Changing your account beneficiary details can feel like a daunting task, but it doesn't have to be! In this article, we'll break down the essential steps you need to take to ensure your loved ones are taken care of in the event of the unexpected. We'll also share some helpful tips to avoid common pitfalls during the process. So, let's dive in and simplify your beneficiary update journey together!

Account Information Identification

Changing account beneficiary details requires attention to specific information to ensure proper management of assets. Financial institutions typically request the account number, which identifies the specific account within their system. Beneficiary names should be clearly stated, along with their Social Security Numbers (SSNs), which serve as unique identifiers to prevent any confusion among multiple beneficiaries. The percentage of assets for each beneficiary must be clearly outlined, reflecting the desired distribution upon the account holder's passing. Additional documents may be required, such as identification proof and a signed request form, ensuring compliance with legal regulations governing estate management. This process is crucial for avoiding disputes and ensuring the account holder's wishes are respected.

Authorization and Consent Statement

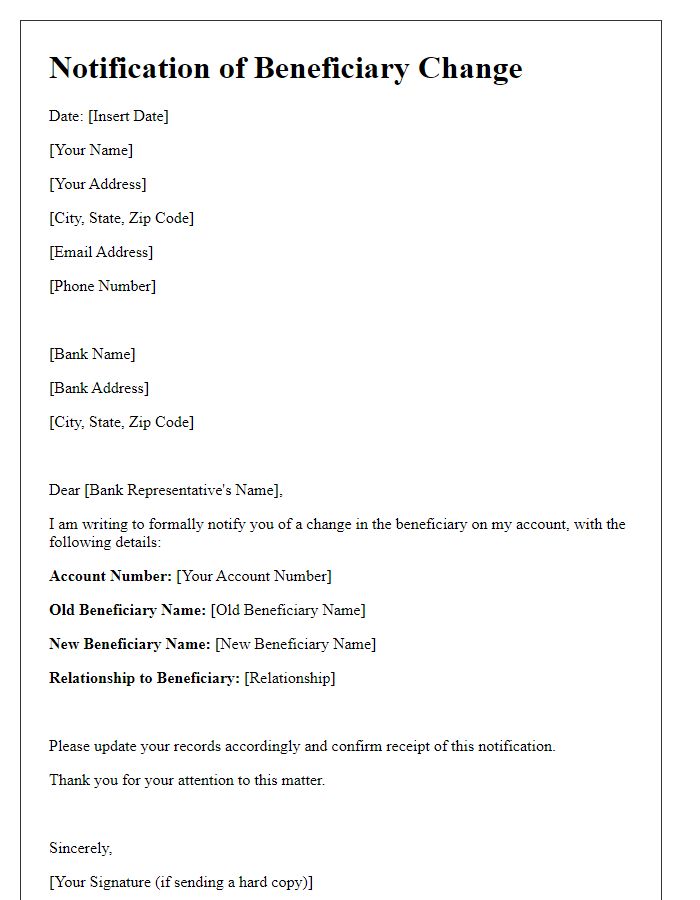

The process of changing account beneficiary details requires careful consideration and compliance with financial institution protocols. Authorization and Consent Statement is a formally drafted document indicating the account holder's explicit permission to update or modify beneficiary information. This statement generally includes essential details such as the account number for identification purposes, the name of the current beneficiary along with any relevant identifiers, and the proposed new beneficiary's name, along with their contact information. It must also denote the account holder's signature and the date of consent to ensure clarity and legal validity. Maintaining accurate records through this process is crucial for ensuring the rightful transfer of assets upon the account holder's passing, adhering to laws such as the Uniform Probate Code in the United States, which governs estate settlements.

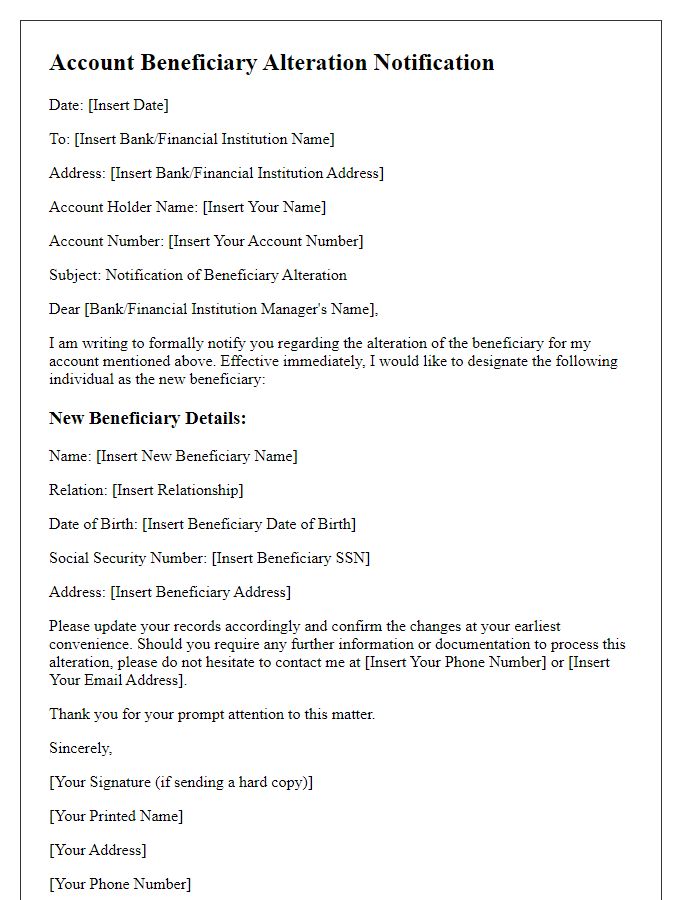

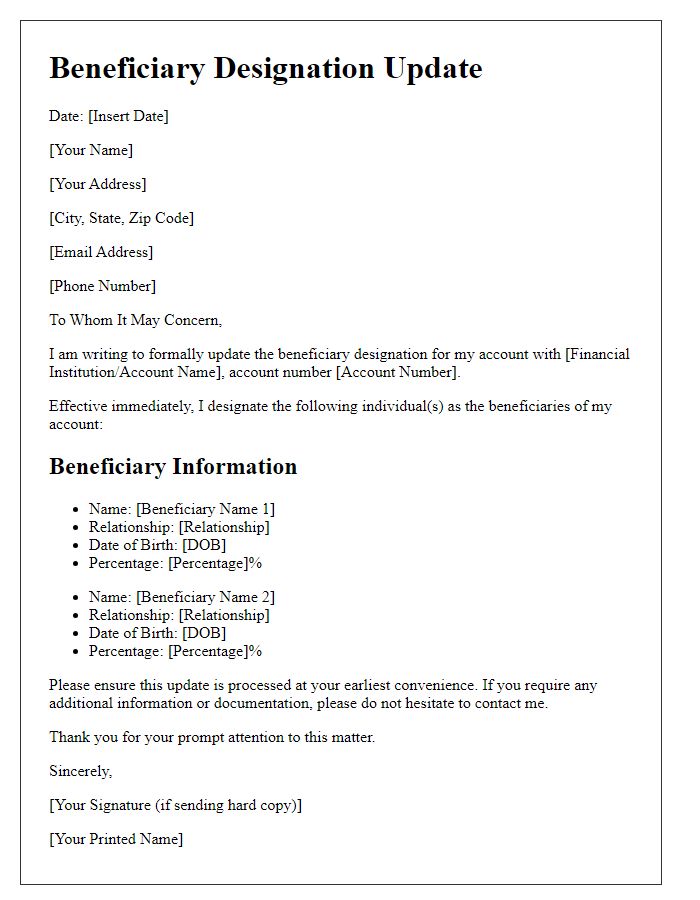

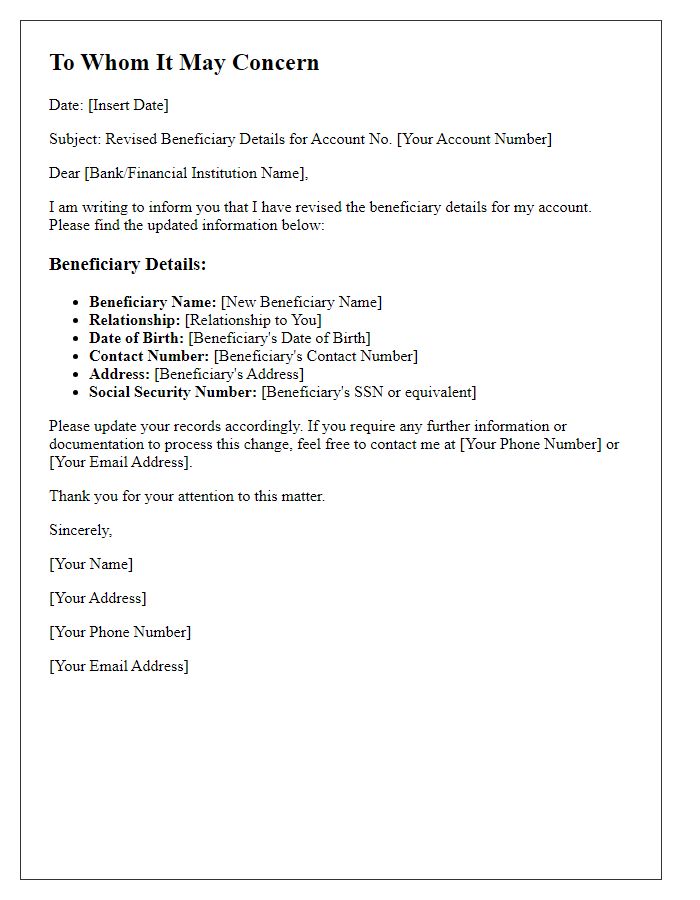

New Beneficiary Details

Changing beneficiary details for financial accounts is a crucial process that ensures financial security for assets. When an account holder needs to update this information, it typically involves providing clear identification and specific new beneficiary details, such as full names, relationship to the account holder, Social Security numbers (or equivalent identifiers), and contact information. Institutions often require documentation to verify the changes, which may include forms like Beneficiary Change Request forms or additional identity verification documents. It's important to follow the financial institution's guidelines, ensuring that any changes reflect accurately in the account records to prevent disputes or confusion in the future.

Contact Information for Follow-up

Updating account beneficiary details requires precise communication to ensure accurate processing. A beneficiary, typically defined as an individual or entity designated to receive assets or benefits from a financial account, must have current contact information for verification. This includes essential elements such as the full name of the beneficiary, their relationship to the account holder, updated phone number, and email address. These details allow the institution, like a bank or insurance provider, to follow up effectively, ensuring all changes are documented and any necessary confirmations conducted. Clear and accurate contact information streamlines the process, minimizing the chances of delays or errors.

Signature and Date Verification

Changing beneficiary details in financial accounts requires careful adherence to verification processes. Banks and financial institutions often mandate a signature verification procedure, ensuring that the account holder's authorization is legitimate. This process typically includes submitting a formal request form containing specific details about the account, such as account number and current beneficiary information. The account holder must provide a clear signature consistent with previous signatures on file, which is then compared meticulously by bank officials. In addition, the date of the request must be clearly indicated to comply with internal policies and regulatory requirements. Some institutions may also require notarization or an additional witness to enforce security measures and prevent fraudulent activities during the transition of beneficiary details.

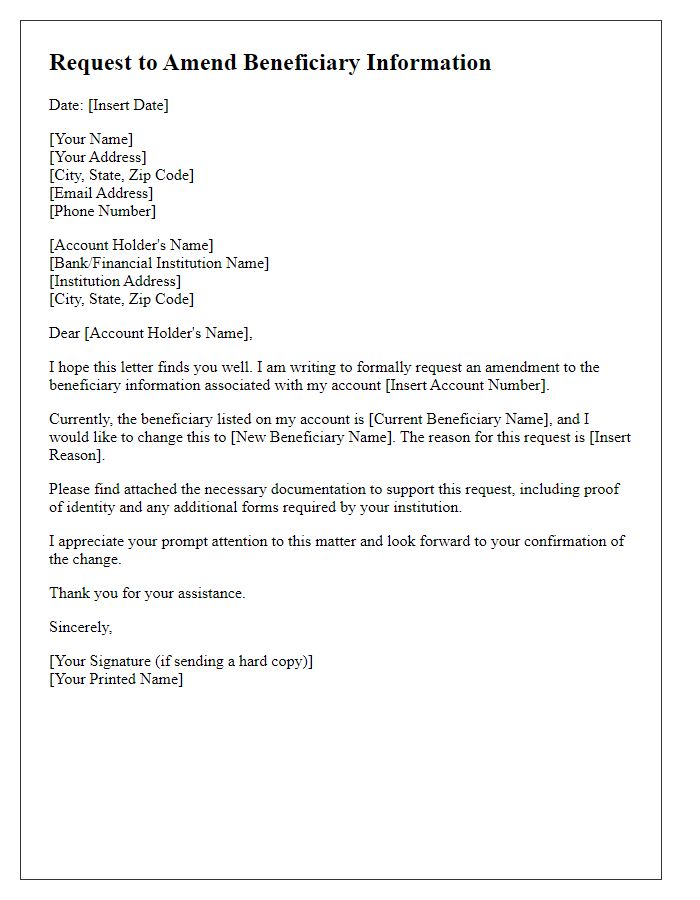

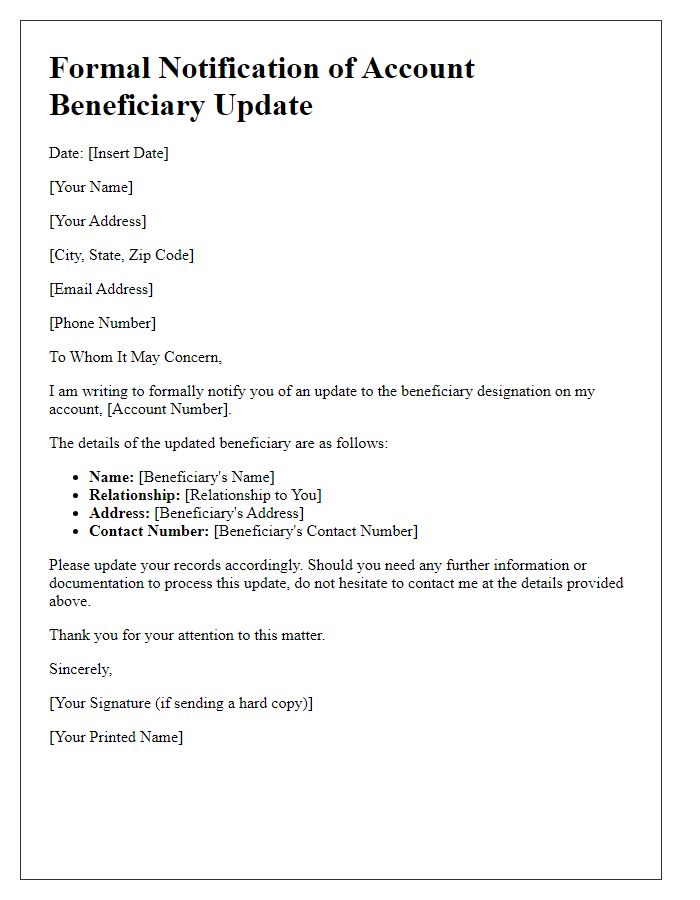

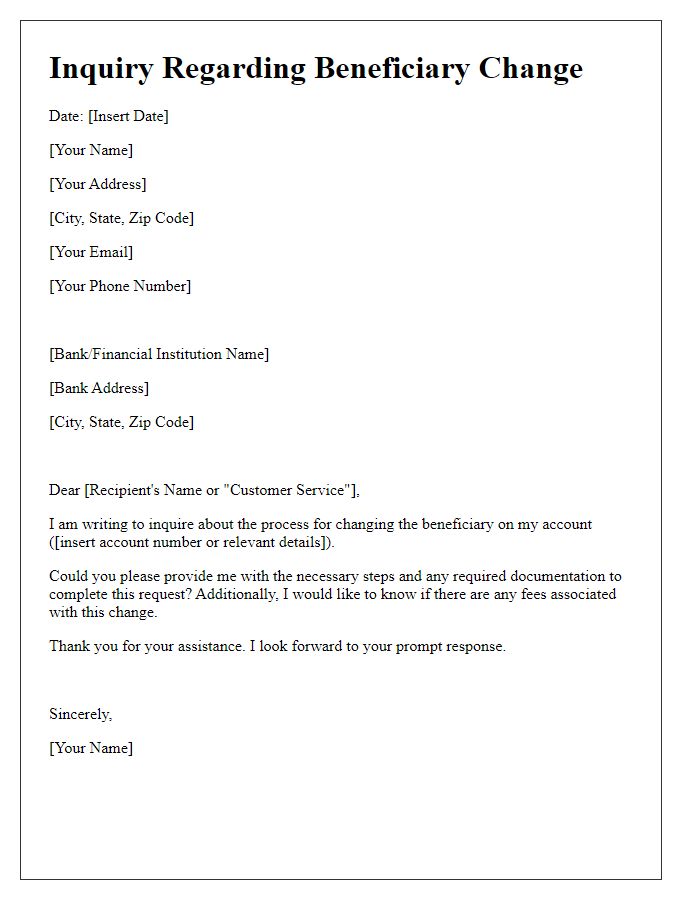

Letter Template For Account Beneficiary Details Change Samples

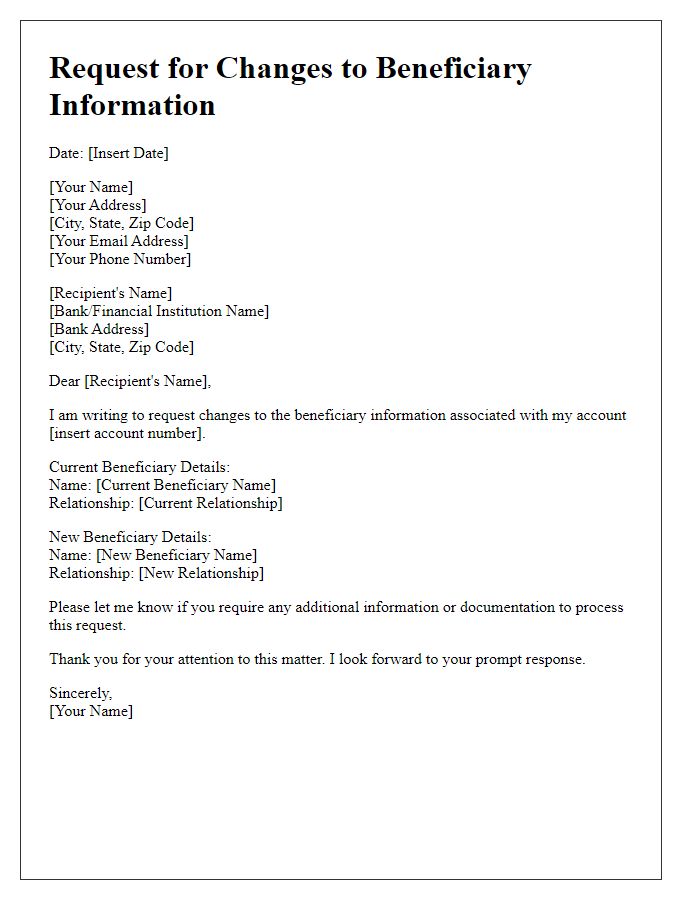

Letter template of request for changes to account beneficiary information

Comments