Are you looking to craft the perfect management representation letter? This essential document plays a crucial role in ensuring transparency and accountability between management and auditors. In this article, we'll guide you through the key components of a compelling management representation letter, making the process not only simple but also effective. So, grab a cup of coffee and join us as we explore the ins and outs of this important communication tool!

Introduction and Purpose

Management representation letters serve as formal documents that request assertions from management regarding the accuracy and completeness of financial statements or other disclosures. These letters typically arise during audits, presenting a formal request to management for confirmation of various elements within the financial reporting process, enhancing credibility. They serve to clarify management's responsibility in ensuring that financial statements reflect a true and fair view, adhering to accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). The purpose is to gather management's assurances about the presence of necessary accounting records, the compliance with applicable statutes, and the absence of undisclosed liabilities, thus providing auditors with the confidence and evidence needed for their evaluation of financial statements.

Details of Required Representations

A management representation request typically involves the communication of specific information and assurances to auditors during the financial audit process. Key entities within the organization, such as the Chief Financial Officer or the Finance Director, are expected to provide detailed insights regarding the financial statements of the company. Representations may cover topics such as compliance with laws and regulations, the accuracy of financial records, ownership of assets, and the completeness of liabilities. Various dates are crucial, such as the fiscal year-end date (e.g., December 31, 2023), when the financial statements are prepared and reviewed. It is important for management to clarify that all material transactions have been disclosed and accounted for in accordance with applicable accounting standards, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Deadline for Response

A management representation request is crucial for financial audits, ensuring accurate representations of a company's financial standing. The deadline for response typically aligns with the audit timeline, often set for two weeks prior to the audit completion date. This timeline allows auditors adequate time to analyze management's assertions regarding financial statements and internal controls. Companies must ensure timely compliance to maintain audit integrity, with any delays potentially impacting the overall audit schedule and credibility. Clear communication and adherence to this deadline is essential for efficient workflow and legal compliance, as stipulated under various regulatory frameworks like GAAP or IFRS.

Contact Information for Queries

Management representation requests typically require clear communication to facilitate the resolution of queries efficiently. Organizations should provide comprehensive contact information that includes the name of the representative, their official title, and the department they belong to, such as Accounting or Compliance. This should be accompanied by direct contact details, including a professional email address (e.g., name@company.com) and a phone number (e.g., +1 234 567 8900) with the appropriate country code. Additionally, office hours and response time expectations should be outlined to manage the inquiry process effectively. This structured approach ensures that all stakeholders have access to essential information for inquiries related to representation during audits or financial reviews.

Assurance of Confidentiality

Management representation requests are essential in auditing processes, often requiring assurance of confidentiality. In such contexts, key entities include auditing firms like Deloitte, PwC, or KPMG, which may issue representations to client management. A crucial aspect involves detailing limitations on information sharing, stipulating that sensitive data (pertaining to finance or strategic decisions) remains restricted to authorized personnel only. Specific guidelines may reference regulations such as GDPR (General Data Protection Regulation) or CCPA (California Consumer Privacy Act), which emphasize the protection of personal and corporate information. Furthermore, a clear outline of the scope of the audit (e.g., for fiscal year 2022) can help establish trust and clarity about the confidentiality obligations. Properly safeguarding proprietary knowledge enhances the integrity of the organizational review, fostering a secure environment for dialogue between management and auditing bodies.

Letter Template For Management Representation Request Samples

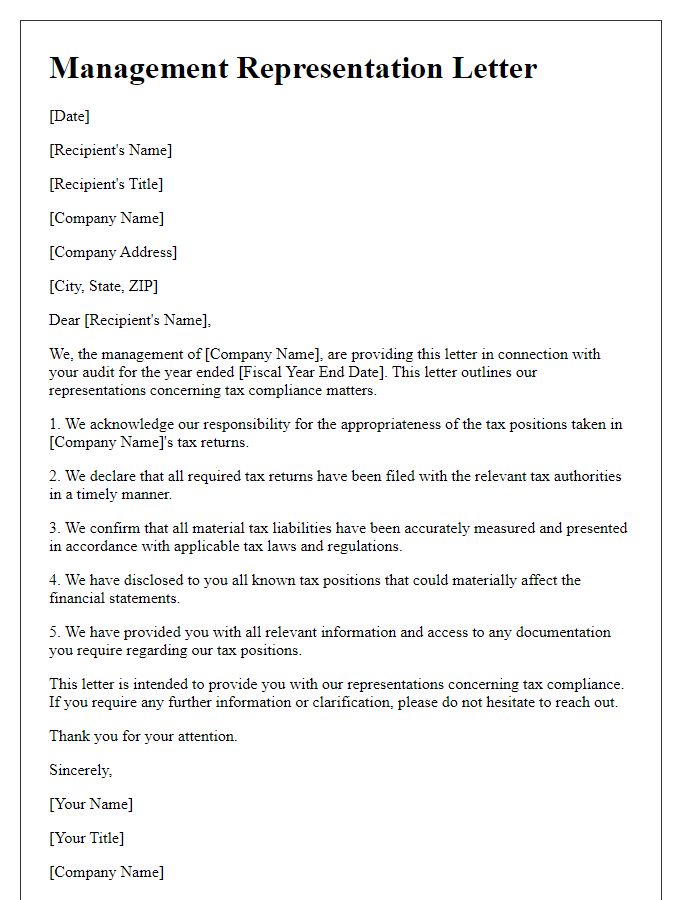

Letter template of management representation regarding financial statements

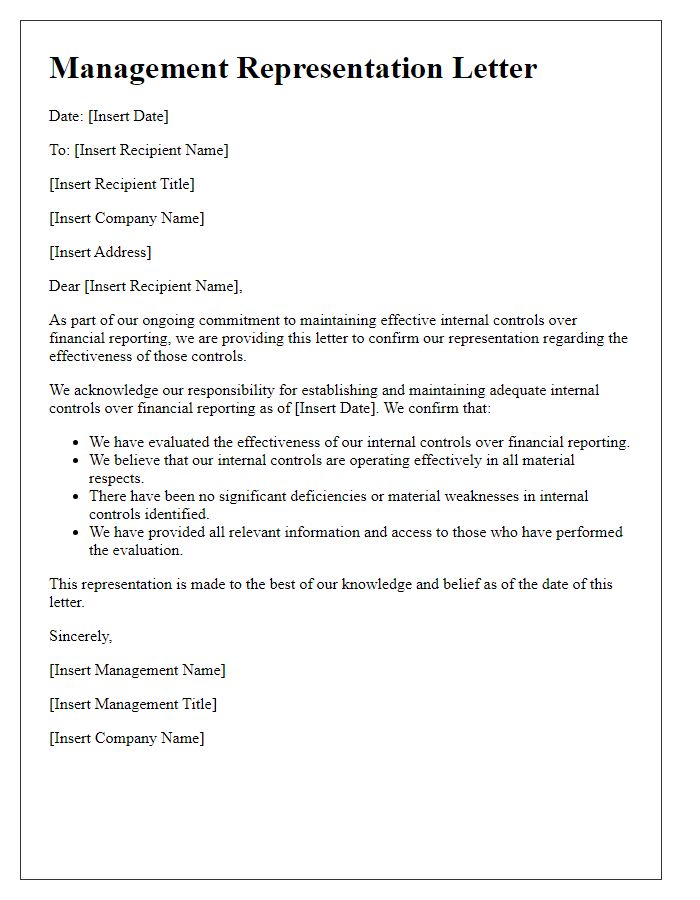

Letter template of management representation for internal compliance reviews

Letter template of management representation for external audit engagement

Letter template of management representation related to corporate governance

Letter template of management representation for due diligence processes

Comments