliance and optimal protection for the designated heirs.

Contingency plans for unforeseen circumstances.

A comprehensive beneficiary asset protection plan is essential for safeguarding investments and property during unforeseen circumstances. Contingency plans should address potential events such as sudden illness, natural disasters like hurricanes or floods, and economic downturns impacting asset value. Implementation of designated trust accounts ensures financial resources remain intact for beneficiaries, securing their future. Regular assessments of property value and insurance coverage can protect assets from depreciation or loss, particularly in high-risk areas like coastal regions. Additionally, incorporating legal safeguards, such as power of attorney designations, allows trusted individuals to manage affairs in emergencies, ensuring swift and effective decision-making.

Contact information for legal advisors and plan executors.

A beneficiary asset protection plan outlines key contact information essential for effective management and safeguarding of assets, ensuring smooth transitions. Legal advisors, typically comprising estate planning attorneys or financial planners, often located in cities such as New York or Los Angeles, provide crucial guidance on compliance and asset distribution. The plan executors, appointed individuals responsible for administering the will, usually include trusted family members or experienced professionals, like accountants, who understand financial systems and regulations. Including phone numbers, email addresses, and physical addresses facilitates immediate communication during critical periods, such as the passing of a benefactor or during asset disputes. Maintaining this detailed information within a secure, accessible document helps prevent delays and mismanagement.

Letter Template For Beneficiary Asset Protection Plan Samples

Letter template of beneficiary asset protection plan for trust beneficiaries.

Letter template of beneficiary asset protection plan for heirs of an estate.

Letter template of beneficiary asset protection plan for business owners.

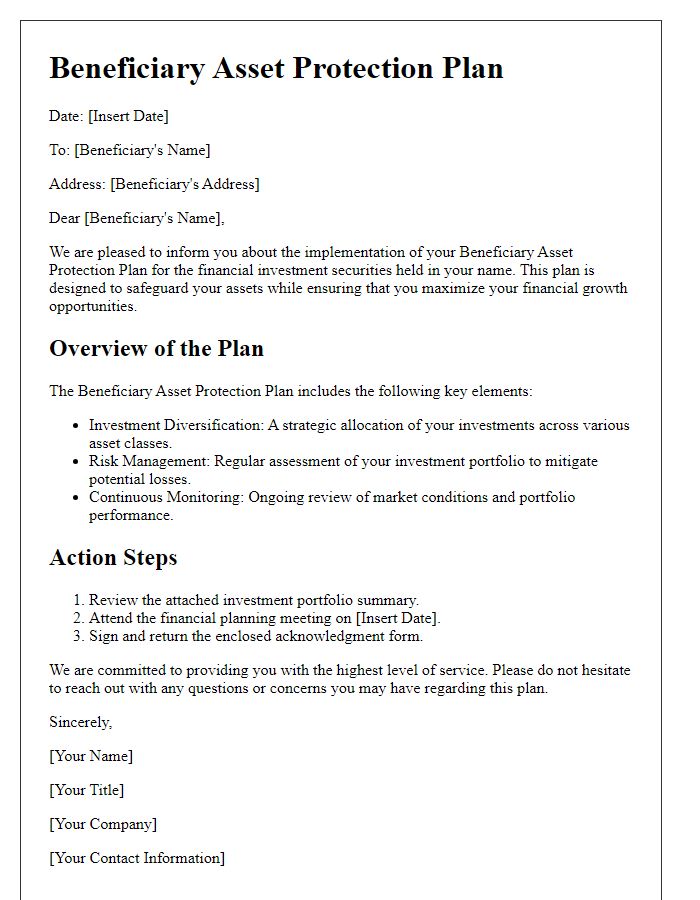

Letter template of beneficiary asset protection plan for retirement accounts.

Letter template of beneficiary asset protection plan for life insurance policies.

Letter template of beneficiary asset protection plan for individuals with special needs.

Letter template of beneficiary asset protection plan for blended families.

Letter template of beneficiary asset protection plan for charitable beneficiaries.

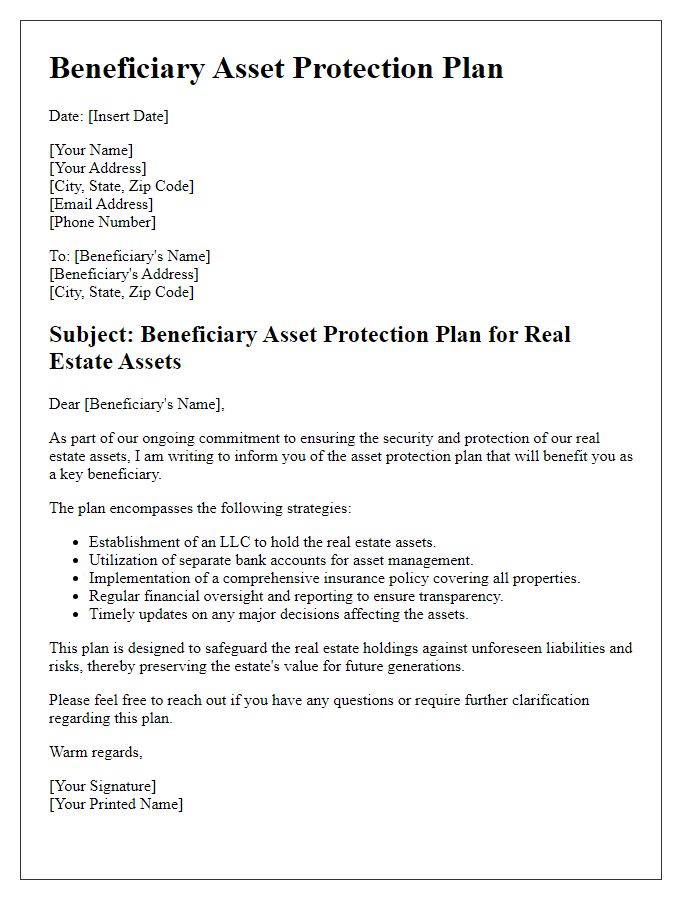

Letter template of beneficiary asset protection plan for real estate assets.

Comments