Are you ready to navigate the ATM card renewal process with ease? Many of us rely on our cards for daily transactions, and knowing how to renew them can save time and prevent hassle. In this article, we'll discuss the essential steps you need to follow for a smooth renewal experience, along with some helpful tips to keep in mind. So, stick around to learn more about streamlining the ATM card renewal process!

Account Holder Name and Address

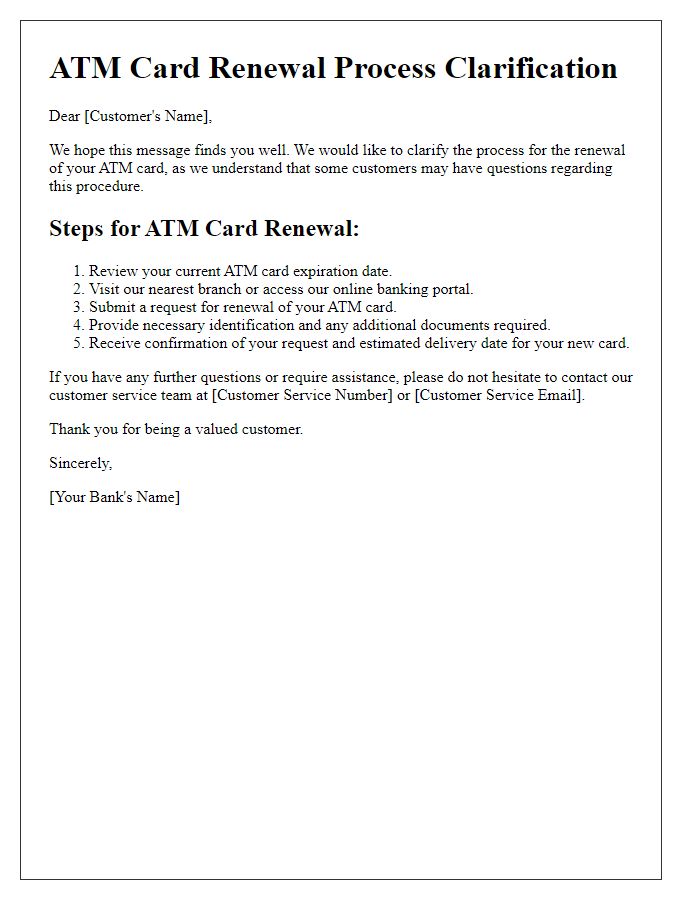

The ATM card renewal process involves several important steps ensuring uninterrupted access to banking services. Account holders, such as John Doe residing at 123 Elm Street, Springfield, IL, must typically initiate the renewal request through their bank's official website, mobile app, or customer service hotline. Banks often send notification letters approximately 30 days before the card's expiration date, outlining required procedures. Upon successful submission of the renewal form, banks may issue new cards within 7 to 14 business days, depending on processing times. Card delivery often includes tracking options for enhanced security, ensuring that sensitive items like ATM cards reach the intended recipient without delay.

Subject Line: ATM Card Renewal Request

The ATM card renewal process often involves several steps that ensure timely issuance of a new card. Customers usually start by submitting a request through their bank's online portal, which requires personal identification, such as a government-issued ID or bank account number. The current ATM card, typically valid for three to five years, needs to be reviewed, as banks may notify customers about renewal a month prior to expiration. Upon verification, banks may charge a nominal fee, which varies between institutions, usually ranging from $0 to $25. The new card is usually dispatched via postal services, and delivery might take between seven to fourteen business days, depending on geographical location. Security measures include activation procedures that often involve setting a new Personal Identification Number (PIN) upon receipt.

Current Card Details and Expiry Date

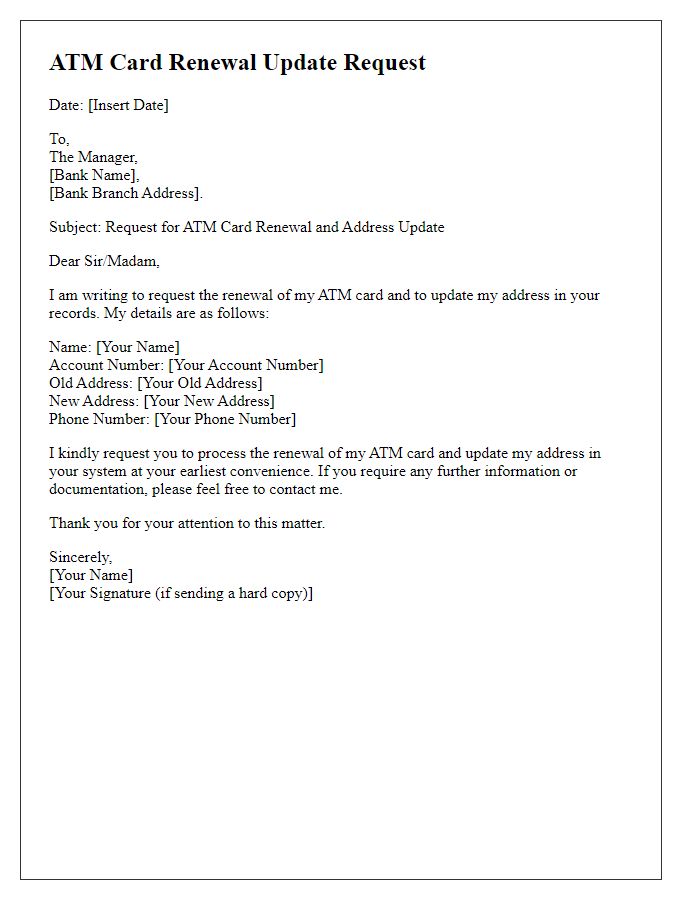

The ATM card renewal process requires specific current card details, such as the card number, card type (Visa, MasterCard), and expiry date (typically a four-digit format, e.g., 12/25). Regularly monitoring these details is crucial as cards generally have a validity period of three to five years. Upon nearing the expiry date, commonly marked on the front of the card, banks initiate renewal procedures to ensure uninterrupted access to funds. Users may receive notifications via SMS or email prompting them to verify the expiration date and update their address if necessary to ensure timely delivery of the new card.

Reason for Renewal

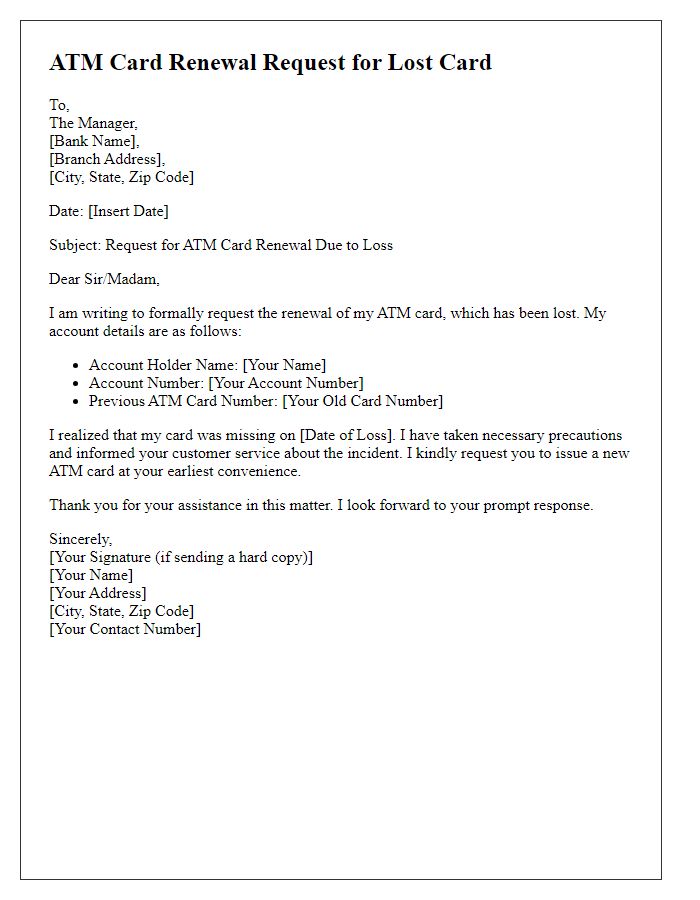

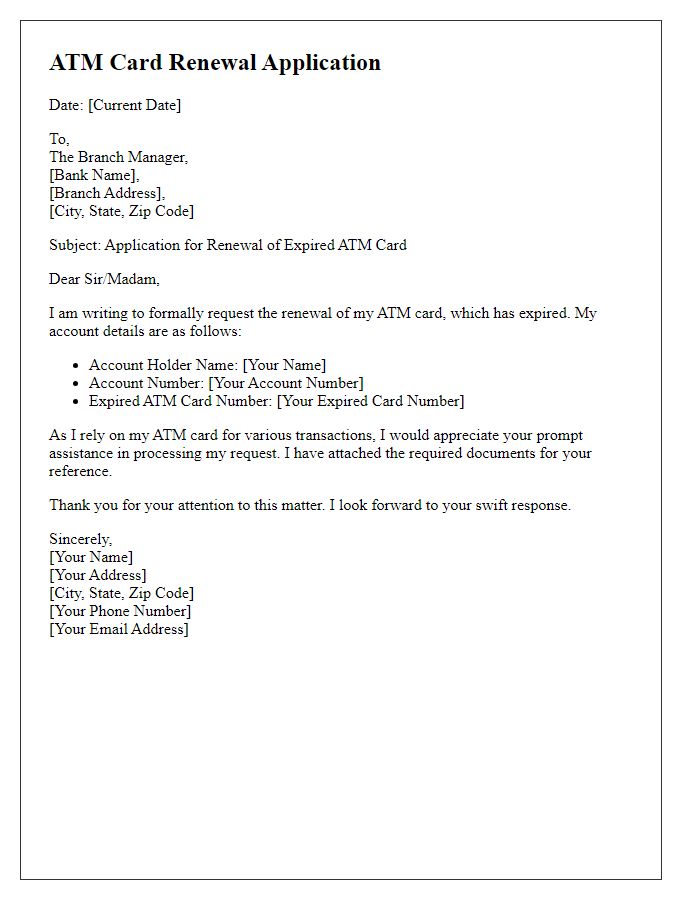

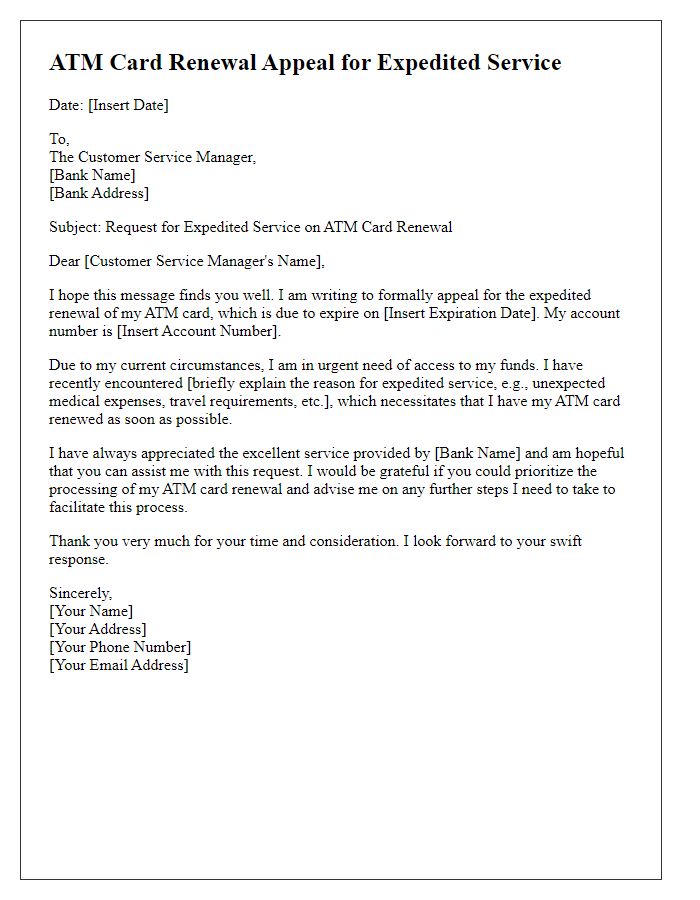

An ATM card renewal process often arises due to various reasons, including expiration of the current card, loss or damage of the card, or enhancing security features provided by banks. Expiration typically occurs every 3 to 5 years, depending on the issuing financial institution. A damaged card may involve broken magnetic stripes or malfunctioning chip technology, rendering it unusable at bank machines or point-of-sale terminals. Additionally, financial institutions may issue new cards to introduce updated security measures, such as EMV chip technology, which significantly reduces fraud risk compared to older magnetic stripe cards. The renewal ensures uninterrupted access to bank accounts and funds for customers, allowing for seamless transactions in places like grocery stores or online shopping platforms, enhancing overall user experience.

Contact Information for Further Communication

During the ATM card renewal process, it is crucial to provide accurate contact information to ensure seamless communication with the financial institution. Customers should list their full name, current address, and active phone number, preferably a mobile number for immediate response. Email addresses should also be included, as many banks utilize electronic communication for updates and verification. For added security, customers may choose to provide a secondary phone contact or an alternative email. This information ensures that notifications regarding the renewal timeline, any required documentation, and changes to services are communicated effectively. Regular updates can prevent delays in receiving the new ATM card.

Letter Template For Atm Card Renewal Process Samples

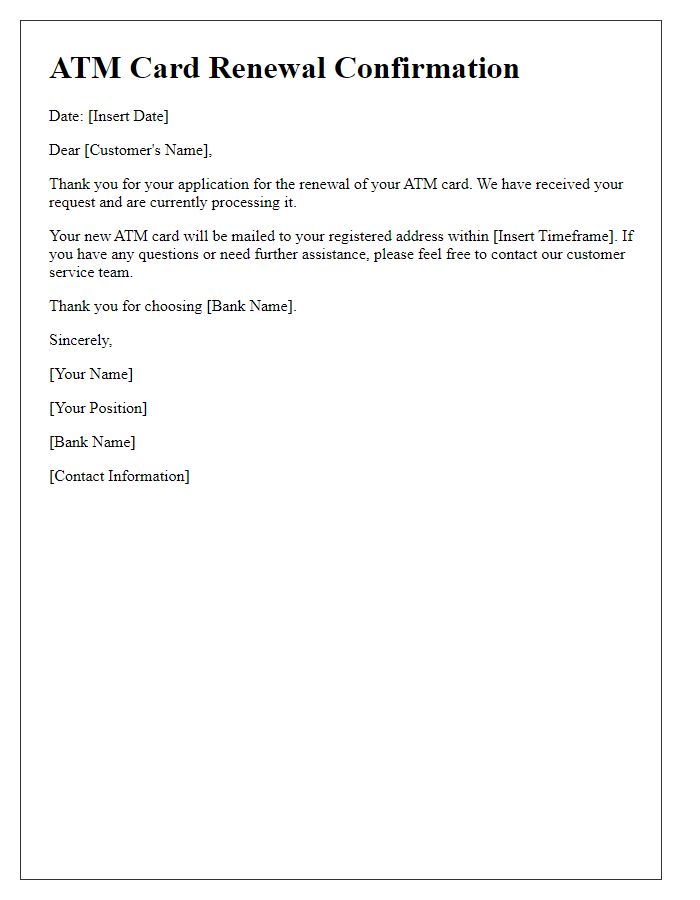

Letter template of ATM card renewal confirmation for received application.

Comments