In today's ever-evolving business landscape, maintaining transparency and accountability is crucial for success. A third-party audit can provide invaluable insights, ensuring your organization meets necessary standards while boosting stakeholder confidence. This letter template is designed to streamline your communication with auditors, ensuring that all pertinent information is clearly presented. Dive into our guidelines to craft a compelling audit correspondence that sets the tone for a fruitful audit experience!

Clear Purpose Statement

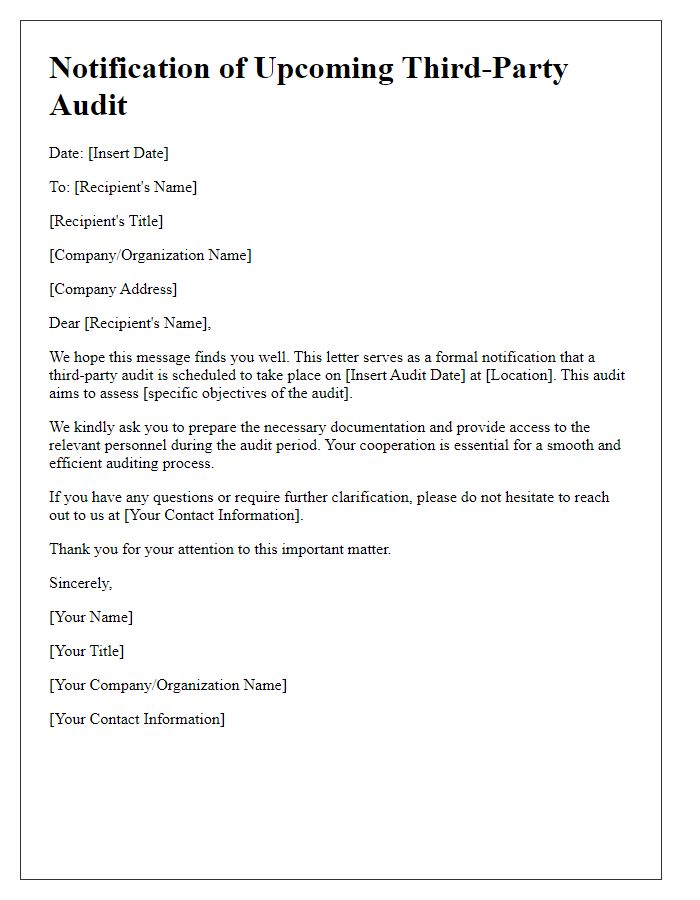

Third-party audits, essential for compliance with standards such as ISO 9001, provide an objective assessment of an organization's processes and controls. Organizations must prepare meticulously for these audits by ensuring all necessary documentation is available, including financial reports, internal policies, and procedural guidelines. Audit dates, often scheduled months in advance, require coordination among various departments to facilitate a smooth evaluation process. Communication with the auditing firm, such as Deloitte or PwC, plays a crucial role in clarifying expectations and addressing any concerns, ultimately leading to improved operational efficiency and risk management strategies.

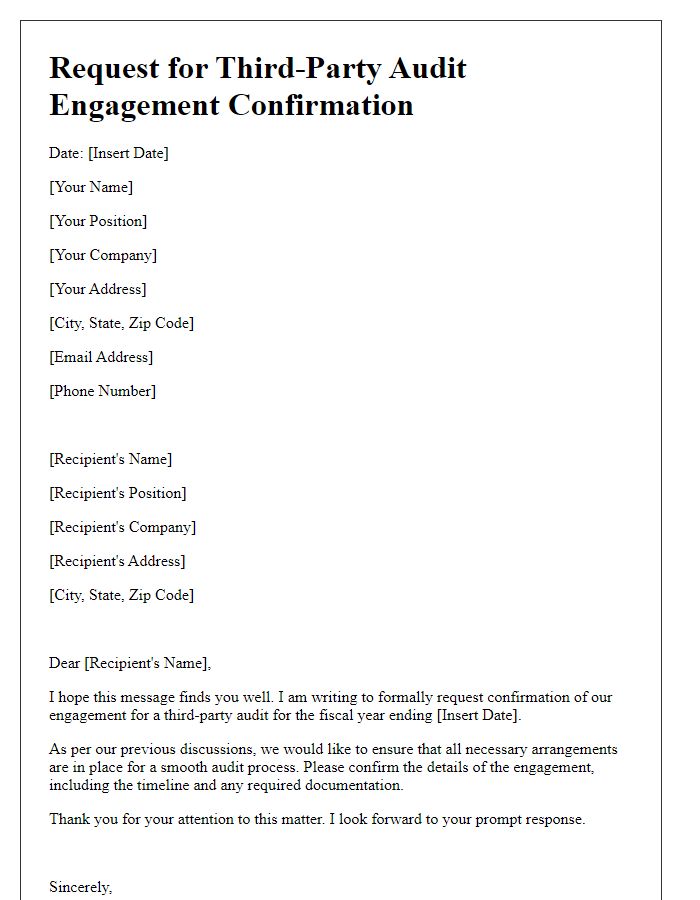

Contact Information

For third-party audits, precise contact information is crucial for effective communication. Essential details include the auditor's name, such as John Smith, the auditing firm, for example, Deloitte Touche Tohmatsu Limited, and direct phone numbers like (123) 456-7890. Email addresses are also vital, often resembling john.smith@deloitte.com. Additionally, incorporating the physical address, such as 123 Main Street, Suite 400, Cityville, ST 12345, ensures clarity in correspondence. Providing alternative contacts can help streamline communication, especially in urgent situations, enhancing the overall effectiveness of the audit process.

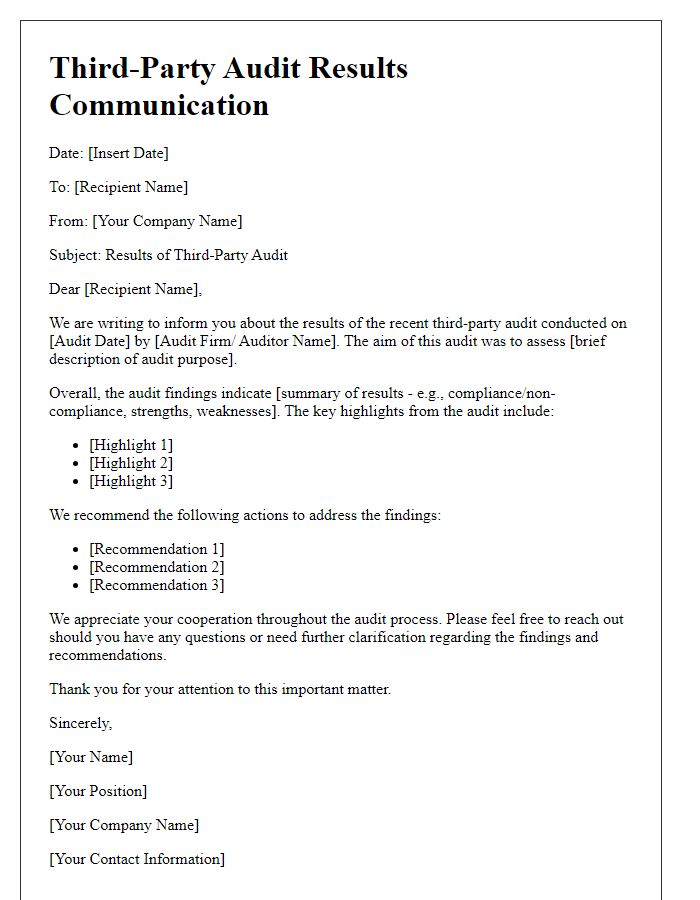

Compliance References

Third-party audits play a crucial role in ensuring compliance with industry standards and regulatory requirements. During a compliance audit, auditors assess various documents, processes, and operations of a company, often focusing on specific guidelines such as ISO 9001 (Quality Management Systems), GDPR (General Data Protection Regulation), or SOX (Sarbanes-Oxley Act). Compliance references may include critical dates, such as the last audit conducted on March 15, 2023, or the upcoming submission deadline for compliance reports due by December 31, 2023. Audit firms like Deloitte or PwC are commonly engaged for these evaluations, with results typically influencing business practices and risk management strategies. A thorough understanding of relevant regulations and best practices is essential for all stakeholders involved in the audit process.

Document List

A third-party audit correspondence requires a comprehensive list of documents, ensuring transparency and compliance. The primary documents essential for review include financial statements such as balance sheets and income statements, tax returns from the previous three years to verify obligations, internal control policies detailing procedures in place, records of transactions including invoices and receipts, compliance documentation such as certifications or licenses relevant to industry standards, and previous audit reports to assess ongoing issues. Additionally, risk assessment reports detailing identified risks and mitigation strategies contribute to a thorough evaluation. Collecting supporting documentation such as contracts, employee records, and meeting minutes enhances the audit, providing context and clarity essential for thorough examination.

Response Deadline

Third-party audit correspondence requires precise communication regarding response deadlines for compliance. An audit report, like the one produced by Moore Global (2023), typically outlines necessary action items with specific response dates. For example, if an audit identifies discrepancies in financial records, a company may be given a 30-day deadline to provide corrective documentation. This ensures timely follow-up with stakeholders, including regulatory agencies such as the Securities and Exchange Commission (SEC), which mandates adherence to strict reporting timelines. Clear communication fosters accountability and ensures all involved parties, such as internal auditors and external consultants, are aligned on obligations, thus enhancing overall audit effectiveness.

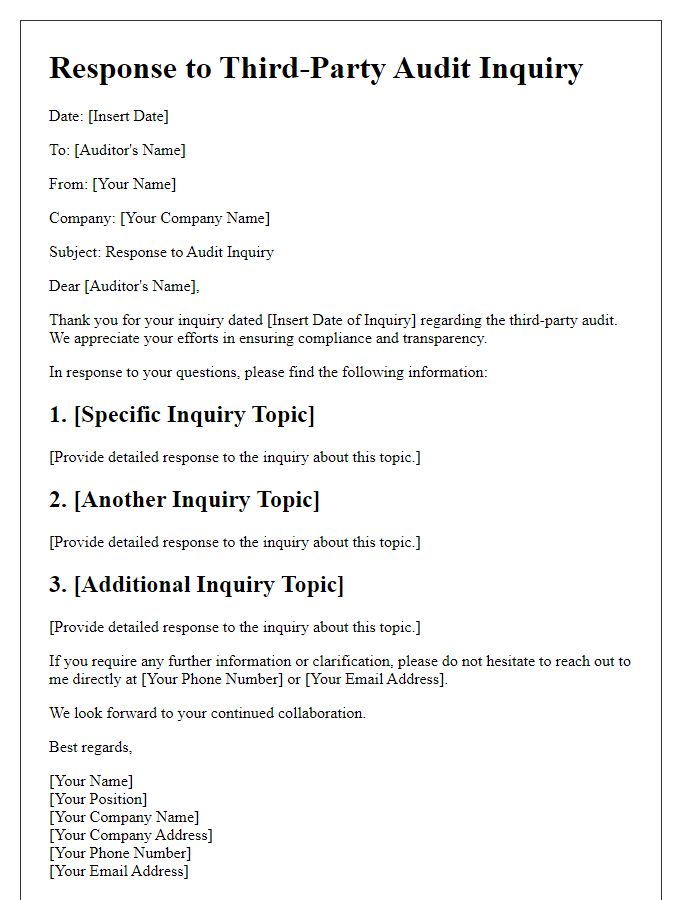

Letter Template For Third-Party Audit Correspondence Samples

Letter template of request for third-party audit engagement confirmation

Comments