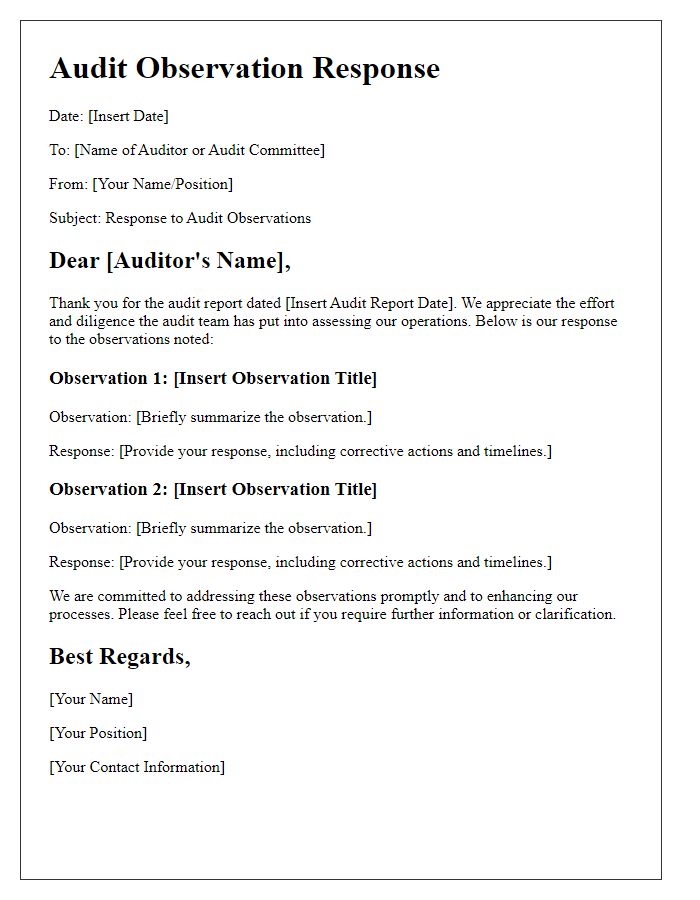

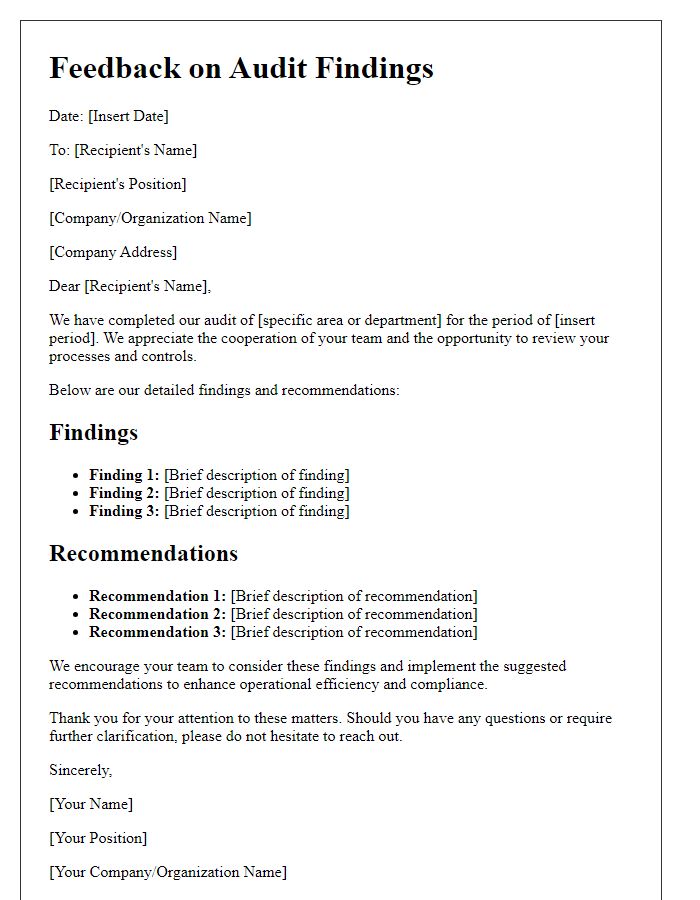

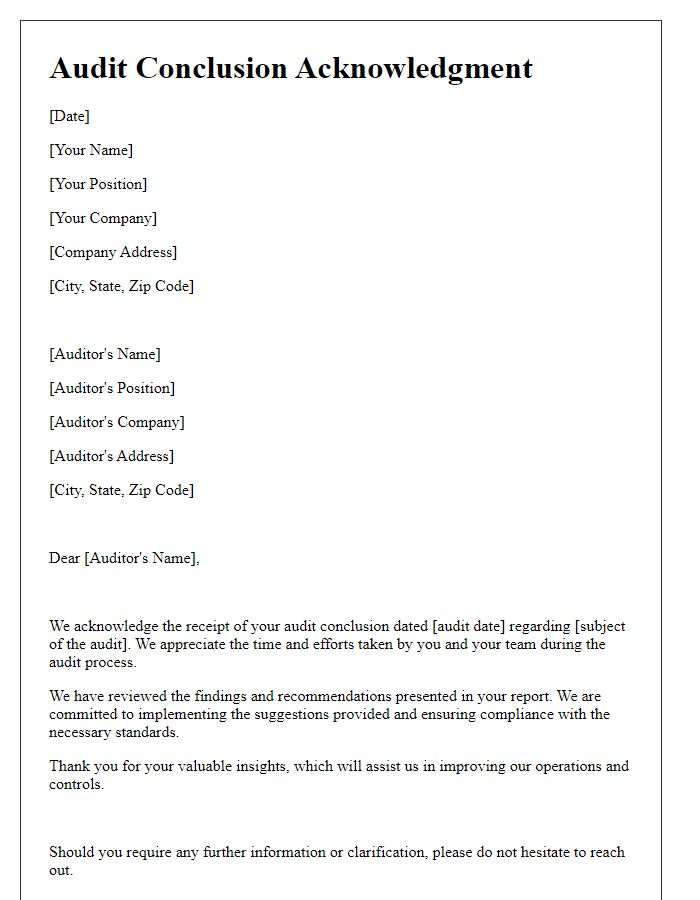

When it comes to providing feedback on audit observations, crafting a well-structured letter is essential for clarity and professionalism. Whether you're acknowledging findings or outlining corrective actions, your tone should be both conversational and constructive. This not only fosters an open dialogue but also ensures that the recipient feels valued and supported in their efforts to improve. Curious to learn more about effective audit communication? Let's delve deeper into the key elements of a impactful feedback letter!

Clear and concise language

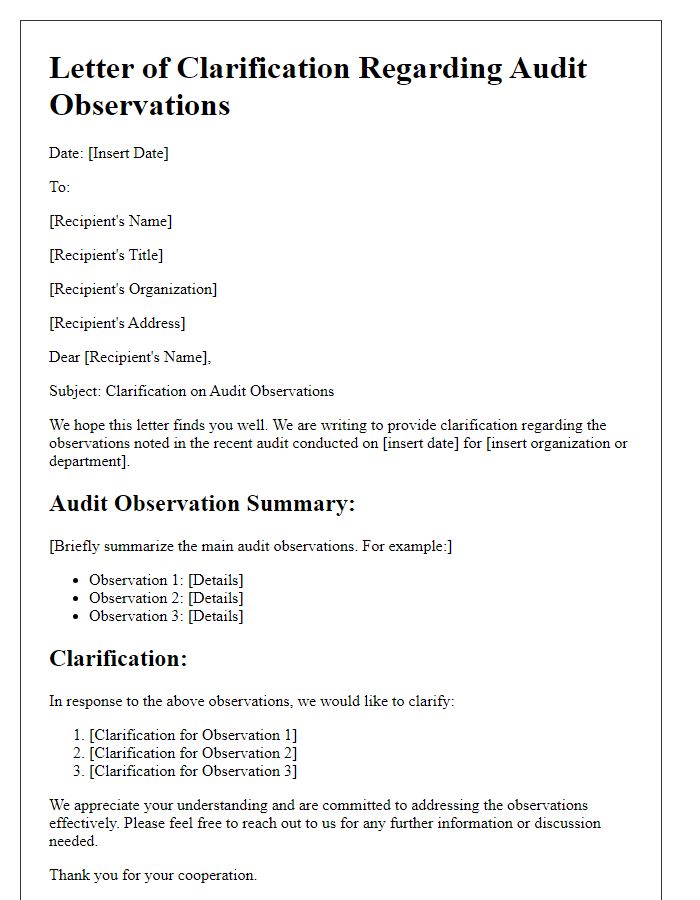

Audit observations often reveal key insights regarding organizational practices, highlighting areas for improvement. Detailed feedback, provided in a structured format, can greatly enhance understanding and facilitate actionable steps. Observations should include direct references to specific processes, policies, or compliance standards. It's essential to emphasize critical findings, ensuring clarity in identifying discrepancies or inefficiencies. Additionally, supplementary data such as numerical metrics or relevant industry benchmarks can offer context and weight to the observations, guiding the organization towards effective resolution in alignment with best practices.

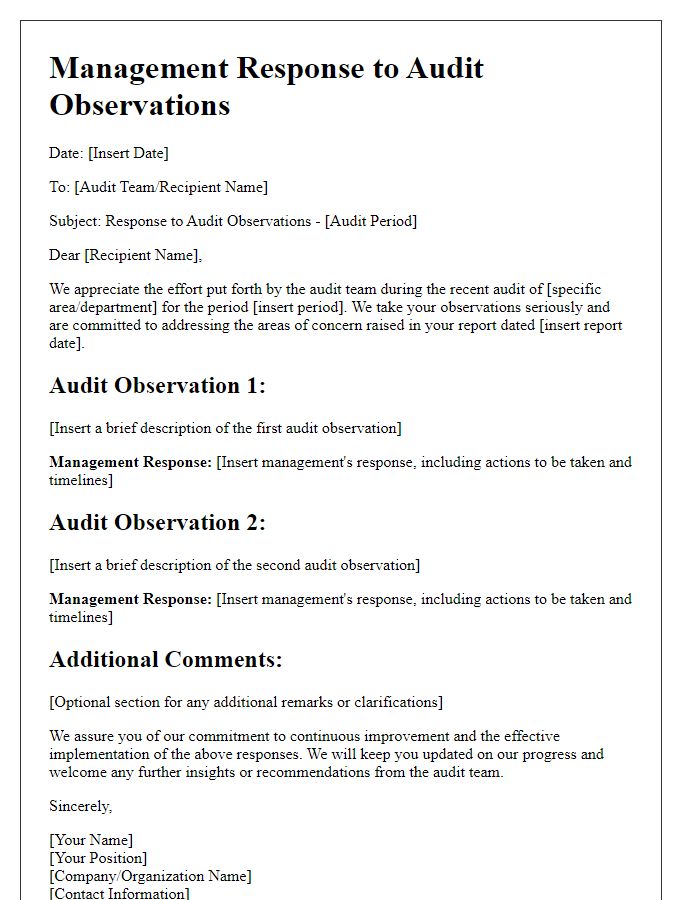

Structured format

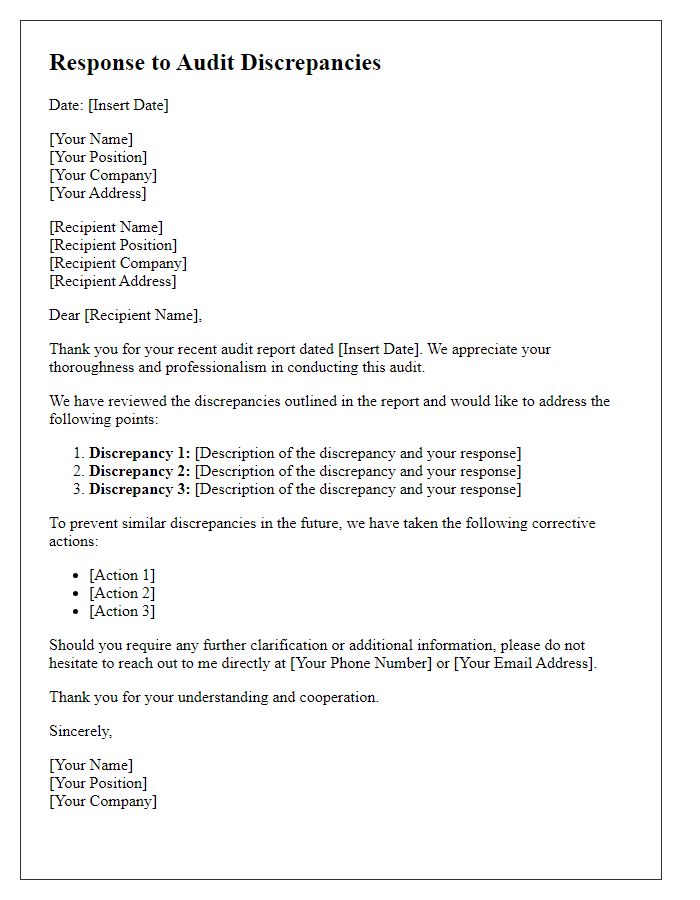

Audit observations often highlight discrepancies or areas needing improvement within an organization. A structured feedback format for audit observations should include the following components: 1. **Observation Description**: Clearly outline the specific observation made during the audit. For instance, "In the 2022 financial report for XYZ Corporation, discrepancies were noted in the inventory valuation process." 2. **Criteria**: Reference the relevant policies, regulations, or standards that were not met. "According to GAAP (Generally Accepted Accounting Principles), inventory must be recorded at the lower of cost or market value." 3. **Cause**: Analyze the potential reasons behind the observation. "The discrepancy occurred due to a lack of consistent valuation methods applied across various inventory categories." 4. **Effect**: Describe the potential impact or consequence of the observation. "Inaccurate inventory valuation can lead to misleading financial statements and affect decision-making processes impacting investors and stakeholders." 5. **Recommendation**: Provide actionable suggestions for addressing the observation. "Implement standardized inventory valuation practices and conduct regular training for accounting staff to ensure compliance with established policies." 6. **Management Response**: Space for management to provide feedback or actions taken regarding the observation. "Management acknowledges the observation and plans to revise the inventory procedures by Q1 2024." 7. **Follow-Up**: Indicate the timeline for follow-up on the observation. "A follow-up audit will be conducted in Q2 2024 to assess the implementation of recommended actions." This structured feedback format helps enhance clarity and effectiveness when communicating audit findings.

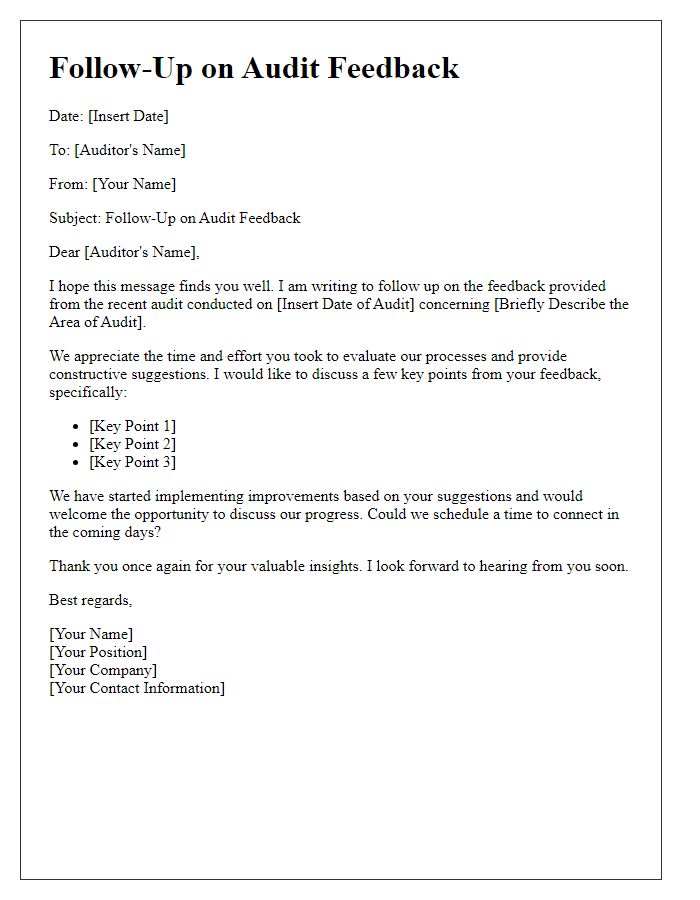

Positive and polite tone

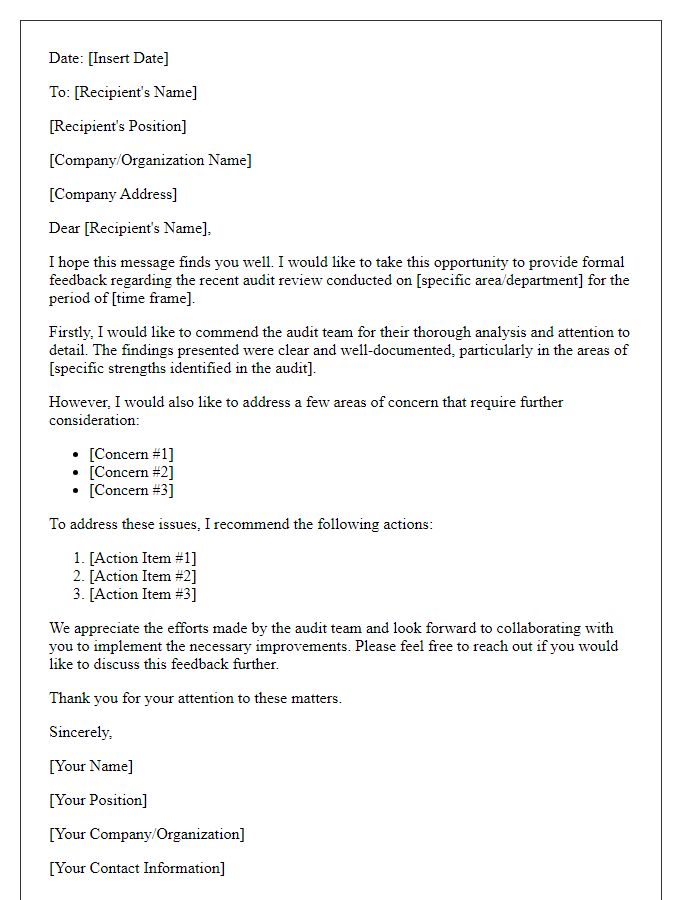

A well-organized audit observation can highlight positive aspects and provide constructive feedback for growth. The audit process at XYZ Corporation, conducted on October 15, 2023, revealed commendable adherence to operational protocols, reflecting management's commitment to quality assurance practices. The financial records were meticulously maintained, with transaction logs from the previous quarter showing a 98% accuracy rate. Furthermore, employee engagement during the audit showcased a proactive approach to compliance, noted especially in the procurement department. Precious metrics and timeline adherence illustrate a solid foundation for continuous improvement. Continued focus on these effective practices will further enhance the overall efficiency and effectiveness of operations moving forward.

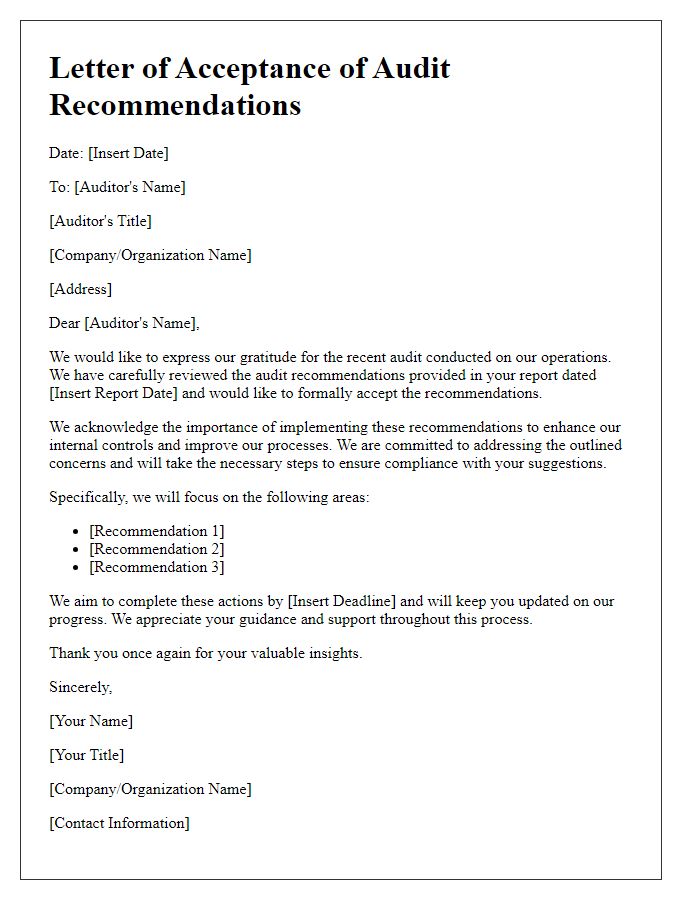

Specific and actionable recommendations

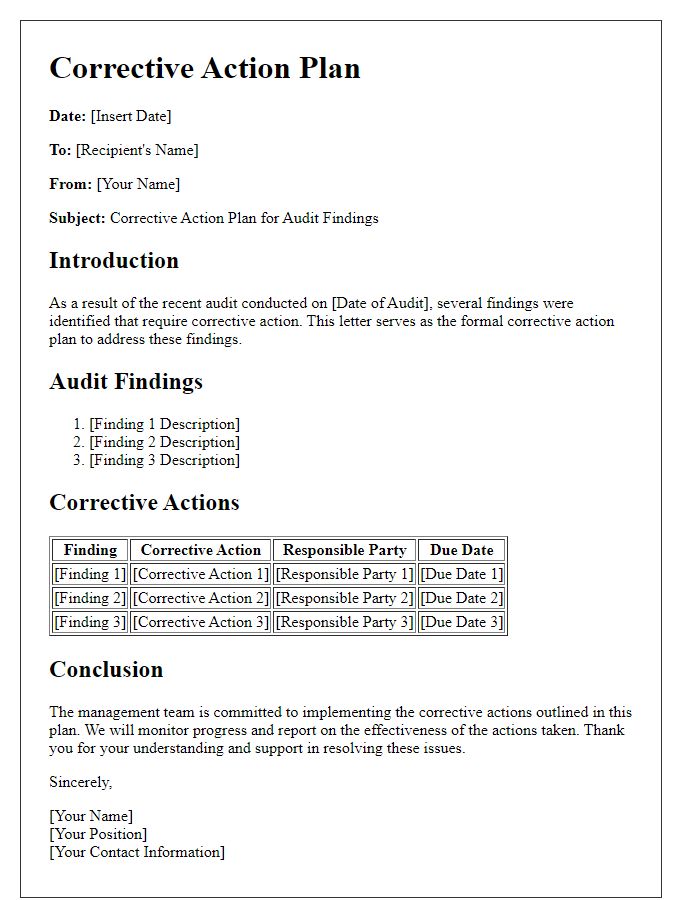

In the audit observation process, providing specific and actionable recommendations is crucial for improving organizational practices and ensuring compliance. Clear recommendations enable stakeholders to understand the necessary steps to enhance operational efficiency and address identified deficiencies effectively. For instance, when an audit reveals discrepancies in financial records, suggesting the implementation of a monthly reconciliation process can be a practical solution. Further, recommending the adoption of specific software tools, like QuickBooks (widely used for financial management), can streamline record-keeping and reduce human error. Training staff on compliance regulations (e.g., Sarbanes-Oxley Act for publicly traded companies) ensures adherence to legal standards and mitigates risks. Setting measurable goals, such as reducing discrepancies by 20% within the next quarter, provides clear benchmarks for progress evaluation. Regular follow-up evaluations can help in reassessing the effectiveness of implemented strategies, ensuring continuous improvement in the audited areas.

Evidence-based observations

Audit observations often reveal critical insights into organizational practices. For instance, discrepancies in financial records, such as mismatched figures or unrecorded transactions, may indicate potential areas for improvement. Evidence-based observations, derived from systematic analysis of documents like financial statements and internal controls, highlight inconsistencies within the organization's accounting procedures. In thorough audits, auditors often examine compliance with regulatory standards, identifying lapses that could expose the organization to risks, including legal penalties. Observations can also focus on operational efficiencies, where workflows in departments, such as procurement, reveal bottlenecks, impacting overall productivity. The ultimate goal of presenting these evidence-based observations is to foster transparency and drive continuous improvement within the institution's processes and governance.

Comments