When a loved one passes away, the last thing on our minds is often the paperwork that follows. However, understanding how to submit a death benefit claim can help ease some of the financial burden during such a challenging time. It's essential to know what documents you need and how to properly fill out those forms to ensure a smooth process. Join us as we explore a comprehensive letter template that simplifies this crucial task for beneficiaries.

Clear Identification and Contact Information

A clear identification section is crucial for a beneficiary death benefit claim, ensuring all parties involved can easily verify information. Essential elements include the full name of the deceased policyholder, date of birth (often formatted as MM/DD/YYYY), and policy number, which uniquely identifies the insurance policy. Beneficiaries must also provide their complete contact information, including current address, phone number, and email address, facilitating prompt communication regarding the claim. This clarity helps insurers process requests efficiently, reducing delays and potential complications. Including a clearly labeled subject line, such as "Beneficiary Claim for Policy [Policy Number]," can also improve clarity in electronic submissions.

Precise Claim Details and Policy Information

To successfully file a beneficiary death benefit claim, it is crucial to gather precise claim details and relevant policy information. The policy number, typically found on the insurance documents or statements, identifies the specific life insurance contract issued by the insurer, such as Prudential or MetLife. The deceased individual's full name and Social Security number must be documented for verification purposes, along with the date of death, which may require a certified death certificate issued by the local government, such as the Vital Statistics Office. Beneficiaries should note the circumstances surrounding the death, whether accidental or due to natural causes, as this may influence the claim process. Additionally, any required claim forms, which can vary by insurance provider, should be completed accurately, including signatures from all beneficiaries involved, to facilitate a smooth processing experience.

Required Documentation and Attachments

When filing a beneficiary death benefit claim, proper documentation is critical for a smooth processing. Essential documents include a certified copy of the death certificate, which provides official confirmation of the individual's passing, often issued by the appropriate state authority or hospital. Additionally, the claim form, which varies by insurance provider, must be accurately completed and signed by the beneficiary. Identification verification, such as a government-issued photo ID (Driver's License or Passport), is necessary to confirm the beneficiary's identity. Any policy information, including the original insurance policy document or a summary, can expedite the claims evaluation process. Lastly, if applicable, any documentation regarding financial dependents or a will may be included to clarify beneficiary designation and ensure the rightful distribution of benefits.

Formal Request for Processing and Payment

In the wake of a loved one's passing, the process of claiming life insurance death benefits can be both emotionally taxing and complex. To initiate this claim, it is essential to gather crucial documents such as the original life insurance policy, a certified copy of the death certificate issued by a judicial authority, and proof of identity of the claimant. Financial institutions may also require forms specifically tailored to the policy's requirements, which outline the beneficiary's relationship to the deceased. It is advisable to submit all relevant documentation promptly to the insurance provider, ensuring clear contact information for follow-up and potential inquiries. Each company may operate under distinct timelines, often requiring 30 to 60 days for processing, while emphasizing their legal obligations necessitating thorough verification before benefit disbursal.

Assurance and Consent for Information Verification

Beneficiary death benefit claims require clear communication and detailed verification processes. The Assurance and Consent for Information Verification form serves to protect both the claimant and the insurance company. This document typically requires the claimant to assert their relationship (such as spouse, child, or dependent) with the deceased individual, ensuring that benefits are disbursed to the appropriate parties. The form also includes consent clauses allowing the insurance provider to access relevant personal information such as medical records and policy details, which may date back several years. Furthermore, the submission of this form is often accompanied by required documentation, including a certified death certificate, which confirms the date of passing, an essential factor in determining eligibility for benefit claims. Accuracy in providing this evidence is crucial, as incorrect information can lead to delays or denial of claims.

Letter Template For Beneficiary Death Benefit Claim Samples

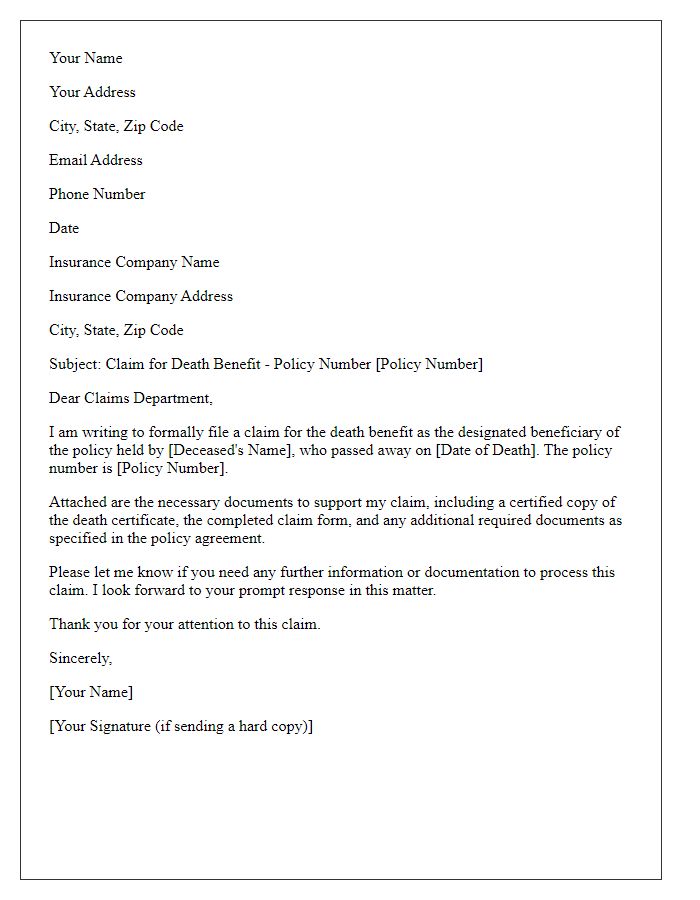

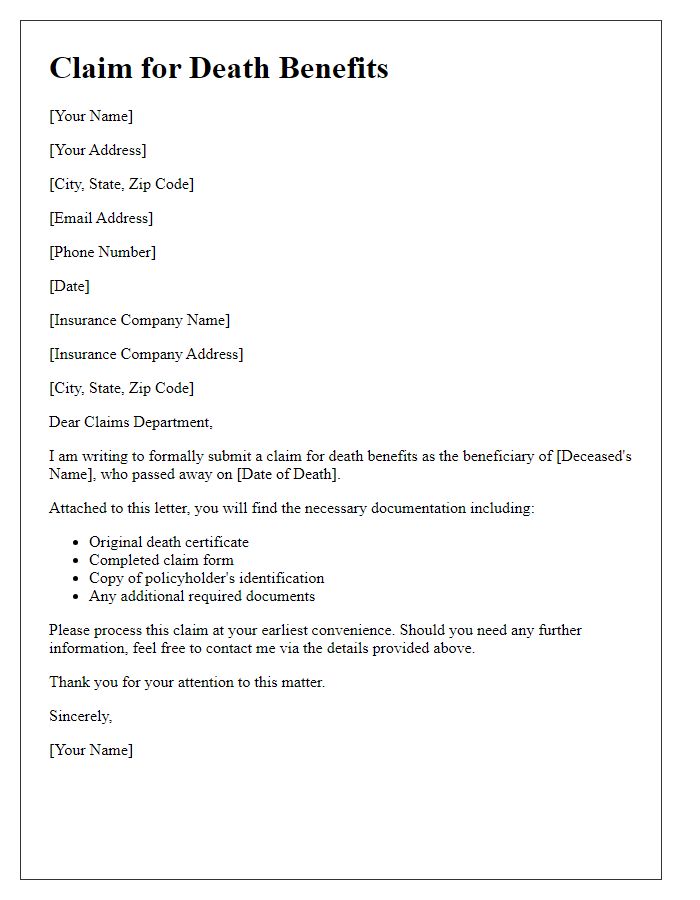

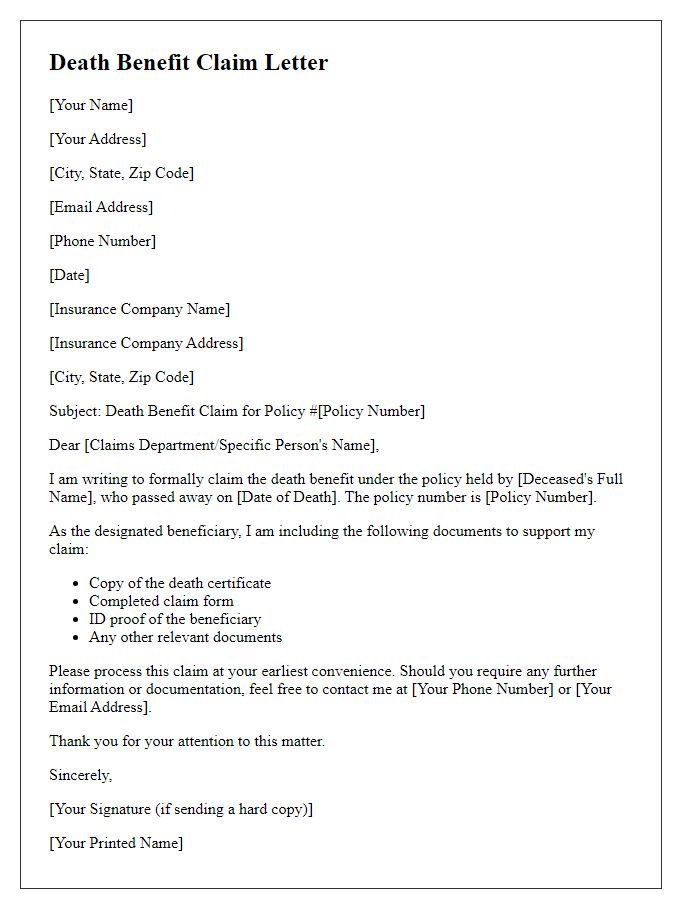

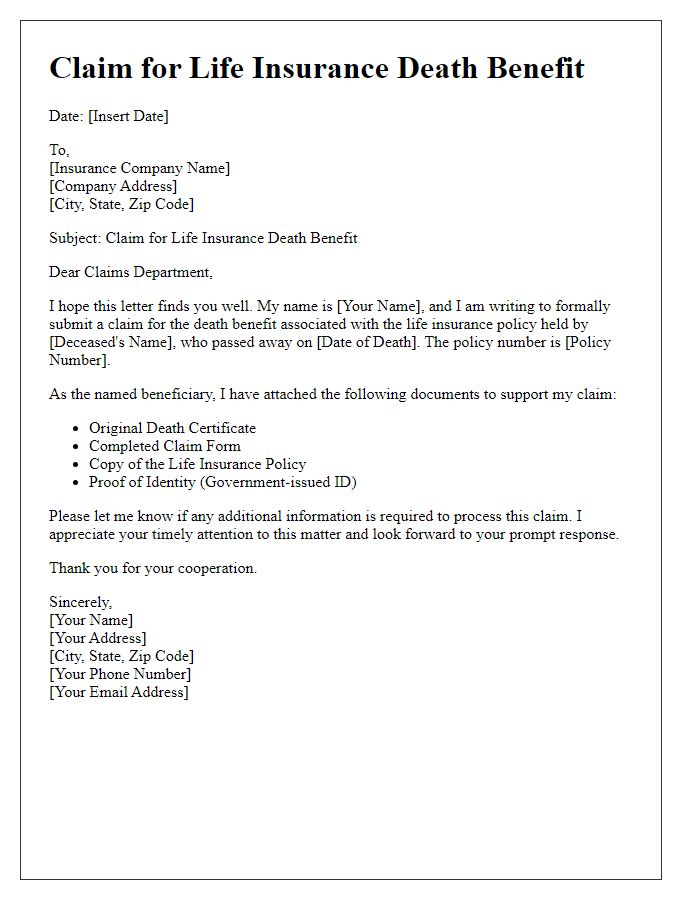

Letter template of filing a death benefit claim as a designated beneficiary

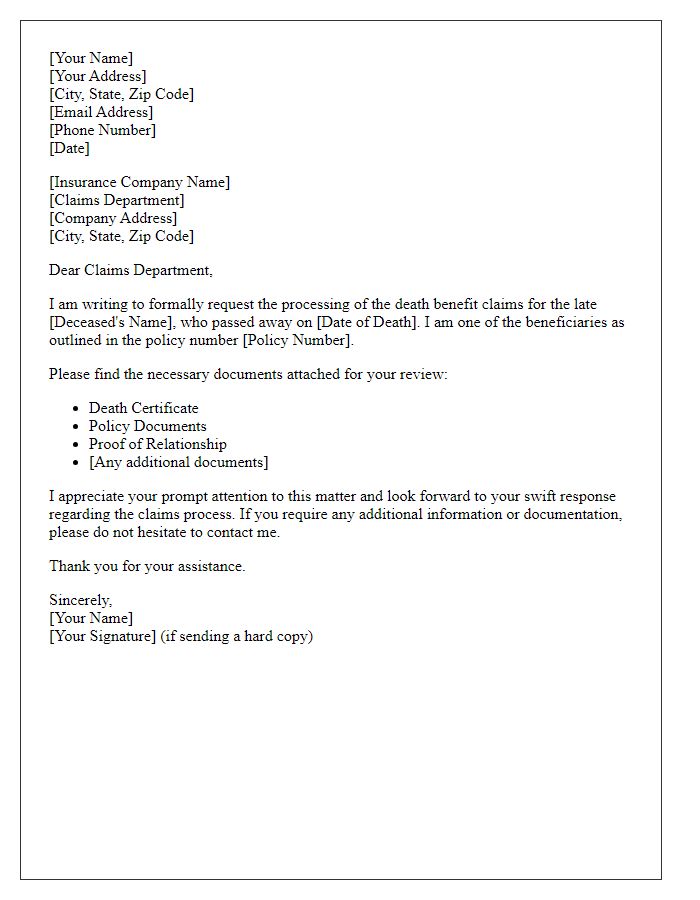

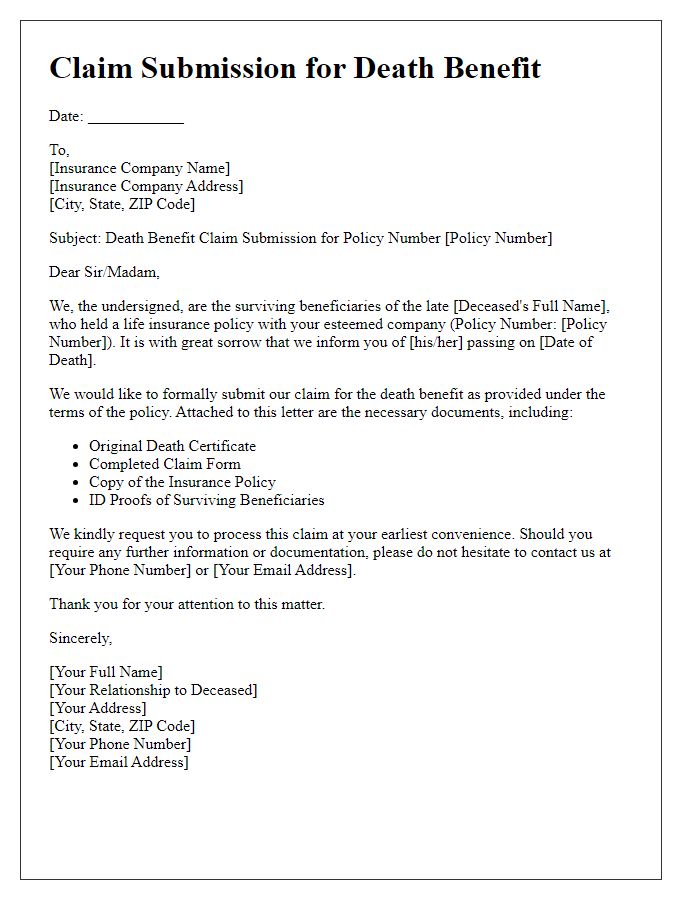

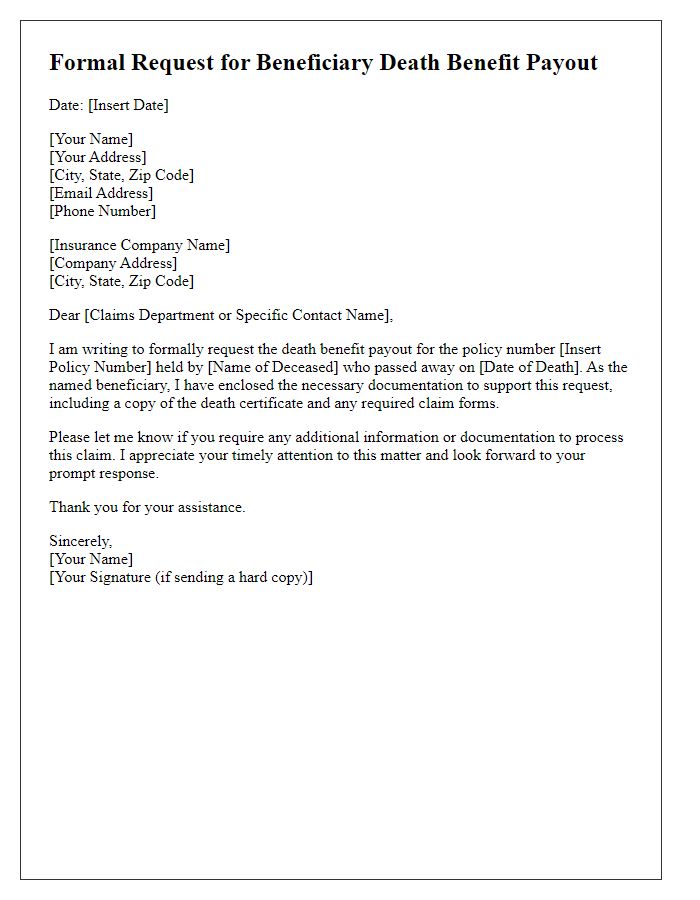

Letter template of requesting death benefit claims processing for beneficiaries

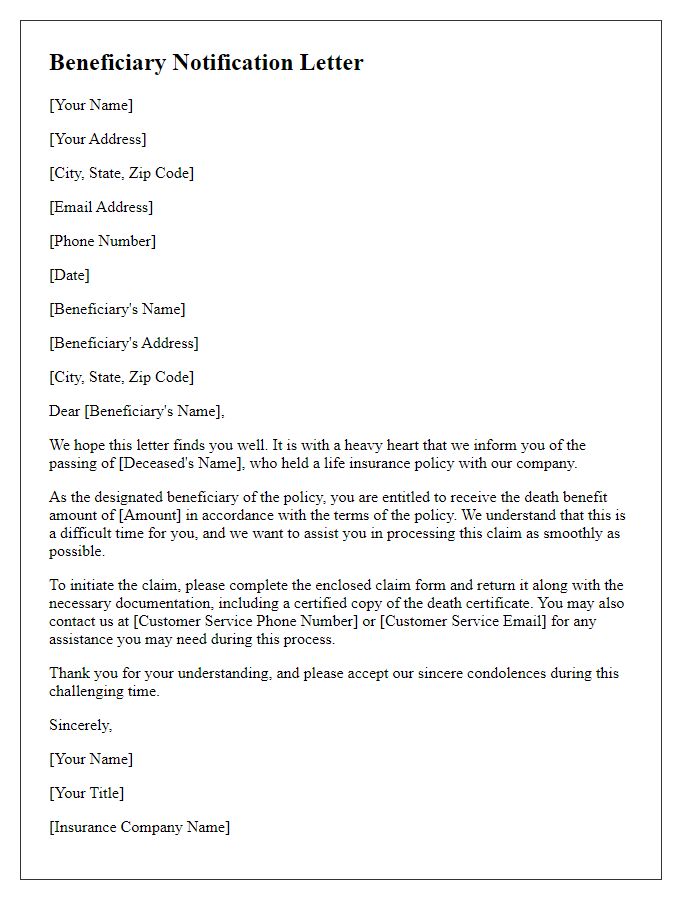

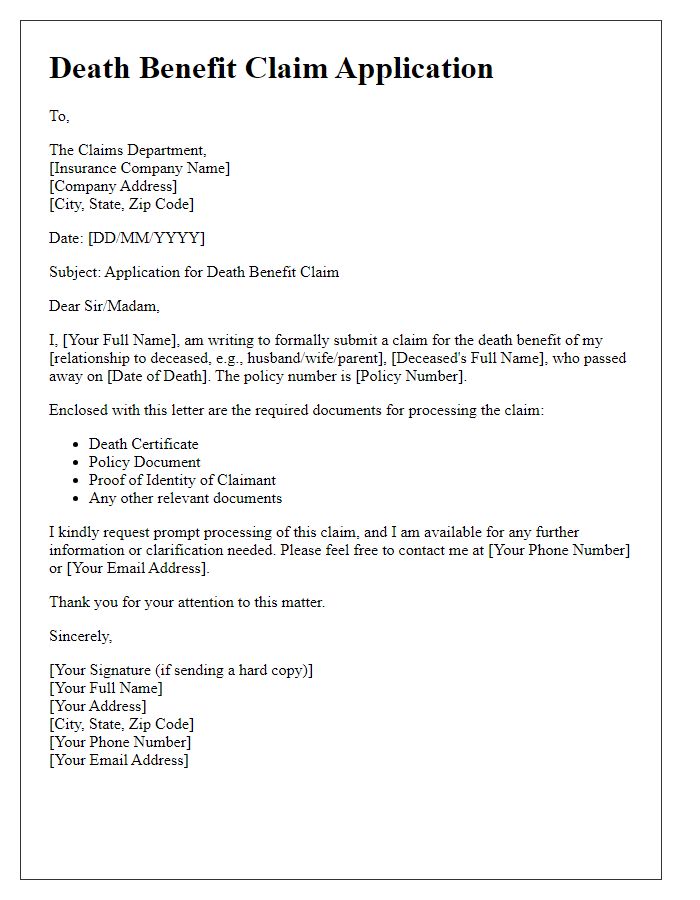

Letter template of beneficiary notification for life insurance death benefit claim

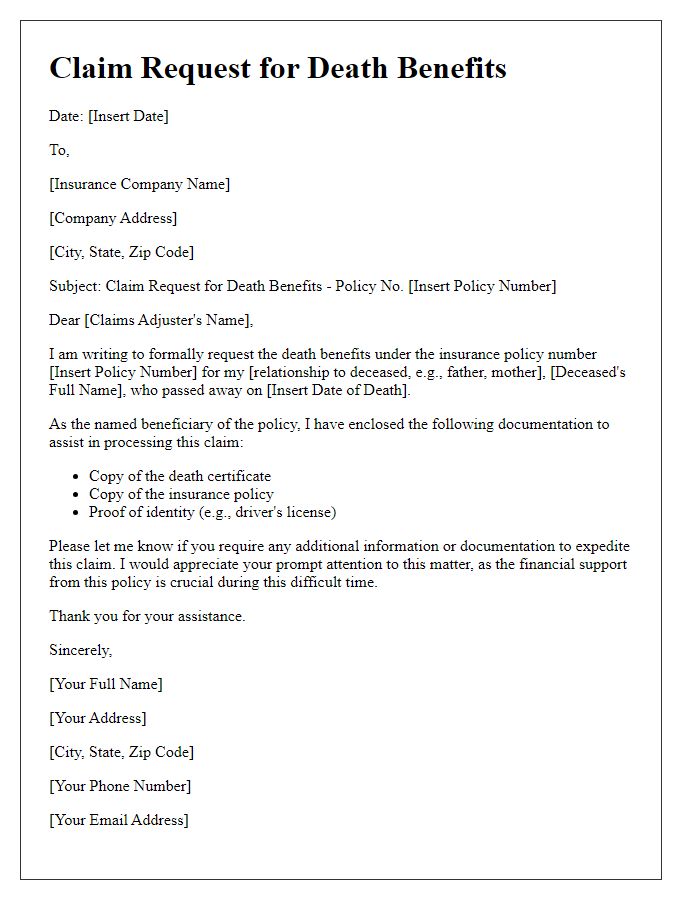

Letter template of submitting a claim for death benefits as a beneficiary

Letter template of death benefit claim submission from surviving beneficiaries

Letter template of death benefit claim application for life insurance beneficiaries

Comments