Are you feeling overwhelmed by the prospect of negotiating audit fees with your provider? It's a common concern for many businesses looking to balance quality service with budget constraints. In this article, we'll explore effective strategies and best practices to approach your audit firm for a fair fee negotiation. So, let's dive in and empower you to secure the audit services you need at a price you can afford!

Clarity in Scope of Work

Negotiating audit fees requires a clear understanding of the scope of work involved in the audit process, including the specific activities and deliverables expected. The scope of work typically encompasses various areas such as financial statement examination, compliance testing, and internal control assessments. For example, during an audit, the auditor might review transactional documents, perform risk assessments, and evaluate the adequacy of financial reporting within Generally Accepted Accounting Principles (GAAP). Detailed breakdowns of staff involvement, including senior auditors and assistants, can impact the overall labor costs. Additionally, geographical location can play a significant role in determining fees, with urban areas generally incurring higher professional service rates. Understanding the nuances of the audit requirements will provide a solid foundation for negotiating fair and reasonable audit fees.

Benchmarking Against Industry Standards

Negotiating audit fees effectively requires a comprehensive understanding of industry standards and benchmarks. Organizations, such as the American Institute of CPAs (AICPA), provide guidelines regarding average audit fees, which can range significantly based on organization size, complexity, and geographic location. For instance, small businesses may incur fees between $5,000 and $15,000, while large corporations could face fees exceeding $100,000. Engaging an auditing firm, like Deloitte or PwC, may influence costs due to their reputation and service depth. Analyzing the fee structures of peer companies within the same sector can also offer insights into reasonable negotiations, fostering a foundation for equitable discussions. Additionally, understanding the scope of services included--such as compliance reviews, tax services, or advisory roles--will help clarify and justify the proposed audit fees. Negotiating with clear benchmarks enhances credibility and can lead to cost-effective arrangements for both parties.

Historical Audit Fees and Adjustments

Historical audit fees serve as a benchmark in negotiating future audit engagements, reflecting the financial landscape of previous fiscal years. In the accounting industry, fees typically fluctuate based on service complexity and client requirements. For instance, a comprehensive audit performed in 2022 might have incurred fees totaling $50,000, while adjustments made for additional services, like compliance consultancy, could have led to an increase of approximately 15%. Understanding these past expenditures provides context for current negotiations, wherein clients may seek to align fee structures with anticipated budget constraints. Factors influencing adjustments, such as regulatory changes or organizational growth, merit consideration in discussions with audit firms, ensuring equitable agreements that accommodate both parties' expectations.

Value-Added Services and Expertise

When negotiating audit fees, emphasizing value-added services and expertise is crucial. Audit firms often provide specialized knowledge in areas such as regulatory compliance, risk management, and financial reporting. For instance, firms with industry-specific experience can offer insights that enhance operational efficiency and mitigate risks. Moreover, additional services such as fraud detection, internal controls assessment, and data analytics can significantly benefit clients. Highlighting the qualifications of the audit team, including certifications like CPA or ACCA, and their prolonged experience can reinforce trust in the firm's capabilities. Ultimately, demonstrating how these services contribute to cost savings and improved operational effectiveness can justify the fee negotiation process.

Flexible Payment Terms

Audit fees can significantly impact a company's financial health, particularly for small and medium-sized businesses. Negotiating flexible payment terms can alleviate immediate financial pressure while ensuring compliance with accounting standards such as GAAP (Generally Accepted Accounting Principles). Terms like staggered payments (spreading fees over several months) or discounts for early payment (often up to 5% of total fees) can be considered. Additionally, establishing clear timelines, like 30 days after audit completion for the first installment, enhances budgeting accuracy. Engaging with reputable audit firms, such as Deloitte or PwC, known for their client collaboration, may yield favorable arrangements that suit the specific financial capabilities of the organization. Addressing these terms upfront fosters a transparent relationship, ultimately paving the way for more effective audit practices and financial stability.

Letter Template For Audit Fee Negotiation Samples

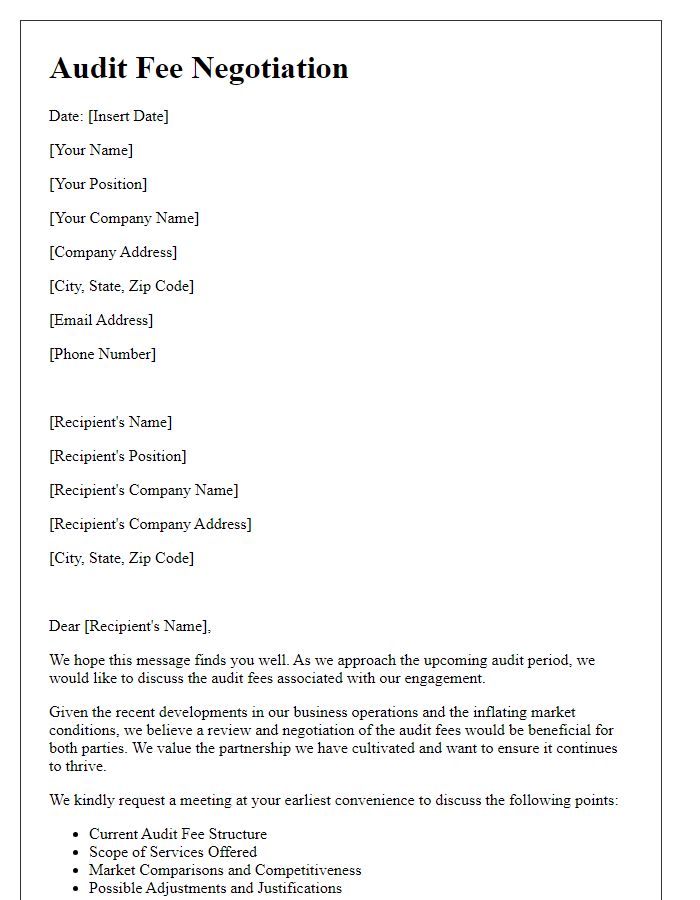

Letter template of audit fee negotiation for multinational corporations.

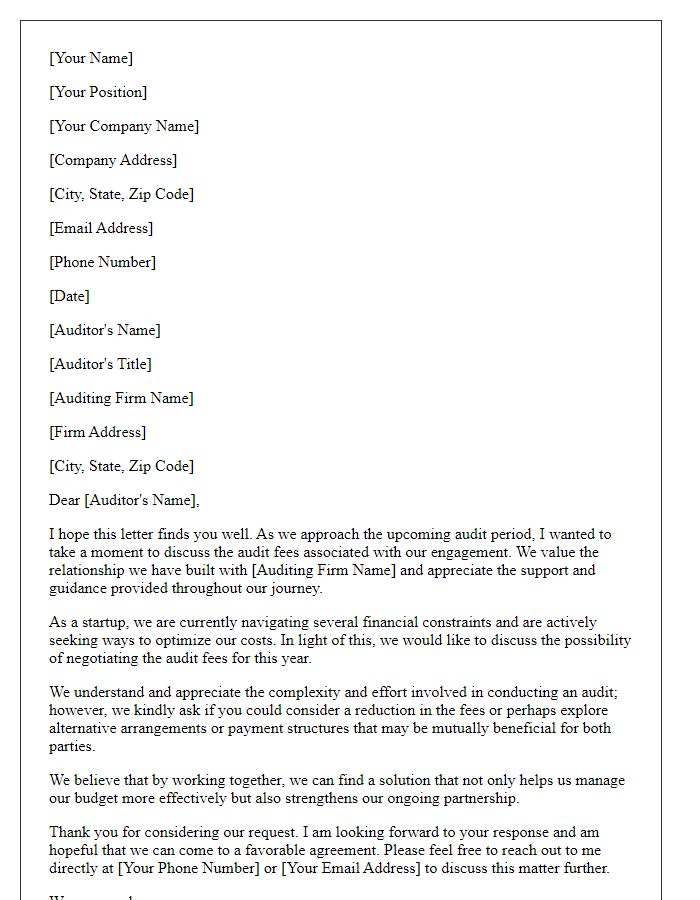

Letter template of audit fee negotiation for startups seeking cost reduction.

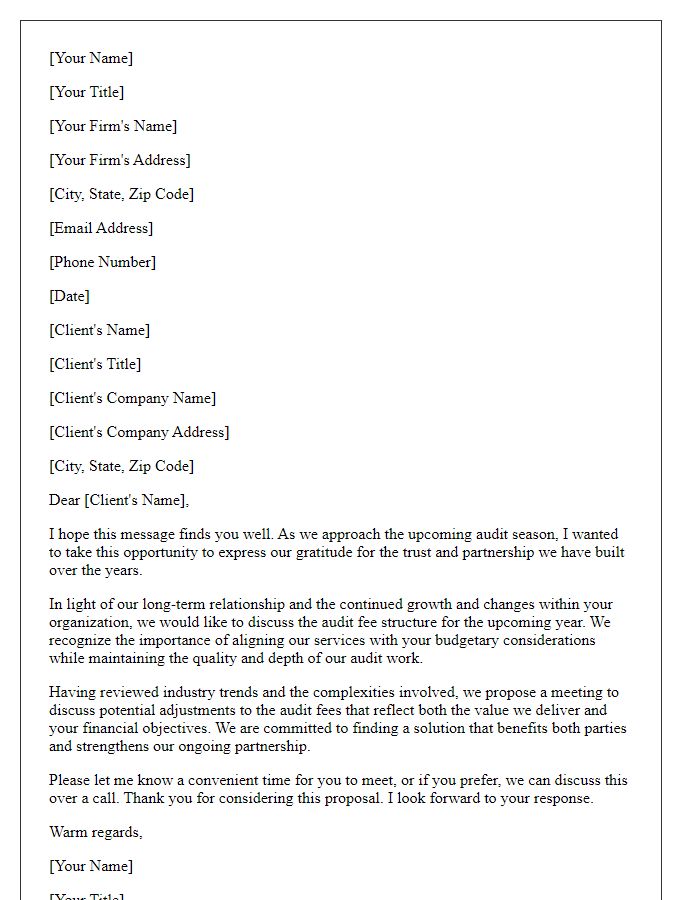

Letter template of audit fee negotiation for long-term client relationship.

Comments