Have you ever looked at your credit card statement and felt a wave of confusion wash over you? You're not aloneâmany people find themselves puzzled by unexpected charges or unfamiliar fees. Clarifying your statement can not only alleviate financial stress but also help you manage your budget more effectively. Ready to unravel the mysteries of your credit card statement? Keep reading for some essential tips!

Account Information

Credit card statements provide essential account information, reflecting transactions that take place over a billing cycle, typically lasting 30 days. Each statement summarizes crucial details such as the account number, cardholder name, and total outstanding balance. For example, a statement may show charges ranging from everyday purchases at retail outlets to subscription services (like Spotify or Netflix), with dates and amounts listed for each transaction. Payment options are also detailed, indicating the minimum due amount and due date, often necessitating prompt attention to avoid late fees. Additionally, the statement highlights interest rates, reward points accrued, and any promotional offers, making it vital for responsible financial management. Understanding this information ensures cardholders maintain good standing and optimize their credit usage.

Statement Reference Details

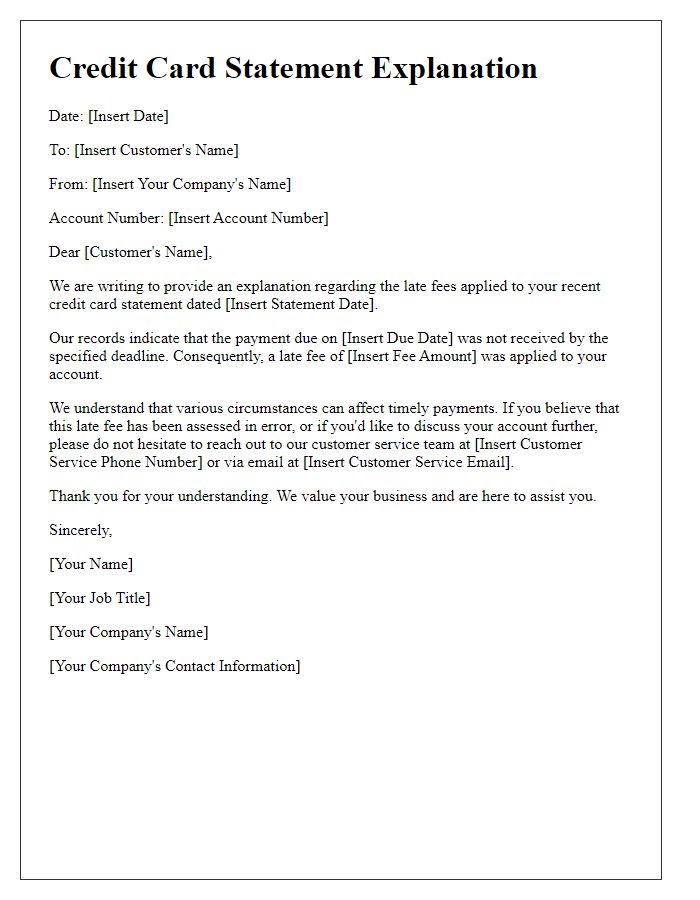

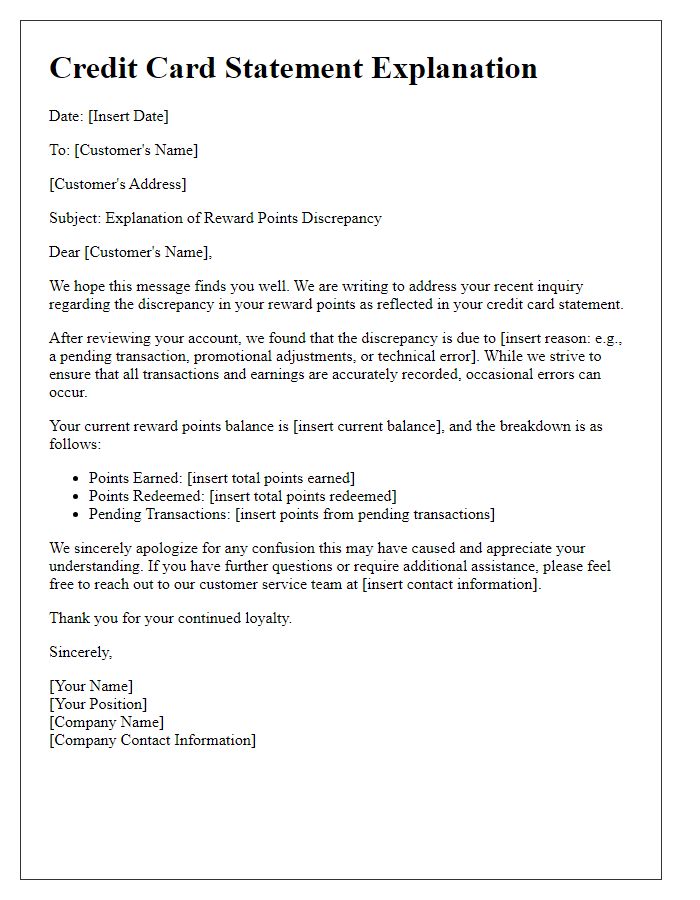

Credit card statement discrepancies often arise from various transaction details. Each statement reference includes unique identifiers such as transaction date (often in MM/DD/YYYY format), merchant name, and posted amount that require scrutiny. For instance, a charge from Amazon (popular e-commerce platform) might reflect differing amounts due to taxes or discounts applied. Monthly statements can also include fees, such as annual fees (sometimes around $95 for premium cards) and interest charges (typically ranging from 15% to 25% APR), which contribute to the overall balance. Understanding these key components can clarify any confusion regarding outstanding amounts and payment obligations.

Description of Discrepancy

In a financial statement, discrepancies in credit card transactions can often lead to confusion and concern for consumers. Common discrepancies could include unauthorized charges from merchants, such as a $150 purchase from an online retailer that the cardholder did not recognize. Billing errors, like duplicate charges for the same $75 transaction at a restaurant, may also appear. Additionally, issues surrounding incomplete credits, such as a missing $50 refund for a returned product, can contribute to discrepancies. It's crucial for consumers to review their statements diligently to identify these inconsistencies, ensuring financial accuracy and security.

Supporting Documents

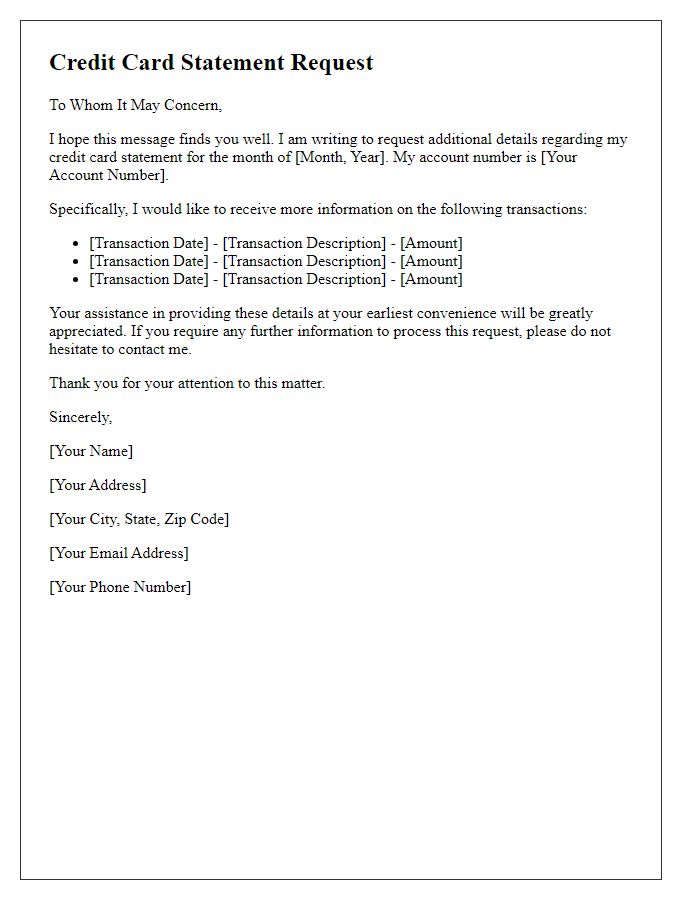

Credit card statements can often require clarification due to discrepancies in transactions, billing errors, or fraudulent charges. Important documents for supporting evidence may include previous statements showing transaction history, receipts from purchases, and communication records with customer service representatives from financial institutions. Statements from the previous month can offer context for disputed charges. For instance, highlighting charges labeled as "pending" on the statement may clarify pending payments. Ensuring all pertinent details are included in the compiled documents can facilitate a smoother resolution process with the credit card issuer, typically Visa or MasterCard, which adheres to strict regulatory guidelines for consumer protection.

Contact Information

Contact information plays a crucial role in resolving issues related to credit card statements. Customers should provide their full name, which helps in identifying the account associated with the query. The account number is essential, typically comprising 16 digits, and uniquely identifies the credit card account in question. Including a phone number ensures timely communication, while an email address allows for written confirmation of any updates or resolutions. Additionally, specifying the best hours for contact, such as weekdays between 9 AM and 5 PM, can facilitate efficient correspondence with customer service representatives. Providing accurate and detailed contact information helps streamline the clarification process and ensures accurate resolution of discrepancies on the credit card statement.

Letter Template For Credit Card Statement Clarification Samples

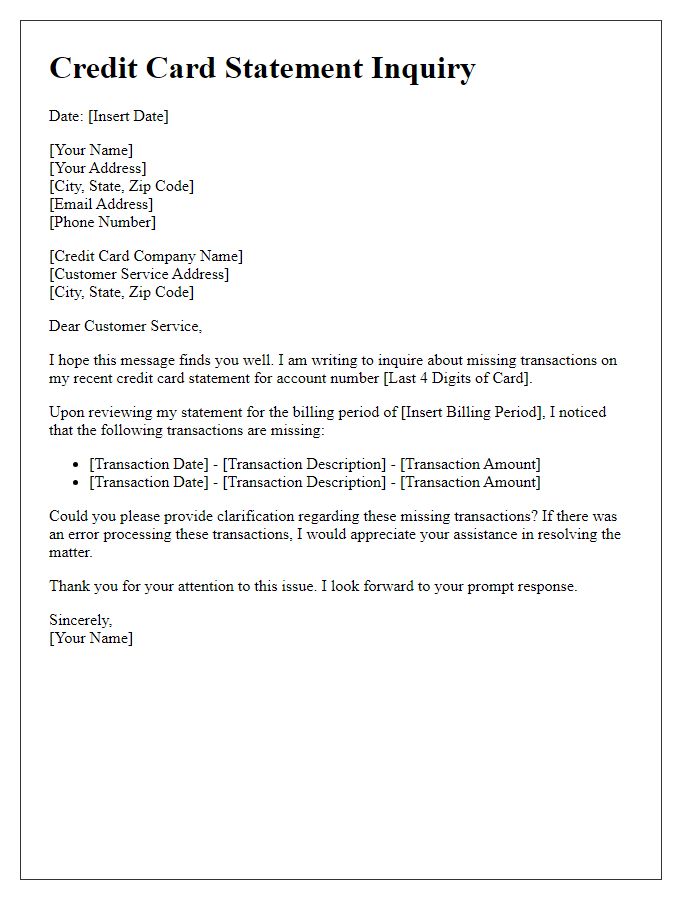

Letter template of credit card statement inquiry for missing transactions

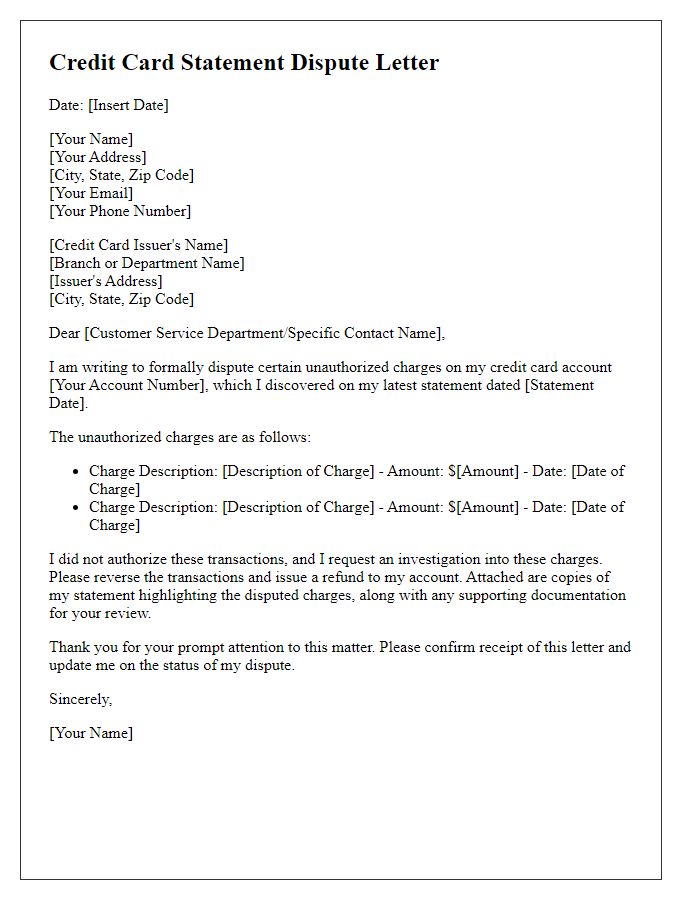

Letter template of credit card statement dispute for unauthorized charges

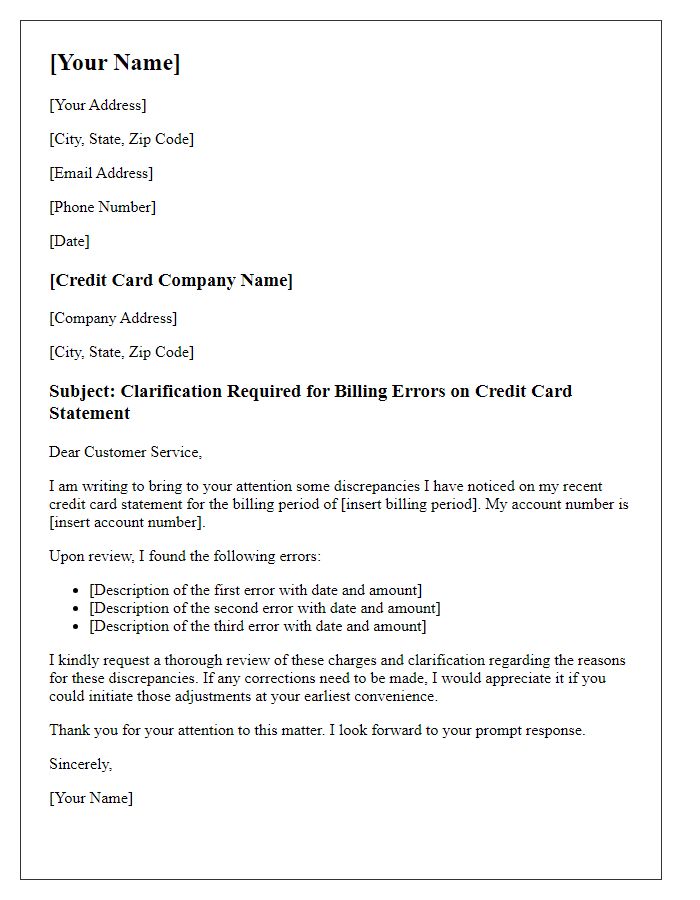

Letter template of credit card statement clarification for billing errors

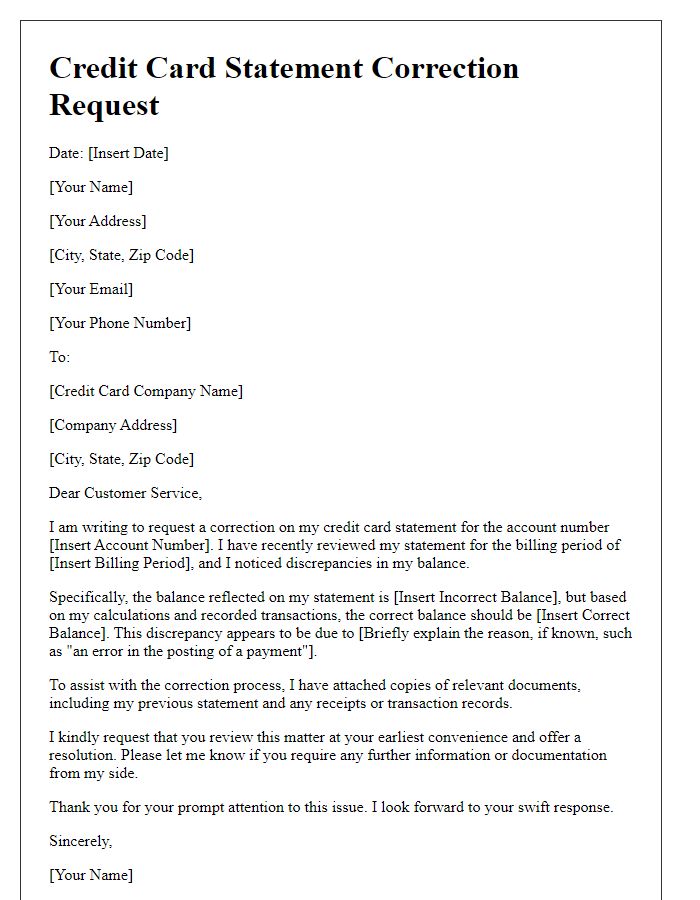

Letter template of credit card statement correction for incorrect balances

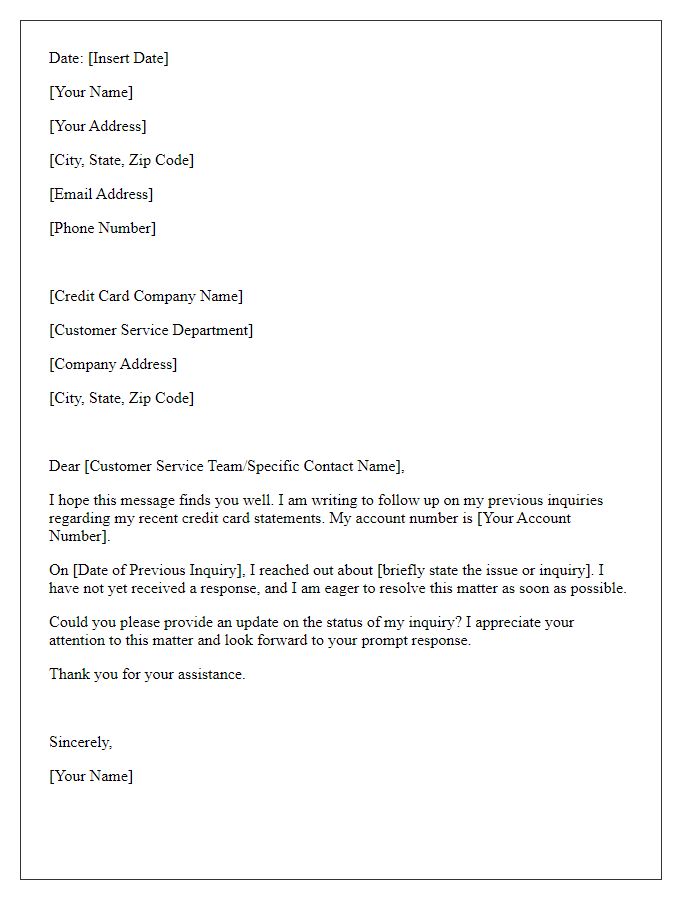

Letter template of credit card statement follow-up for previous inquiries

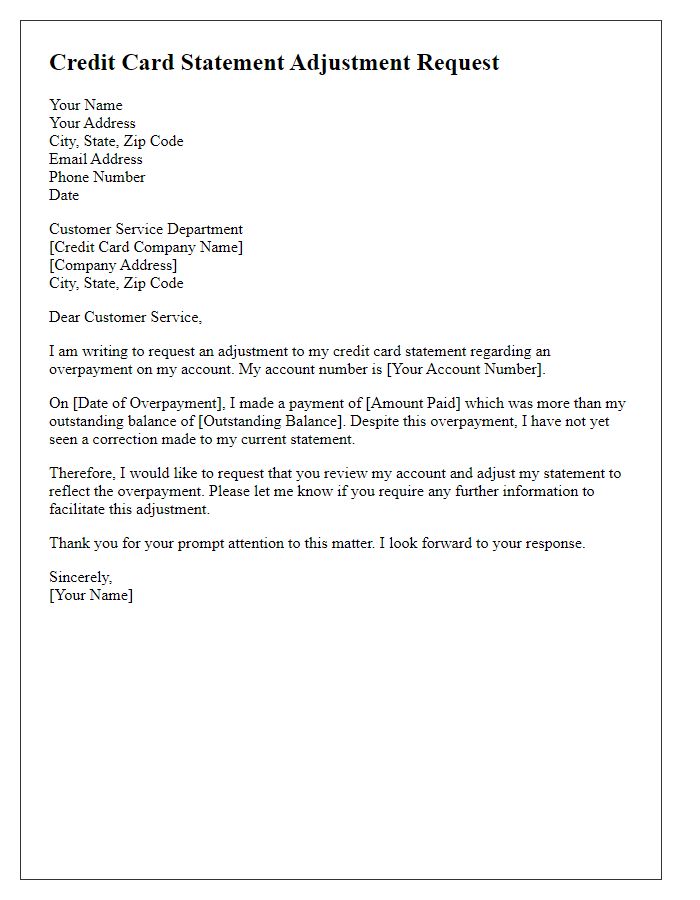

Letter template of credit card statement adjustment request for overpayments

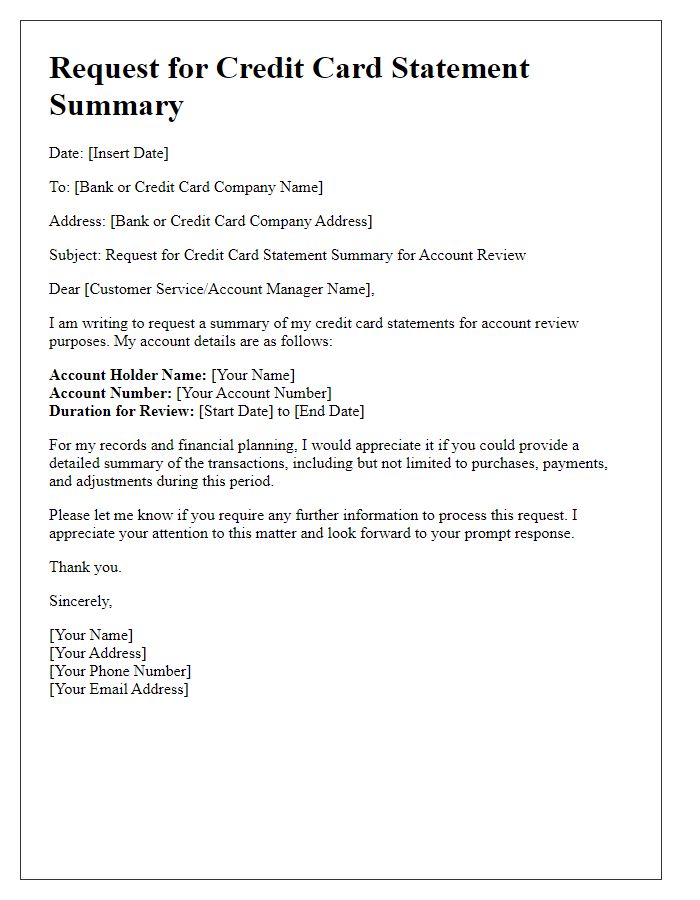

Letter template of credit card statement summary request for account review

Comments