Are you feeling the pinch of your current credit card limit and considering asking for an increase? You're not alone, as many people find themselves in a similar situation, whether it's for unexpected expenses or just to improve their credit utilization ratio. Requesting a credit card limit increase can seem daunting, but with the right approach and a well-structured letter, you can make your case effectively. Curious about how to craft the perfect request? Read on for our detailed guide!

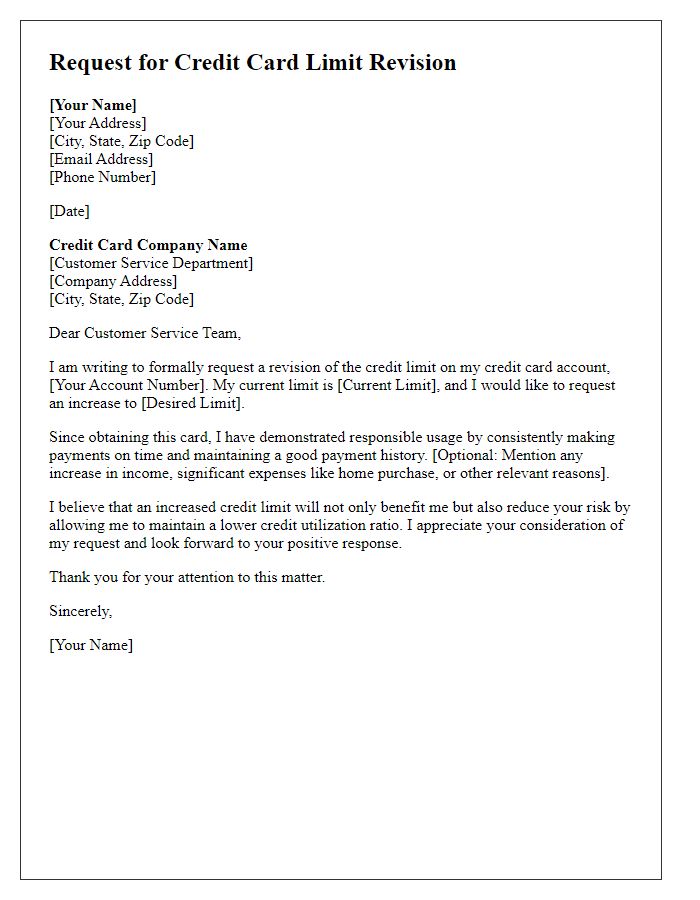

Personal Identification Information

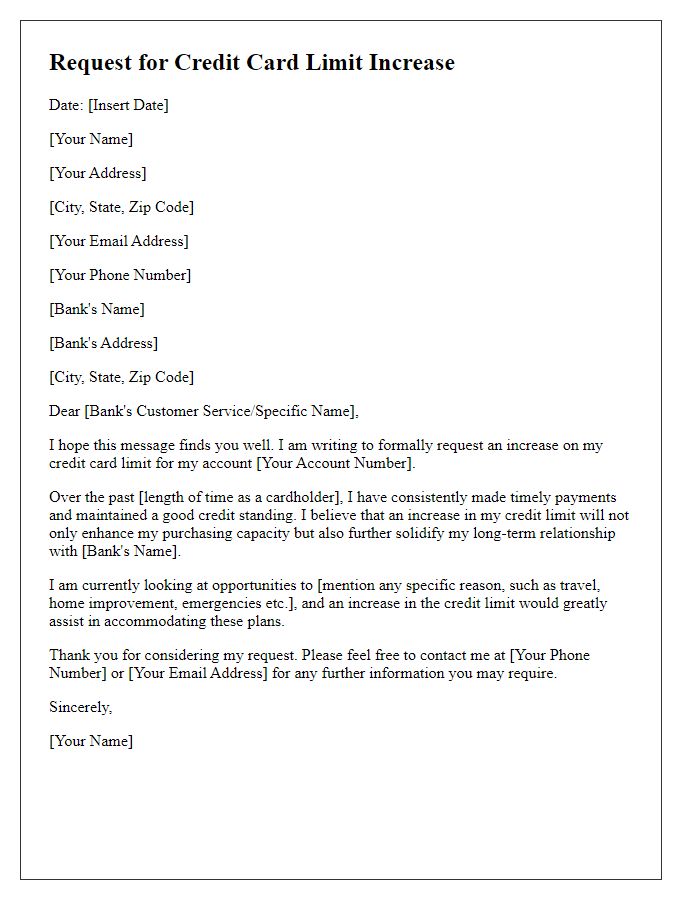

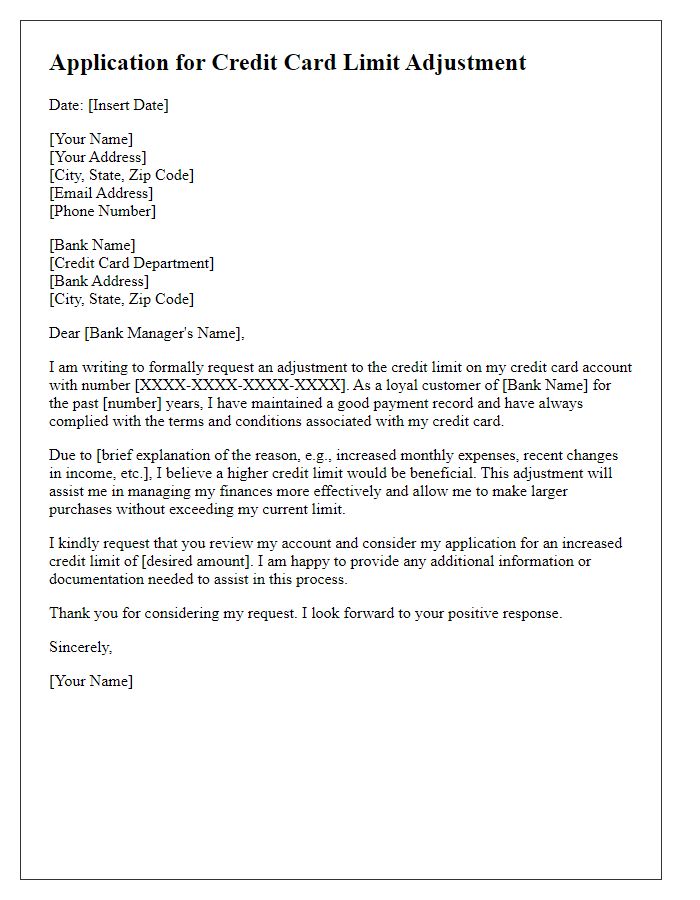

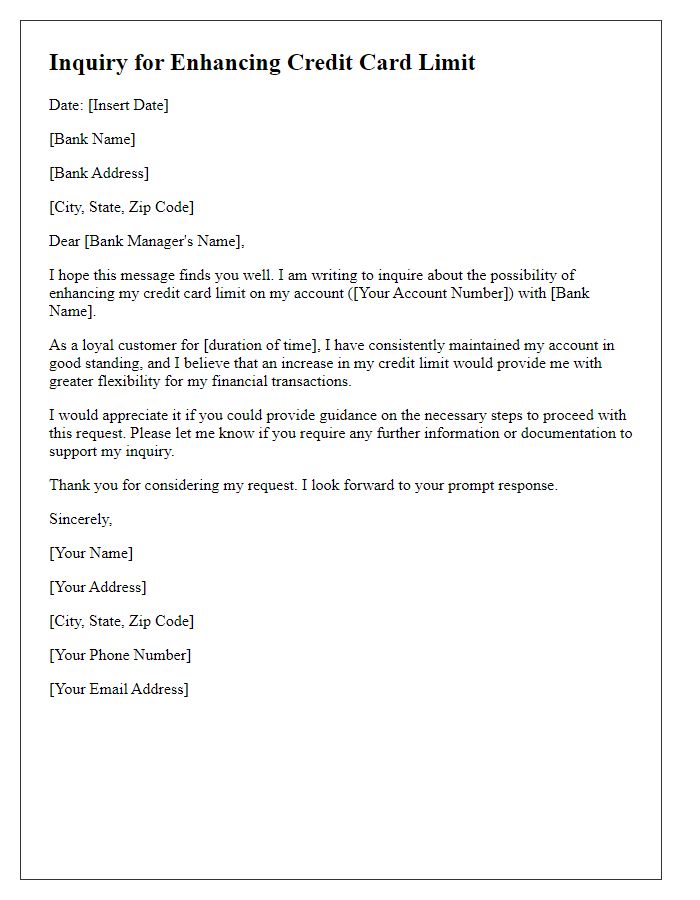

A request for a credit card limit increase requires the inclusion of essential personal identification information to verify the applicant's identity. Important details include the individual's full name, exactly as it appears on the credit card and account statements; the complete mailing address, including city, state, and zip code, to ensure correspondence reaches the correct location; and the account number of the credit card for which the limit increase is being requested. Additional identifiers may consist of the date of birth, Social Security number (only if necessary for verification), and contact phone number. Accurate and complete information streamlines the review process by credit card issuers, enabling them to efficiently assess the request based on the applicant's creditworthiness and payment history.

Current Account Details

Current account details include essential information such as the account holder's name, account number, and bank name. The account holder typically provides monthly income details, current credit limit, and average monthly expenses to assist the bank in evaluating a credit limit increase. Credit history, which reflects payment behavior over the past few years, is also considered. The account holder might also want to mention any recent changes, such as a raise or new job, which could justify the limit increase request. This information aids in assessing the account's financial profile and creditworthiness.

Justification for Increase

Requesting a credit card limit increase can enhance financial flexibility and improve credit utilization ratios. Higher limits, typically available after demonstrating responsible usage and timely payments over a period (usually six months to one year), can positively impact credit scores. A limit increase can lower the credit utilization percentage, ideally below 30%, beneficial for maintaining a healthy financial standing. Additionally, increased limits provide greater purchasing power for necessary expenses such as home improvements, travel, or medical bills without nearing the credit cap, promoting better cash flow management. Institutions often consider factors such as income history, overall creditworthiness, and current debt obligations when evaluating requests for limit increases.

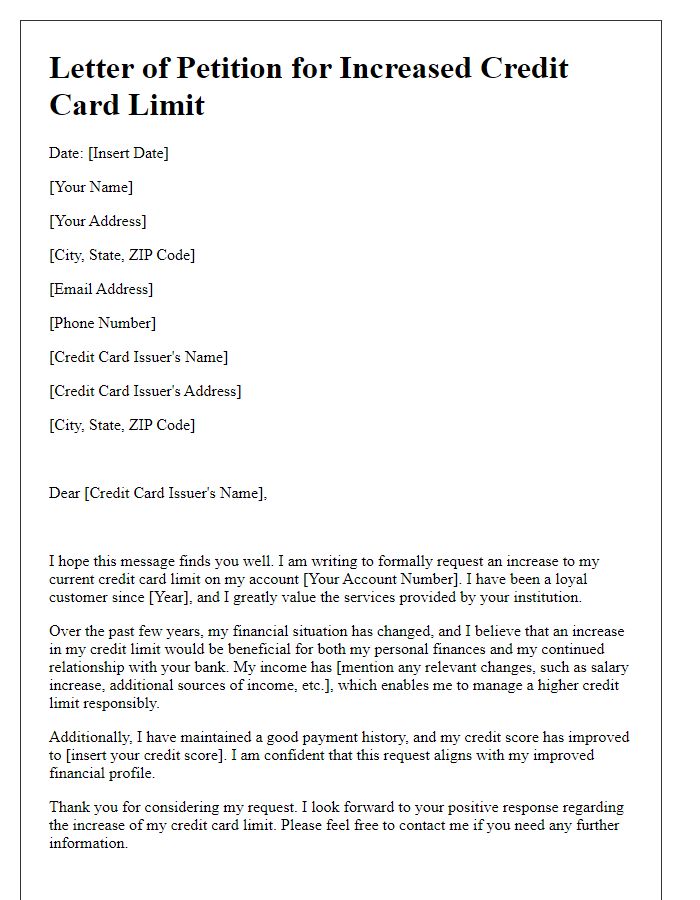

Financial Stability Evidence

A credit card limit increase request requires substantial evidence of financial stability, demonstrating the ability to manage higher credit effectively. Documentation like recent pay stubs, typically covering the last two months, can showcase consistent income sources. Bank statements from the past three months reveal overall financial health, reflecting savings balance and regular deposits. A credit report from major bureaus (Experian, TransUnion, Equifax) exhibits credit score trends and payment history, crucial indicators of responsible credit behavior. Additionally, a detailed employment verification letter confirms job stability and longevity, establishing a predictable income stream. Highlighting low debt-to-income ratios, ideally under 30%, reinforces a favorable financial position, increasing confidence in the request for a credit limit improvement.

Credit History Highlight

Strong credit history often plays a crucial role in requesting a credit card limit increase. A consistent record of on-time payments (typically 95% or higher) over several years can demonstrate reliability to lenders. Additionally, a low credit utilization ratio, ideally below 30%, indicates responsible credit management. The average age of accounts, which can significantly impact credit scores, should ideally be five years or older to reflect stability. Regularly monitoring your credit report for accuracy ensures that no errors undermine your creditworthiness during the limit increase request. Positive historical events, such as successful debt repayment or significant increases in income, can further bolster your case for a higher credit limit.

Comments