Are you looking for a reliable way to confirm an insurance payment to a beneficiary? Whether you're managing the aftermath of a loved one's passing or simply needing to ensure that financial matters are in order, understanding the essential components of a beneficiary insurance payment confirmation letter can greatly ease the process. This straightforward template will guide you through the necessary details to include, ensuring that your letter is both clear and professional. Ready to dive deeper into crafting the perfect confirmation letter? Read on for more insights!

Policy Details

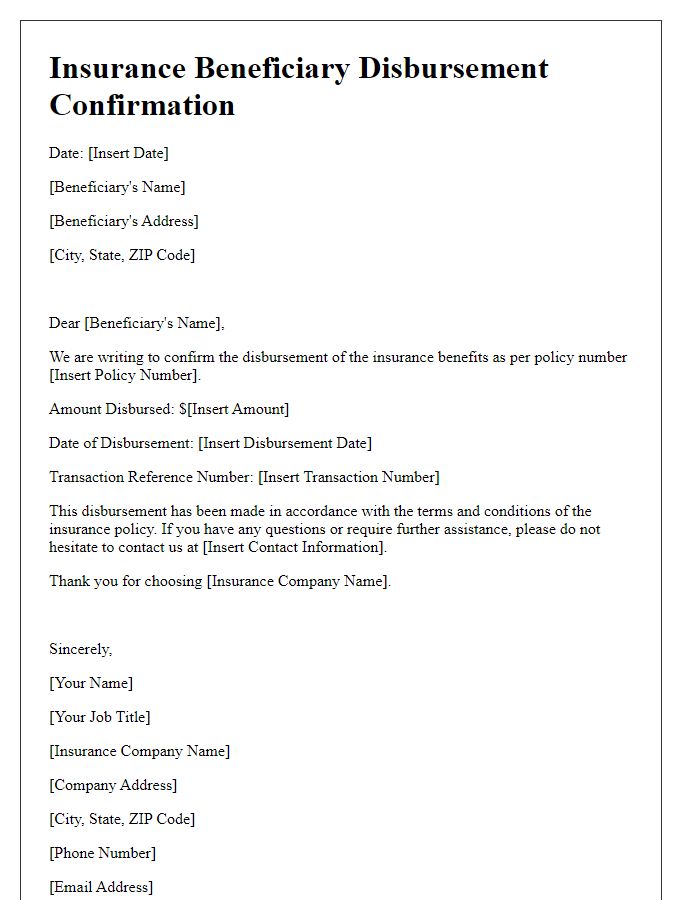

Beneficiary insurance payment confirmations are crucial documents that provide assurance of payment, including specific policy details. Important information includes policy number, typically formatted with a combination of letters and numbers, indicating the unique identifier for the insurance contract. Coverage amount refers to the total payout designated to the beneficiary, often ranging from thousands to millions of dollars depending on the policy terms. Date of payment indicates when the transaction was processed, marked with a specific date format, highlighting the timeliness of payment processing. Beneficiary name identifies the individual or entity entitled to receive the payment, ensuring clarity in the distribution process. Additional details may encompass the insurance provider name, which offers credibility, and policy type, such as whole life or term life insurance, providing context to the type of coverage.

Beneficiary Information

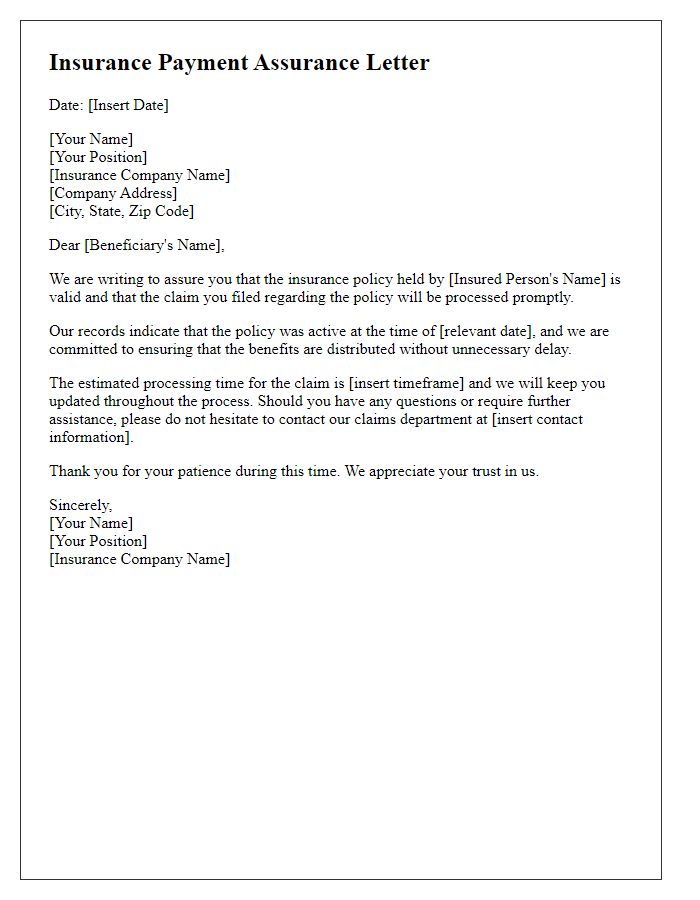

Beneficiary information plays a crucial role in the insurance payment process, ensuring timely and accurate distribution of benefits. This includes the full name of the beneficiary, responsible for receiving the payout, as well as their social security number or tax identification number, which verifies their identity. It also encompasses the beneficiary's date of birth, providing proof of their age, essential for certain policies that may have age restrictions. Address details, including street, city, state, and zip code, are necessary for accurate correspondence and disbursement of funds. Additionally, the relationship to the policyholder, whether spouse, child, or other dependent, is vital to confirm the eligibility to receive benefits. Such precise information streamlines the claims process, ensuring a smooth and efficient transaction aligned with the policy's terms.

Payment Amount and Method

A confirmed beneficiary insurance payment, usually processed through electronic funds transfer (EFT) or check, amounts to $50,000. This payment follows the successful completion of the claims process under the Life Insurance Policy number 123456789, issued by Acme Insurance Company, established in 1985. The funds are typically deposited within 7-10 business days into the beneficiary's account, ensuring timely financial support. Proper documentation, including death certificates or claim forms, must have been submitted to initiate this payment process. Timely confirmation of this payment serves as a vital assurance for beneficiaries navigating through this challenging time.

Confirmation Statement

Beneficiary insurance payment confirmation serves as a crucial document in the insurance claim process. This statement typically outlines the details of the policy, including the policyholder's name, the insurance company (e.g., State Farm, Allstate), and relevant policy numbers. It confirms the payment amount disbursed to the designated beneficiary, ensuring transparency in transactions following the policyholder's passing. Essential elements such as the payment date, method (e.g., electronic transfer or check), and any deductions or fees applied are also included. This confirmation provides beneficiaries with necessary proof of the payment received, assisting in personal financial planning during a challenging time.

Contact Information

Beneficiary insurance payment confirmation typically includes essential details regarding the insured event, the recipient, and the financial transaction involved. For instance, the document may specify the insurance policy number, which uniquely identifies the coverage contract, and the amount to be disbursed as a benefit payout. Additionally, it would provide the beneficiary's name and contact information, including their address and phone number, ensuring accurate communication. The date of the confirmation serves as a timestamp for the transaction, while the insurance company's name and contact details affirm the legitimacy of the payment. Central to this process is the assurance that the beneficiary receives financial support promptly, often after an unfortunate event, such as the policyholder's passing.

Comments