Are you considering breaking your fixed deposit but unsure of the implications? Many individuals find themselves in this predicament, as unexpected financial needs can arise at any moment. Understanding the policies surrounding fixed deposit breakage is crucial to making informed decisions and avoiding unnecessary penalties. Let's explore the key points you should be aware of, and I invite you to read more to arm yourself with the knowledge needed for this important financial decision.

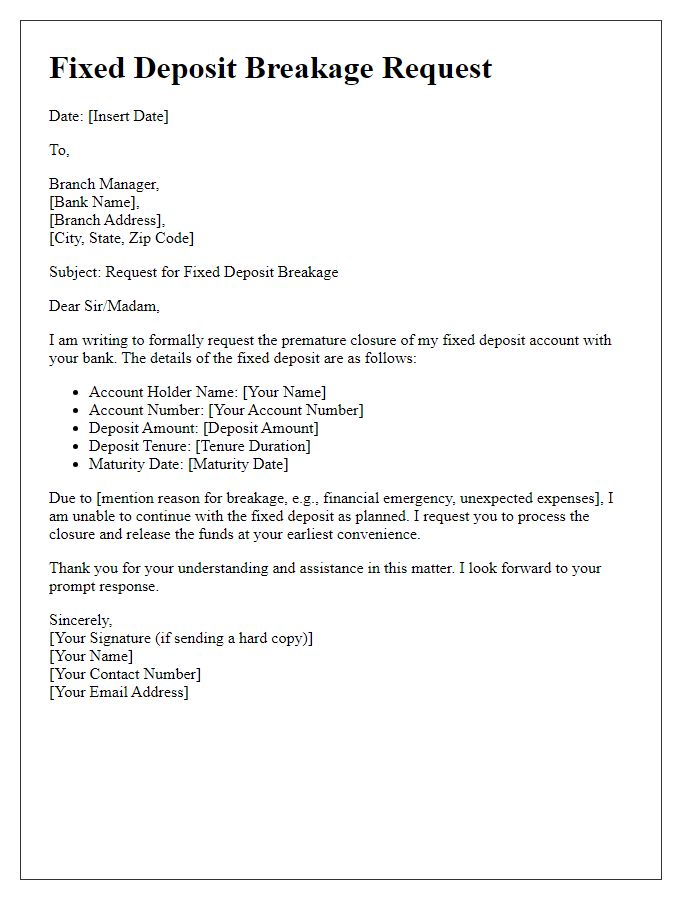

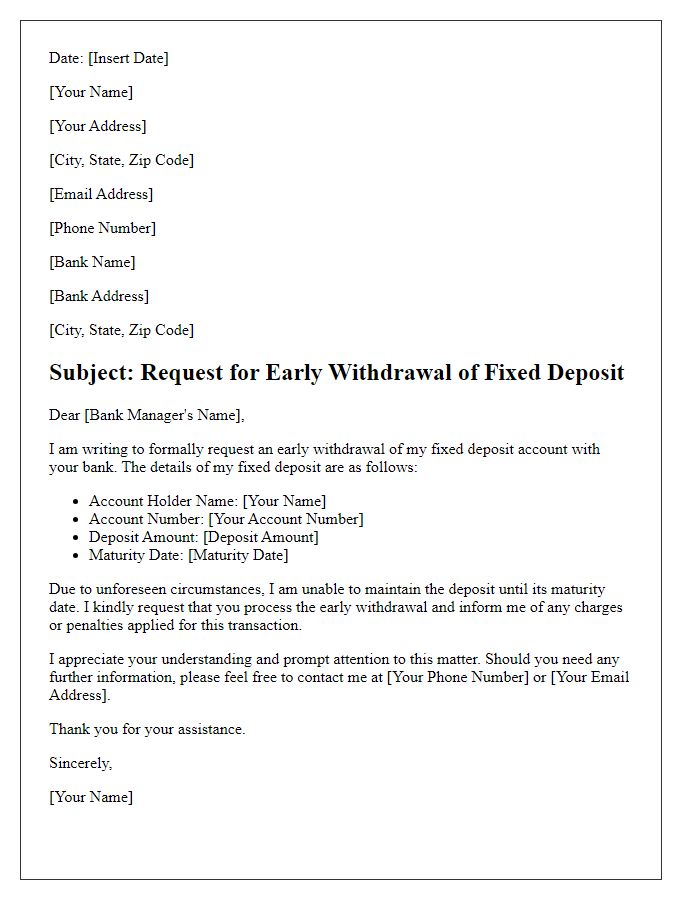

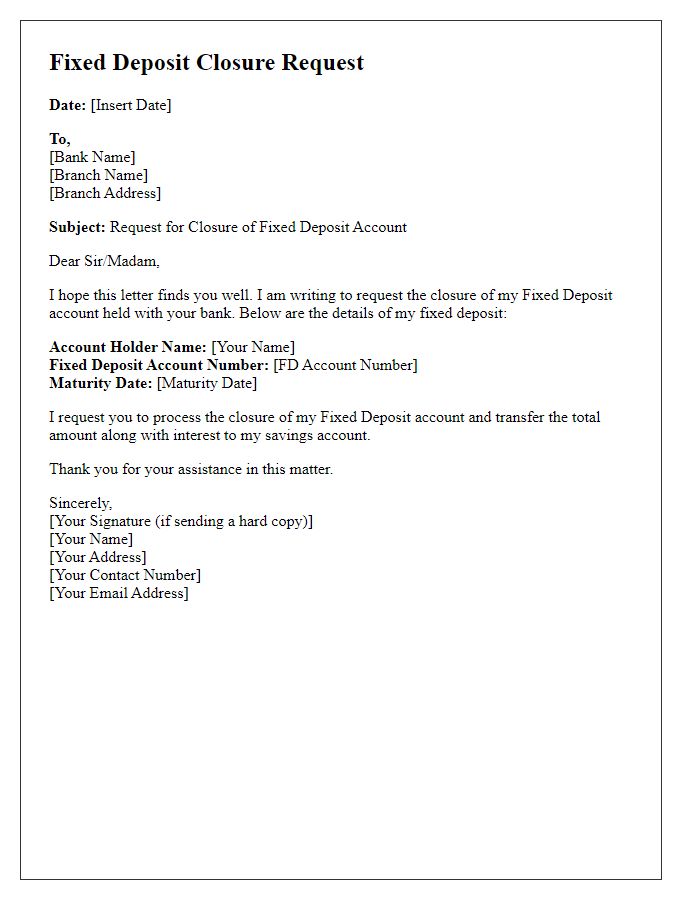

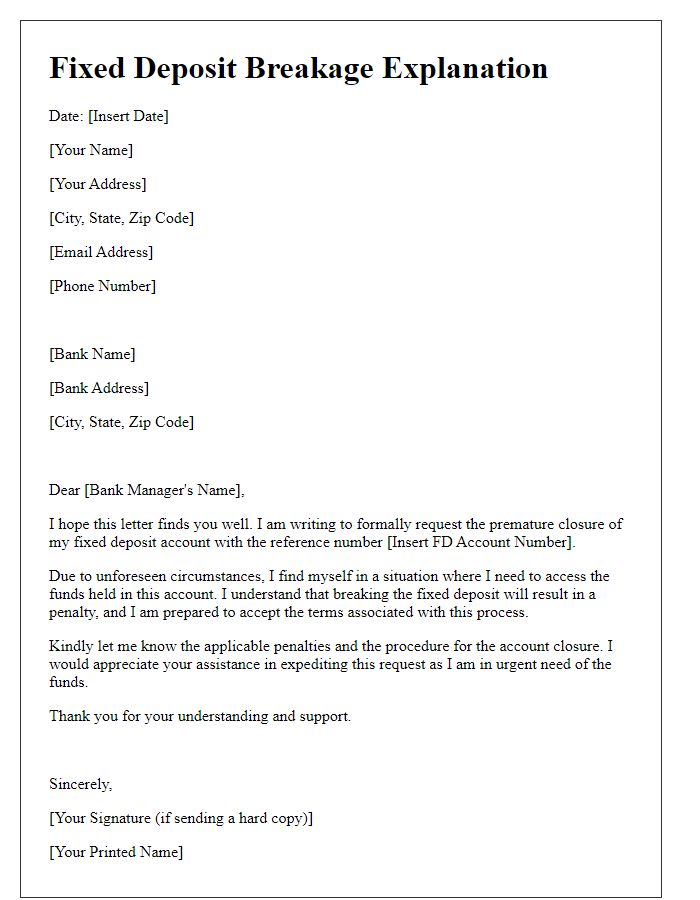

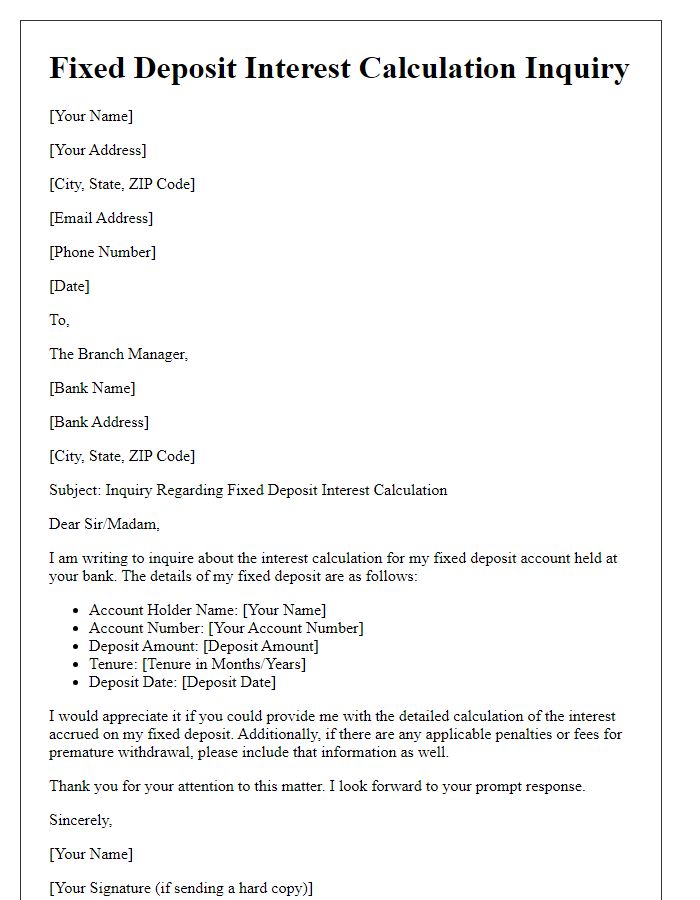

Account Information

Fixed deposit accounts, such as those offered by ABC Bank, typically come with specified terms and conditions. Breaking a fixed deposit before its maturity date can incur penalties, often ranging from 0.5% to 2% of the interest amount depending on the tenure and institution policy. Customers, like Ms. Jane Smith with account number 123456789, should be aware that the principal amount remains unaffected, but interest earnings may be significantly reduced. Notably, banks such as XYZ Financial Services have been known to apply a sliding scale for penalties based on the early withdrawal period, including options for partial withdrawal without penalties up to specified limits. Customers seeking information regarding their fixed deposit breakage policy should consult their local bank branch or customer service hotline, available in various languages to cater to diverse clientele.

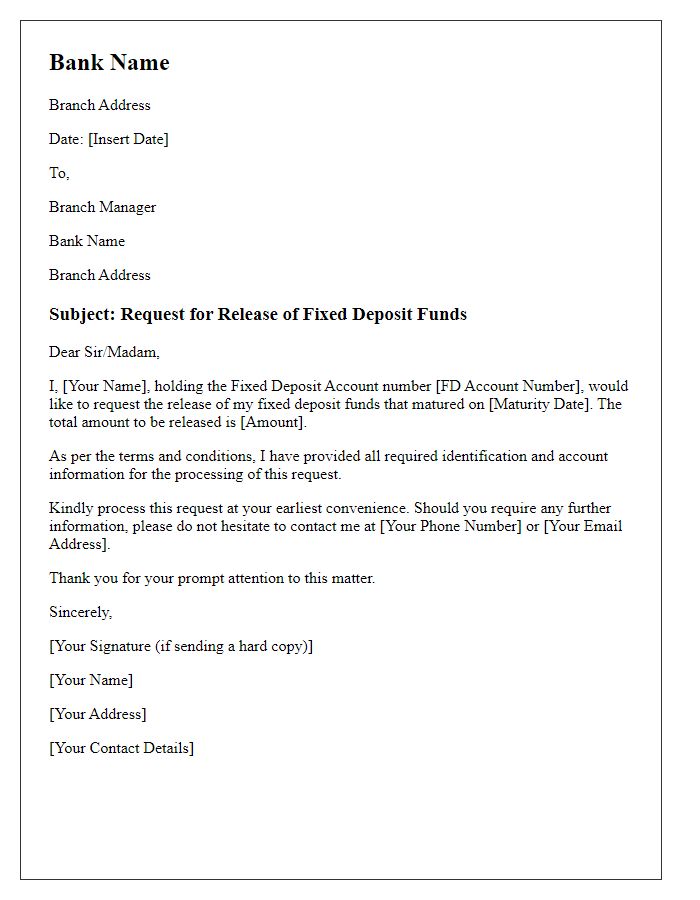

Deposit Details

Fixed deposit accounts, such as those offered by prominent banks like Bank of America or HSBC, have specific terms regarding early withdrawal, commonly referred to as breakage policy. Early withdrawal prior to maturity often incurs penalties, usually ranging from 0.5% to 2% of the total deposit amount, depending on the remaining term. For example, if an individual had a fixed deposit of $10,000 for a year and decided to withdraw after six months, they may lose $50 to $200 in interest, substantially impacting overall earnings. Additionally, the original principal may also be affected depending on the bank's specific policies. It is advisable for depositors to review the fixed deposit agreement thoroughly to understand implications, including any grace periods or exceptions that may apply, to avoid unexpected financial losses.

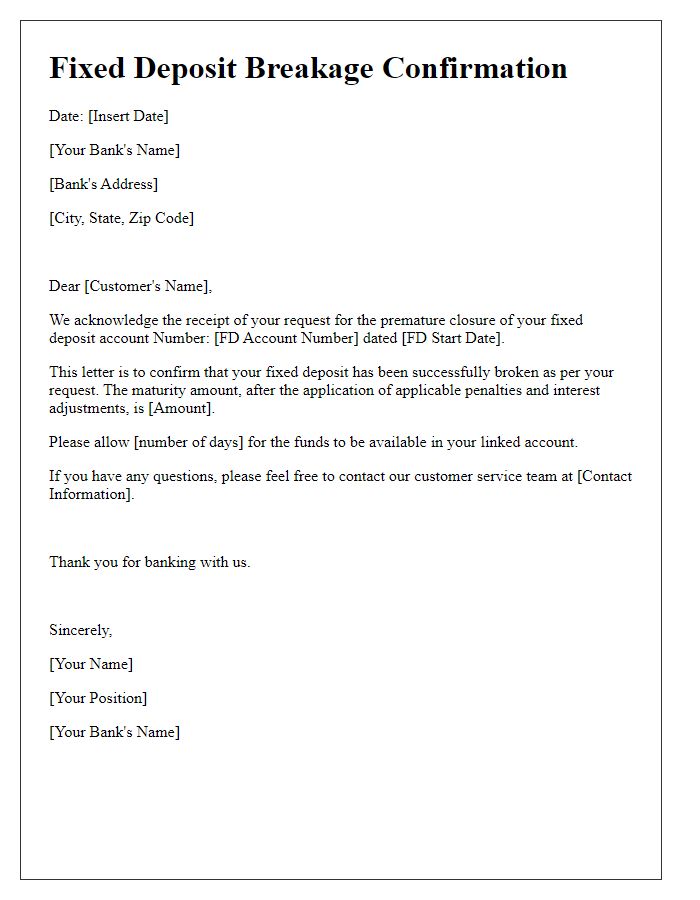

Reason for Breakage

Fixed deposit breakage can occur for several reasons, often related to unexpected financial needs or changes in personal circumstances. Common reasons include emergency expenses such as medical bills, urgent home repairs, or sudden job loss, which may necessitate accessing funds prematurely. Additionally, changes in interest rates can prompt individuals to consider breaking a fixed deposit to reinvest in more lucrative savings options. External factors such as economic downturns or personal financial crises can also lead to a breakage of fixed deposits, as individuals seek immediate liquidity to stabilize their financial situation. It is essential to be aware of the penalties and fees associated with breaking a fixed deposit, which can significantly affect the final amount received. Understanding the terms and conditions set by the financial institution, including any applicable grace periods, can help mitigate the impact of breakage on one's overall financial health.

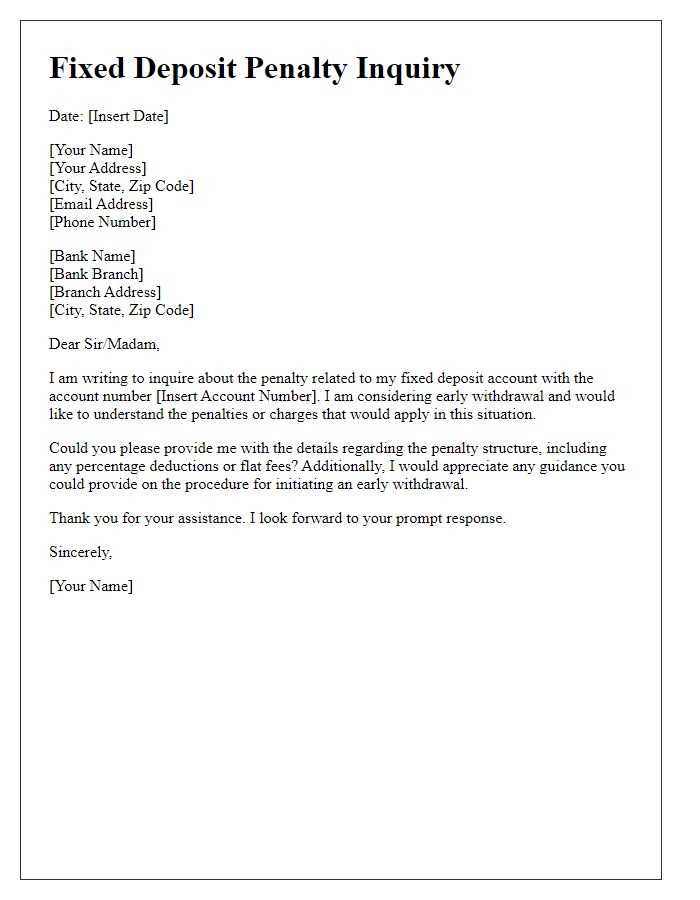

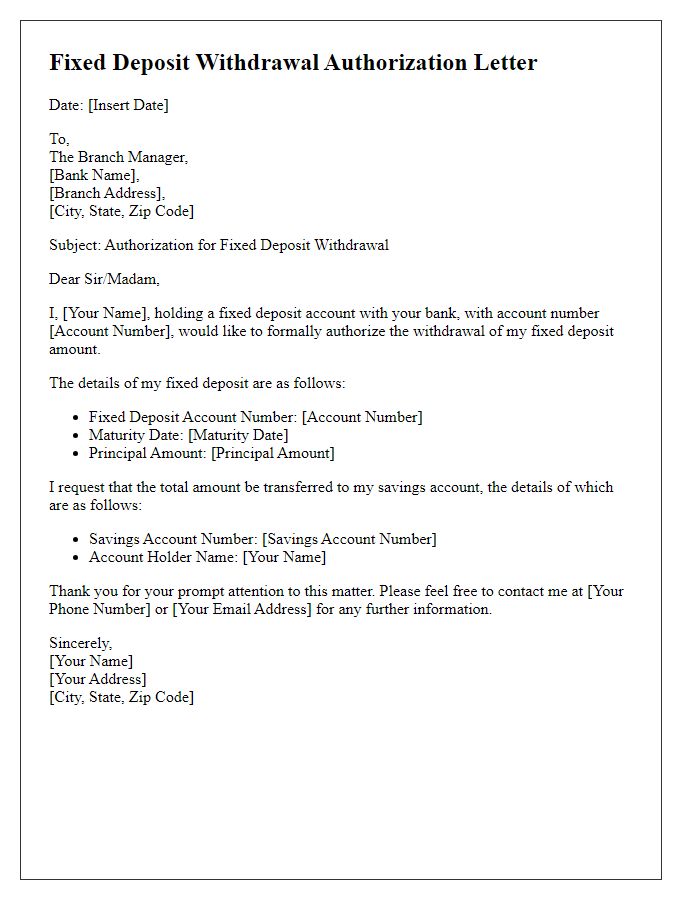

Penalty and Charges

Fixed deposit breakage policies for banks often include specific penalties and charges that apply when clients wish to prematurely withdraw their funds from fixed deposit accounts. Typical penalties might involve a deduction of a percentage of accrued interest based on the account's terms, often ranging from 1% to 3%, depending on the duration remaining until maturity. Banks may also impose administrative charges that can disrupt total returns, commonly calculated as a flat fee or as a percentage of the total deposit amount. Understanding the timeline for withdrawal, which may vary from institution to institution, is also crucial. In some cases, notices of intent to break the fixed deposit may be required, impacting the withdrawal process. Clients should thoroughly review their bank's specific policy documents to ascertain detailed conditions and costs associated with breaking a fixed deposit.

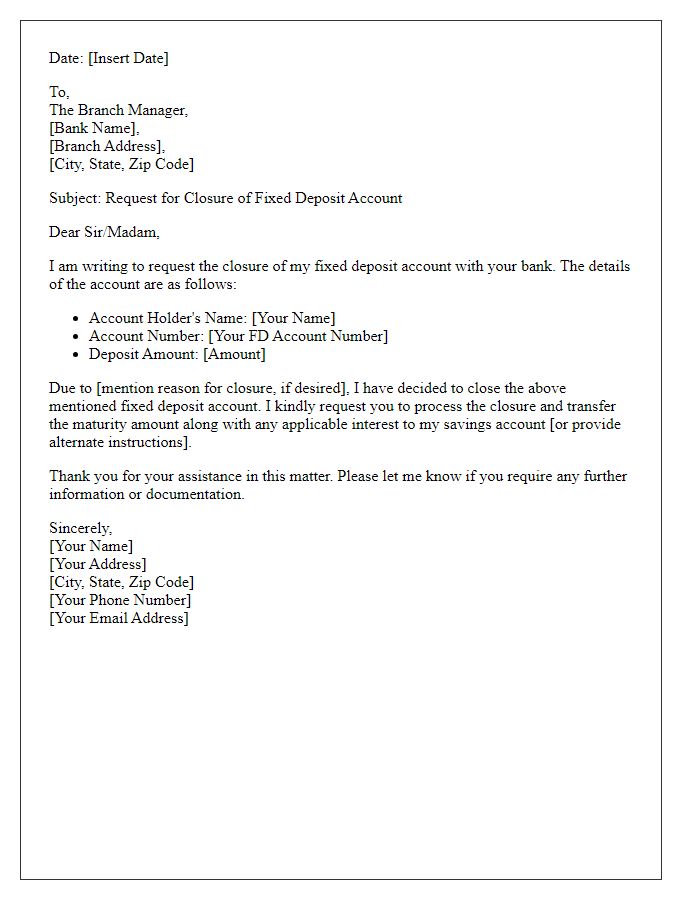

Contact Information

Fixed deposit breakage policies can significantly impact financial planning, particularly when unexpected circumstances arise. Institutions like banks impose penalties for early withdrawals, often calculated as a percentage of the interest earned, which can range from 0.5% to 2%. The specifics of these penalties may vary based on deposit duration; for example, withdrawals made within six months of the investment may face harsher penalties compared to withdrawals after one year. Notably, customers must investigate the terms outlined in documents provided at account opening, particularly pertinent terms such as interest rates, minimum balance requirements, and the institution's contact information for inquiries and clarifications. Understanding these details ensures individuals make informed decisions regarding their fixed deposits.

Comments