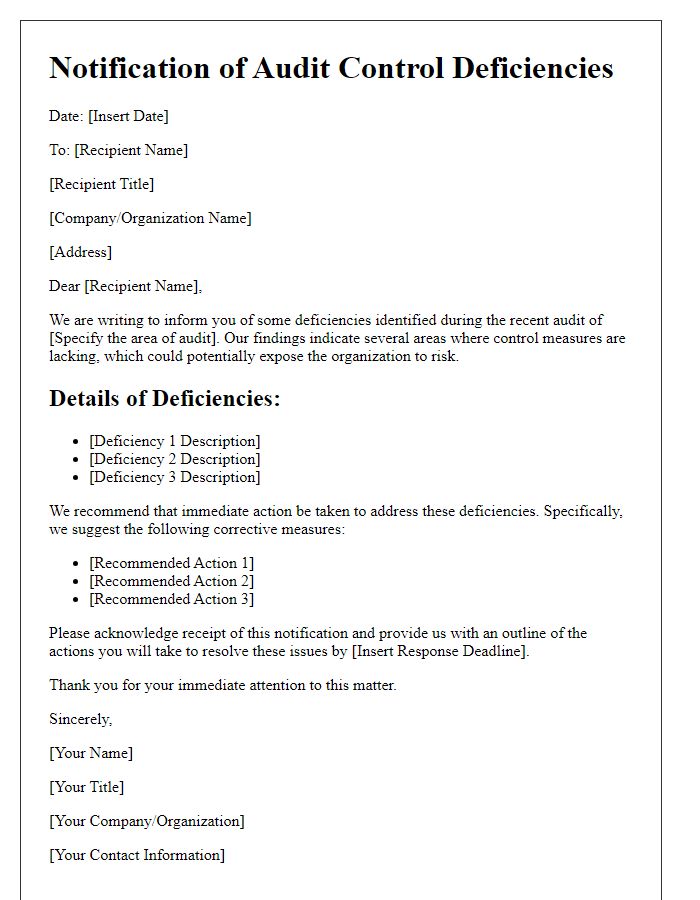

Are you looking for a clear and effective way to address audit control deficiencies? Crafting the perfect letter can make all the difference in conveying your message without losing important details. In this article, we'll explore essential elements to include in your letter to ensure transparency and accountability while maintaining a professional tone. So, let's dive in and discover how to communicate these concerns effectivelyâread on to find out more!

Clear and Concise Language

Audit control deficiencies often highlight weaknesses in internal processes, potentially affecting financial integrity. Documentation irregularities can manifest in areas such as data entry (manual errors exceeding 10%) or authorization protocols, leading to unauthorized transactions. Inadequate segregation of duties may occur when one individual has control over multiple aspects of a financial process, increasing fraud risks. Regular monitoring of compliance with regulatory standards (like the Sarbanes-Oxley Act) is essential; failure to do so could result in significant fines or penalties. Implementing robust internal controls and conducting timely audits can mitigate these risks and enhance overall operational efficiency.

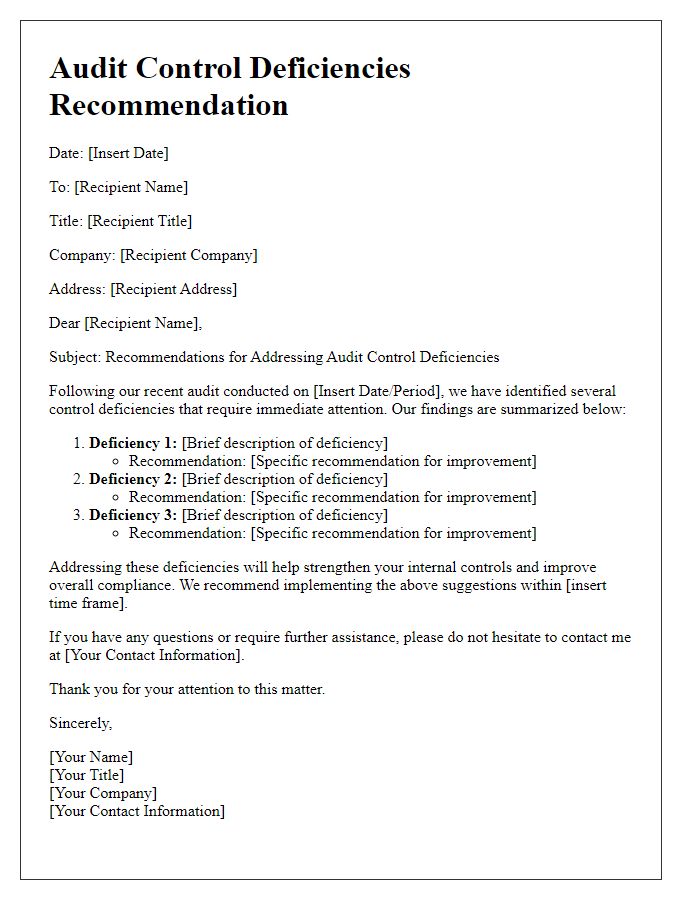

Identification of Specific Deficiencies

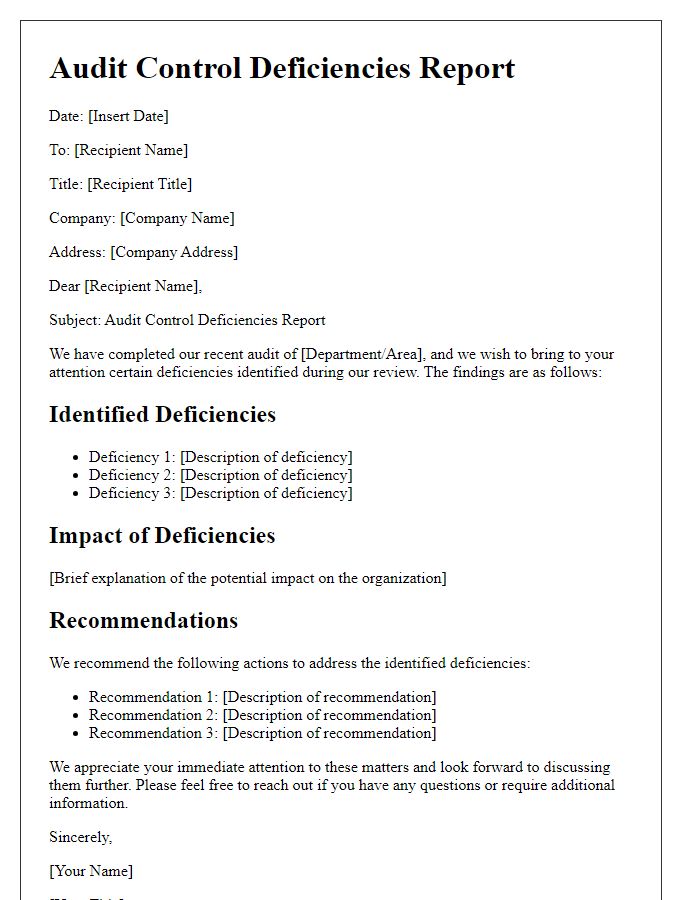

Audit control deficiencies can have significant implications for organizational integrity and compliance, particularly in financial reporting. Identified issues may include, but are not limited to, inadequate segregation of duties, where a single employee manages multiple conflicting responsibilities, thus increasing the risk of errors or fraud. Additionally, insufficient documentation practices, such as lack of receipts for transactions, can lead to challenges in verifying expenses during audits. Inadequate internal controls, as seen in many small businesses, may allow unauthorized transactions, further complicating compliance with regulatory standards set forth by bodies like the Sarbanes-Oxley Act. Furthermore, failure to implement timely reconciliation processes, particularly in cash management, can result in discrepancies affecting overall financial accuracy. Remediation plans must be developed and executed to address these deficiencies, ensuring ongoing compliance and enhancing overall organizational accountability.

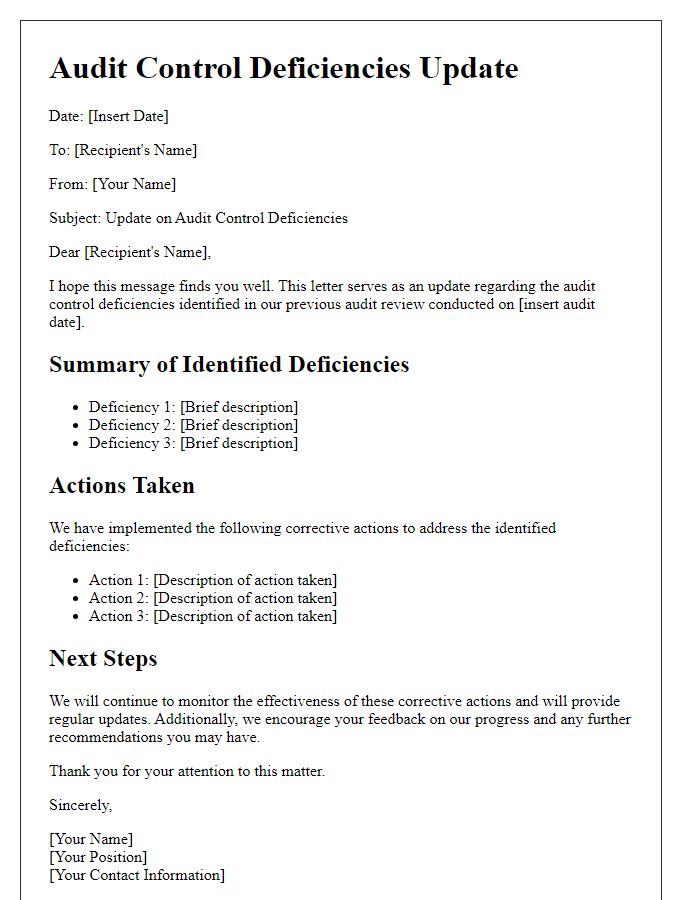

Impact Analysis and Risk Assessment

Audit control deficiencies can significantly impact organizational operations, leading to increased financial risks and compliance issues. Inadequate internal controls may result in erroneous financial reporting, where misstatements over $1 million have been identified. These deficiencies often arise during audits conducted by firms such as Deloitte or PwC, revealing vulnerabilities in processes like revenue recognition and inventory valuation. Furthermore, risk assessments indicate heightened exposure to fraud, especially in environments lacking robust oversight mechanisms. The 2022 Sarbanes-Oxley Act mandates stringent reporting requirements, highlighting the importance of mitigating risks associated with control deficiencies. Organizations may face regulatory penalties exceeding $500,000, alongside reputational damage that could affect stakeholder trust and investor confidence.

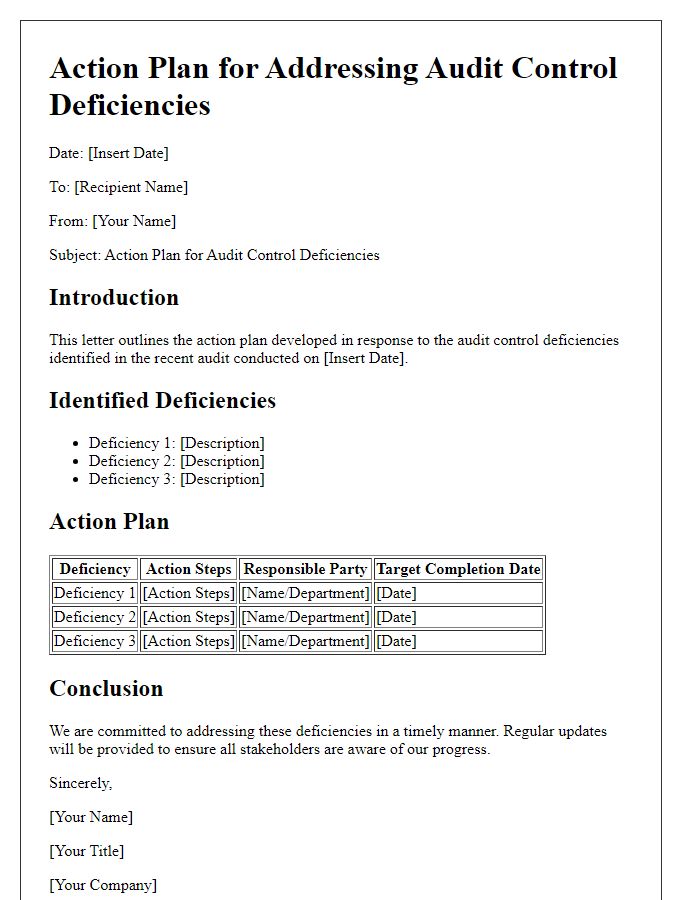

Recommended Actions and Solutions

Identifying audit control deficiencies in financial institutions can lead to significant risks, particularly in compliance and accuracy of financial reporting. Common deficiencies include improper segregation of duties, inadequate documentation practices, and insufficient oversight of transactions. To address these issues, organizations should implement recommended actions such as establishing clear policies for financial processes, conducting regular training sessions for staff on compliance measures, and utilizing audit management software to enhance tracking and reporting capabilities. Furthermore, institutions should consider periodic audits by external firms (such as Big Four auditors) to ensure adherence to regulatory standards, increasing accountability across departments. Monitoring tools (like key performance indicators) can also help detect discrepancies in real-time, allowing for prompt resolution of issues and strengthening overall internal controls.

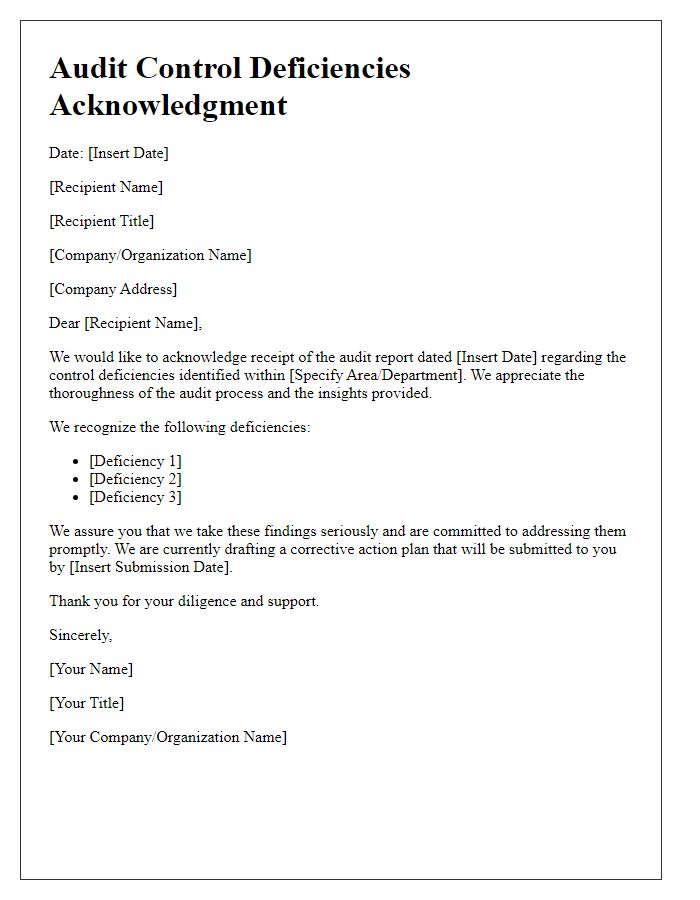

Professional Tone and Compliance Assurance

Audit control deficiencies can undermine financial integrity in organizations, especially during external audits following regulations like Sarbanes-Oxley Act of 2002. Consistent discrepancies in documentation practices, including invoice approvals and expense reports, often lead to non-compliance risks. Lack of segregation of duties, where one individual manages both transaction processing and record-keeping, heightens vulnerability to fraud, notably in sectors like financial services or healthcare. Additionally, insufficient training on compliance requirements for employees can result in unintentional errors, limiting the effectiveness of internal controls. Highlighting these areas in an audit report ensures stakeholders understand the potential impact on operational efficiency and risk management strategies, reinforcing the importance of addressing such deficiencies promptly.

Comments