Are you considering the best ways to secure your loved ones' future through beneficiary succession planning? It's a crucial step that ensures your assets are passed on smoothly and according to your wishes. With so many options available, navigating this landscape can feel overwhelming. Join us as we explore effective strategies and insights to make informed decisions about your succession planning!

Clarity of beneficiary details

Succession planning is vital for ensuring that assets, such as real estate, financial accounts, and valuable personal belongings, are efficiently transitioned to intended heirs upon one's passing. Beneficiary details, including full names, dates of birth, and relationship to the deceased, provide clarity and legal validity to estate planning documents. Specific laws governing inheritance and probate procedures, vary by state or country, impacting the distribution process. Maintaining updated beneficiary designations on retirement accounts (such as 401(k)s) and insurance policies is crucial, preventing unintended heirs from receiving assets. Miscommunication or ambiguity in beneficiary information can lead to conflicts, delays in asset transfer, and increased legal fees. Regular reviews of beneficiary designations, particularly following major life events, like marriages, divorces, or births, help ensure that the succession plan reflects current intentions and familial relationships.

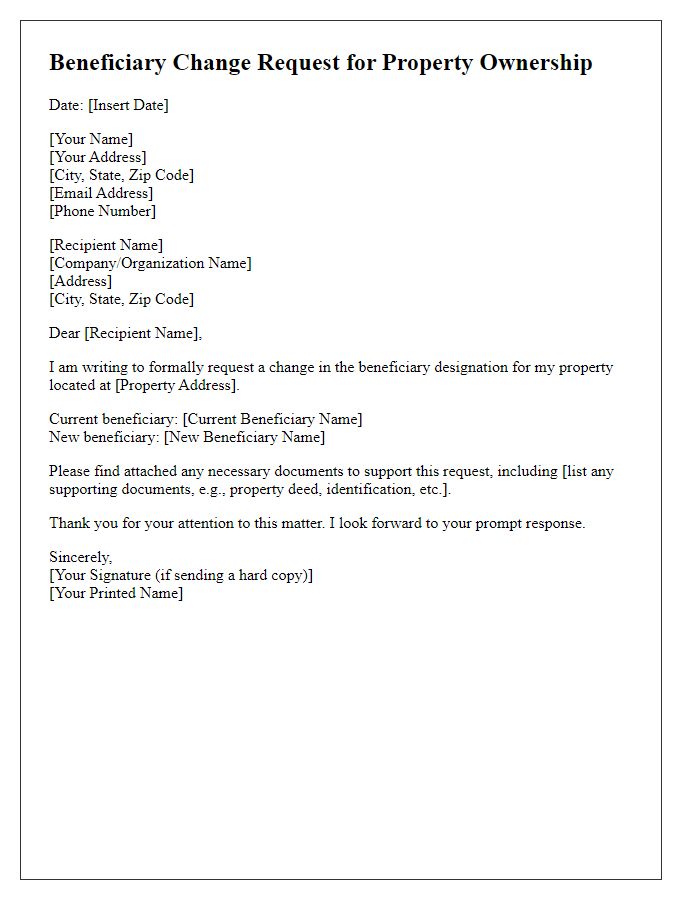

Legal compliance and documentation

Beneficiary succession planning ensures that assets are distributed according to a person's wishes after their passing. Legal compliance is crucial, involving adherence to state laws regarding wills and trusts. Documentation, such as a last will and testament, health care directives, and power of attorney, must be meticulously executed. State-specific requirements, like notarization and witness signatures, can affect the validity of these documents. Succession planning also involves updating beneficiary designations on financial accounts, retirement plans, and insurance policies to reflect current intentions. Regular reviews (at least every three to five years or after major life events) can prevent legal disputes and ensure a smooth transition of assets. Professional guidance from estate planning attorneys can help navigate complex regulations and provide tailored solutions.

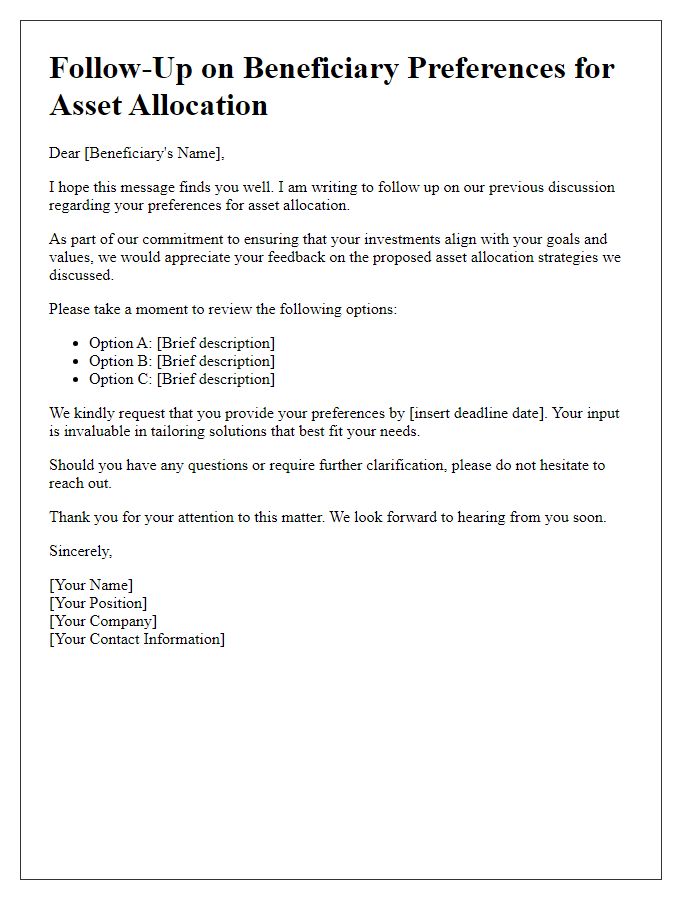

Asset distribution plan

Succession planning plays a critical role in asset distribution strategies for individuals and families. A well-constructed asset distribution plan ensures clarity regarding the allocation of valuable possessions, property, financial accounts, and investments upon an individual's passing. Engaging with legal professionals can help create a comprehensive plan, minimizing potential disputes among beneficiaries and ensuring compliance with state laws. Important considerations include specifying distribution percentages, naming guardians for dependents, and outlining special provisions for unique assets like family heirlooms. Regularly updating the plan to reflect changes in personal circumstances or legislation is essential for maintaining its effectiveness and alignment with the individual's wishes.

Tax implications and strategies

Beneficiary succession planning requires careful consideration of tax implications and strategies to ensure efficient asset transfer to heirs. In the United States, the estate tax threshold is $12.92 million as of 2023, impacting wealth management for high-net-worth individuals. Understanding the generation-skipping transfer (GST) tax is crucial for individuals planning to leave assets to grandchildren or beyond, as it imposes additional taxes on transfers exceeding $12.92 million. Strategies such as creating irrevocable trusts can be effective in reducing estate taxes and providing beneficiaries with greater control over inherited assets. Additionally, gifts of cash or assets not exceeding $17,000 annually per recipient can enhance tax efficiency while maintaining philanthropic intentions. Consulting with tax professionals and estate planners ensures beneficiaries navigate complex tax laws effectively, maximizing their inheritance and minimizing liabilities.

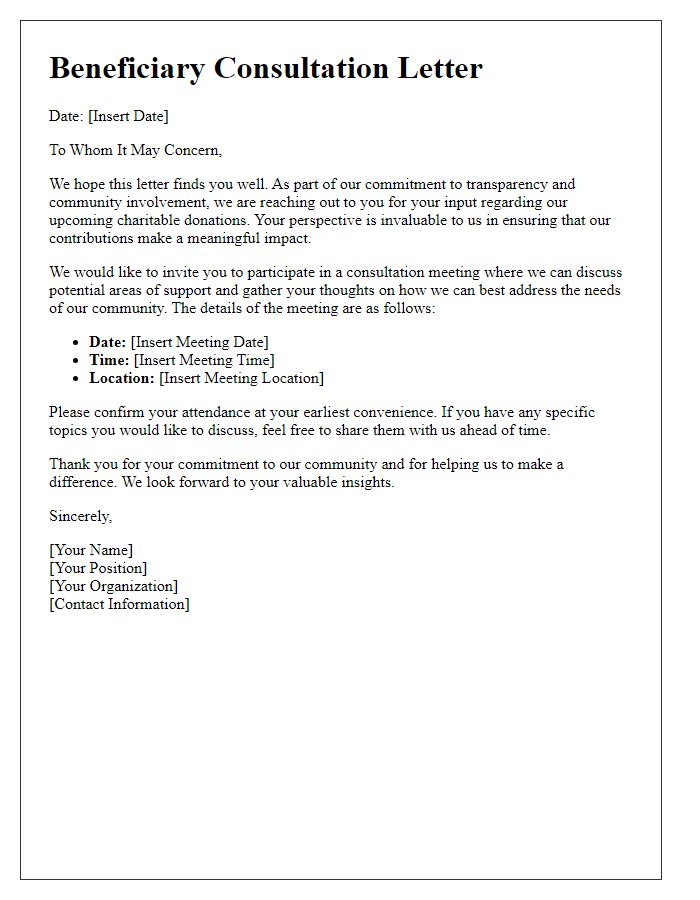

Communication channels and support

Beneficiary succession planning involves navigating various communication channels to ensure clarity and support. Effective communication methods include in-person meetings, such as those held in estate planning offices in major cities like New York and Los Angeles, where financial advisors and estate lawyers collaborate. Online platforms, such as secure video conferencing tools like Zoom, have gained popularity for remote consultations, allowing beneficiaries to engage with experts from the comfort of their homes. Resources like informational webinars hosted by estate planning organizations provide valuable insights about the succession process. Moreover, support groups may be available in local community centers, facilitating discussions among individuals facing similar planning challenges. Utilizing these diverse channels enhances understanding and eases the complexities surrounding beneficiary succession planning.

Letter Template For Beneficiary Succession Planning Inquiry Samples

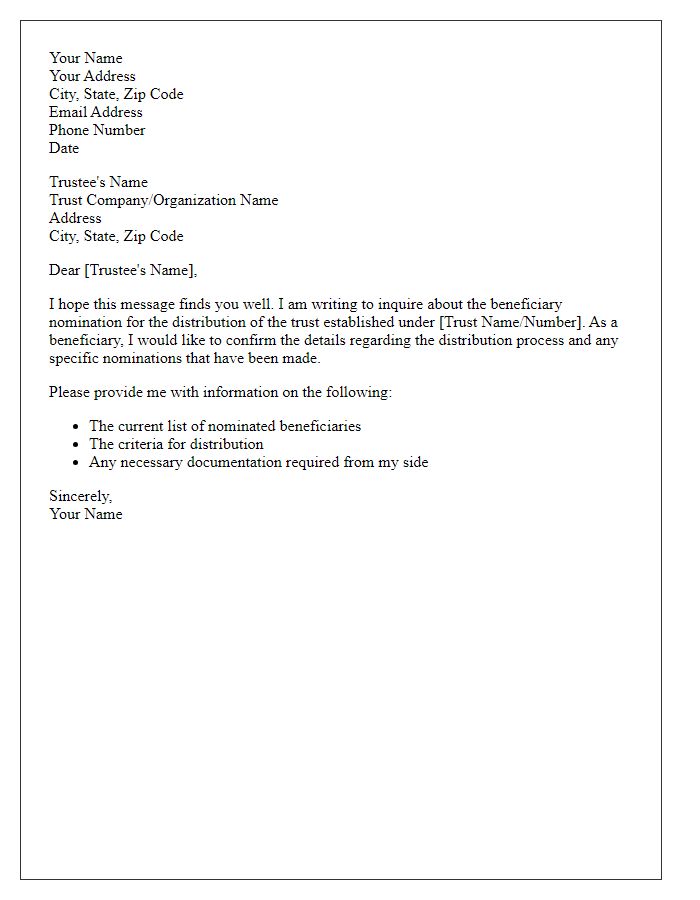

Letter template of inquiry regarding beneficiary nomination for trust distribution

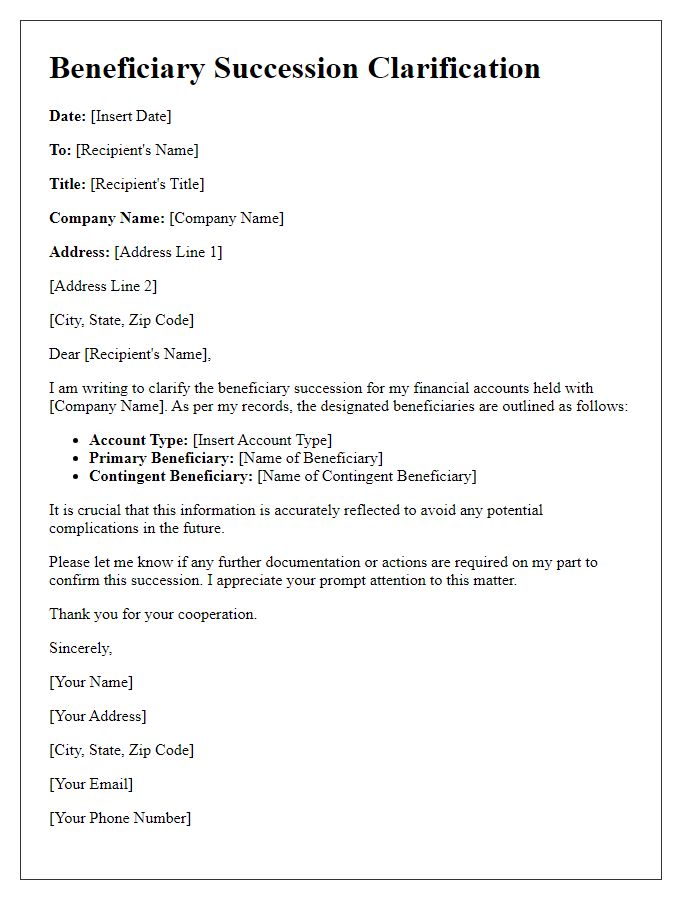

Letter template of beneficiary succession clarification for financial accounts

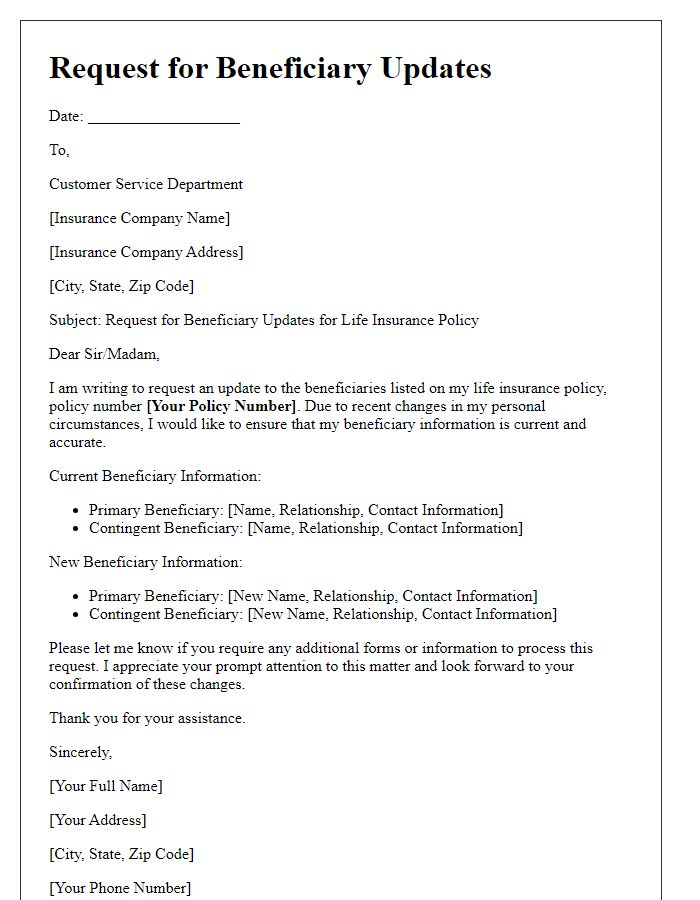

Letter template of request for beneficiary updates in life insurance policy

Letter template of beneficiary selection discussion for retirement accounts

Letter template of inquiry about contingent beneficiaries for investments

Comments