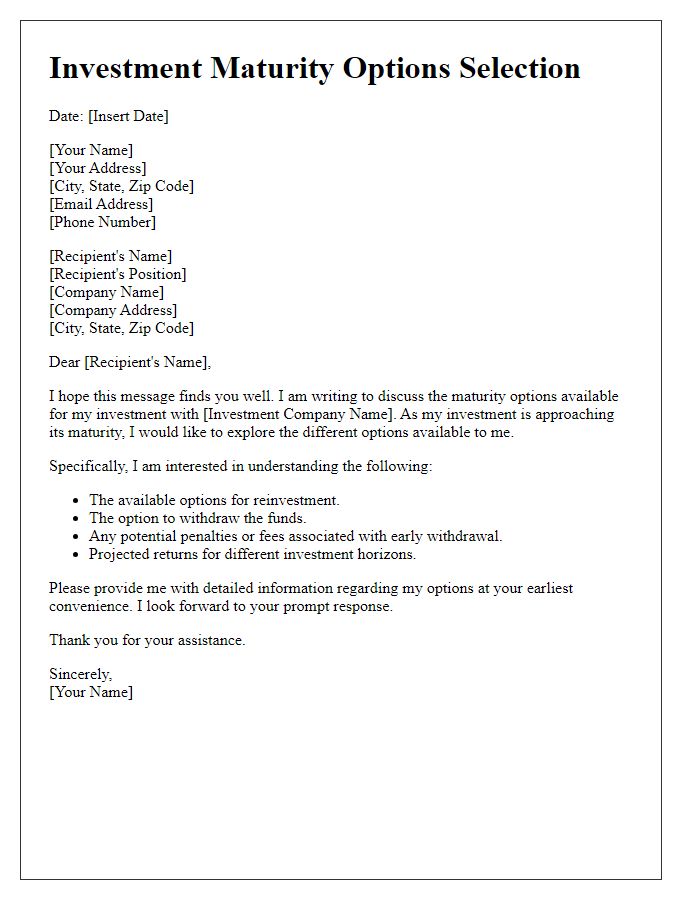

Are you ready to take the next step in managing your investment portfolio? Understanding how to handle investment maturity instructions can seem daunting, but it doesn't have to be. In this article, we'll break down the essentials of crafting a clear and effective letter for your investment maturity, ensuring that you navigate the process with confidence. So, let's dive in and explore the key elements you need to include!

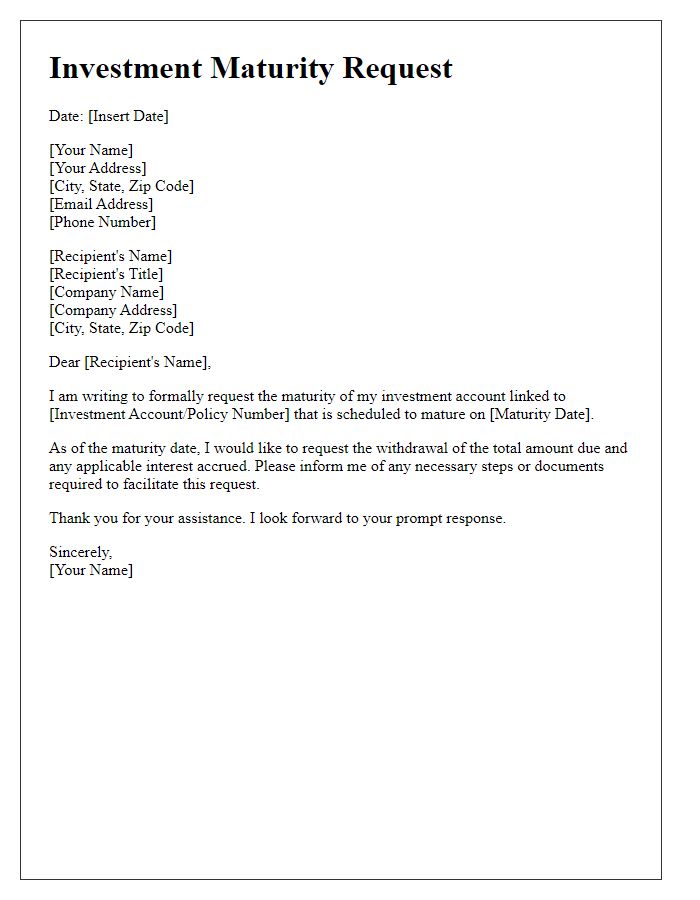

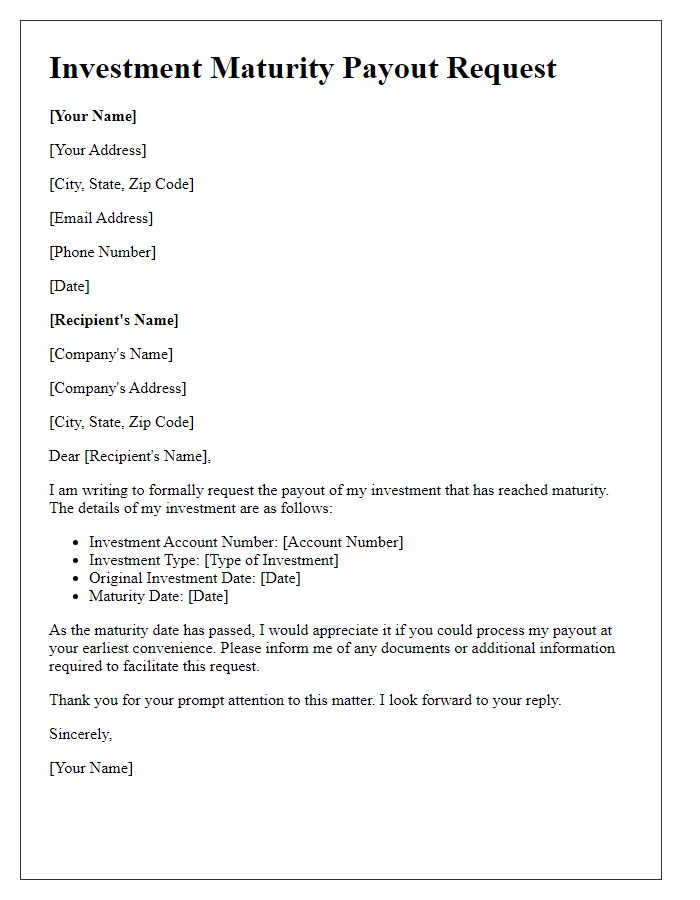

Personal Information: Name, Address, Contact Details.

Investing in financial instruments often leads to maturity events where the investor must provide personal information to process the transaction effectively. Personal information such as full name, residential address, and up-to-date contact details is crucial in ensuring accurate identification and successful completion of the maturity instructions. Incorrect or outdated information may lead to delays or complications in receiving proceeds. Registrars and financial institutions typically require this data in adherence to know-your-customer (KYC) regulations, designed to enhance security and prevent fraud. Providing complete personal information ensures smooth communication regarding the investment's status and additional instructions if necessary.

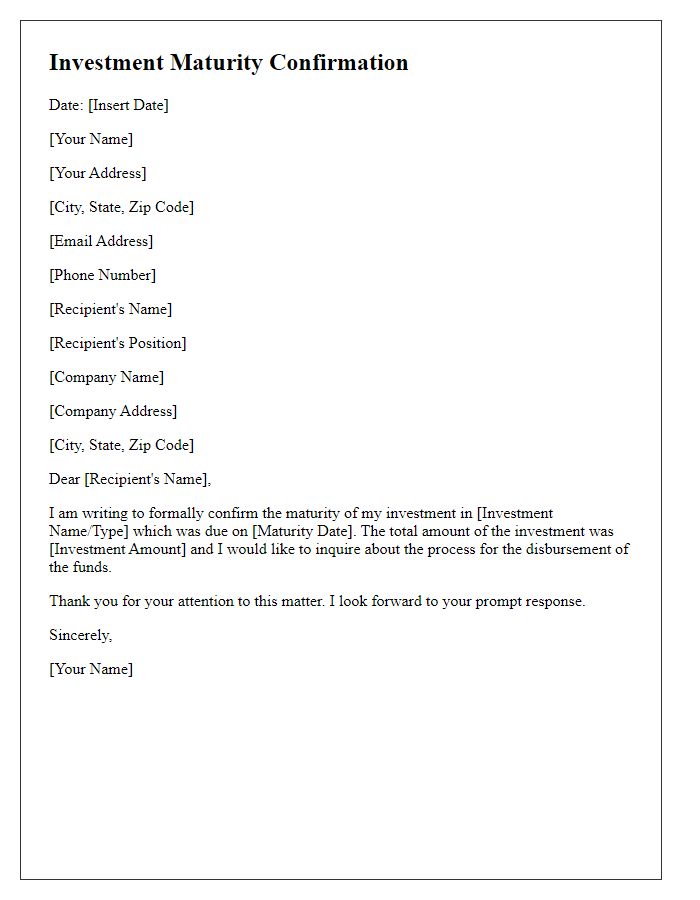

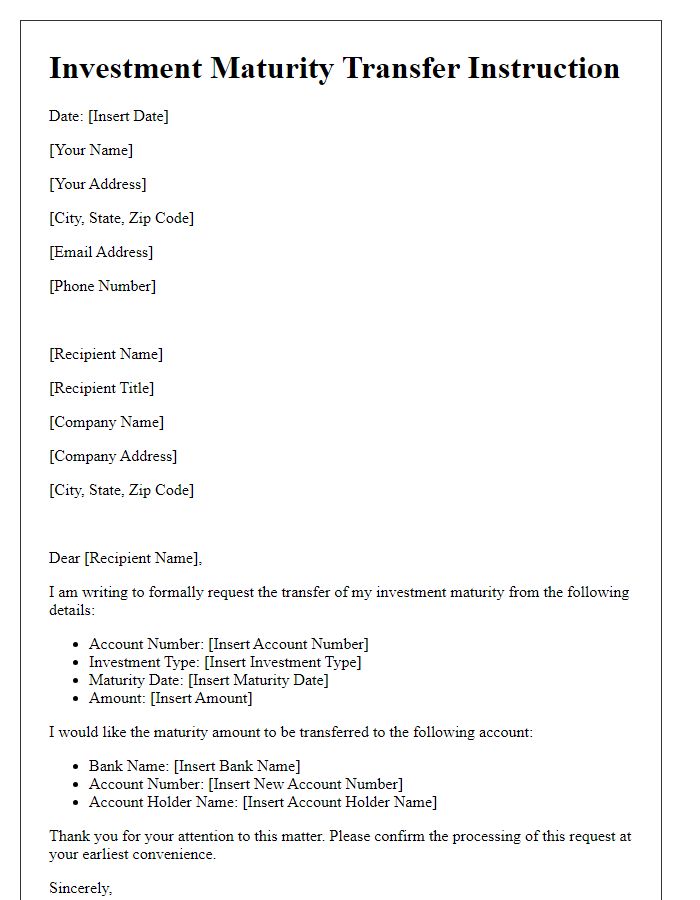

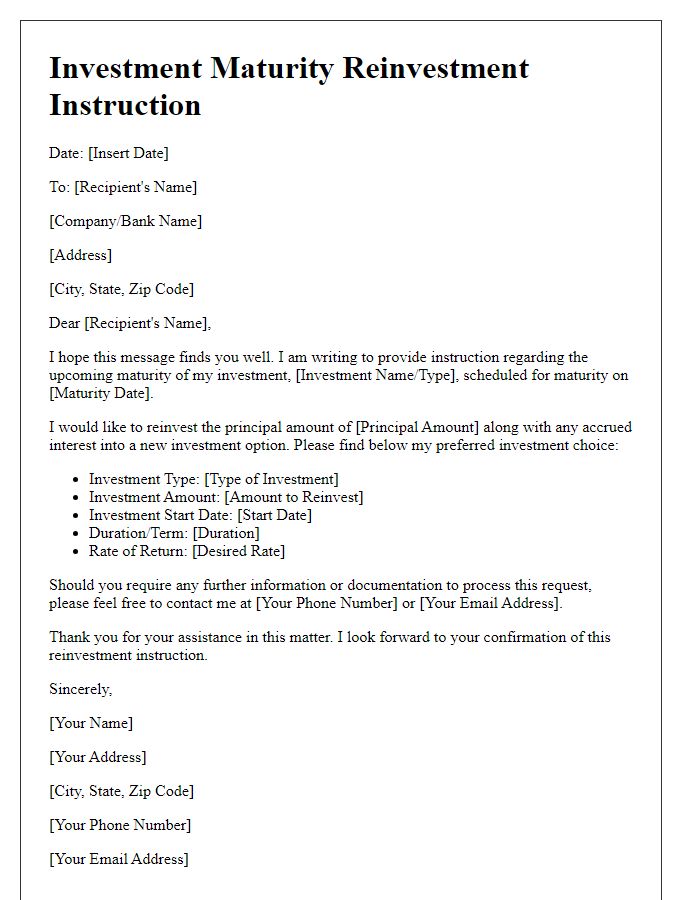

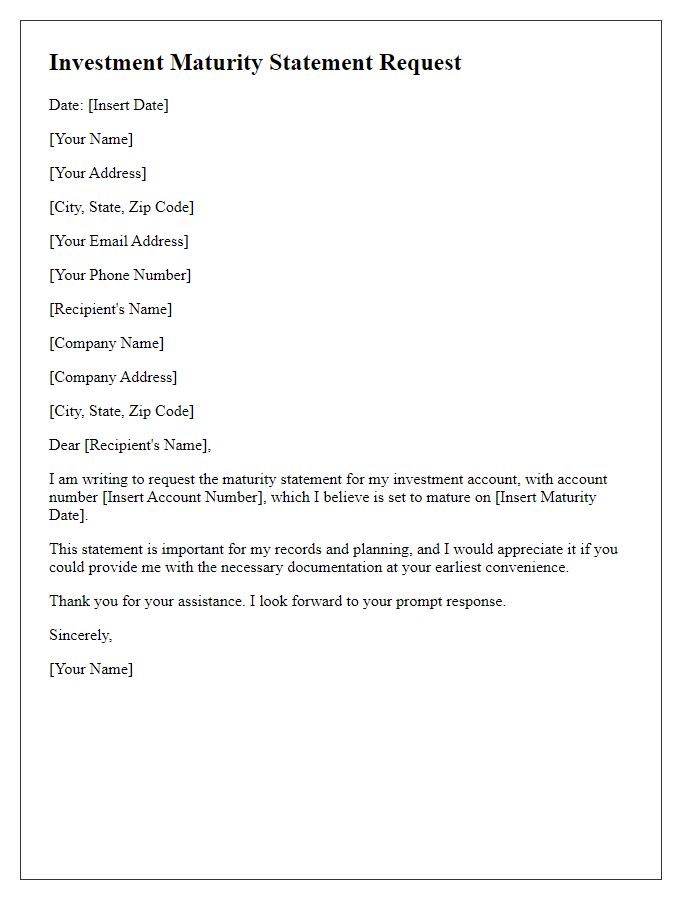

Investment Details: Account Number, Investment Type, Maturity Date.

Matured investments require specific instructions to ensure effective processing. Investment details include the account number, a unique identifier facilitating management of funds, alongside the investment type, which may range from stocks, bonds to mutual funds, each with different maturity characteristics. The maturity date, typically denoting the end of the investment term, signifies a crucial timeline, as it often influences decisions on reinvestment or liquidation of assets. Proper management of these details can optimize financial outcomes, yielding increased returns while minimizing risks involved in capital allocation.

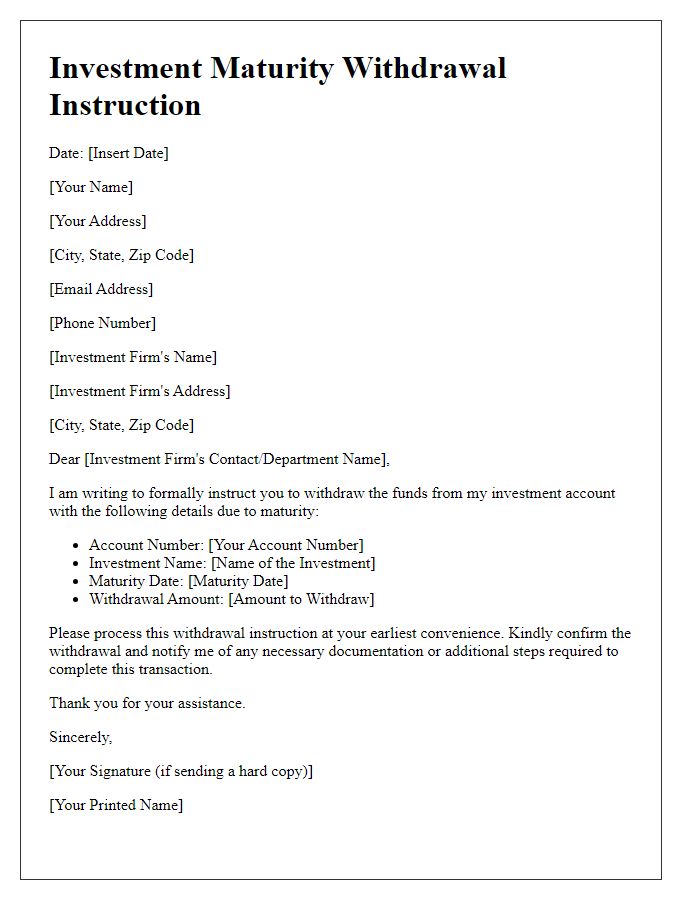

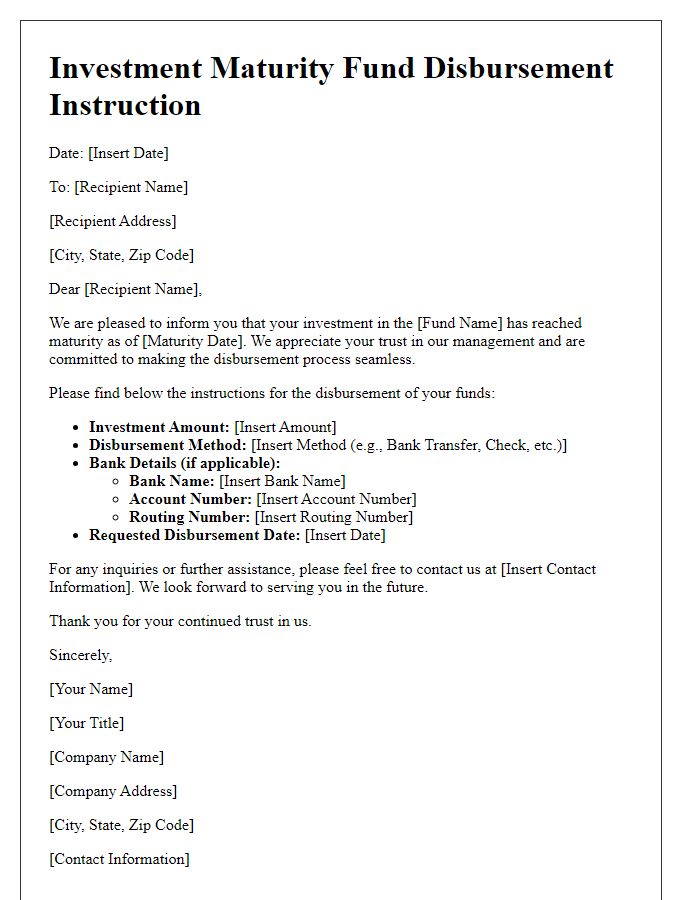

Withdrawal Instructions: Preferred Payment Method, Bank Account Details.

Upon reaching investment maturity, clients must submit withdrawal instructions detailing their preferred payment method and corresponding bank account information. This process ensures seamless and secure processing of funds. Clients are encouraged to specify their preferred payment method, which may include direct bank transfer or check disbursement. For bank account details, essential information such as the account number, routing number for U.S. banks, and the financial institution's name must be provided. Accuracy in this submission is crucial to prevent delays or errors in fund distribution.

Tax Considerations: Withholding Instructions, Tax Identification Number.

Investment maturity instructions require careful attention to tax considerations that impact the final payout. Tax withholding instructions should specify the appropriate percentage to be withheld based on current federal and state regulations, ensuring compliance with IRS guidelines. The investment may be subject to various tax implications, such as capital gains tax, which can vary depending on the holding period and type of investment. It is essential to provide a valid Tax Identification Number (TIN), which serves as a crucial identifier for tax purposes to ensure accurate reporting of income earned. Failure to provide a TIN may result in backup withholding at the maximum rate, significantly reducing the total return on investment.

Signature and Date: Authorization, Acceptance of Terms.

Investment maturity instructions require precise documentation to ensure compliance with financial regulations and client agreements. Signatures provide legal authorization, confirming the investor's acceptance of terms outlined in the investment contract. This essential step usually includes a date, indicating when the investor acknowledges their consent, which can affect timelines for disbursement and any associated fees. Investors must be aware of specific terms related to maturity options, such as options to reinvest or withdraw funds, which can vary by investment vehicle, including stocks, bonds, or mutual funds. Proper execution of these instructions is critical for the successful transition of assets and can influence future investment decisions.

Comments