Have you ever checked your bank statement only to find an unfamiliar charge that leaves you scratching your head? If you're nodding along, you're not aloneâunauthorized transactions can be both alarming and frustrating. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. In this article, we'll guide you through a simple letter template to address unauthorized transactions and reclaim your peace of mind, so keep reading to learn more!

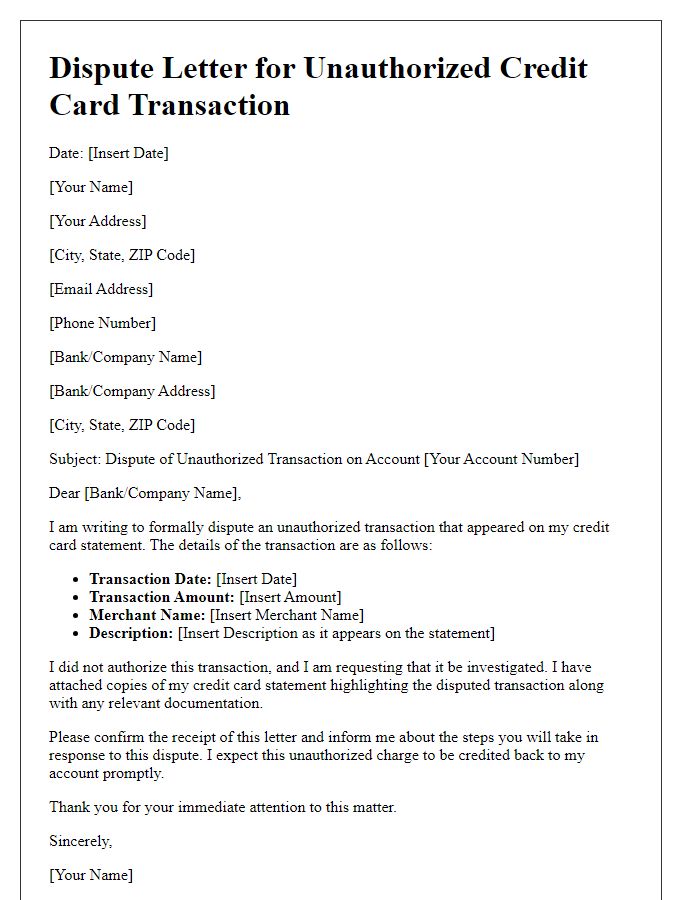

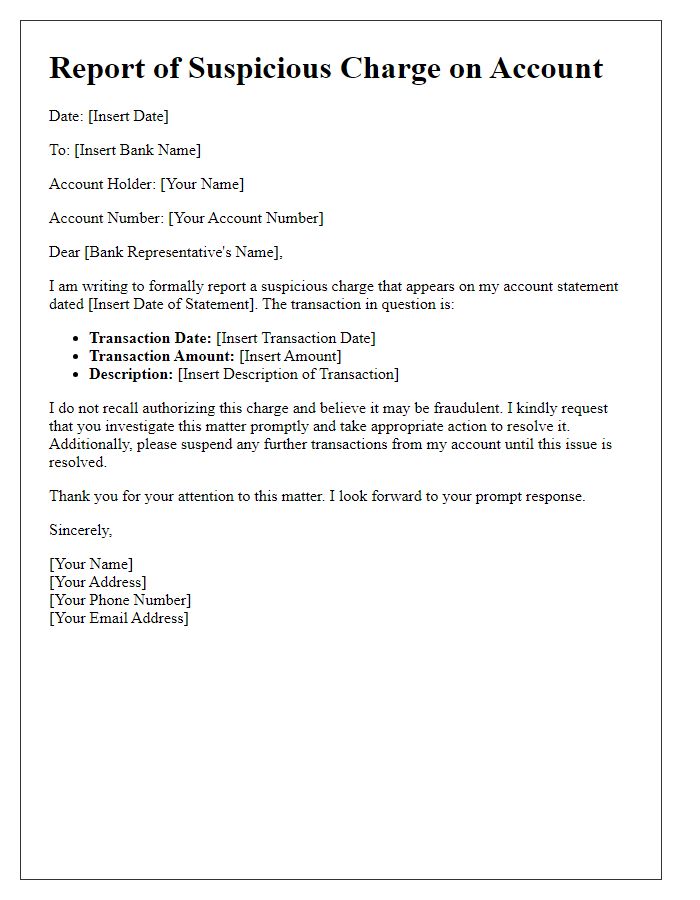

Account Information

Unauthorized transactions can severely impact bank account security and user trust. Accounts such as checking or savings often represent a person's financial well-being, with funds typically held in institutions like Bank of America or Wells Fargo. Unauthorized withdrawals, often ranging from tens to thousands of dollars, can occur due to various reasons, including phishing attacks where personal information is obtained illegally. The American Bankers Association emphasizes the importance of immediately reporting such transactions to prevent further financial loss and initiate a dispute resolution process. Banks may require details like transaction dates, amounts, and descriptions to investigate promptly. Security measures, such as two-factor authentication, are recommended to enhance account protection against future fraudulent activities.

Transaction Details

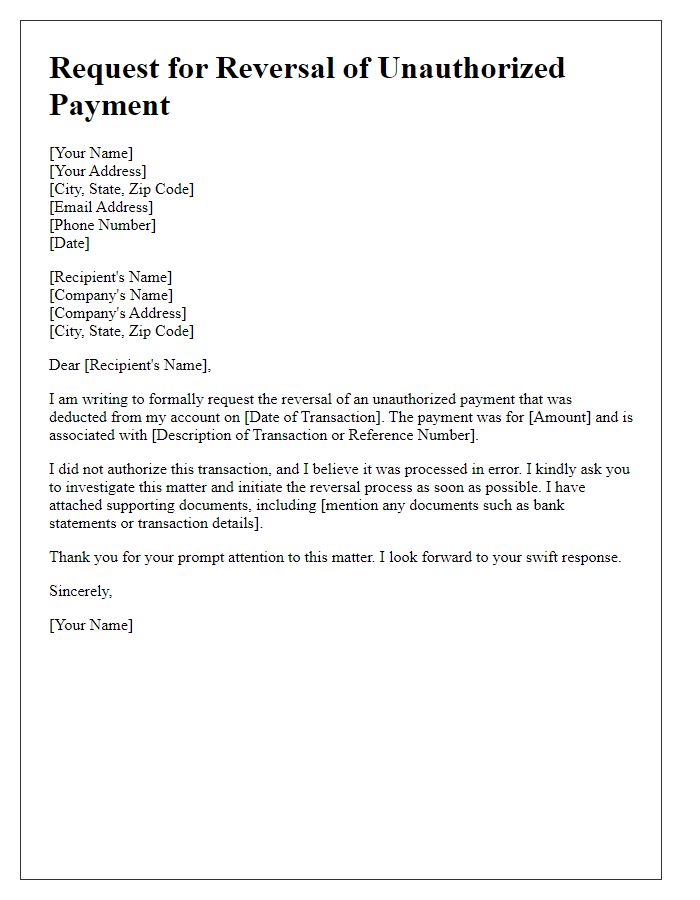

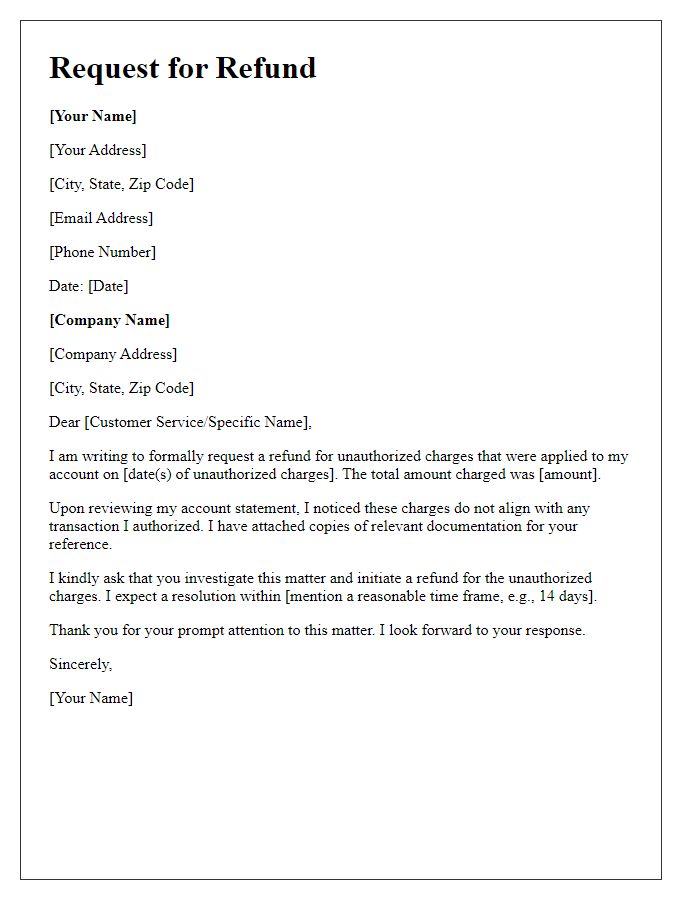

Unauthorized transactions can cause financial stress for consumers, particularly when they involve significant amounts of money, such as $250 or more. Consumers must identify the transaction details, including the date (for example, October 1, 2023), the merchant name (e.g., OnlineRetailer Inc.), and the method of payment (credit card, debit card). It's crucial to report these issues promptly to financial institutions, often within 60 days of the statement date, as established by federal regulations. Documentation such as bank statements and transaction receipts may be necessary to support the dispute. Timely reporting not only helps resolve the situation but also minimizes potential losses and ensures consumer protection under laws such as the Fair Credit Billing Act.

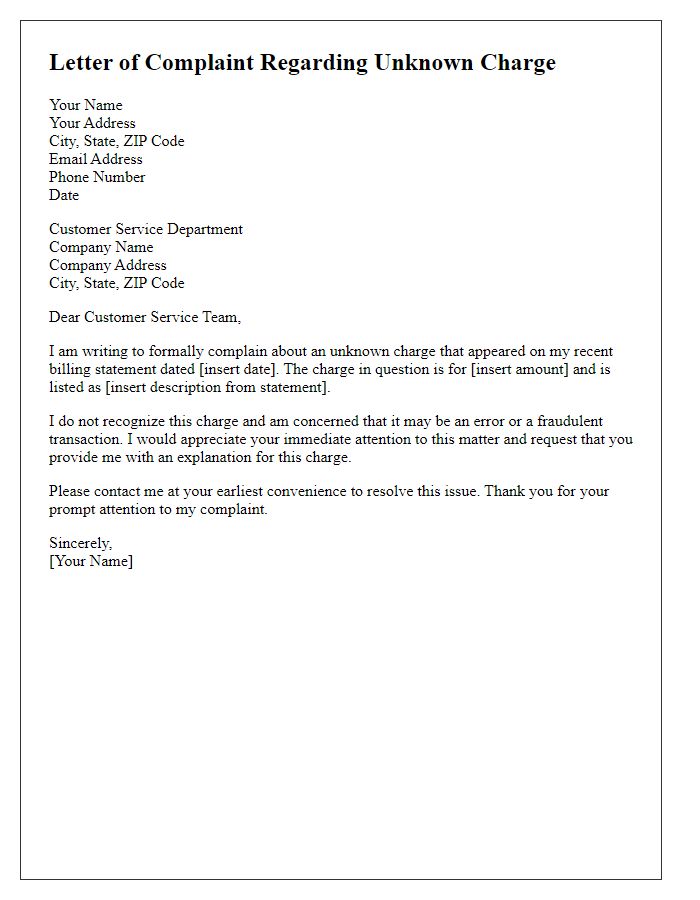

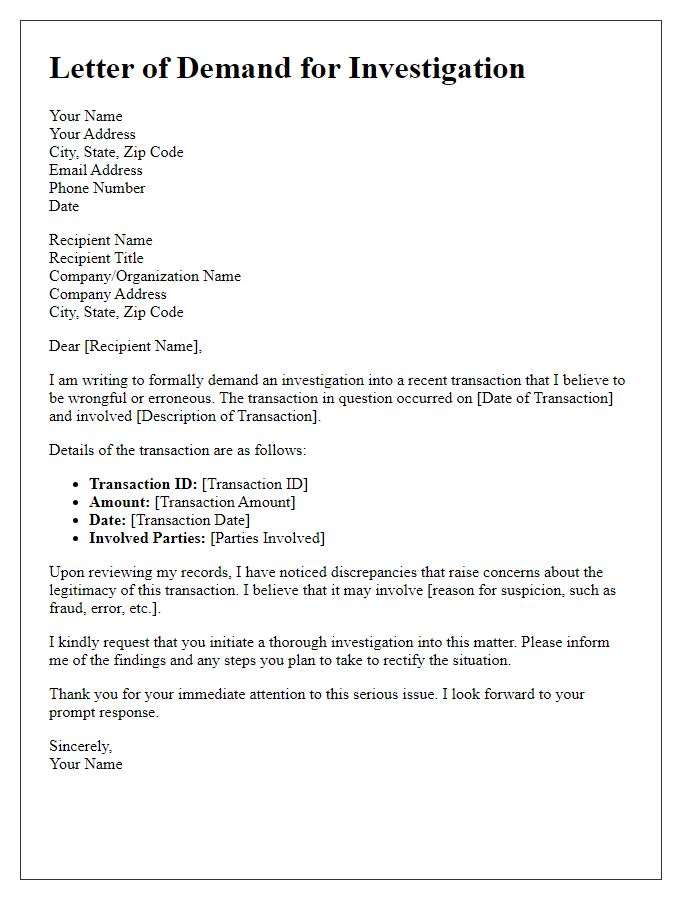

Description of Dispute

Unauthorized transactions can create significant financial distress for individuals and businesses. Such disputes often arise when transactions, typically totaling amounts of hundreds to thousands of dollars, appear on bank statements without the consent of the account holder. Events such as identity theft or data breaches at major retailers, affecting millions of customers, frequently lead to these incidents. Affected individuals should promptly report these unauthorized charges to their financial institution, typically within 30 days of detection, to initiate an investigation. Additionally, gathering supporting documents, such as bank statements and any relevant correspondence, can strengthen the case for reimbursement. Financial institutions like banks and credit card companies, governed by regulations such as the Fair Credit Billing Act, are legally obligated to assist in resolving these disputes, ensuring that consumers are protected from fraudulent activities.

Supporting Documentation

Unauthorized transactions can lead to significant financial loss and stress for individuals. Essential documentation includes detailed account statements showing disputed charges, transaction dates, and amounts, along with identification verification materials like government-issued identification (e.g., passports or driver's licenses). Additional evidence may encompass written communication regarding the dispute, such as emails or letters sent to financial institutions. Surveillance footage can provide context if the transaction occurred in a physical location, while police reports may aid in substantiating claims of fraud. Collectively, these records form a compelling case when contesting unauthorized charges in order to seek resolution and reimbursement.

Contact Information

Unauthorized transaction disputes can arise in various financial scenarios, particularly with credit cards and online banking. Customers may notice erroneous charges on their statements that lack their approval. Each financial institution typically requires specific contact information for these disputes, encompassing essential details like the account number, transaction date, and amount in question. Providing clear communication through official customer service channels, such as 1-800 numbers or secure online chat options on websites, facilitates the resolution process. Furthermore, documenting interactions with relevant dates and names can help track the progress of the dispute more effectively.

Comments