Opening a bank account is an exciting step towards managing your finances efficiently, and crafting the right request letter can make the process smooth and straightforward. In this article, we'll guide you through the essential components of a bank account opening request letter, ensuring you convey your intentions clearly and professionally. We'll explore tips on what information to include, from your personal details to the type of account you wish to open. So, get ready to dive in and learn how to write an effective letter that sets the stage for your banking journey!

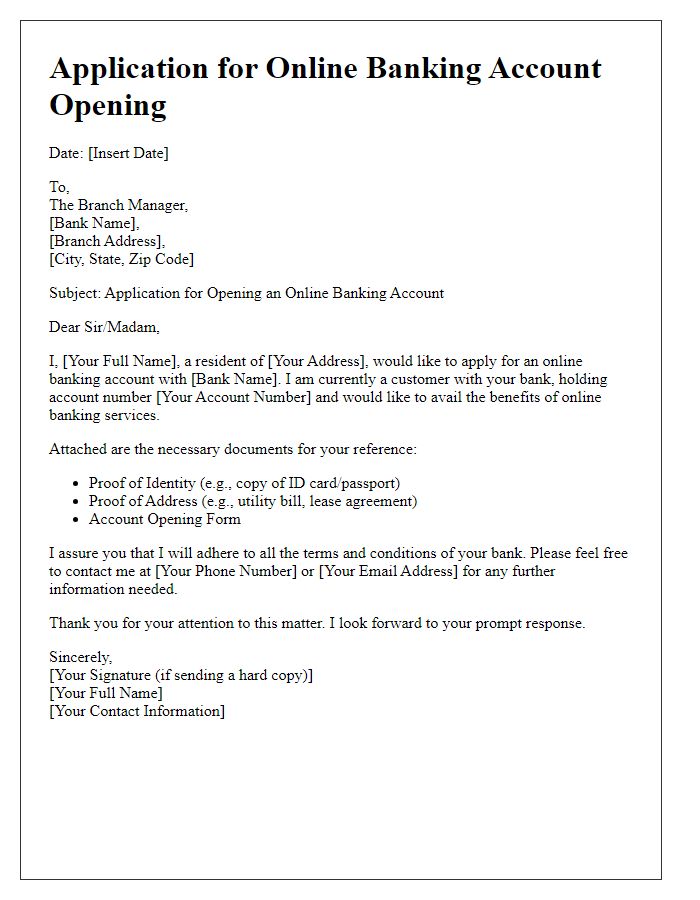

Applicant's personal details

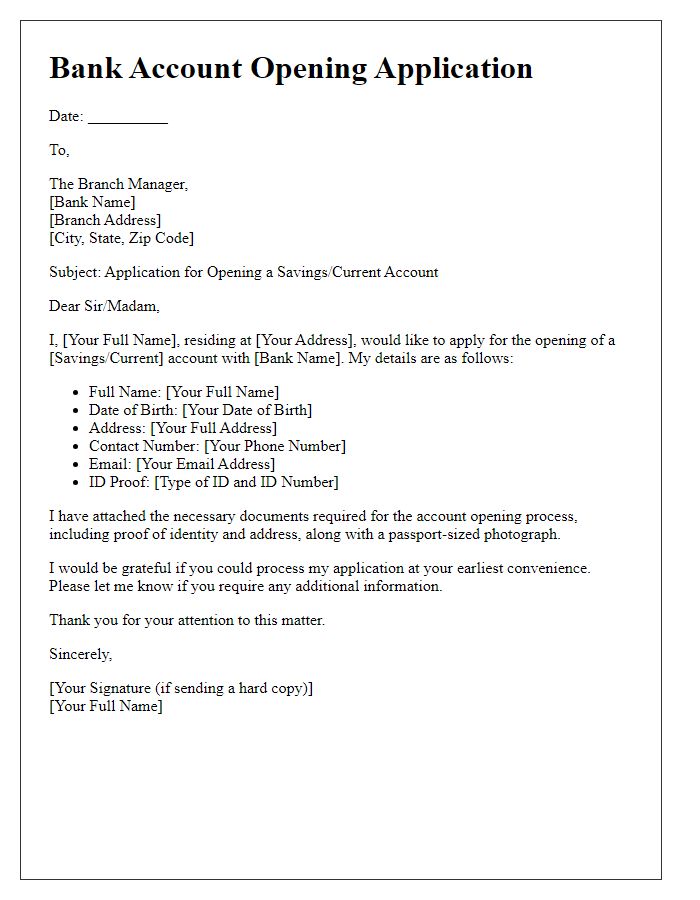

To open a bank account, individuals must provide essential personal information that includes their full name, which is necessary for identity verification. Applicants must also include their date of birth, ensuring compliance with legal age requirements for account holders, typically 18 years. A permanent residential address, critical for communication and legal documents, should be highlighted, along with a valid government-issued identification number, such as a social security number or national ID. Additionally, providing a contact number enables the bank to reach out regarding account details and updates, while an email address facilitates electronic communications and online banking services. Some banks may also request employment information, such as job title and employer details, to assess financial stability.

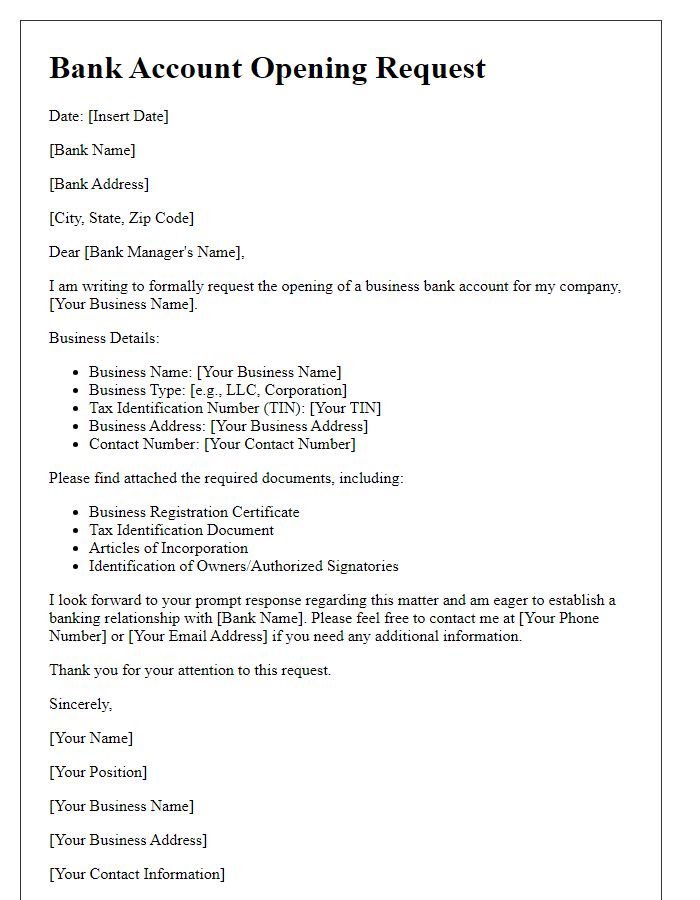

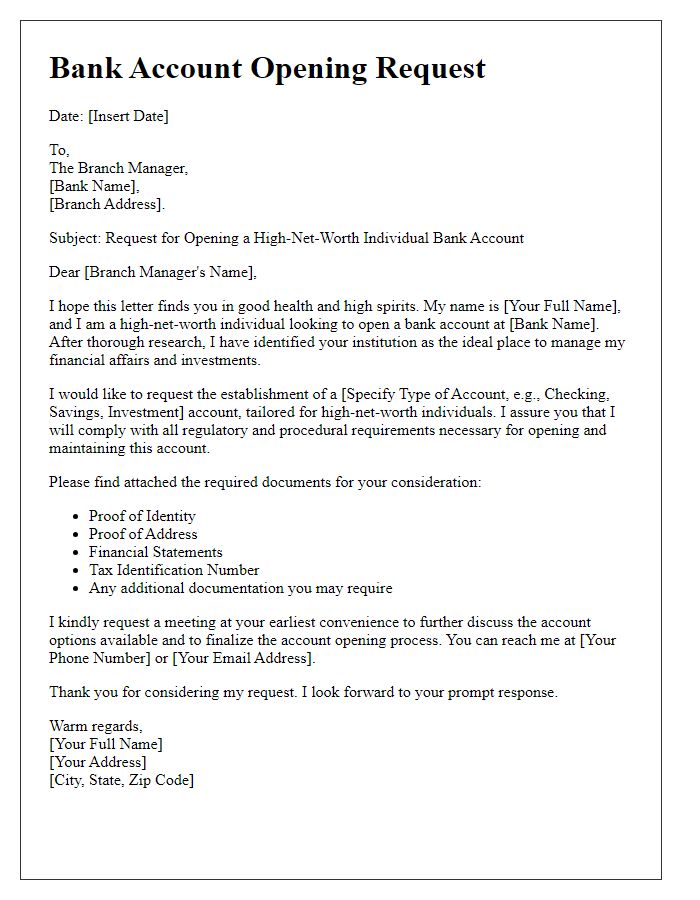

Type of account requested

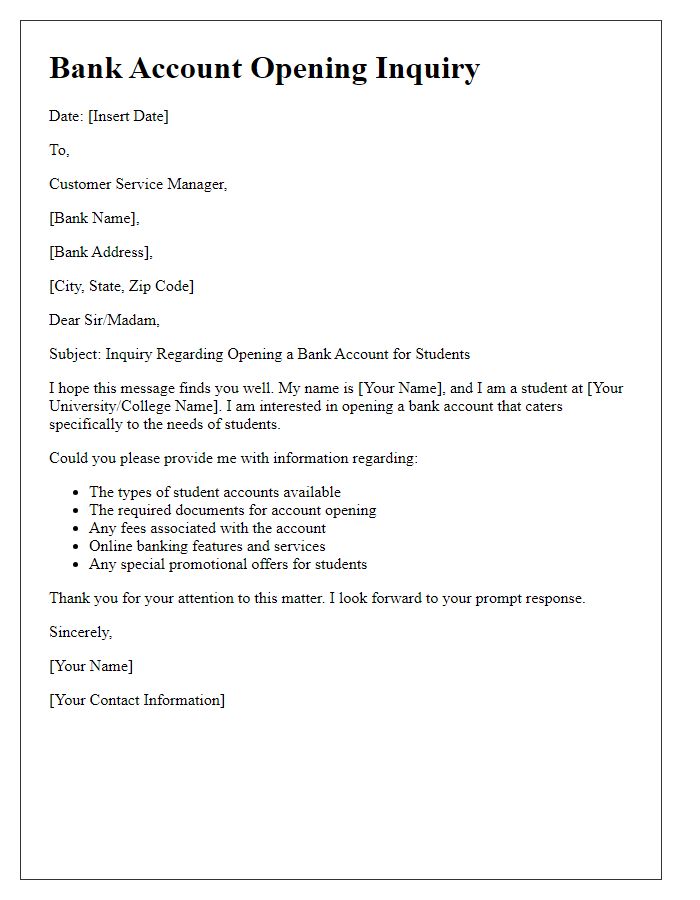

Individuals seeking to open a savings account may require specific documentation and identification to receive competitive interest rates and maintain financial stability. Financial institutions often require information such as the applicant's full name, social security number, address, and proof of employment. Opening a checking account allows access to daily banking needs, including ATM withdrawals and debit card transactions. Some banks may offer special promotions or bonuses for new accounts, enhancing the appeal of financial management. Researching types of accounts available at institutions such as Bank of America or Wells Fargo helps in understanding features like online banking, mobile deposits, and minimum balance requirements.

Required documentation

Opening a bank account typically requires specific documentation to successfully complete the process. Applicants often need to provide identification documents, such as a government-issued photo ID (e.g., passport or driver's license), to verify identity. Proof of address, like utility bills or rental agreements, is also necessary to confirm residency. Additional documentation may include Social Security numbers or tax identification numbers for tax purposes. Some banks might require an initial deposit amount, which varies by financial institution, and forms specific to the type of account being opened (e.g., savings or checking). Understanding the exact requirements can differ by bank, so it's advisable to consult individual banking institutions directly for their specific documentation checklist.

Contact information

To open a new bank account, individuals must gather essential contact information, including full name, permanent address (including city, state, and zip code), email address for digital correspondence, and a valid phone number (mobile or landline) for account notifications. Additional details may include Social Security Number (or equivalent identification), employment information (such as employer's name and address), and financial information like annual income. Providing accurate contact information ensures seamless communication with the bank regarding account management, updates, and required documentation. This information facilitates the verification process, ensuring compliance with banking regulations, such as the USA PATRIOT Act, which mandates identity verification for account holders.

Signature and date

Opening a new bank account involves submitting a request form that typically includes personal information, desired account type, and terms acceptance. Banks often require identification, such as a driver's license or passport, along with proof of residence like a utility bill. The date of request submission is crucial for processing timelines, while the signature signifies consent to the bank's terms and conditions. Additionally, it authenticates the application, ensuring that all personal data is verified and legally binding according to financial regulations.

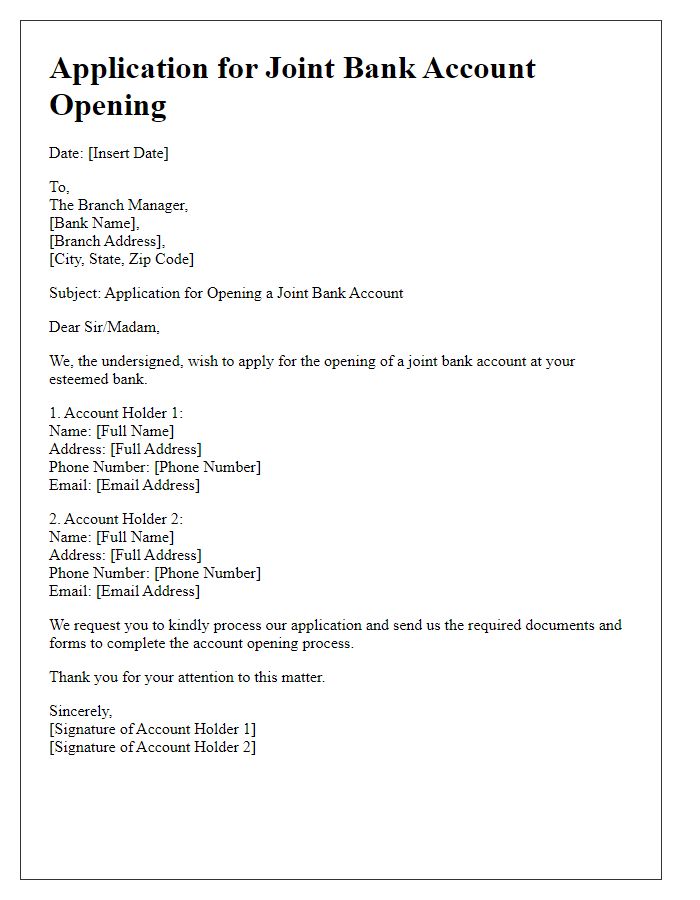

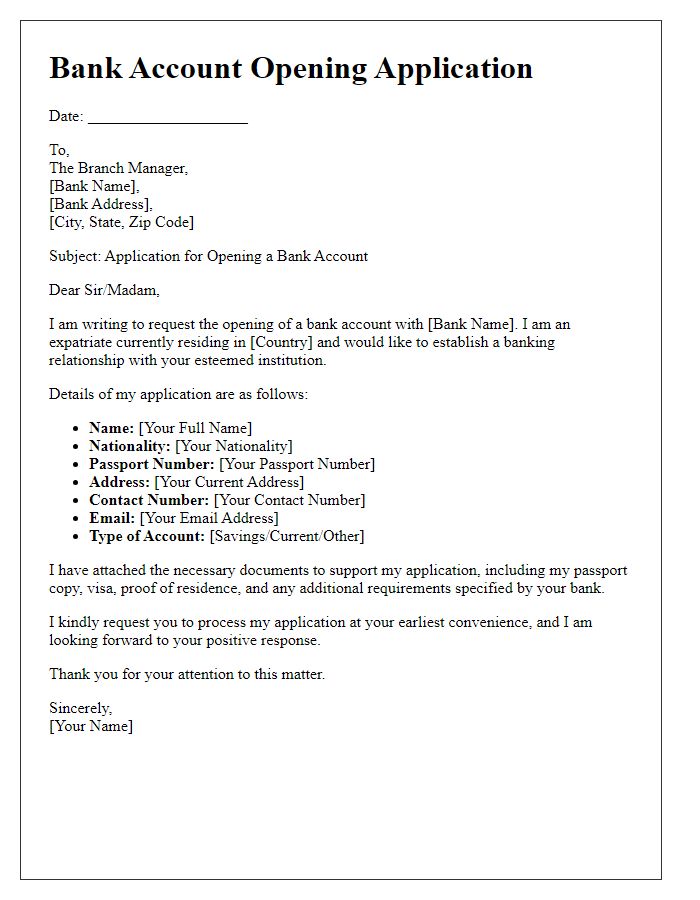

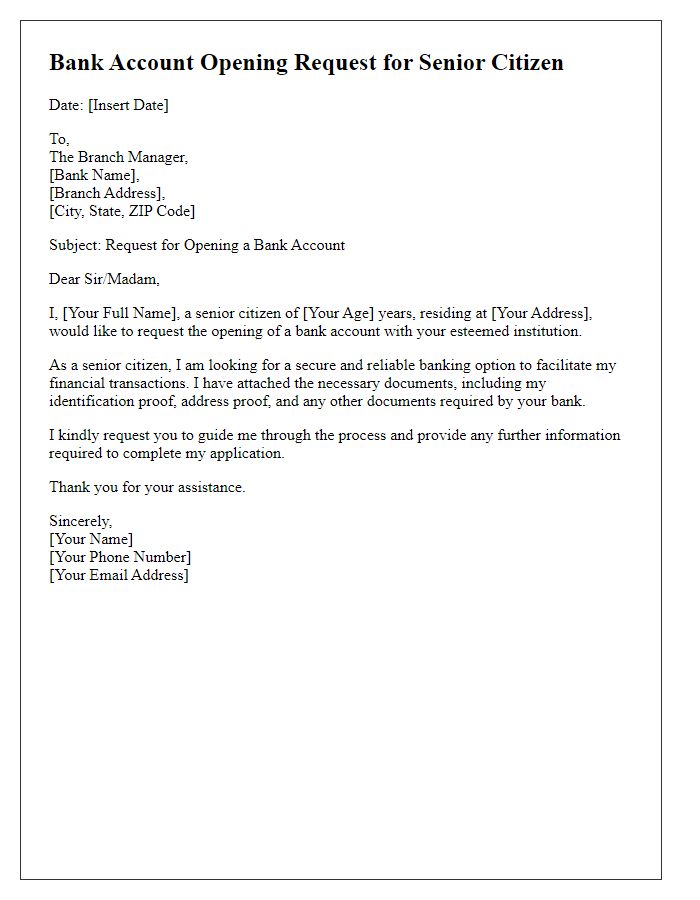

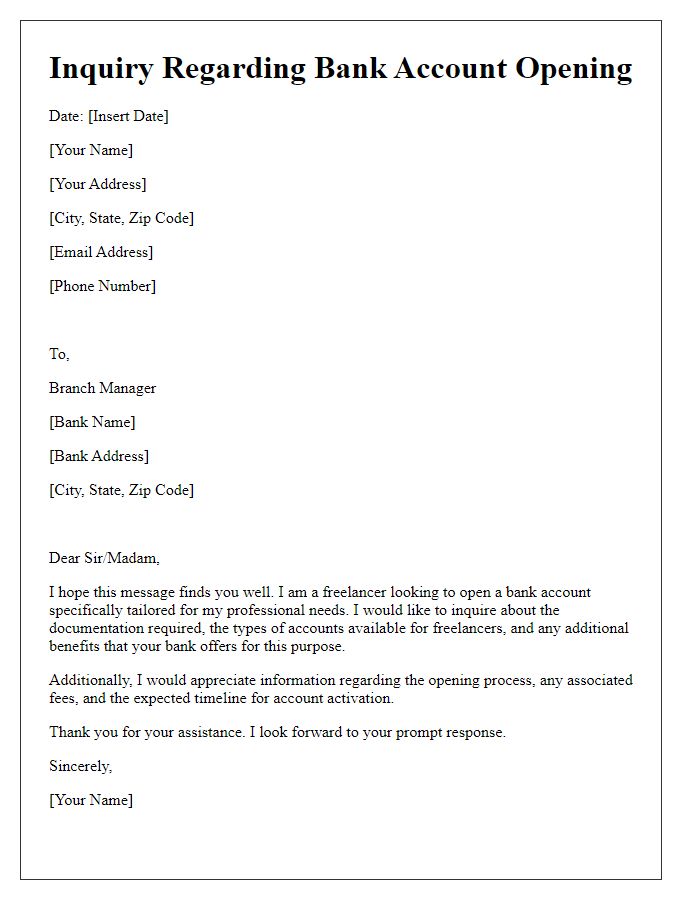

Letter Template For Bank Account Opening Request Samples

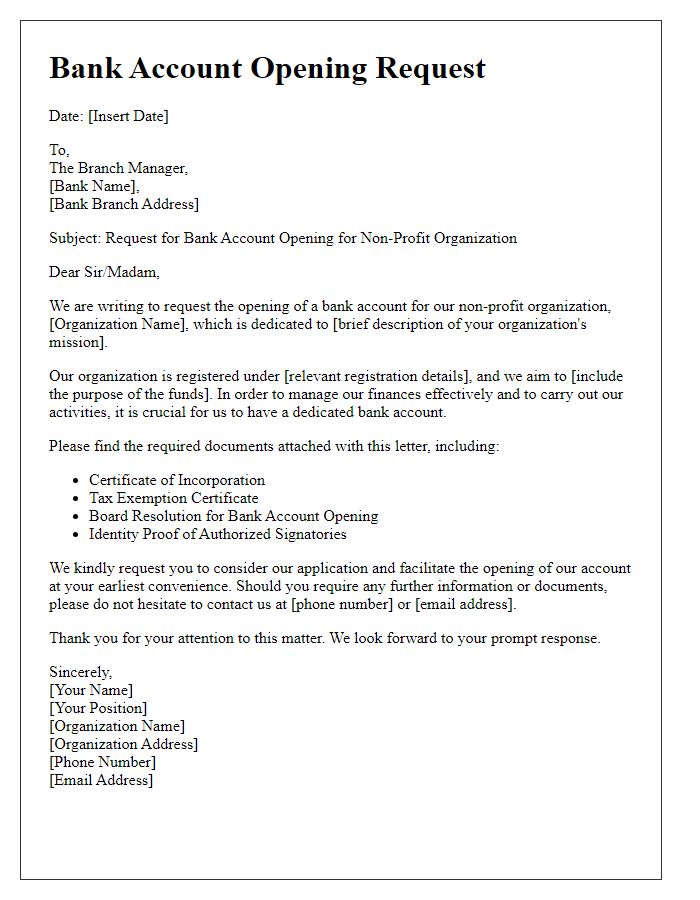

Letter template of bank account opening request for non-profit organizations

Comments