Are you looking for a straightforward way to confirm the receipt of a letter to a beneficiary? Writing a beneficiary confirmation receipt can be simple and effective, ensuring clear communication. This not only fosters trust but also helps in maintaining organized records. If you want to learn more about crafting the perfect letter template, keep reading!

Clear Identification of Parties Involved

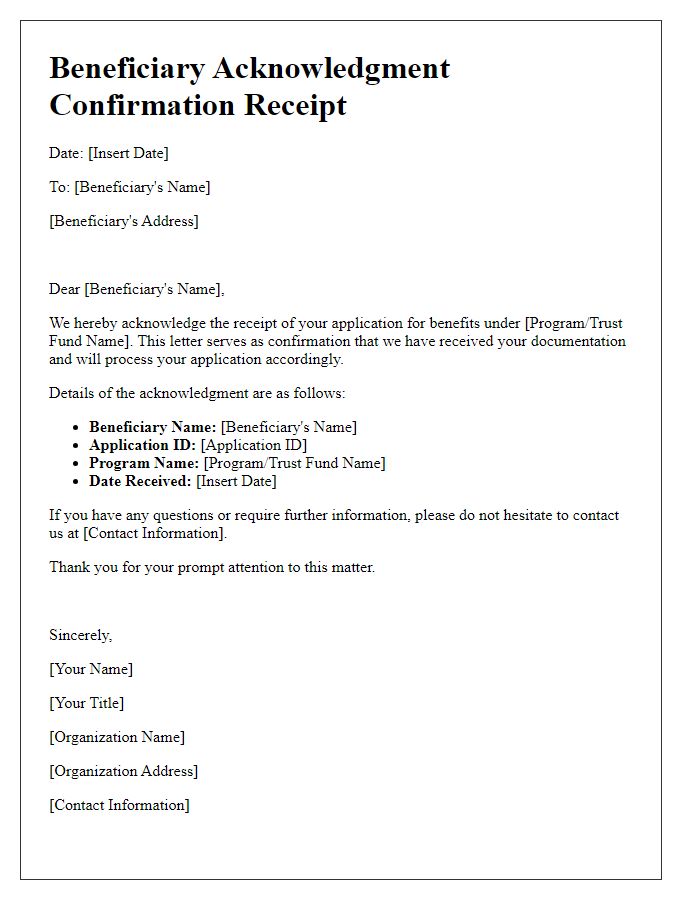

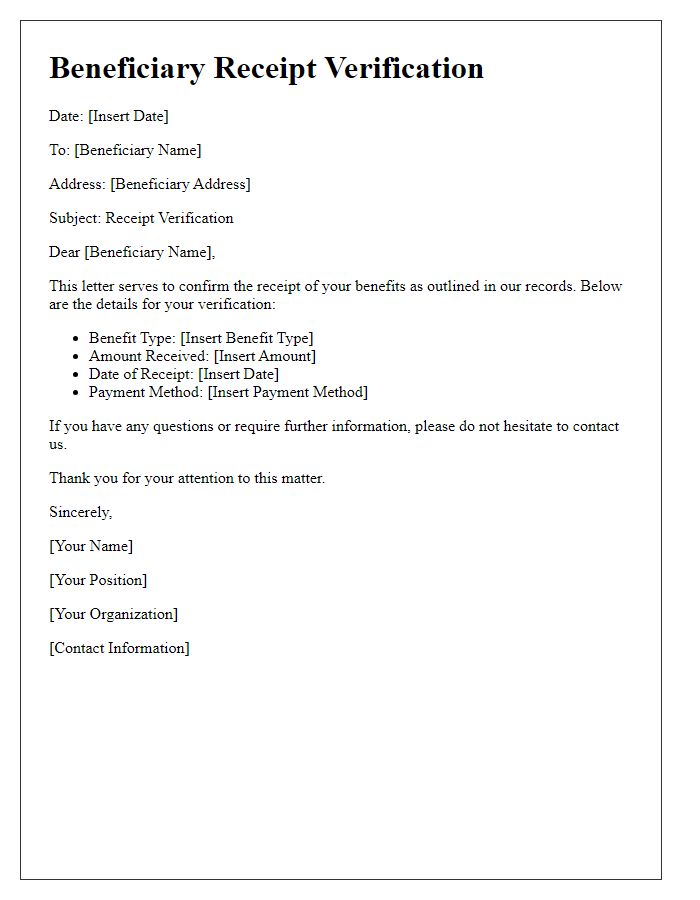

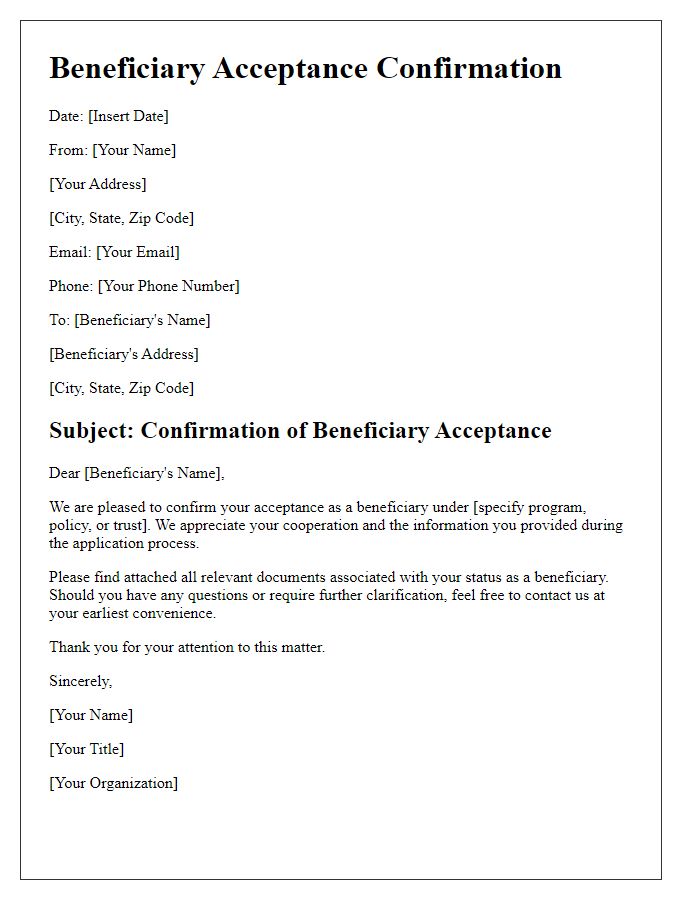

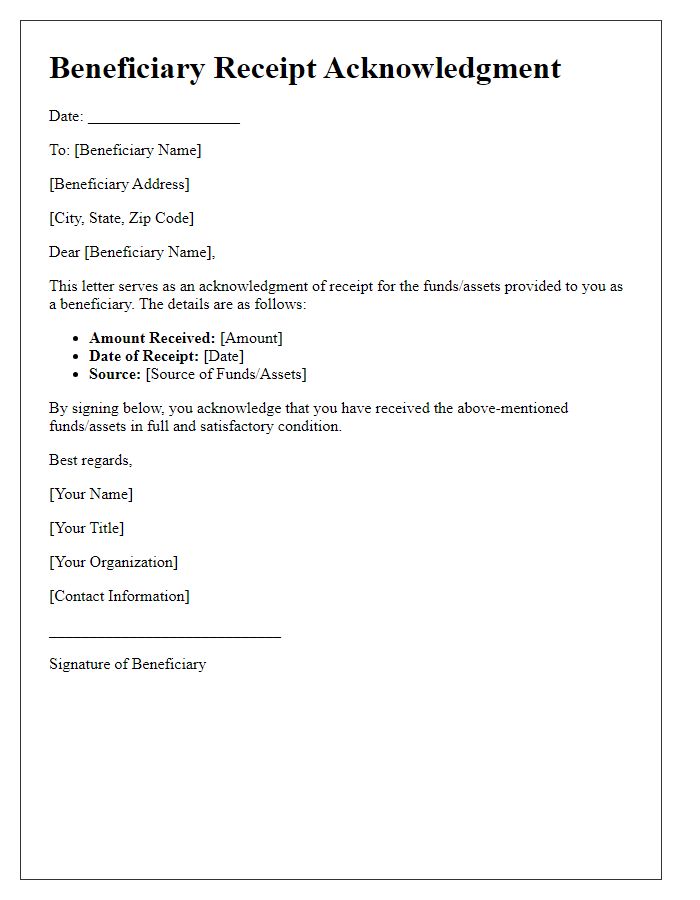

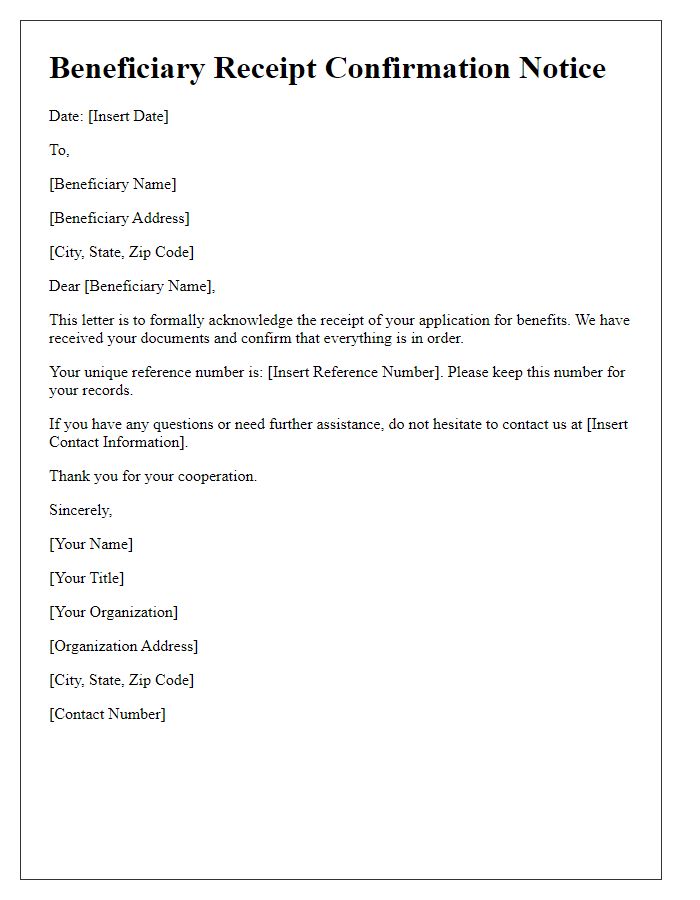

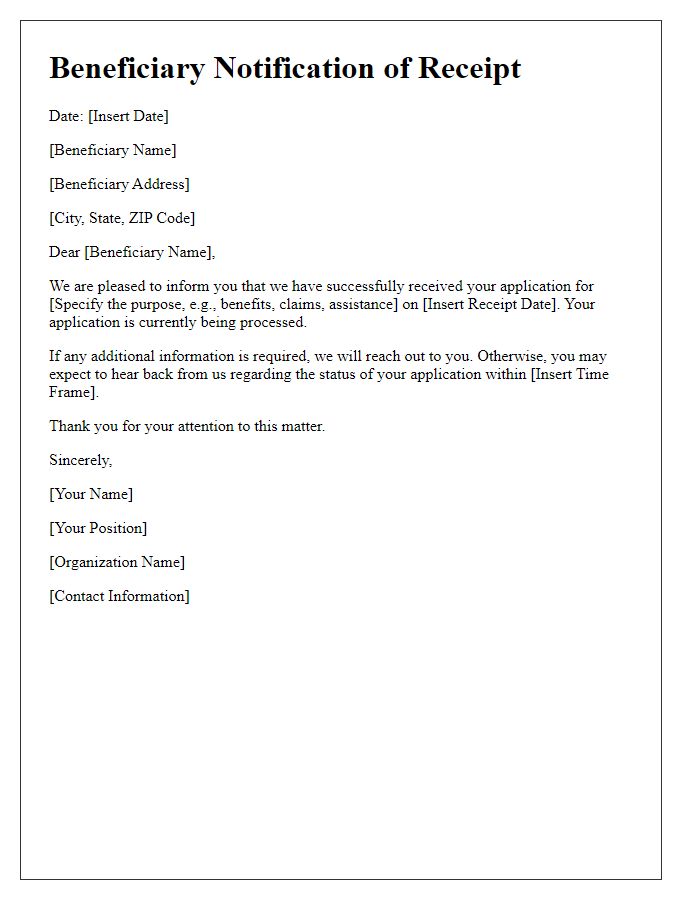

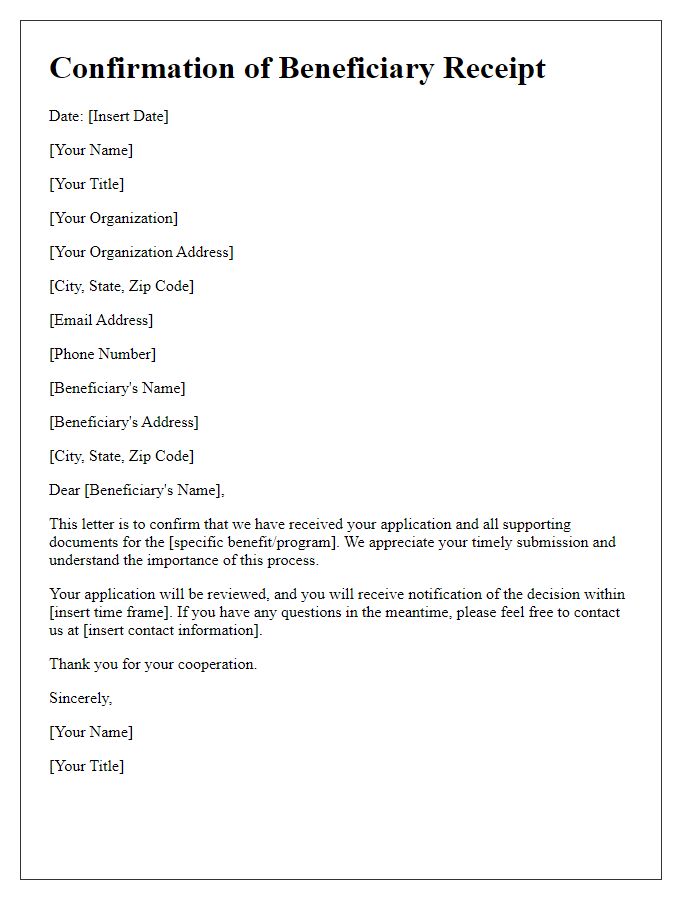

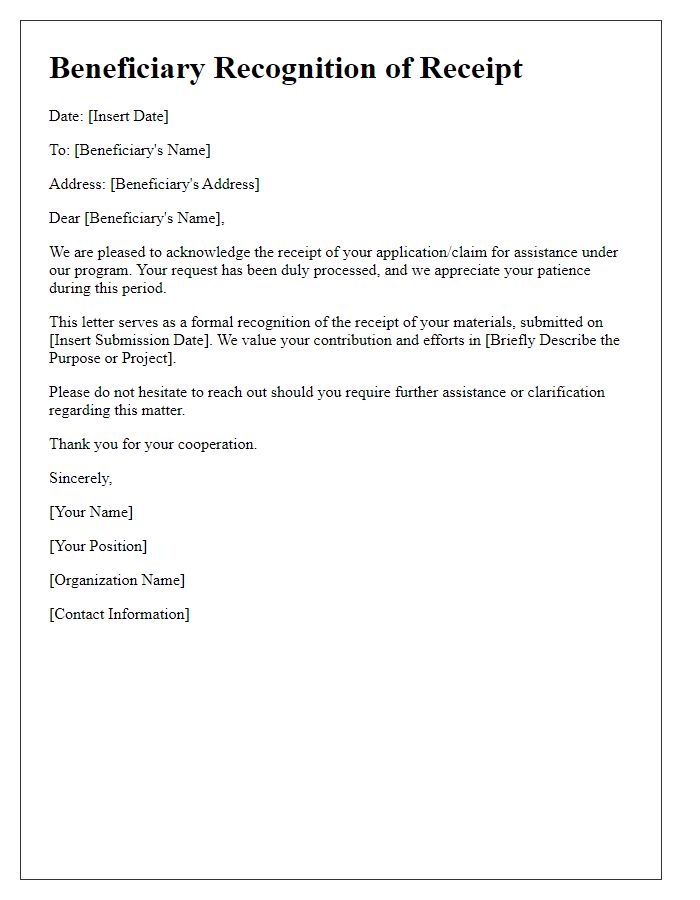

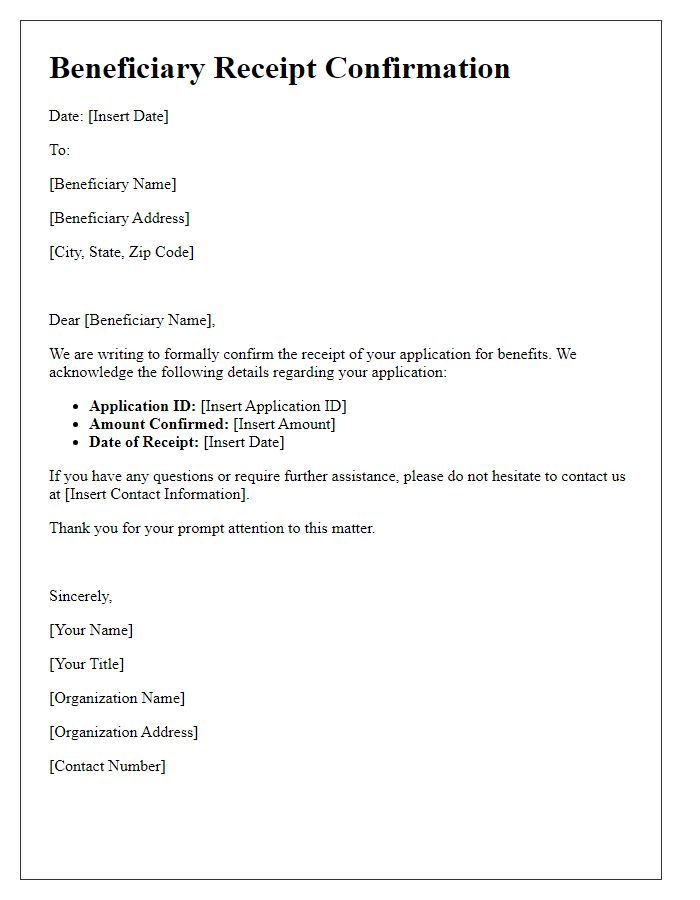

A beneficiary confirmation receipt serves as a formal acknowledgment of the receipt of funds or benefits, typically issued by an organization or individual disbursing the amount to the designated beneficiary. Key parties include the beneficiary, whose identity is often confirmed through personal details such as full name, address, and identification numbers, and the disbursing entity, which may be a financial institution, government agency, or charitable organization. This document usually contains vital information such as transaction amounts, dates, confirmation numbers, and specific program details, ensuring clarity regarding the transaction. Maintaining meticulous records of both parties helps establish accountability and traceability for future reference and audit purposes.

Detailed Description of Assets or Funds

The Beneficiary Confirmation Receipt serves as official documentation detailing the assets or funds transferred to a designated individual or entity. This receipt includes specific information such as the asset type (real estate properties, bank account balances, stocks, or bonds), associated values (monetary amounts reflected in currency), and any pertinent identification numbers (like property tax ID or account numbers). It may also outline the source of the funds, whether from a trust distribution or an inheritance settlement, along with names of associated parties involved in the transaction. The date of the transfer, location of the assets, and signatures from both the beneficiary and the authorized representative provide further validation and acknowledgment of receipt. Documenting these details ensures clarity and legal backing concerning the beneficiary's rights to the conferred assets or funds, preventing any potential disputes.

Confirmation Statement of Receipt

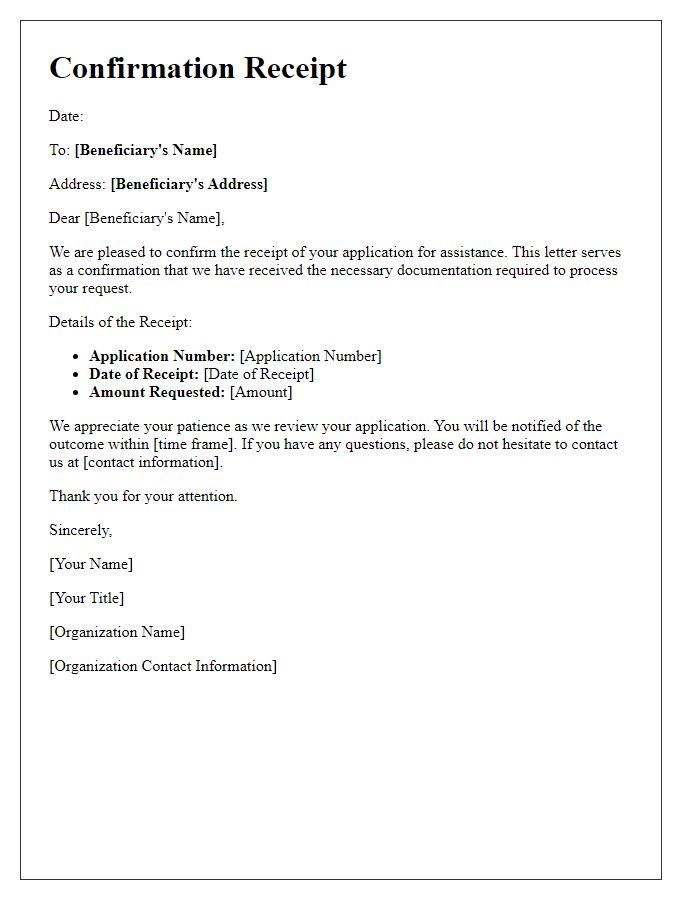

A Confirmation Statement of Receipt serves as an essential document for beneficiaries, affirming the acceptance of funds or assets. This statement typically includes specific details, such as the recipient's name, the amount received (which might be a monetary value or a description of assets), and the date of receipt, often reflecting transactions in financial assistance programs or estate settlements. It is crucial for record-keeping, ensuring transparency and accountability. Beneficiaries may also provide signatures, along with the date, to confirm acknowledgment of the receipt. This document can be pivotal in legal or financial disputes, proving the acceptance of benefactor generosity or contract fulfillment.

Contact Information for Further Inquiries

Beneficiary confirmation receipts are essential documents that acknowledge the receipt of funds or assistance. This receipt often includes critical details such as the beneficiary's name, date of transaction, amount received, and the purpose of funds, often specified within programs or organizations supporting financial aid. For any inquiries regarding the confirmation receipt or to seek further assistance, beneficiaries can provide contact information such as a phone number, email address, or office location. This ensures streamlined communication and efficient resolution of questions. It's important that the contact information reflects accurate details for the issuer's department or authorized personnel to maintain transparency and trust in the transaction process.

Legal and Compliance Disclaimers

Legal and compliance disclaimers outline the responsibilities and obligations related to the receipt of funds or assets by a beneficiary. These disclaimers typically emphasize the importance of adhering to applicable laws and regulations governing financial transactions, such as the Anti-Money Laundering (AML) Act and the Office of Foreign Assets Control (OFAC) guidelines. They provide clarity on the validity of the transaction, stating that the beneficiary must acknowledge awareness of any conditions tied to the receipt. Information such as the beneficiary's identification, tax identification number, and the transaction amount must be accurately documented to ensure compliance and to mitigate risks associated with fraud or misuse of funds. Additionally, disclaimers may specify that failure to comply with these terms could result in legal action or the reversal of the transaction.

Comments