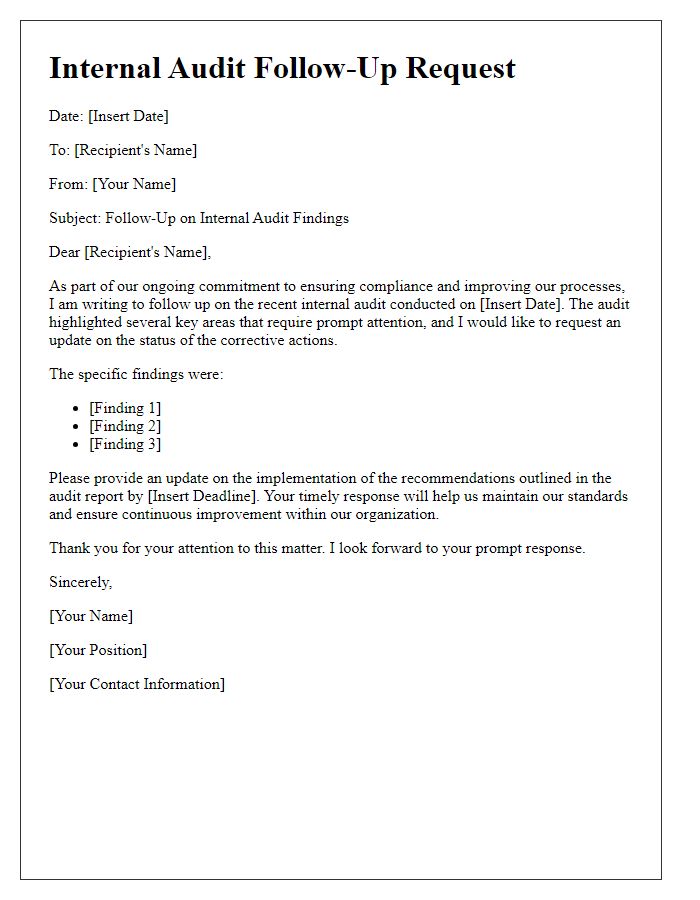

In the world of internal audits, effective communication is key to achieving transparency and improvement. One essential tool in this process is a well-crafted follow-up letter, which not only reinforces findings but also encourages collaboration among teams. By addressing specific concerns and outlining actionable steps, you can foster a proactive approach to audits and ensure that everyone is on the same page. Curious about how to structure your own internal audit follow-up letter? Let's dive deeper!

Date and Reference Number

An internal audit follow-up report identifies areas of improvement within organizational processes. Dated reports are essential for tracking progress over time, with reference numbers enabling easy retrieval. In organizations, documentation of audit findings is crucial for maintaining compliance. Follow-up actions regarding noted deficiencies often assigned to specific departments, ensure accountability and enhance operational efficiency. Documentation remains critical for regulatory requirements and aids in future audits, contributing to overall organizational transparency.

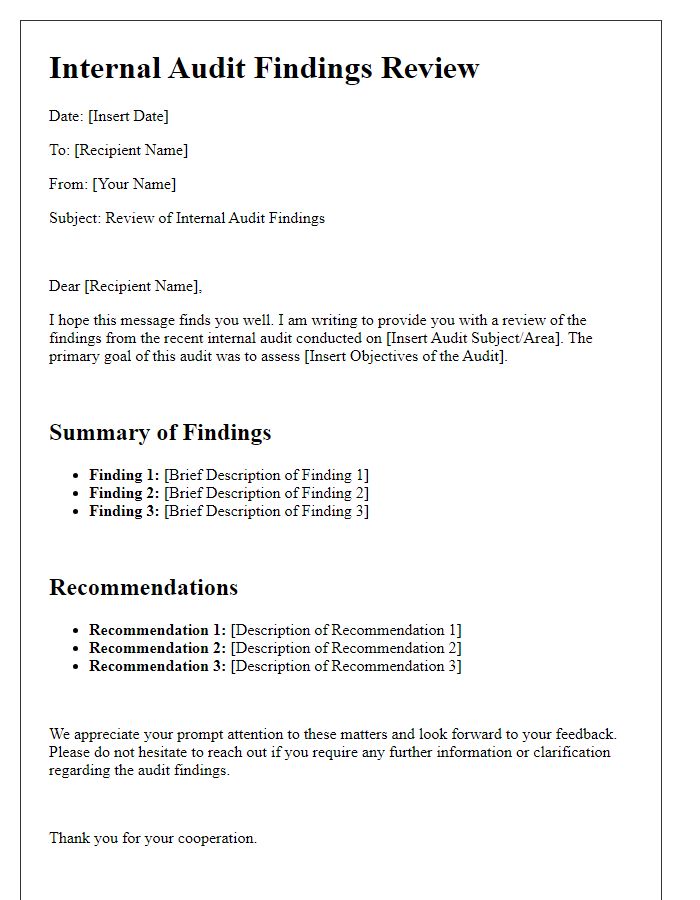

Audit Findings and Observations

Internal audits often reveal critical findings and observations that require prompt attention. An internal audit report detailing these findings can include sections like discrepancies in financial records, operational inefficiencies, or compliance issues with regulations such as Sarbanes-Oxley (SOX). Identified discrepancies in financial processes, such as variances exceeding 5% in monthly budget reports, demand corrective action. Observations may also highlight inadequate documentation practices, particularly in departments handling sensitive data, increasing risks of data breaches. Additionally, recommendations for improvement, such as implementing new financial software or conducting staff training sessions, may be included to enhance overall compliance and efficiency. Timely follow-up on these findings is essential for maintaining organizational integrity and ensuring adherence to industry standards.

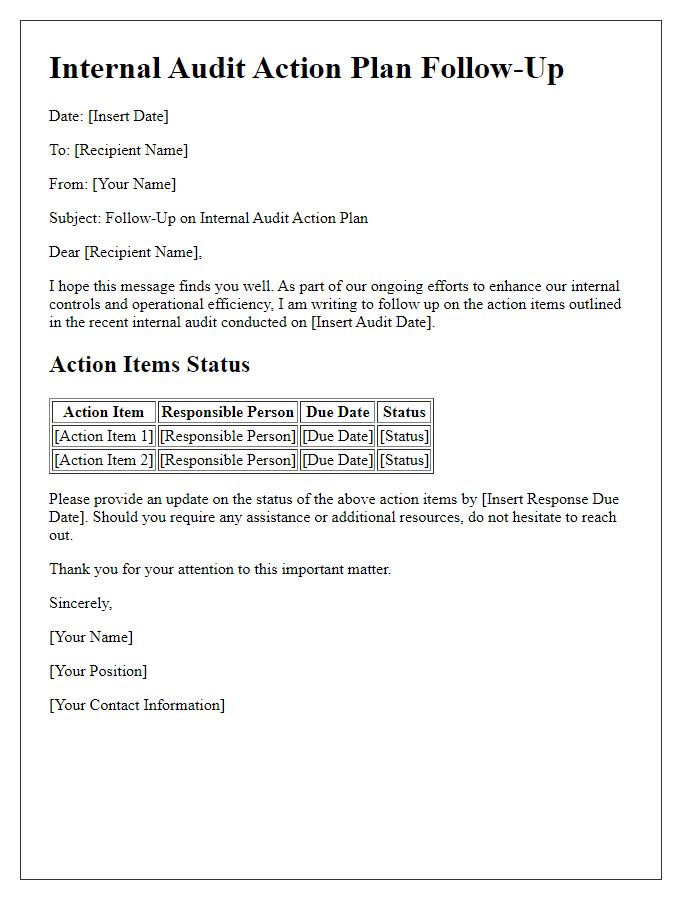

Action Items and Responsibilities

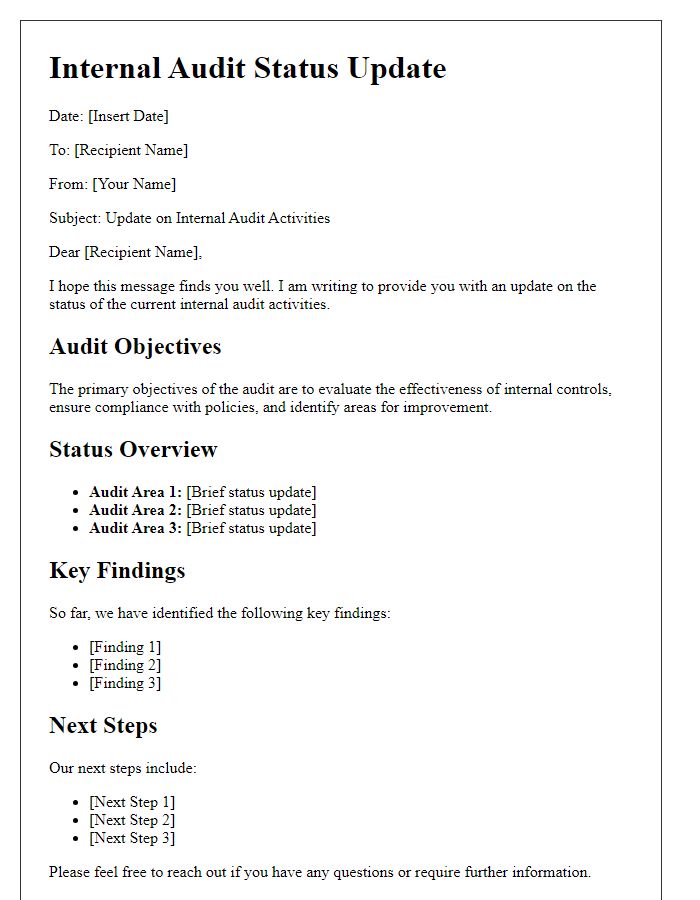

Internal audit follow-up reports are crucial for tracking progress on identified action items and assigning responsibilities. Timelines usually range from immediate responses to long-term resolutions. The action items may include policy revisions, training programs, or process improvements. Responsibilities typically fall on department heads, compliance officers, and individual team members, each required to update on progress during quarterly meetings. Regular follow-ups enhance accountability, ensuring issues such as financial discrepancies or operational inefficiencies are addressed effectively to maintain organizational integrity.

Deadline for Progress Updates

The internal audit follow-up process requires timely updates from various departments to ensure compliance and effective implementation of recommendations. Each department must submit progress updates concerning the audit findings by the specified deadline of March 31, 2024. This systematic approach is essential for maintaining transparency and accountability within the organization. Departments must address priority items identified in the internal audit report dated January 15, 2024, particularly those impacting operational efficiency and risk management strategies. Ensuring that corrective actions are documented and measurable will facilitate the upcoming review meeting scheduled for April 10, 2024, at Headquarters Conference Room A. Regular communication is vital for meeting these objectives and fostering a culture of continuous improvement.

Contact Information for Further Queries

Internal audits serve to assess compliance and operational efficiency in organizations. Contact information for further queries typically includes essential details such as the auditor's name, position, email address, and telephone number. The auditor's title (e.g., Senior Internal Auditor) provides insight into their expertise level, while a direct phone line (e.g., +1-555-0123) facilitates quick communication. Including organizational details, like the company's headquarters address (e.g., 123 Corporate Blvd, Suite 100, New York, NY), strengthens transparency and trust. A designated timeframe for responses (e.g., within 48 hours) ensures timely follow-up.

Comments