If you're looking to withdraw funds from your designated account or investment, writing a clear and concise letter is essential. A well-crafted letter not only communicates your request effectively but also ensures that all necessary information is included for a smooth processing experience. In this article, we'll guide you through the key elements to include in your beneficiary withdrawal request form and provide helpful tips to make the process as hassle-free as possible. So, let's dive in and help you get your withdrawal request submitted with confidence!

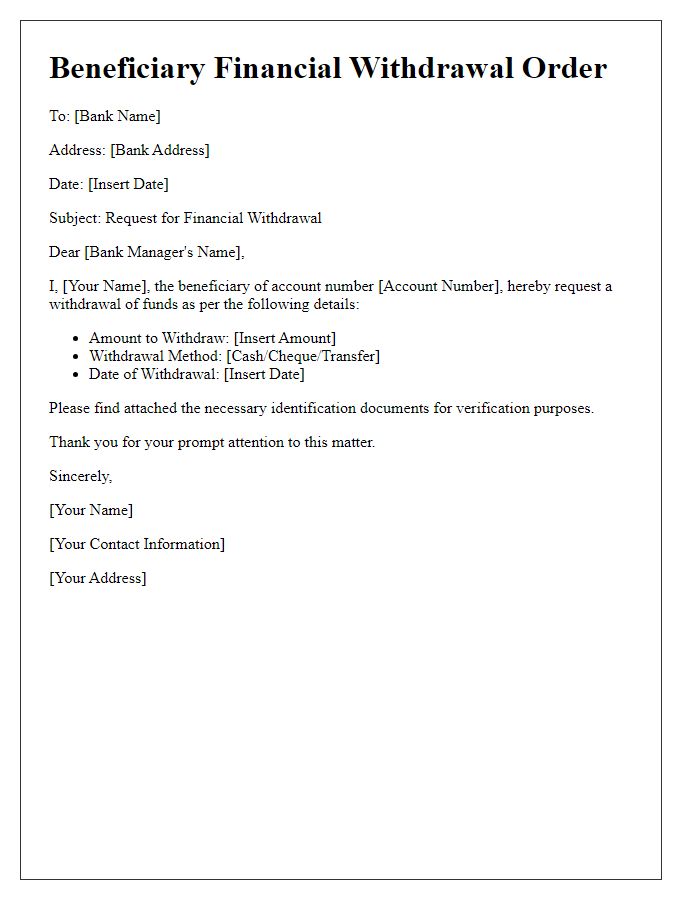

Account Information

Account Information provides essential details for processing beneficiary withdrawal requests. The account number, typically a string of 10-12 digits, identifies the specific account in financial institutions. The account holder's name, which matches the name on official documents, ensures accuracy in processing. The bank name, such as Wells Fargo or Chase, represents the institution managing the funds. Routing numbers, usually consisting of 9 digits, facilitate the transfer of funds between banks. Providing accurate account information is critical to prevent delays or errors in the withdrawal process.

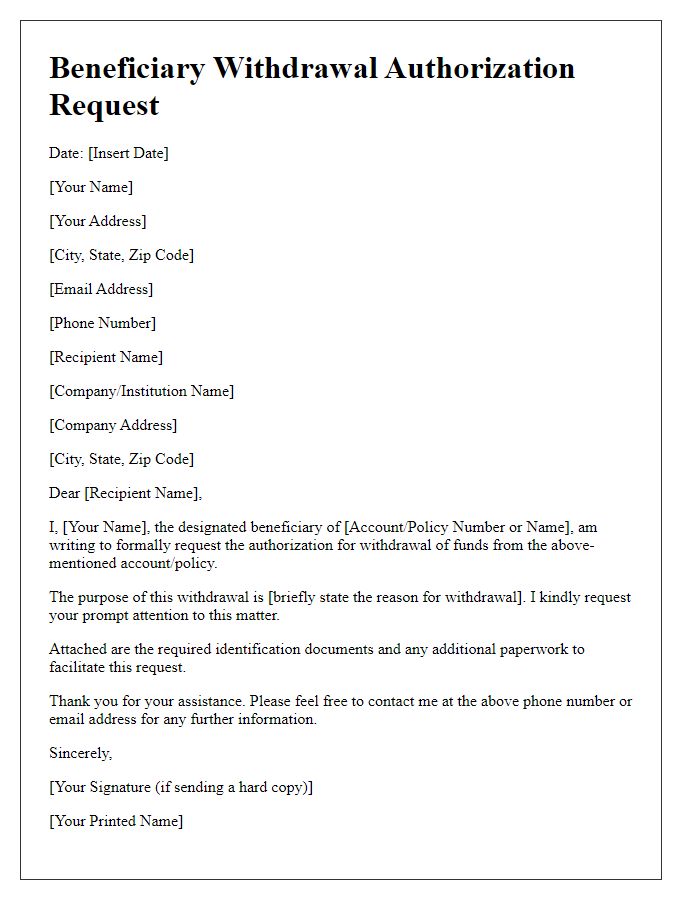

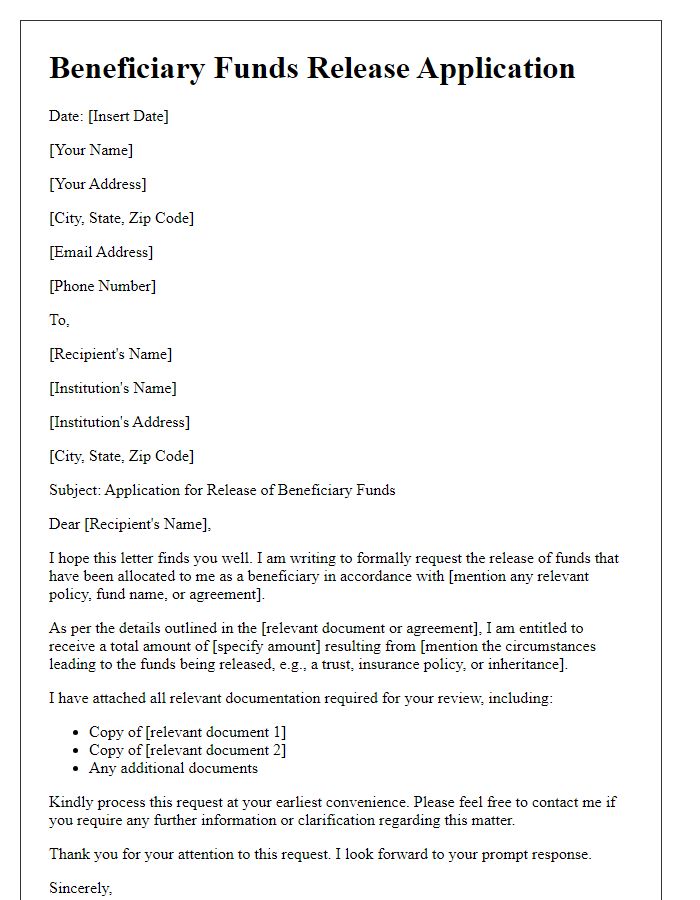

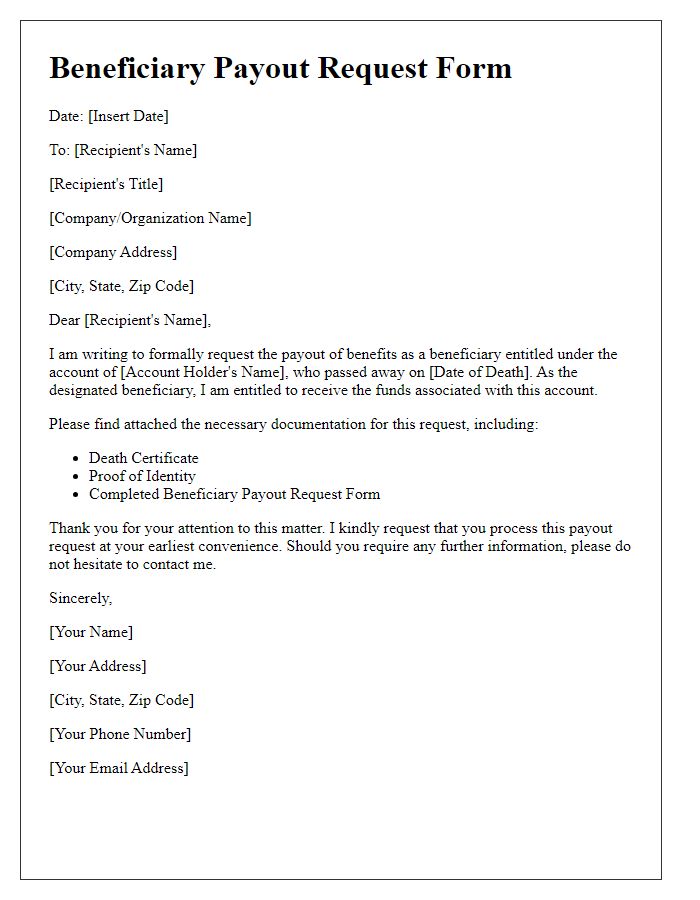

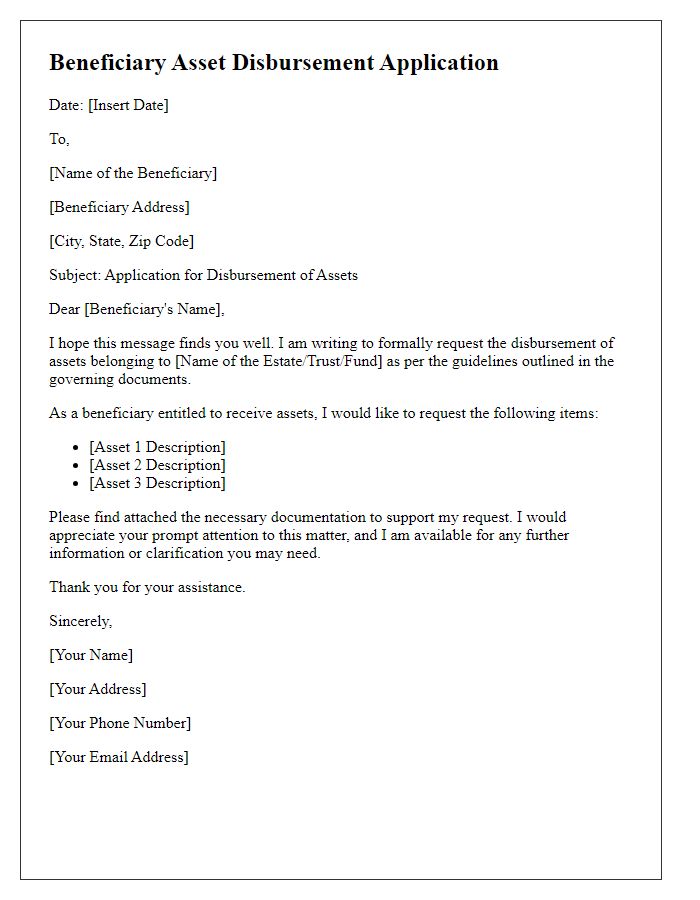

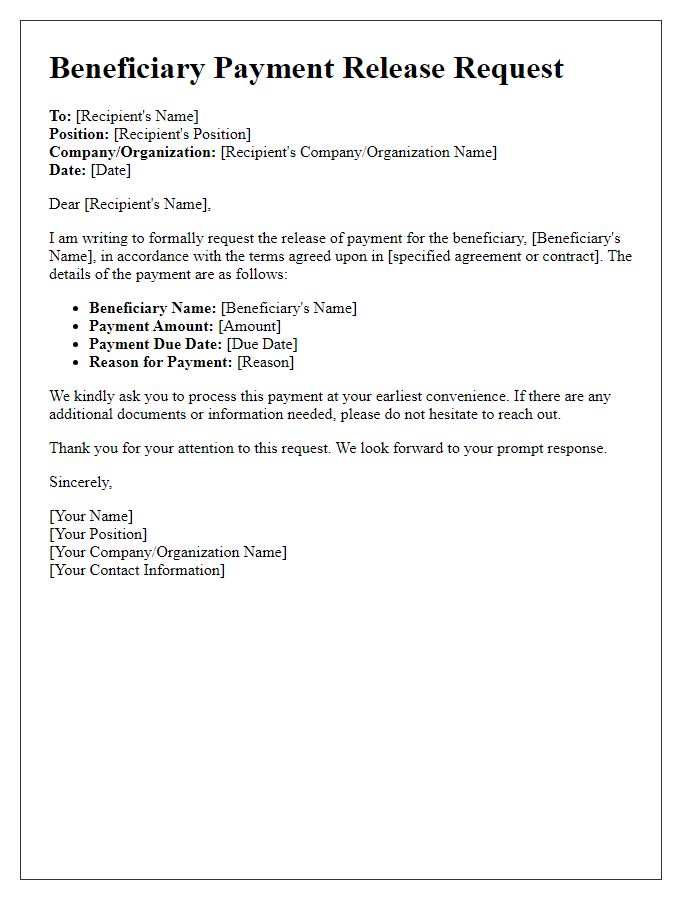

Beneficiary Details

The Beneficiary Withdrawal Request Form requires specific information to ensure accuracy in processing the withdrawal. Beneficiary details include the full name of the individual or entity (like John Doe for individuals or XYZ Foundation for organizations), contact address (street, city, state, zip code), and identification number (such as Social Security Number for individuals or Employer Identification Number for organizations). Essential information also includes the relationship to the account holder, account number related to the withdrawal (e.g., bank account), and the amount to be withdrawn. Clear and precise details in this section facilitate the timely and correct disbursal of funds, avoiding potential delays that could arise from improper documentation.

Withdrawal Amount

The withdrawal amount requested can significantly impact financial transactions within banking systems, especially when dealing with accounts such as savings or investment portfolios. For instance, a withdrawal amount exceeding $10,000 may attract additional scrutiny under federal regulations, such as the Bank Secrecy Act. Furthermore, different financial institutions have varying processing times for withdrawals; traditional banks may take 1-3 business days, while digital banks often process transactions within hours. Understanding these nuances can help beneficiaries efficiently navigate the withdrawal process and avoid potential delays or issues with their financial requests.

Authorization and Signatures

A beneficiary withdrawal request form requires clear authorization and signatures to ensure compliance and legitimacy of the transaction. Each signatory's name should be printed legibly, accompanied by their respective signatures, dated to preserve a chronological record. The form must indicate the beneficiary's relationship to the account holder, along with identification numbers like Social Security or Tax ID for verification purposes. Additionally, witnesses or notary signatures may be necessary depending on the institution's requirements, enhancing the legal standing of the request. This structured approach minimizes potential disputes and facilitates a smooth withdrawal process from financial entities or trusts.

Contact Information for Queries

Contact information is crucial for addressing queries regarding the beneficiary withdrawal request form. Providing specific details, such as a dedicated customer service phone number (e.g., 1-800-123-4567) and an email address (e.g., support@financialinstitution.com), ensures efficient communication. Additionally, including operational hours (e.g., Monday to Friday, 9 AM to 5 PM EST) helps beneficiaries know the best times to reach out for assistance. A physical address, such as the main headquarters located at 123 Finance St., Suite 456, City, State, ZIP, may also be included for formal correspondence or mailing inquiries.

Comments