Are you feeling overwhelmed by your current financial obligations and in need of a breather? You're not alone; many people find themselves in similar situations and seek ways to manage their payments more effectively. In this article, we'll explore a practical letter template that you can use to request a postponement of your interest payments. So, if you're ready to take charge of your financial journey, read on!

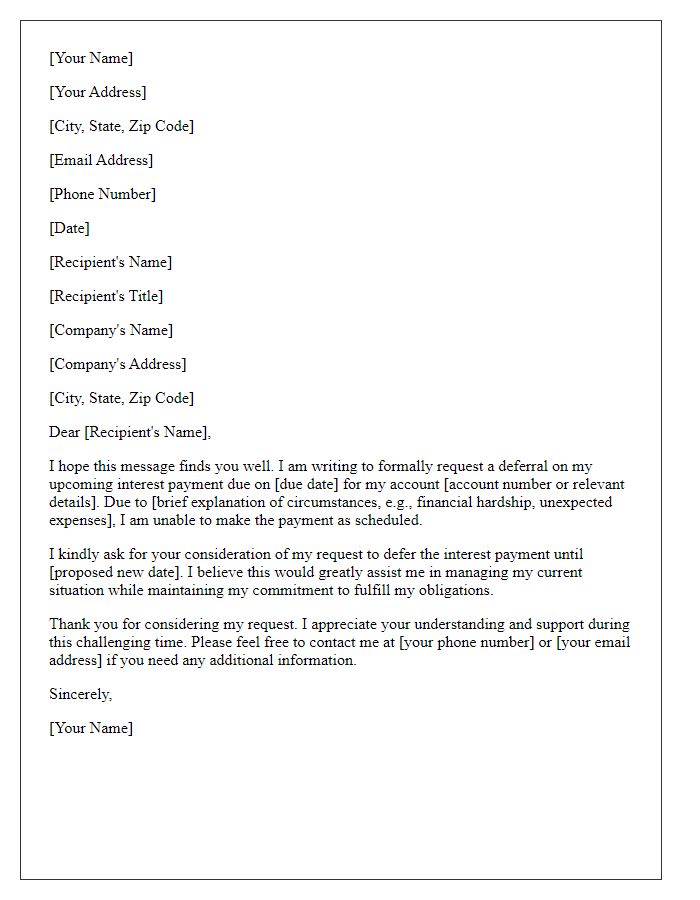

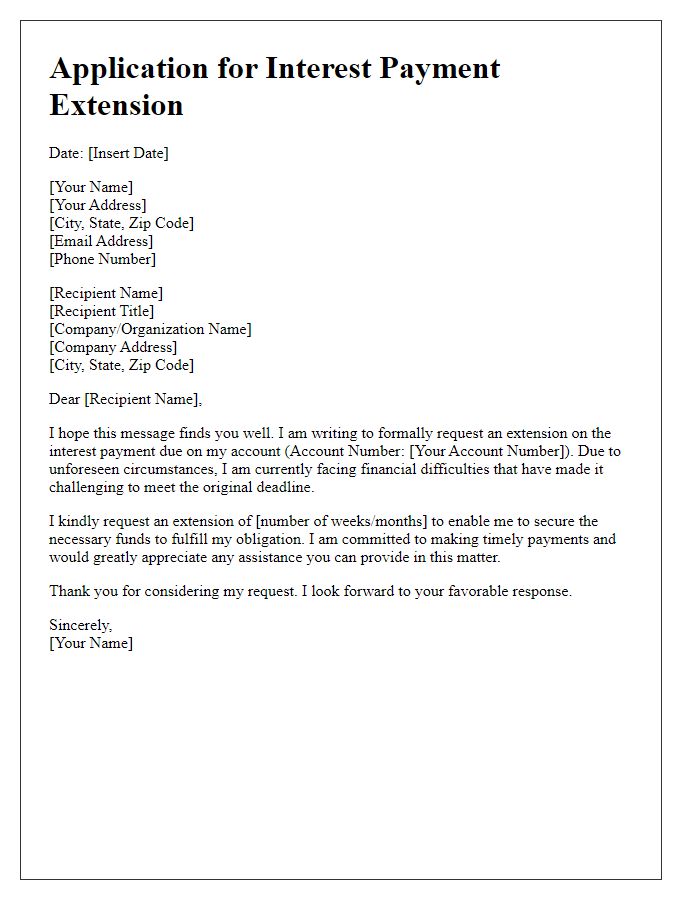

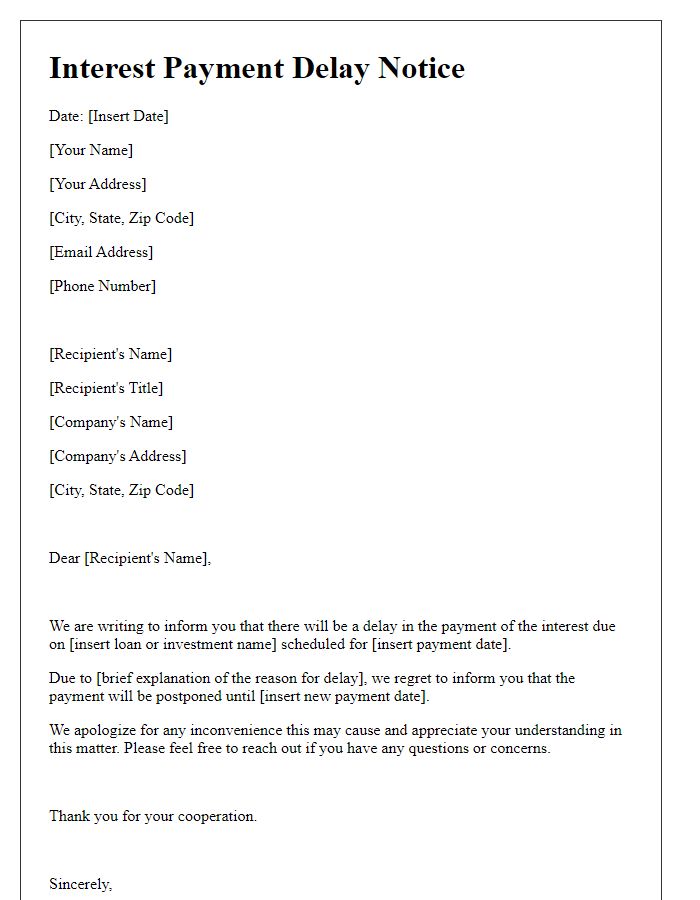

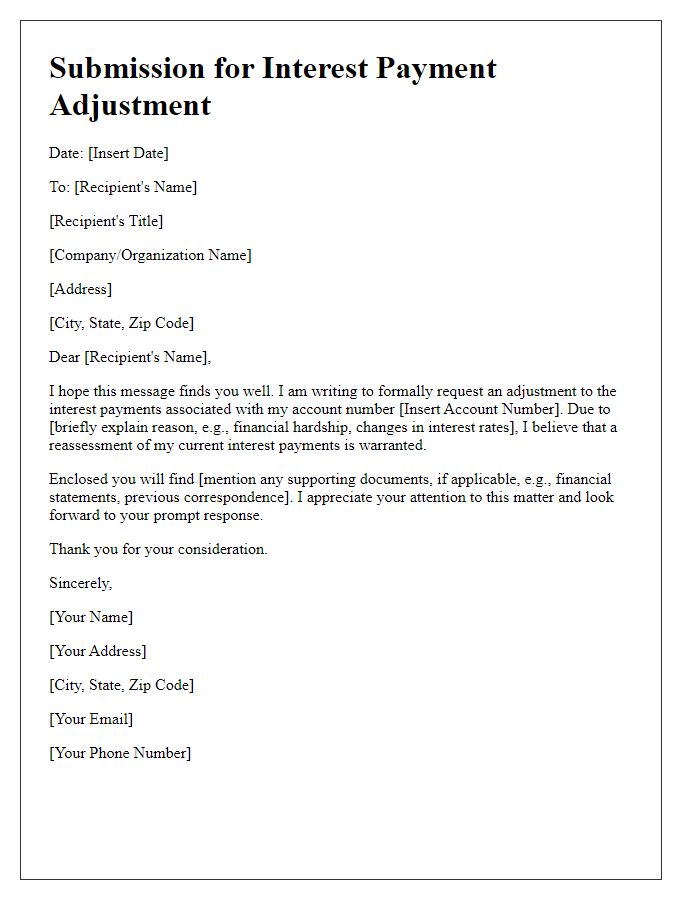

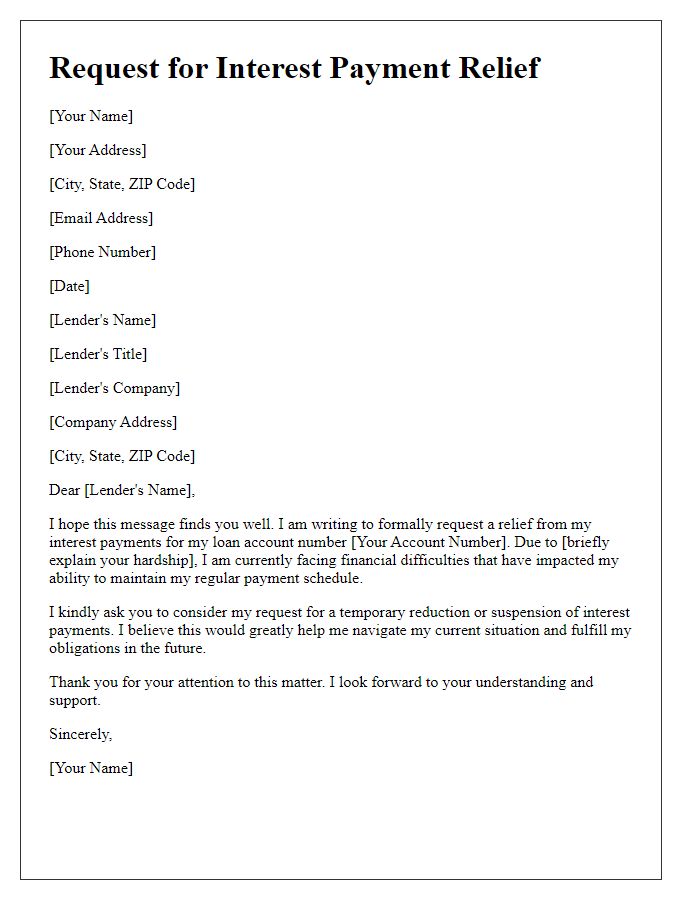

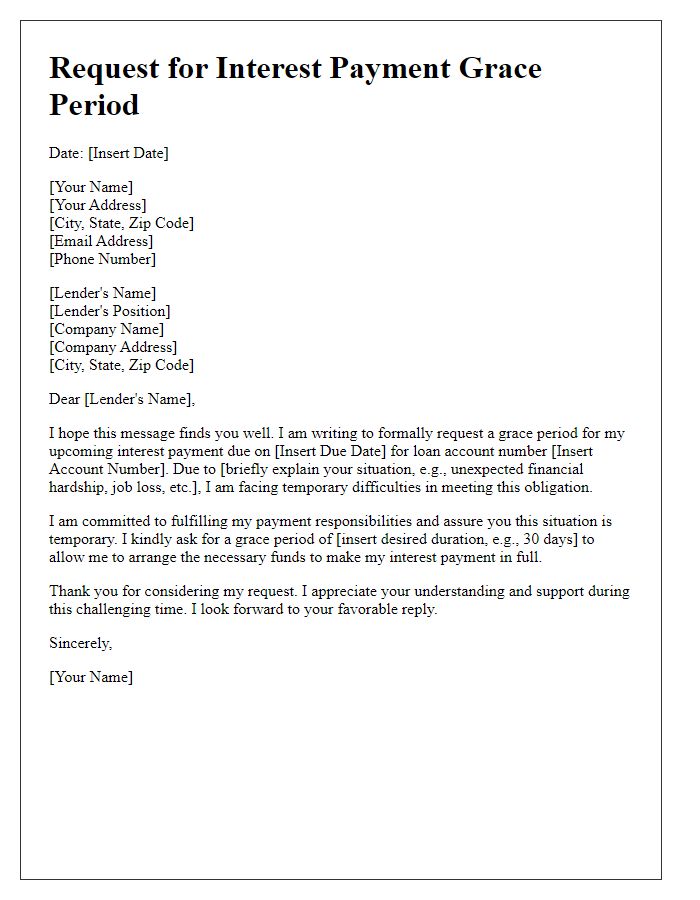

Polite and respectful language

Interest payment postponement requests often arise from financial challenges or unforeseen circumstances. A respectful approach is essential in drafting such requests. Clear communication regarding the specific situation is crucial. It is beneficial to mention any previous positive history with the lender to strengthen the appeal. Clearly stating the desired postponement period (e.g., three months, six months) is necessary for clarity. It's also helpful to express a commitment to fulfill obligations in the future. Ending on a note of appreciation fosters goodwill and sets a positive tone for future interactions.

Clear reason for postponement

Financial difficulties can lead to the postponement of interest payments for loans, mortgages, or other financial obligations. Borrowers may face unexpected circumstances such as job loss, medical emergencies, or economic downturns, affecting their ability to meet deadlines. Institutions often require documentation to support these claims, such as pay stubs, medical bills, or proof of unemployment. Communicating with lenders is essential; this includes providing a detailed account of financial hardships and a proposed timeline for resuming payments. Effective negotiation may result in an agreement for a deferred payment plan, allowing borrowers to manage their finances more effectively during tough times.

Specific new payment date

Delays in interest payments can significantly impact financial stability for borrowers seeking relief. Many lenders allow for postponements under specific conditions. Scheduled dates such as August 15, 2023, or other financial milestones may be proposed as optimal times for resuming payments. This flexibility can assist individuals facing unexpected financial hardships, such as medical emergencies or job loss. It is crucial to communicate with lending institutions to formalize agreements, ensuring understanding of any penalties or fees associated with such delays. Borrowers should keep detailed records of communications for future reference.

Demonstrated financial responsibility

Demonstrated financial responsibility often involves individuals or businesses maintaining a strong repayment history, demonstrating prudent budgeting, and making timely payments. In situations requiring an interest payment postponement, financial institutions may review the borrower's credit history, account statements, and cash flow analysis to assess their reliability. Factors such as consistent payment schedules, mitigating unforeseen expenses, and adherence to loan terms contribute to the borrower's reputation. Engaging in transparent communication regarding temporary financial hardships, such as job loss or medical emergencies, can also illustrate commitment to fulfilling obligations while seeking a temporary solution.

Contact information for follow-up

Seeking interest payment postponement requires clear communication. Include contact information, such as a telephone number and email address, to facilitate follow-up discussions. Ensure the details clearly specify the preferred method of correspondence. Providing a timeline for response can enhance urgency. Clearly state the relevant loan or account number associated with the postponement request. This information will streamline the review process and assist in identifying the correct account for adjustments.

Comments