Are you curious about how a mortgage amortization schedule can change your financial outlook? Understanding this essential tool can empower you to manage your mortgage more effectively and save money over time. It breaks down your payments into principal and interest, helping you visualize how your investment grows. Dive deeper into this topic and learn how to create your own effective amortization schedule!

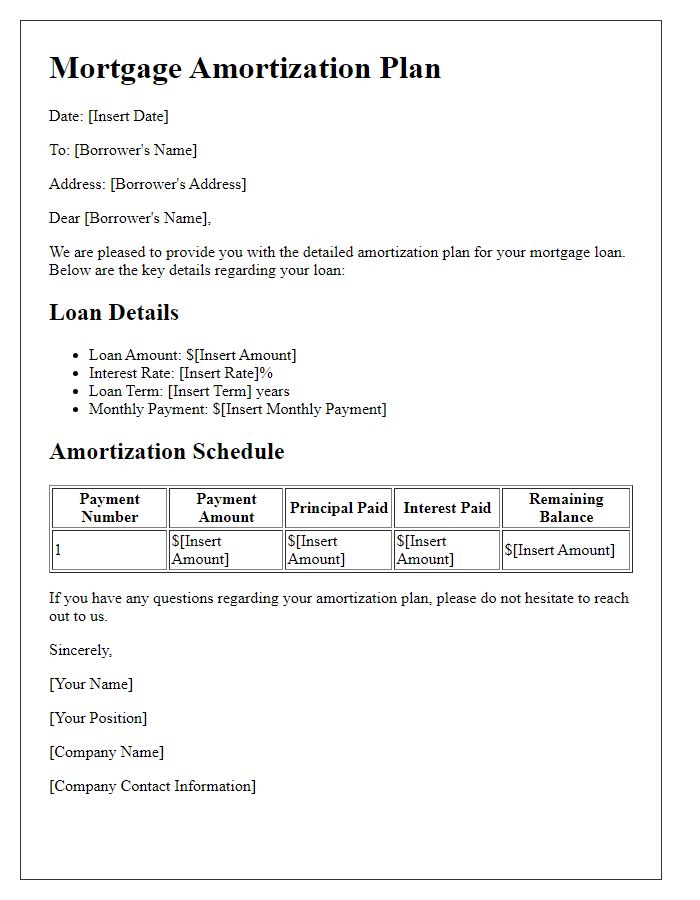

Loan details (principal amount, interest rate, term length)

A mortgage amortization schedule outlines the payment breakdown for loans, including the principal amount, typically ranging from $100,000 to millions, the interest rate, often between 3% and 7%, depending on market conditions and creditworthiness, and the term length, which can vary from 15 to 30 years. This schedule details each monthly payment, illustrating how much goes toward interest versus principal reduction. Key milestones include the early years when interest predominates and later years when more of each payment is applied to reduce the principal balance. Understanding this schedule enables borrowers to visualize their long-term financial commitments and the eventual path to full home ownership.

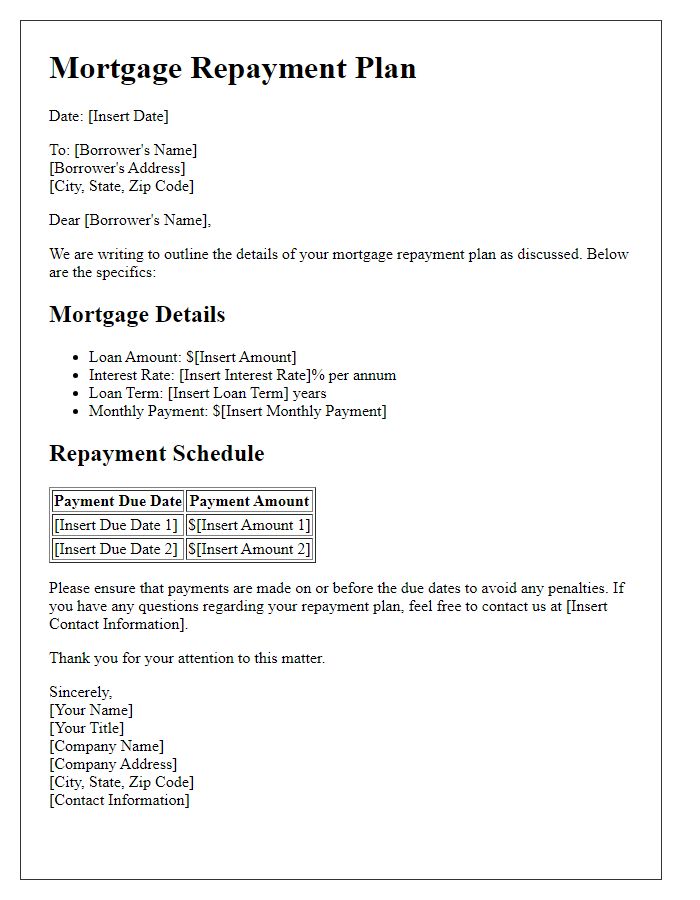

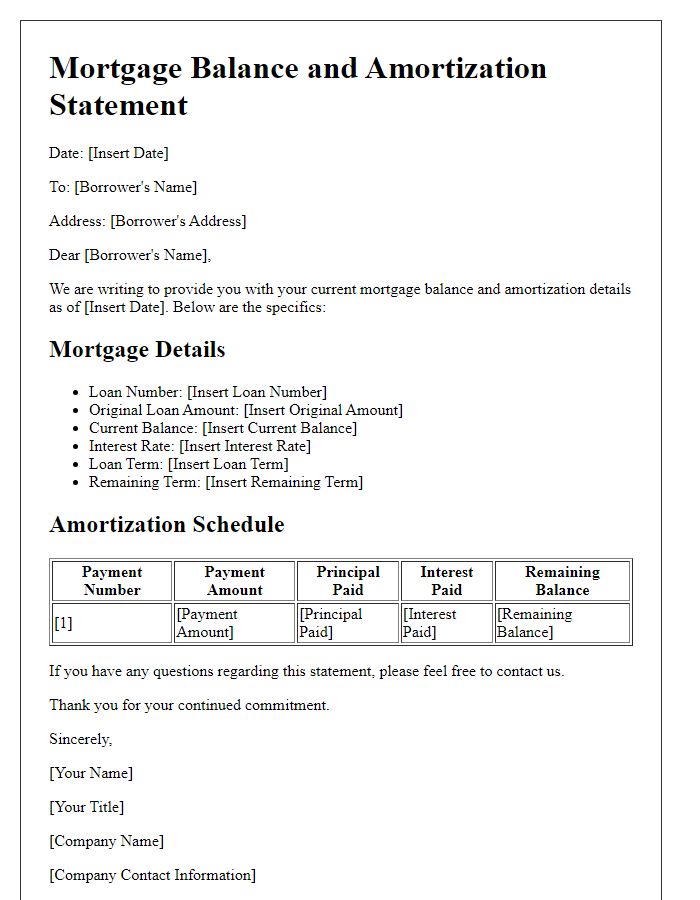

Amortization breakdown (monthly payment, principal, interest)

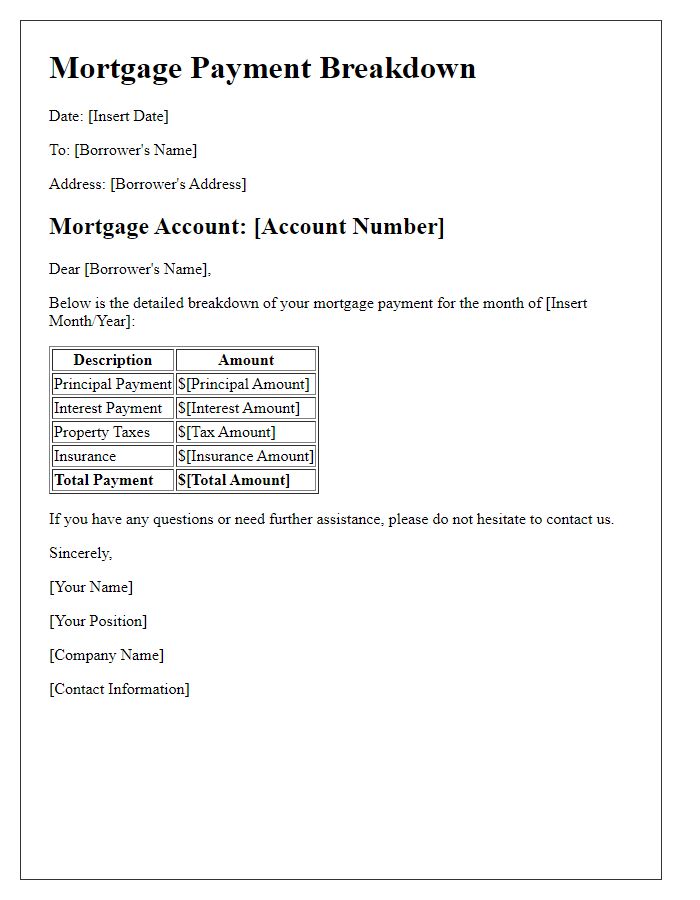

A mortgage amortization schedule provides a detailed breakdown of monthly mortgage payments, illustrating the allocation between principal and interest. Typically structured for 15 or 30-year loans, this schedule outlines payments due each month. For instance, a $300,000 mortgage at a 4% annual interest rate over 30 years results in monthly payments of approximately $1,432. The first month's payment will consist of around $1,000 towards interest and $432 towards reducing the principal balance. Over time, the interest portion decreases while the principal portion increases, demonstrating the gradual buildup of home equity. The final payment reflects a zero balance on the principal loan amount, marking the end of the obligation. An effective amortization schedule helps homeowners visualize and plan their financial commitments in relation to homeownership.

Payment schedule (dates, amounts)

A mortgage amortization schedule details the repayment timeline for a home loan. Monthly payments typically begin after the closing date of the mortgage agreement, often set on the first of the month. The schedule outlines payment amounts, interest rates (ranging from 2.5% to 5% depending on market conditions), and the principal balance outstanding, which gradually declines over time. Common loan terms include 15 years or 30 years, affecting the monthly payment amounts and the total interest paid over the life of the loan. For example, a $300,000 mortgage at 4% interest over 30 years results in monthly payments approximately $1,432. In total, borrowers can expect to pay over $143,000 in interest by the end of the term. This structured approach aids borrowers in tracking their financial commitments and understanding how their principal and interest payments evolve over time.

Contact information for lender

A comprehensive mortgage amortization schedule provides essential details for borrowers seeking clarity on their repayment plan. This schedule outlines the loan term, typically ranging from 15 to 30 years, and lists monthly payment amounts. Each payment breakdown illustrates principal and interest portions, alongside an amortization table detailing the remaining balance after each payment. Contact information for the lender, including the bank's name, address (e.g., Bank of America, 100 North Tryon Street, Charlotte, NC), phone number (1-800-432-1000), and email (support@bankofamerica.com), will facilitate communication regarding any inquiries or payment concerns.

Instructions for accessing digital resources.

Digital resources for mortgage amortization schedules enable homeowners to track payments effectively. Access the official website of financial institutions offering mortgage services, such as Bank of America or Wells Fargo. Use account credentials to log in, ensuring secure access to confidential information. Locate the "Mortgage" section, typically highlighted in the main menu. Look for options labeled "Amortization Schedule" or "Payment Calculator." Most online platforms allow customization based on loan amount, interest rate, and term length, starting from typical 15 or 30-year fixed options. Downloadable PDF versions of the amortization schedule facilitate printing for personal records. Regularly review the schedule to monitor payment progress and adjust budgets accordingly.

Comments