Hey there! We all know how crucial it is to keep everything on track, especially when it comes to audits. However, unforeseen circumstances can sometimes call for a delay, and that's perfectly okay! If you're looking for a well-structured letter template for communicating a postponement in the audit timeline, you've come to the right placeâread on to discover useful tips and a sample letter to guide you.

Clear justification for postponement

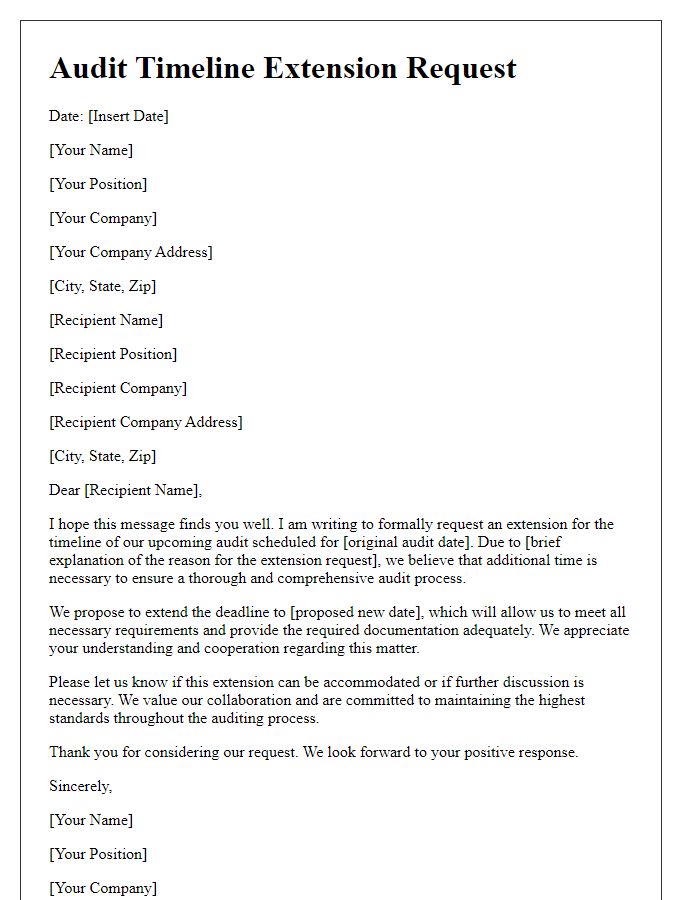

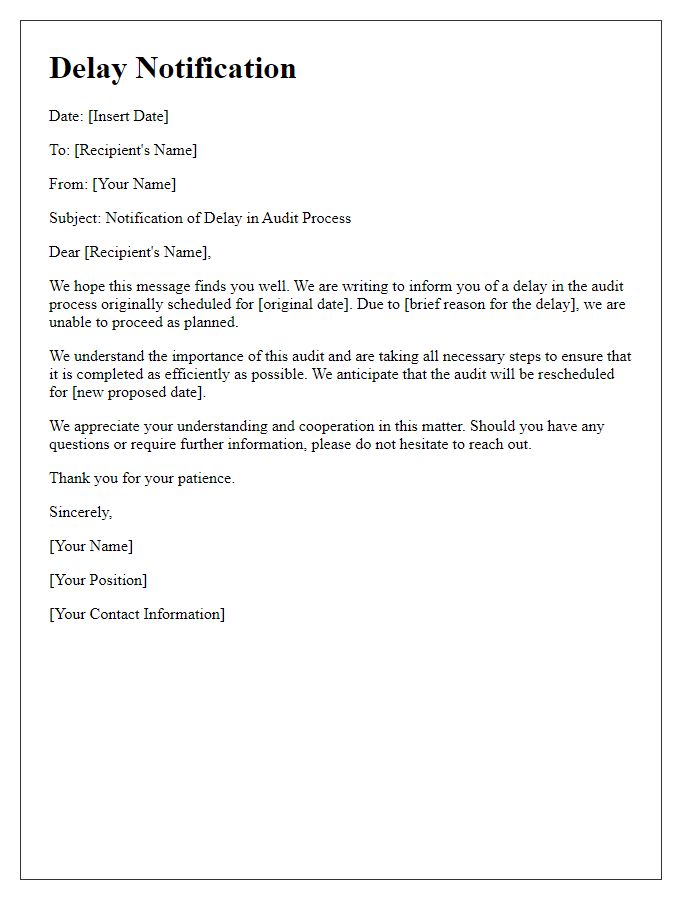

The postponement of the audit timeline is primarily due to unforeseen circumstances affecting core operational procedures. Recent personnel changes have resulted in resource challenges, impacting our ability to gather critical financial documents, such as balance sheets and income statements, necessary for a thorough review. Additionally, the implementation of new regulatory requirements in October 2023 has required extensive staff training and adjustment of internal controls, creating further delays. These factors combined have made it impractical to maintain the original audit schedule without compromising quality and compliance. The proposed new timeline will ensure all necessary protocols are adhered to fully and effectively.

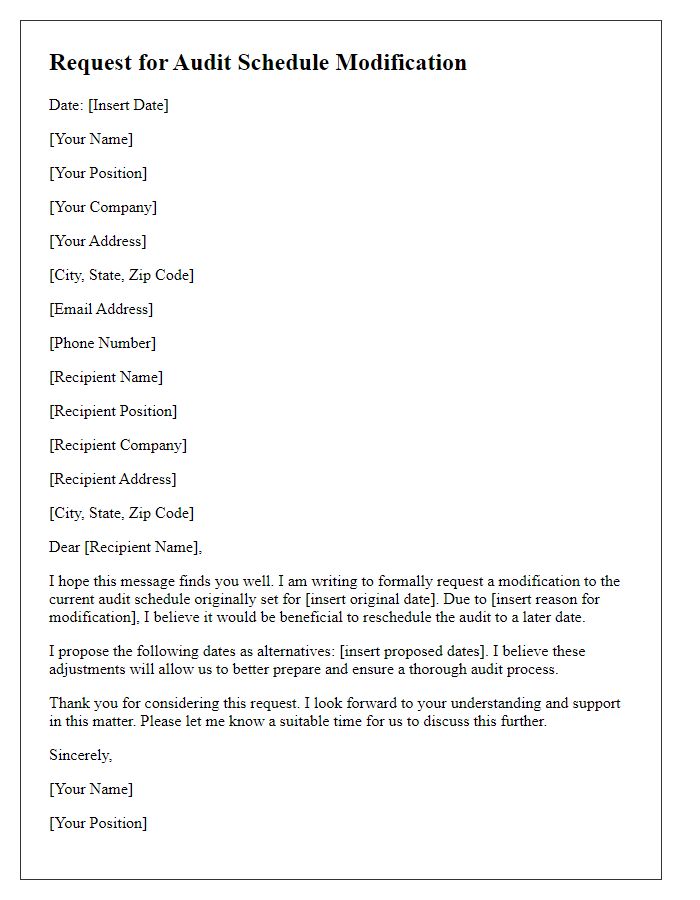

Proposed new timeline and deadlines

The revision of the audit timeline is essential for ensuring thorough evaluation and compliance. The initial timeline, set for October 2023, required detailed assessments and document collection. The proposed new timeline extends these deadlines, promoting an in-depth review. Priority audits, such as financial audits in specific departments, will now be rescheduled to December 2023. Revised deadline for document submission will now be November 15, 2023, allowing departments additional time for preparation. Final analysis and reporting phases will conclude by January 15, 2024, ensuring comprehensive audit results. Stakeholders are urged to adjust their plans accordingly for a smoother audit process.

Assurance of quality and thoroughness

Postponement of an audit timeline often reflects a commitment to ensuring quality and thoroughness in the auditing process. Factors such as unforeseen circumstances, the complexity of financial data, or the need for additional documentation may necessitate this adjustment. In notable instances, organizations like Deloitte or PwC have implemented similar delays to enhance the accuracy of their audits. The revised timeline can provide auditors with ample opportunity to conduct comprehensive examinations, thus safeguarding compliance with applicable regulations and standards. Ultimately, a postponed audit timeline serves to uphold the integrity of financial reporting, thereby fostering stakeholder trust.

Contact information for further communication

The postponement of the audit timeline can significantly impact the operational efficiency of businesses, such as those in manufacturing or finance, typically scheduled for quarterly assessments. Timely communication regarding changes is essential to align stakeholders, including internal audit teams and external auditors, often located in different jurisdictions. For further inquiries, contact the audit coordinator at (555) 123-4567 or email at audit-coordinator@example.com. This ensures clarity and continuity, minimizing disruptions in the audit process, especially important for compliance with regulatory requirements set forth by organizations like the Securities and Exchange Commission (SEC).

Expression of commitment and responsibility

An extended timeline for the audit process, necessitated by unforeseen challenges, demonstrates a commitment to thoroughness and accuracy. This postponement affects key dates, including the initial audit start date of October 15, 2023, now revised to November 5, 2023, allowing for additional preparations. Internal stakeholders, such as the finance team and external auditors from Deloitte, will benefit from this additional time to ensure comprehensive documentation and compliance with regulations. The emphasis remains on the importance of maintaining transparency throughout the process, ensuring that the final outcome will uphold the organization's integrity and accountability in financial reporting.

Comments