Are you looking to present your audit results in a clear and effective manner? Crafting a well-structured letter can make all the difference in communicating your findings and recommendations. Not only does it provide a formal approach, but it also ensures that your audience understands the key points of your audit. Join us as we explore some essential tips and a template to help you create a compelling audit result presentation!

Executive Summary

The Executive Summary of the audit results provides a high-level overview of the financial health and compliance standing of the organization. The audit, conducted over a three-month period from January to March 2023, examined critical areas such as revenue recognition, expense management, and internal controls in accordance with the Generally Accepted Accounting Principles (GAAP). Key findings include a 15% increase in revenue attributed to strategic marketing initiatives, although operational expenses also rose by 10% due to rising inflation rates affecting suppliers. Notable risks were identified in the inventory management process, where discrepancies in stock levels were recorded, suggesting the need for enhanced tracking systems. Recommendations involve implementing regular training programs for staff on compliance standards and adopting advanced software solutions for real-time financial monitoring. The complete report will be distributed to stakeholders by April 15, 2023, to facilitate informed decision-making and strategic planning.

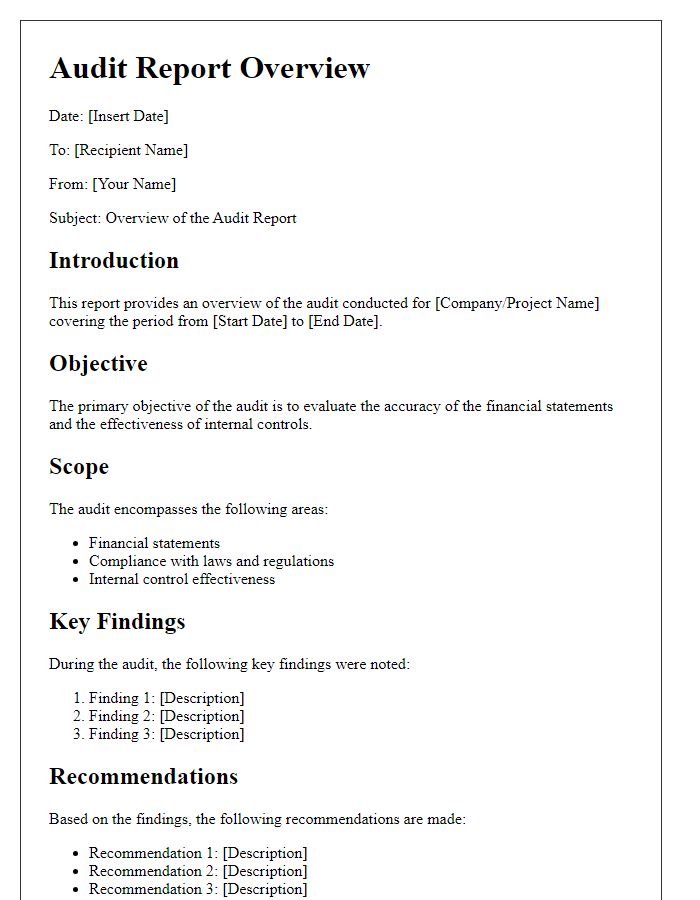

Objective and Scope of Audit

The objective of the audit was to assess the compliance and effectiveness of financial controls within the organization, specifically focusing on operational efficiency and adherence to regulatory standards. The scope included a comprehensive review of financial statements from the fiscal year 2022, analysis of internal control processes, and evaluation of risk management strategies employed by the finance department. Key areas of examination encompassed the accuracy of revenue recognition, expenditure validation, and the integrity of financial reporting mechanisms. The audit was conducted within the headquarters located in New York City, involving reviews of subsidiary financial records from various locations, ensuring a holistic approach to the organization's financial health.

Methodology and Approach

The methodology employed in this audit process followed a structured framework that included several key phases designed to ensure comprehensive analysis and accurate results. Initial planning involved defining the audit objectives and scope, particularly focusing on financial discrepancies within the fiscal year 2022 for XYZ Corporation. Risk assessment tools identified high-risk areas such as revenue recognition and inventory valuation, guiding our examination. Data collection utilized both qualitative methods, such as interviews with department heads, and quantitative techniques, like sampling from financial statements amounting to $10 million in transactions. Analytical procedures included variance analysis and trend assessments to uncover anomalies. Finally, the evaluation of internal controls involved a systematic review of processes in compliance with Generally Accepted Accounting Principles (GAAP). Results presented illustrate key findings, conclusions, and actionable recommendations to enhance operational efficiency and financial integrity.

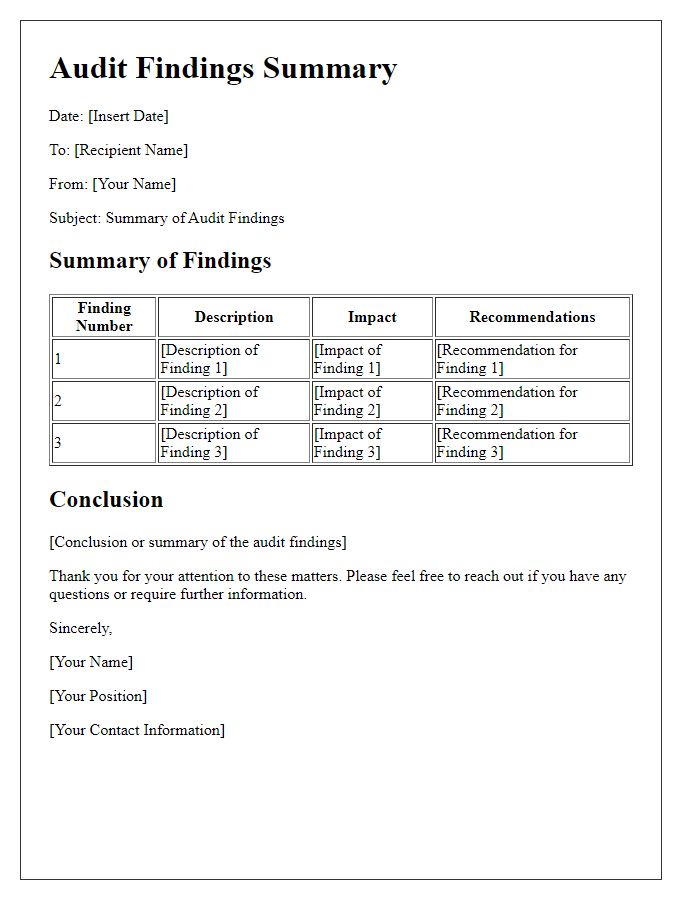

Key Findings and Recommendations

The audit results revealed significant findings concerning financial compliance within ABC Corporation, highlighting discrepancies in expense reporting, such as missing receipts for transactions exceeding $500, which accounted for 15% of total expenses in Q3 2023. Additionally, internal controls showed weaknesses, particularly in inventory management processes at the warehouse located in Springfield, where 10% of stock was unaccounted for during physical counts. Recommendations include implementing a digital expense tracking system to ensure all transactions are documented accurately and regularly conducting inventory audits every quarter to mitigate discrepancies and enhance accountability. Moreover, staff training sessions focused on compliance and documentation practices can improve overall financial integrity.

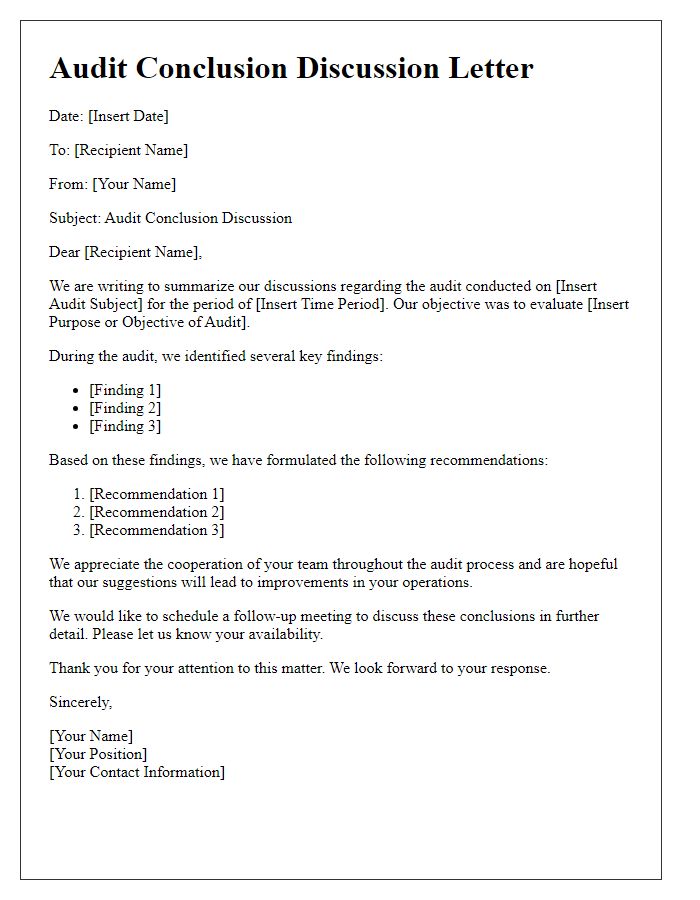

Conclusion and Action Plan

The audit findings at XYZ Corporation reveal significant areas for improvement regarding compliance with financial regulations. Key discrepancies were identified, including a 15% overstatement of revenue in Q2 2023 due to improper documentation practices. The action plan outlines immediate steps: first, implement a robust training program for staff on accurate financial reporting by December 2023. Second, establish a quarterly review process to ensure adherence to compliance standards, beginning in January 2024. Lastly, invest in a new accounting software solution designed to enhance data accuracy and streamline operations, scheduled for deployment in March 2024. These measures aim to rectify current deficiencies and foster a culture of accountability within the organization.

Comments