When it comes to navigating the intricacies of estate planning, understanding the importance of beneficiary trust amendments can be essential for protecting your loved ones' futures. Trust amendments may seem daunting, but they serve as a flexible means to adjust your wishes as circumstances change. Whether you're adding a new beneficiary or clarifying existing terms, these amendments can help ensure that your assets are distributed in accordance with your updated intentions. Curious about the process and best practices for drafting such amendments? Let's dive in!

Clarity in Purpose and Scope

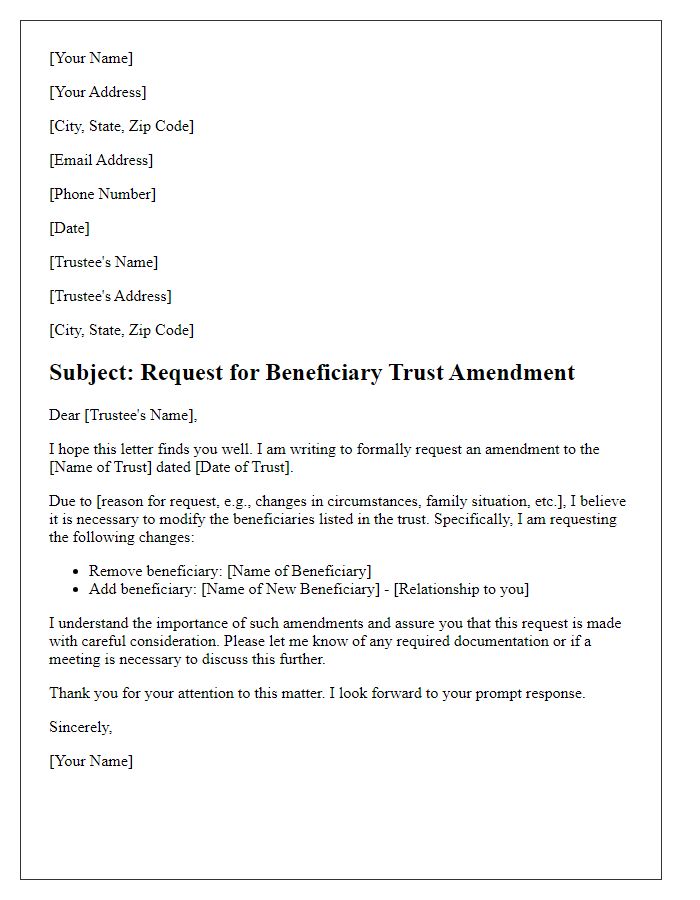

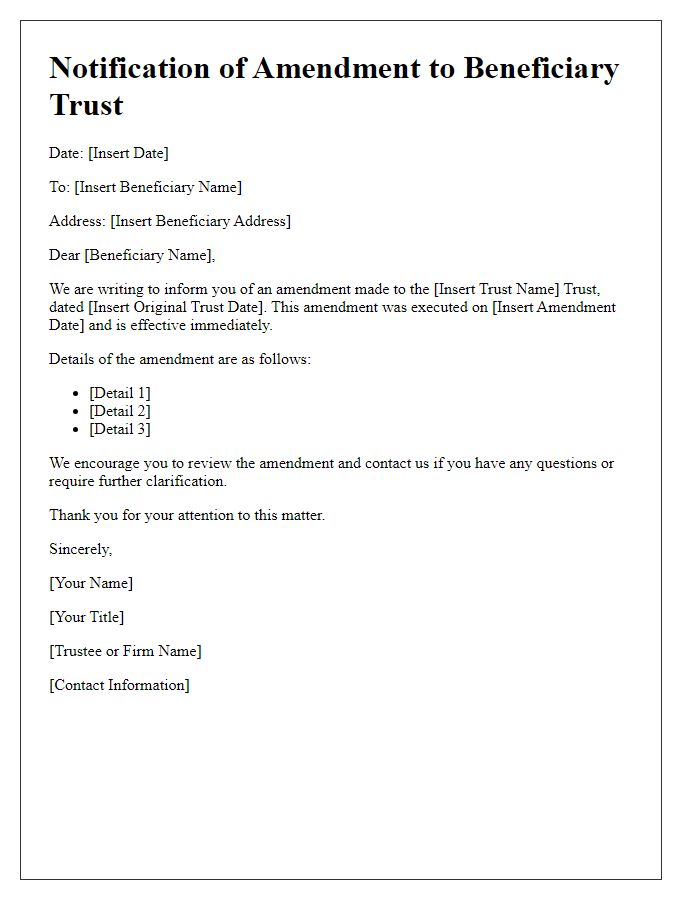

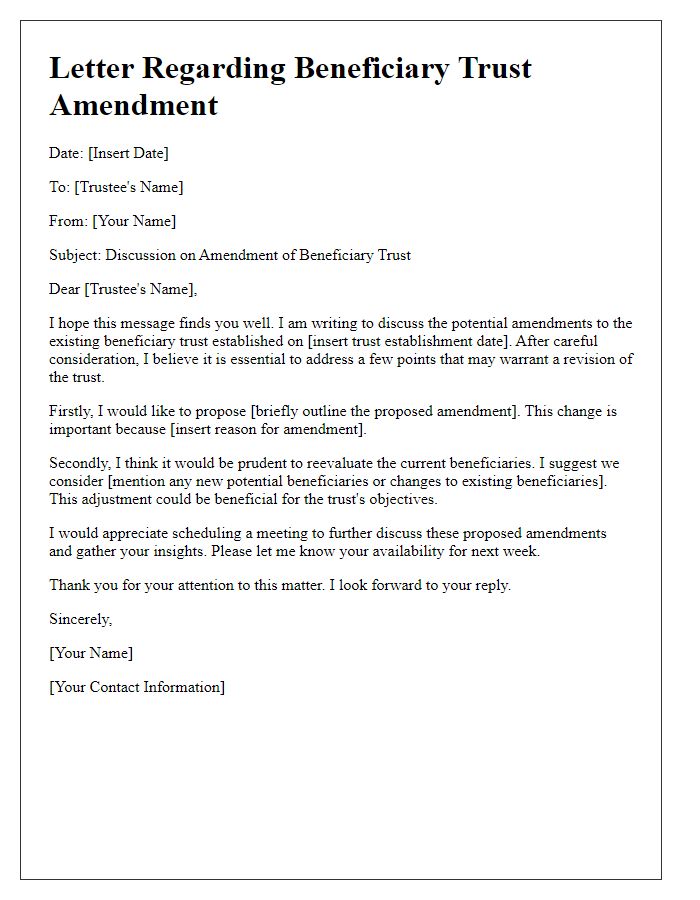

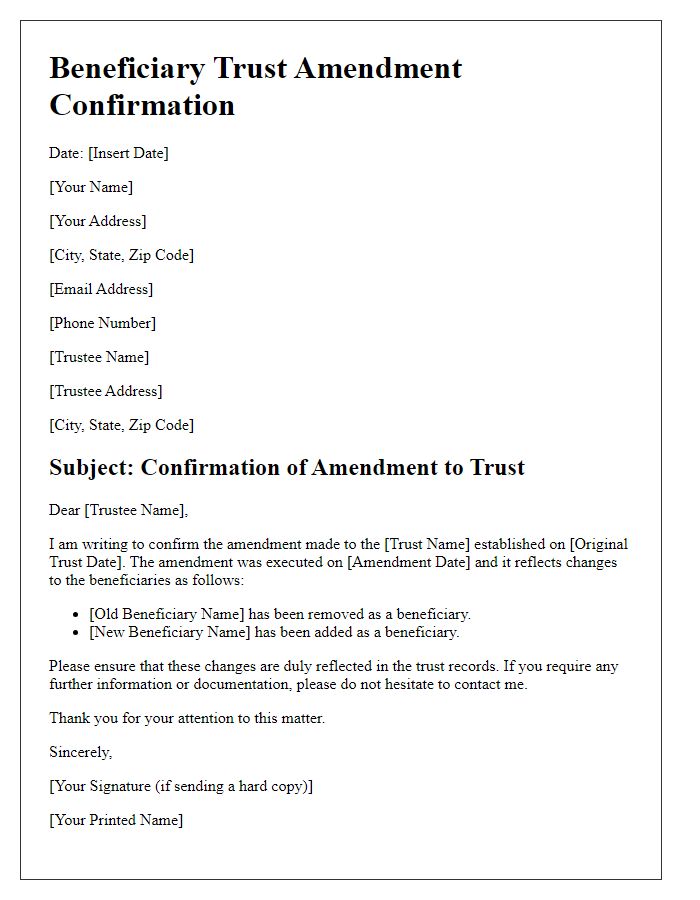

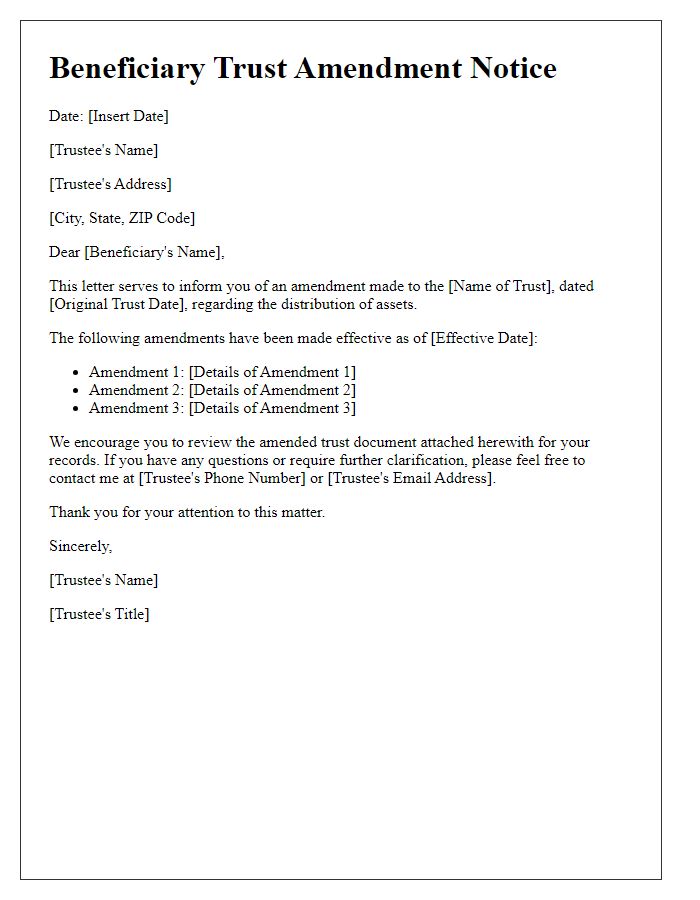

Beneficiary trust amendments ensure clear alignment with the grantor's intentions and objectives, providing defined guidelines for beneficiaries' rights and responsibilities. Legal frameworks often require detailed descriptions of purpose, including financial management strategies and distribution methodologies. The amendment process typically involves formal documentation outlining specific changes, necessitating signatures from trustees and beneficiaries to validate consent. Legal advisors frequently recommend thorough reviews to mitigate potential disputes among parties involved. Timely communication regarding amendments is essential, fostering transparency and trustworthiness among beneficiaries, especially in multiple beneficiary scenarios often present in complex family estates.

Legal Terminology

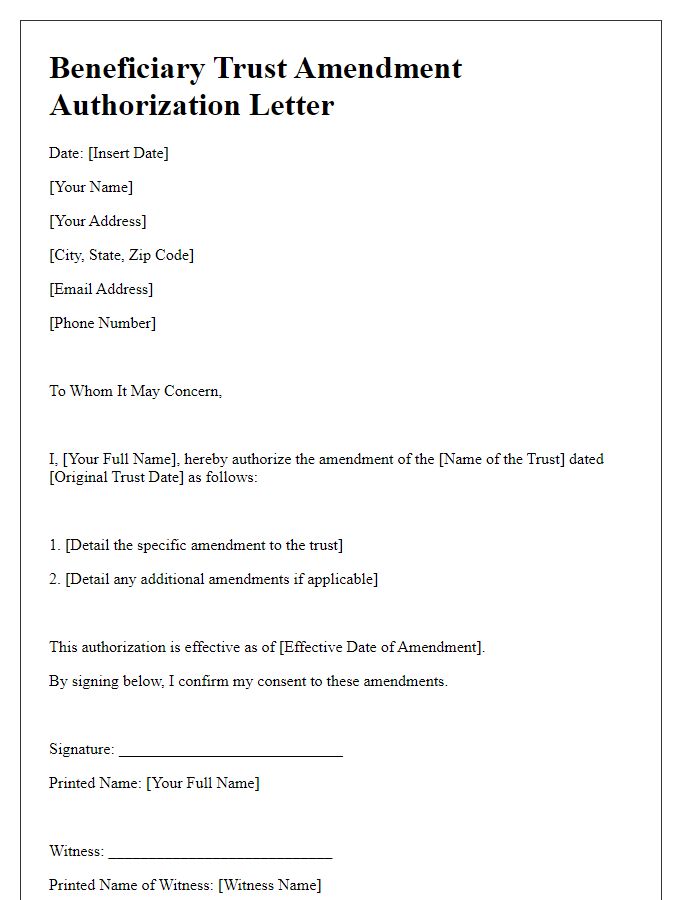

Beneficiary trusts, particularly in the context of estate planning, may require amendments to ensure compliance with changing laws or the grantor's evolving intentions. A proper beneficiary trust amendment involves specific legal terminology to articulate changes clearly. For example, terms like "Grantor" refers to the individual creating the trust, while "Beneficiary" denotes the person entitled to benefits from the trust's assets. Legal phrases must include "Amendment," indicating a formal modification of the trust document, and "Effective Date," specifying when the changes take effect. The amendment also typically outlines the reasons for the modification, such as changes in family circumstances or tax considerations, and must be signed by the Grantor along with notarization to ensure authenticity and validity in jurisdictions under the authority of trust law.

Trustee and Beneficiary Identification

Amending a beneficiary trust requires precise identification of involved parties such as the trustee and the beneficiaries to ensure clarity and legality. The trustee, responsible for managing the trust assets, is often a financial institution or an individual with fiduciary duties, holding a significant role since they must adhere to legal obligations and the wishes of the grantor. Beneficiaries, who receive the benefits from the trust, may include family members, charities, or other designated entities, each identified by their legal names and relation to the trust creator. Accurate descriptions involve specifying addresses, dates of birth, and beneficiaries' roles to prevent any disputes. This meticulous detailing helps uphold the trust's integrity and facilitates smooth amendments aligned with the grantor's intentions.

Compliance with Trust Laws

Trust amendment approval processes require careful compliance with state trust laws and regulations. Beneficiary trusts, designed to benefit specific individuals such as family members or charities, must adhere to the legal framework established in jurisdictions like California or New York. Significant amendments may include alterations to beneficiary distributions, revision of trustee powers, or changes in trust terms. Documentation such as signed consent forms from affected beneficiaries and verification of trustee qualifications ensure compliance. Additionally, legal counsel may review amendments to guarantee alignment with the Uniform Trust Code, preventing future disputes. Accurate record-keeping in accordance with local laws ensures transparency and supports effective trust administration.

Signature and Notarization

Beneficiary trust amendments require careful attention to legal documentation and signature validation processes. When amending a trust, such as a revocable living trust formed in California, it's essential to include specific details like the trust's name, the trustee's identity, and the date of the amendment. Notarization becomes a crucial step, often necessitated by state laws, to ensure authenticity and prevent fraud. The notary public's signature and official seal, along with the trustee's signature, affirm the amendment's legitimacy. Additionally, proper notifications to beneficiaries regarding changes to their entitlements are advised to maintain transparency and avoid future disputes, referencing statutes under the California Probate Code.

Comments