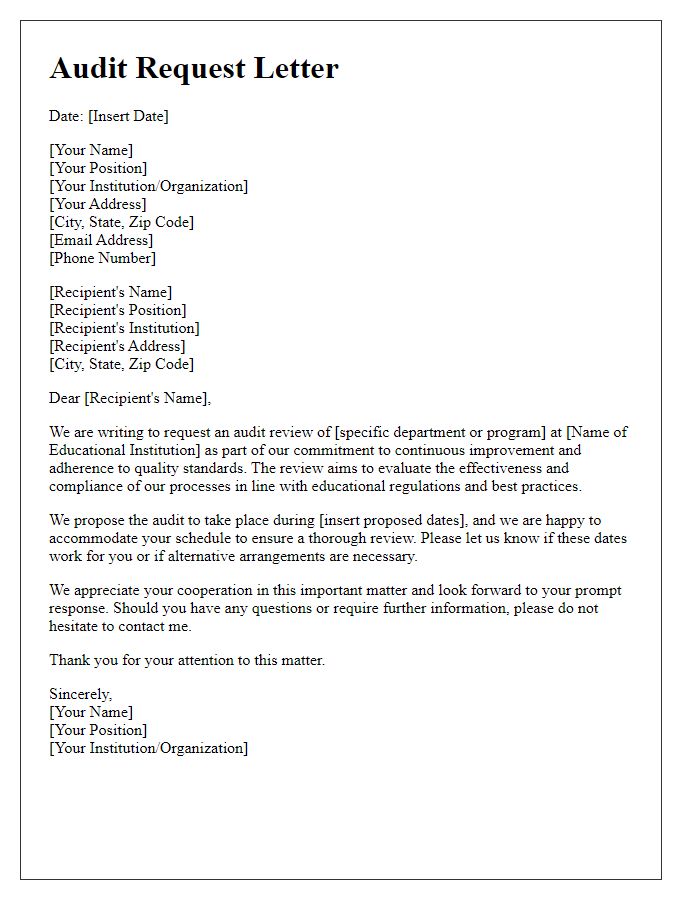

Preparing for an educational institution audit can seem overwhelming, but it doesn't have to be! Understanding the process and how to organize your documentation can make a significant difference in your experience. In this article, we'll guide you through each essential step, ensuring that you're well-equipped to handle the audit with confidence. So, let's dive in and explore the key components you'll need to consider for a successful review!

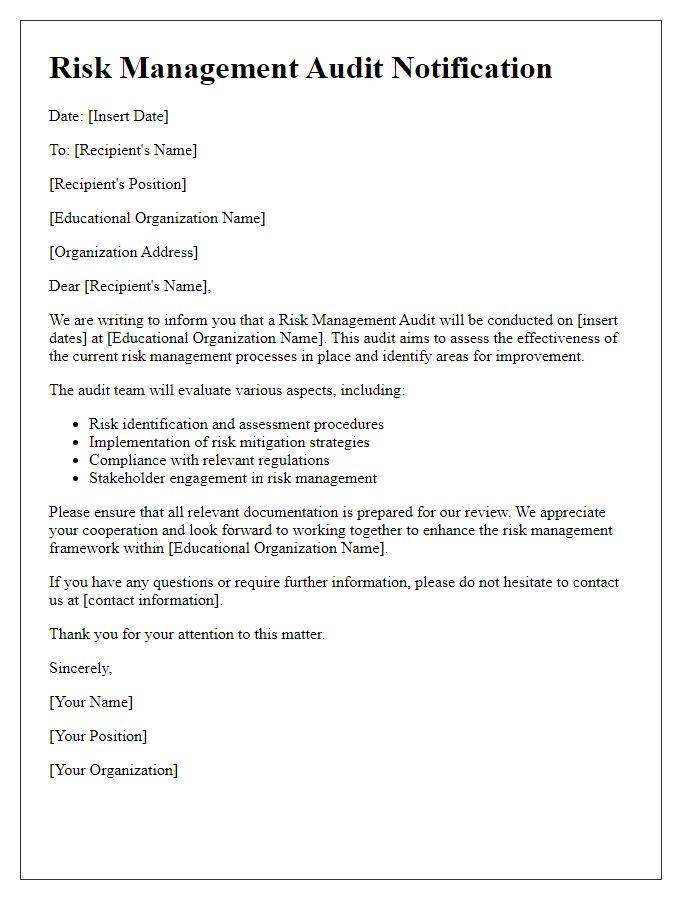

Purpose of Audit

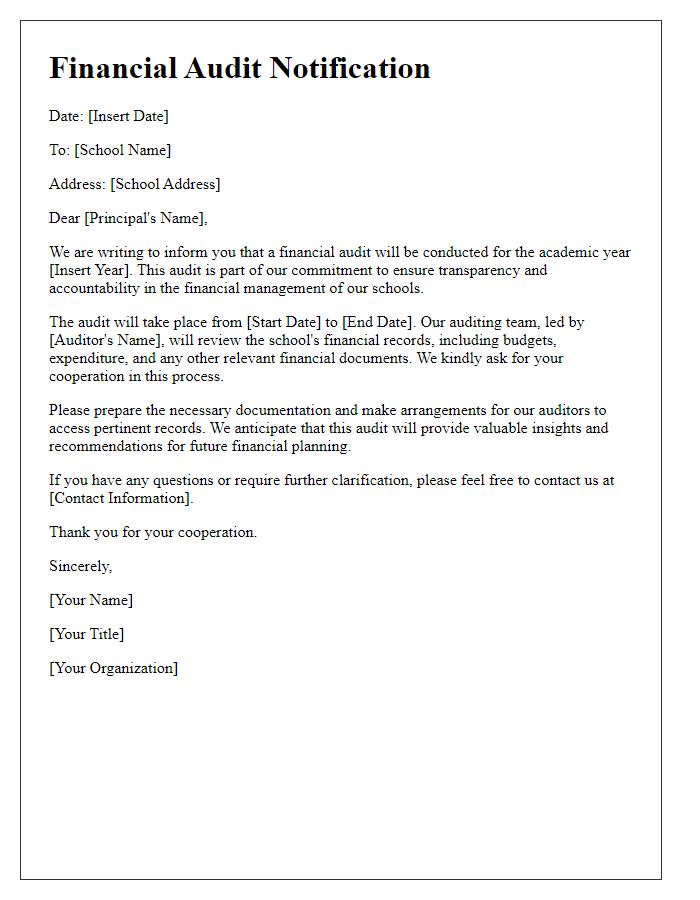

Educational institution audits focus on evaluating compliance with regulatory standards, financial integrity, and operational efficiency. The primary purpose is to ensure adherence to policies set forth by accrediting bodies such as the Higher Learning Commission or the Southern Association of Colleges and Schools. These audits assess financial records, including tuition revenues, grant allocations, and expense management, to ensure transparency and accountability. Additionally, audits examine program effectiveness, student outcomes, and faculty qualifications, promoting continuous improvement within institutions. Ultimately, the audit aims to enhance institutional credibility, improve educational quality, and safeguard stakeholder interests, including students, faculty, and government entities.

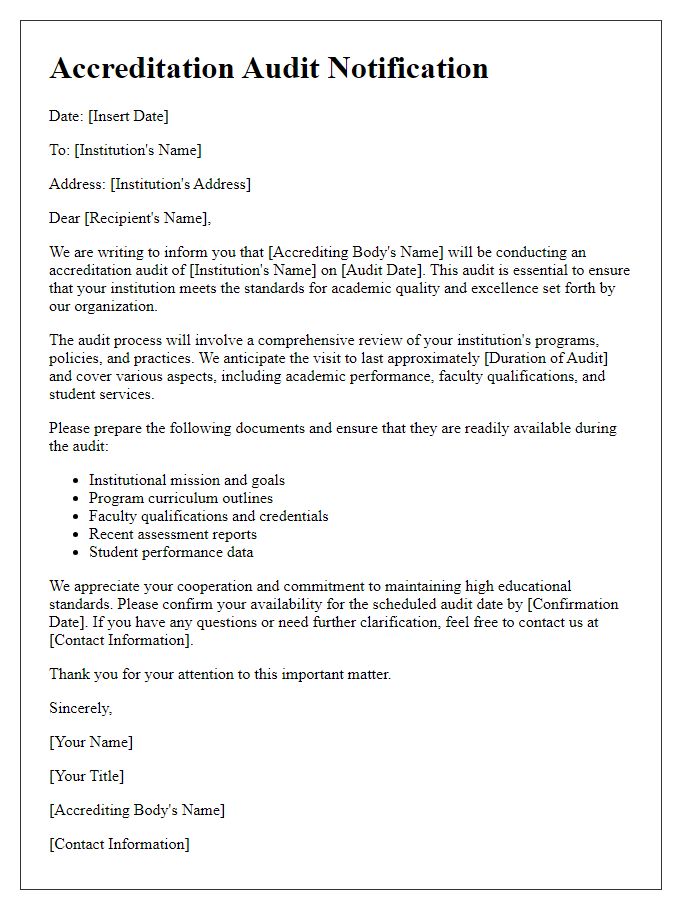

Audit Scope and Objectives

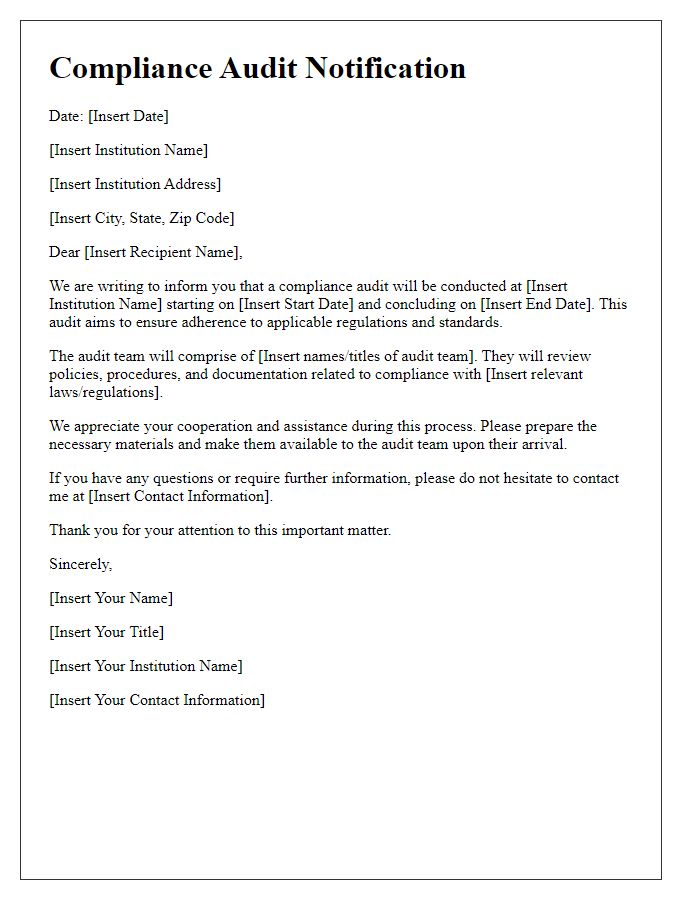

The audit scope includes evaluating the financial statements of the educational institution, focusing on fiscal year 2023, to ensure compliance with Generally Accepted Accounting Principles (GAAP) and internal controls. Objectives involve assessing the accuracy of financial reporting, identifying areas of potential inefficiency, and evaluating the effectiveness of resource allocation. Additional focus will address compliance with federal regulations, including Title IV funding requirements and adherence to state accreditation standards. Key areas of inquiry include enrollment data verification, assessment of tuition revenue streams, and examination of grant utilization. Additionally, the audit will review operational processes, ensuring that expenditures align with budgetary constraints set forth in the institution's strategic plan for achieving educational excellence. The final report will provide recommendations for enhancing financial integrity and operational efficiency.

Audit Timeline and Schedule

The educational institution audit process proceeds through a structured timeline, typically spanning four weeks. Week one encompasses the preliminary planning phase, during which auditors gather essential background information pertaining to the institution's educational practices, financial records, and compliance with local regulations. In week two, auditors conduct fieldwork, engaging with faculty and administrative staff to review documentation related to academic performance metrics, student enrollment statistics, and fiscal expenditures. Week three focuses on data analysis and assessment, where auditors evaluate the findings against established benchmarks and institutional goals. By week four, the auditors compile their observations and recommendations into a formal report, which is presented to the institution's board for review and action. An essential component of this process includes ensuring alignment with standards set forth by organizations such as the Middle States Commission on Higher Education, as well as adherence to state-level educational policies.

Required Documentation

Required documentation for an educational institution audit includes comprehensive financial statements such as income statements, balance sheets, and cash flow statements that reflect the institution's fiscal health over the past fiscal year, typically from January to December. Additionally, detailed records of student enrollment numbers categorized by academic programs, attendance data, and retention rates must be provided to assess institutional effectiveness and student engagement. Compliance documents from state education departments and accreditation bodies, including policies on financial aid and institutional governance, ensure adherence to regulatory standards. Finally, personnel records such as faculty qualifications, staff certifications, and training programs must be reviewed to verify the institution's commitment to maintaining qualified educators.

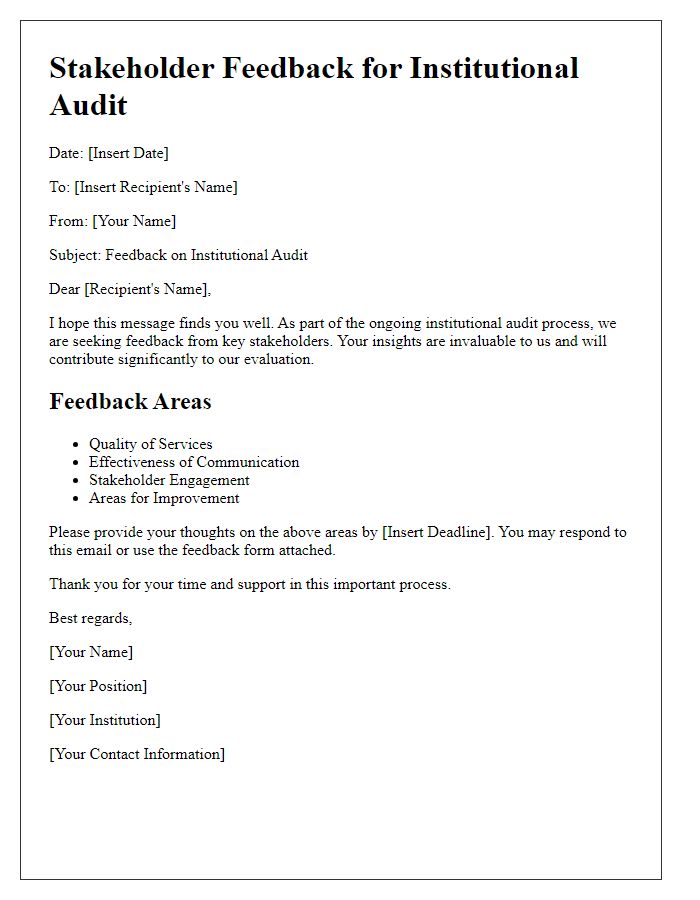

Audit Reporting and Follow-up

Educational institutions undergo audits to ensure regulatory compliance and financial integrity. Audit reporting includes detailed evaluations of financial statements, operational processes, and adherence to educational standards, particularly in K-12 schools and colleges. Follow-up procedures involve monitoring the resolution of identified issues, implementing corrective actions, and ensuring transparency in operations. Recommendations may include enhancing internal controls, improving record-keeping practices, and conducting staff training sessions on compliance. Engaging stakeholders, such as administrators, faculty, and board members, ensures collaborative efforts toward institutional improvement and accountability. Timely follow-ups promote a culture of continuous improvement and foster trust among students, parents, and accrediting bodies.

Comments