Are you looking for a solid way to ensure confidentiality in your audit processes? Drafting an audit confidentiality agreement is essential for protecting sensitive information and maintaining trust between involved parties. This template serves as a comprehensive guide to help you create an effective and legally sound agreement. Join us as we delve deeper into the critical components of this document and explore best practices for safeguarding your audit data.

Clear Definition of Confidential Information

A confidentiality agreement, often referred to as a non-disclosure agreement (NDA), is essential in maintaining the privacy of sensitive information shared during an audit process. Confidential Information may include, but is not limited to, financial records (such as profit margins, balance sheets), proprietary business techniques (like operational procedures), trade secrets (specific designs, formulas), client data (employee information, customer lists), and all documentation related to the audit process. Both parties must thoroughly understand the scope of this confidential information and agree to safeguard it against unauthorized disclosures. It is crucial to establish clear conditions under which this information may be disclosed, ensuring that any breaches result in appropriate remedies or penalties. Awareness of these stipulations helps foster a trustworthy partnership between the auditing entity and the client.

Obligations of Confidentiality

An audit confidentiality agreement outlines the obligations of the parties involved regarding the handling of sensitive information obtained during the audit process. The agreement emphasizes the importance of safeguarding proprietary and financial records, ensuring that all data, including financial statements, internal controls, and operational practices, remains confidential. Typically, the agreement stipulates a commitment to not disclose any information to unauthorized individuals or third parties without explicit written consent. Furthermore, it defines the duration of confidentiality obligations, often extending beyond the conclusion of the audit, to protect trade secrets and sensitive operational information from potential exploitation. Organizations involved in audits, such as accounting firms or internal auditors, must comply with relevant regulations, including those set by the International Auditing and Assurance Standards Board (IAASB).

Permitted Disclosures and Exceptions

Permitted disclosures in an audit confidentiality agreement may include legal obligations, such as compliance with laws and regulations, which necessitate sharing sensitive information with governmental bodies or law enforcement agencies. Additionally, disclosures could extend to authorized personnel, including employees, contractors, or external auditors who require access to conduct their work effectively. Exceptions might allow for information sharing with professional advisors, like legal counsel or accountants, provided these parties also adhere to confidentiality standards. Events such as litigation risks or regulatory inquiries may further compel the sharing of protected information to safeguard organizational interests, aligning with established timelines or agreements set forth in the initial contract.

Duration of Agreement and Survival Clause

The Duration of Agreement regarding audit confidentiality encompasses a specified timeframe during which all parties are obligated to uphold the confidentiality of sensitive information exchanged during the audit process. Typically, this duration spans from the initial signing date, such as January 1, 2024, and may extend up to five years, concluding on December 31, 2028. The Survival Clause ensures that obligations of confidentiality remain enforceable beyond the termination of the agreement, safeguarding proprietary data against unauthorized disclosure even after the duration has lapsed. This clause provides a crucial safeguard, preserving the trust established during the audit and ensuring that both parties remain accountable for protecting confidential information indefinitely.

Legal Consequences and Remedies for Breach

In the realm of audit confidentiality agreements, legal consequences and remedies for breach represent critical safeguards for sensitive financial information. A breach of this agreement may result in significant legal ramifications, including monetary damages that can reach thousands of dollars, as well as potential loss of professional reputation. Legal actions may encompass injunctive relief, preventing further unauthorized disclosure of confidential information. Additionally, breach of such agreements may lead to the withdrawal of auditing privileges, with firms like the American Institute of Certified Public Accountants (AICPA) enforcing strict penalties under their Code of Professional Conduct. In extreme cases, intentional breaches may attract criminal charges, including fines and imprisonment, as dictated by state and federal laws concerning confidentiality and privacy. Confidentiality breaches can also trigger contract termination, requiring the violator to forfeit any rights or fees associated with the audit agreement.

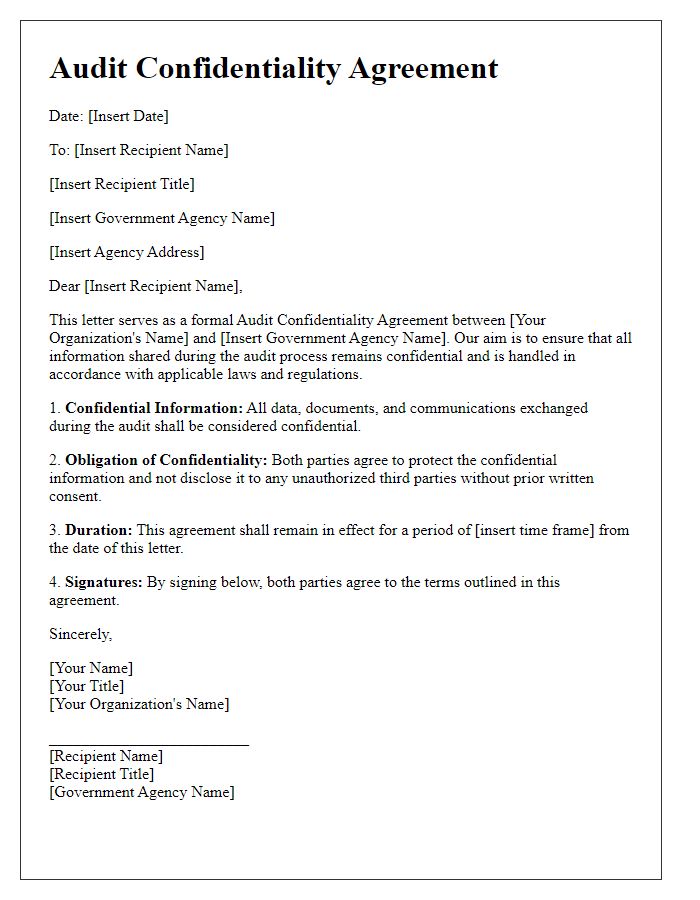

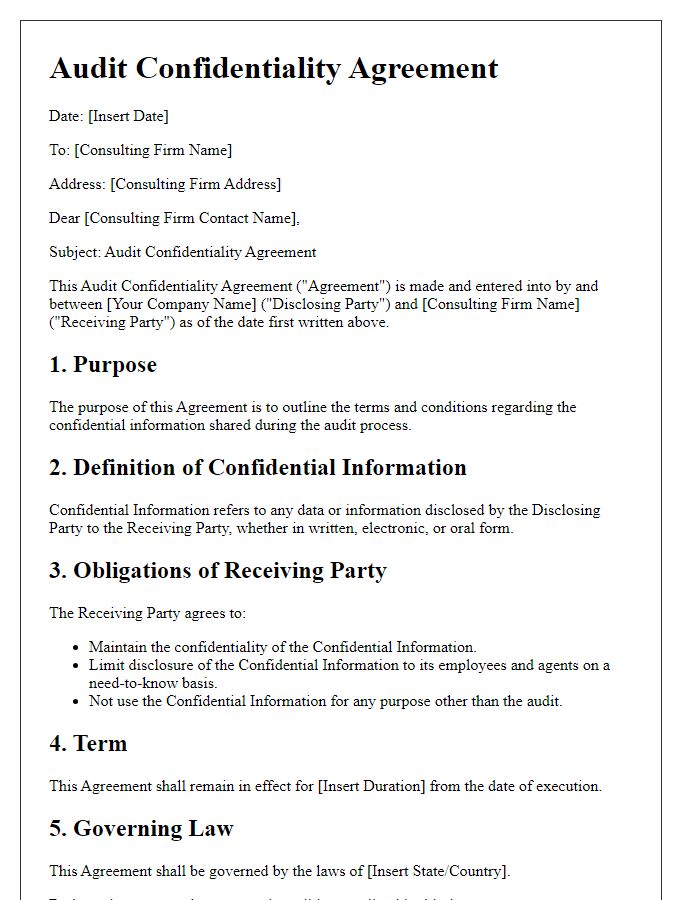

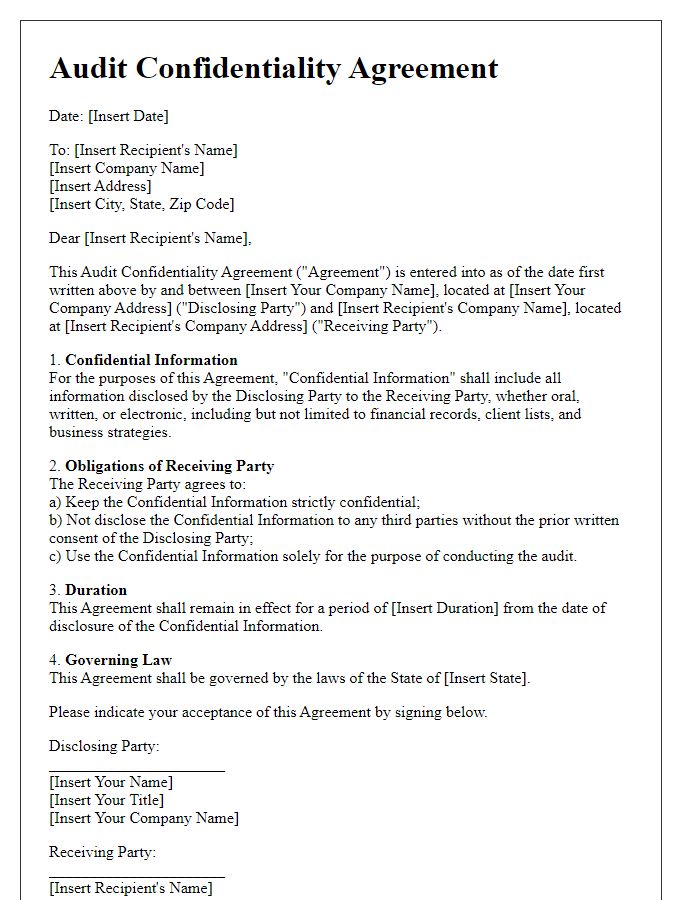

Letter Template For Audit Confidentiality Agreement Samples

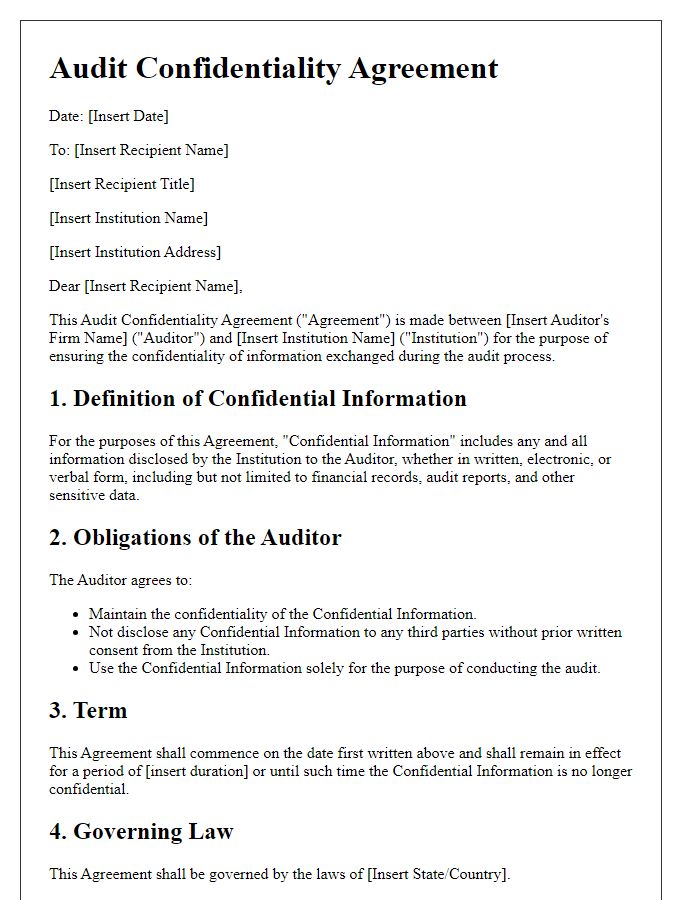

Letter template of audit confidentiality agreement for financial institutions.

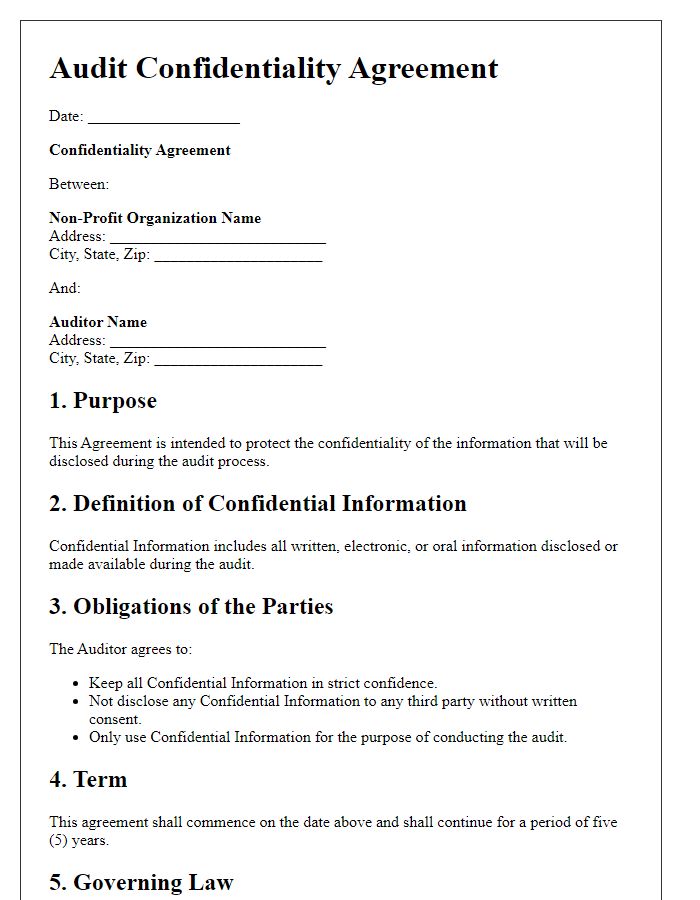

Letter template of audit confidentiality agreement for non-profit organizations.

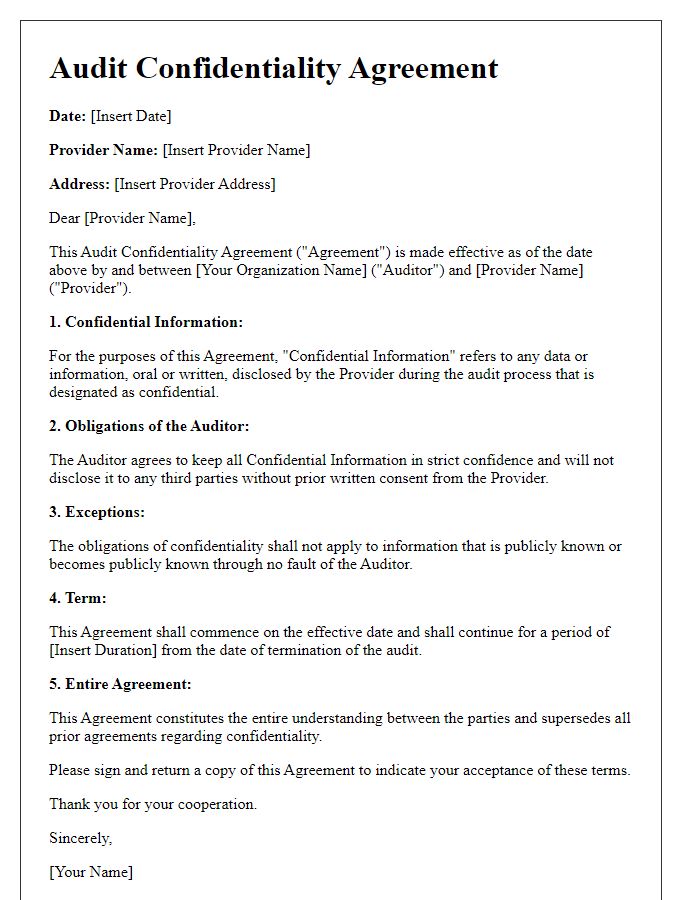

Letter template of audit confidentiality agreement for healthcare providers.

Letter template of audit confidentiality agreement for manufacturing companies.

Letter template of audit confidentiality agreement for technology firms.

Letter template of audit confidentiality agreement for retail businesses.

Letter template of audit confidentiality agreement for educational institutions.

Letter template of audit confidentiality agreement for government agencies.

Letter template of audit confidentiality agreement for consulting firms.

Comments