Welcome to our guide on preparing a letter for your charity organization's audit! We all know that transparency is crucial in the non-profit sector, and having a well-structured letter can set the tone for a smooth auditing process. In this article, we'll walk you through essential components, tips, and templates to help you communicate effectively with auditors while maintaining compliance. So, let's dive in and explore how to strengthen your charity's audit communicationâread on to discover more!

Introduction and Purpose

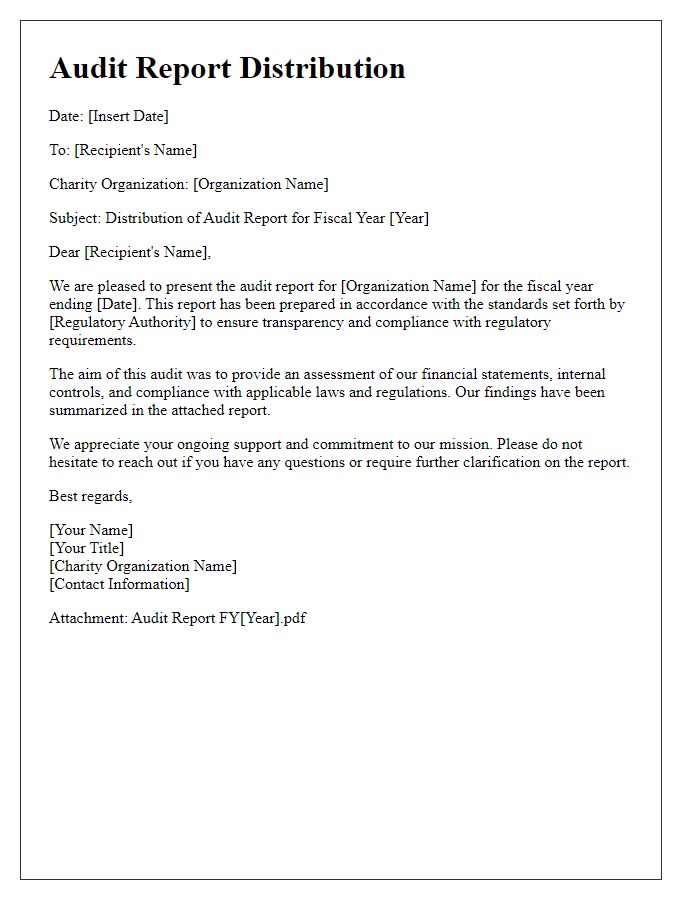

Charity organizations play a crucial role in addressing social issues, providing assistance to vulnerable communities, and promoting philanthropic efforts. The purpose of conducting an audit is to ensure transparency, accountability, and effective utilization of funds. An audit helps assess financial operations, verify compliance with regulations, and evaluate the impact of charitable programs. Implementing thorough auditing processes fosters trust among donors, which can significantly enhance fundraising efforts and community support. Additionally, audits provide insights for improving organizational practices, ultimately leading to more substantial positive outcomes for beneficiaries. Regular audits uphold the integrity of charitable initiatives, ensuring that resources are directed efficiently towards fulfilling organizational missions in an ethical manner.

Scope of Audit

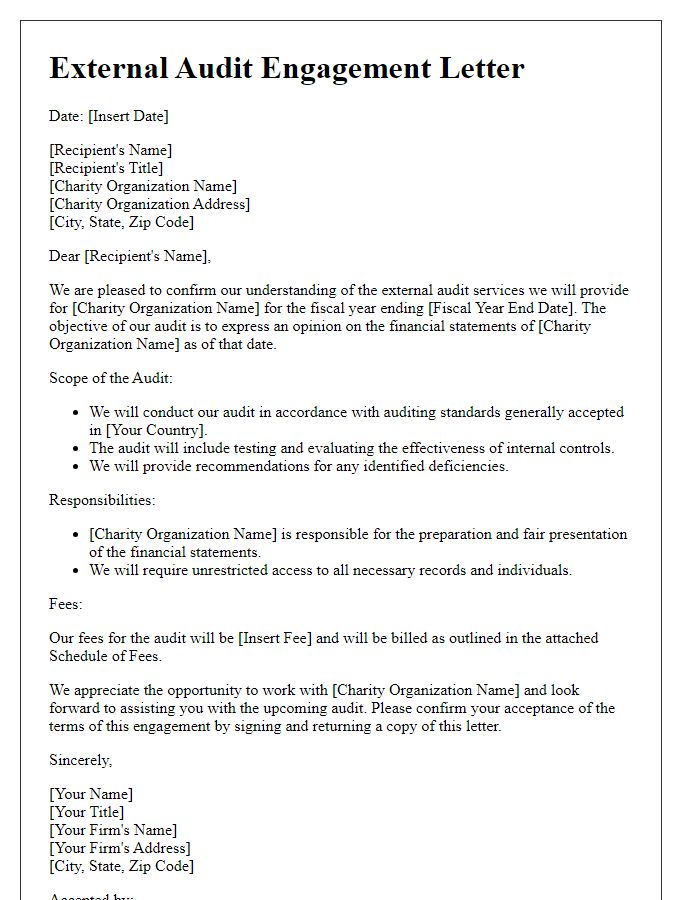

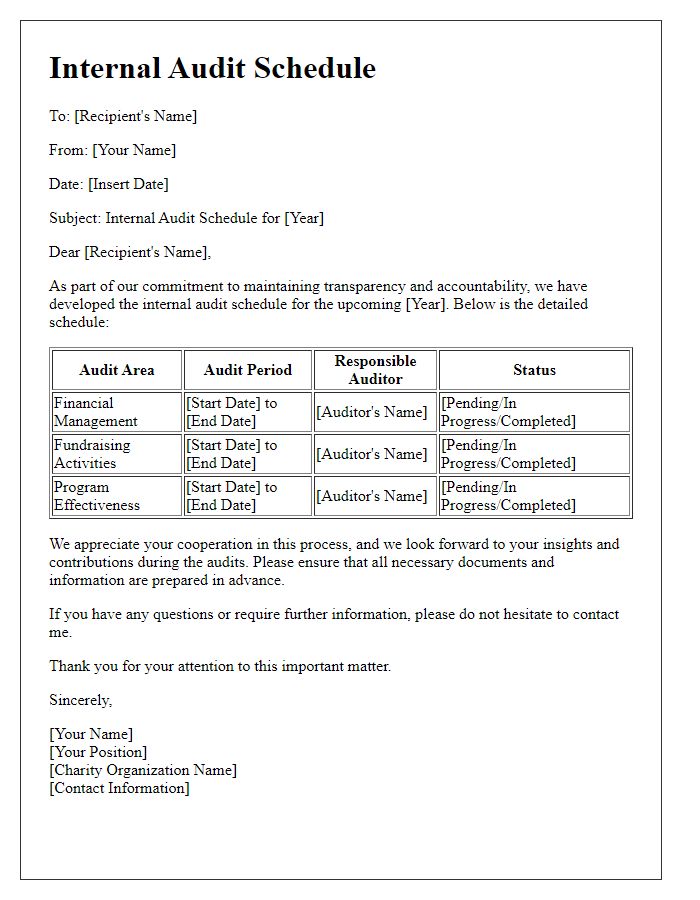

The audit scope for the charitable organization encompasses financial statements, compliance with regulations, operational effectiveness, and adherence to internal controls. Financial statements, including balance sheets, income statements, and cash flow statements, will be examined for accuracy against fiscal year 2022-2023 data. Compliance checks will ensure accordance with IRS regulations, specifically 501(c)(3) status requirements, and state laws governing non-profits, such as Utah's Nonprofit Corporation Act. Operational effectiveness will involve assessing program effectiveness and donor fund allocation for initiatives, such as the recent food drive in September 2023 that aimed to distribute 10,000 meals. Lastly, internal controls will be evaluated to identify risks, ensuring that the organization's assets are safeguarded, cash handling procedures are optimized, and relevant financial reporting aligns with best practices endorsed by the American Institute of Certified Public Accountants (AICPA).

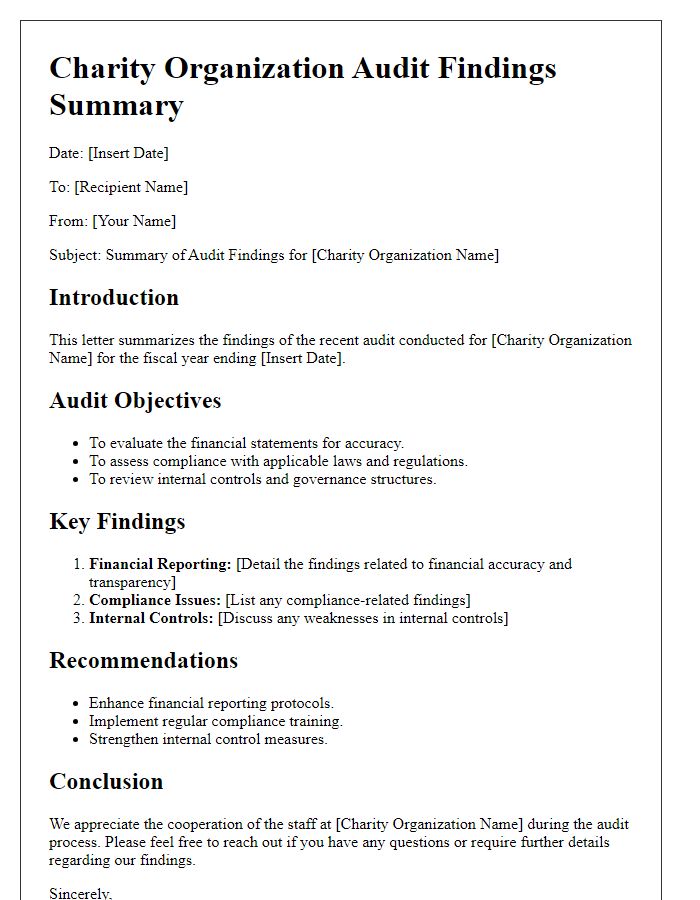

Summary of Findings

A comprehensive audit of the charity organization revealed significant insights into financial management and program effectiveness. The review, conducted between January and March 2023, evaluated financial statements, donor contributions, and expenditure across various programs. Notably, total revenue reached $2 million, with 70% derived from individual donations. However, operational costs were observed to exceed 80% of total expenses, raising concerns about sustainability. Furthermore, program effectiveness was rated at 60%, indicating room for improvement in resource allocation and impact measurement. Recommendations include enhanced monitoring of expenditures and increased transparency in reporting to stakeholders. Overall, the findings highlight the need for strategic adjustments to align financial practices with organizational mission and objectives.

Recommendations

During a charity organization audit, several key recommendations can enhance operational transparency and financial integrity. Establish a robust internal control system to mitigate risks associated with financial mismanagement. Implement regular training programs for staff and volunteers to ensure compliance with regulatory standards, including IRS guidelines for 501(c)(3) organizations. Increase the frequency of financial reviews, ideally on a quarterly basis, to track income and expenditures effectively. Utilize donor management software to maintain accurate donation records and ensure proper acknowledgment of contributions. Establish a clear communication strategy to regularly update stakeholders on financial health and impact reports. Finally, consider forming an independent audit committee to oversee financial practices and ensure accountability, enhancing trust among donors and beneficiaries.

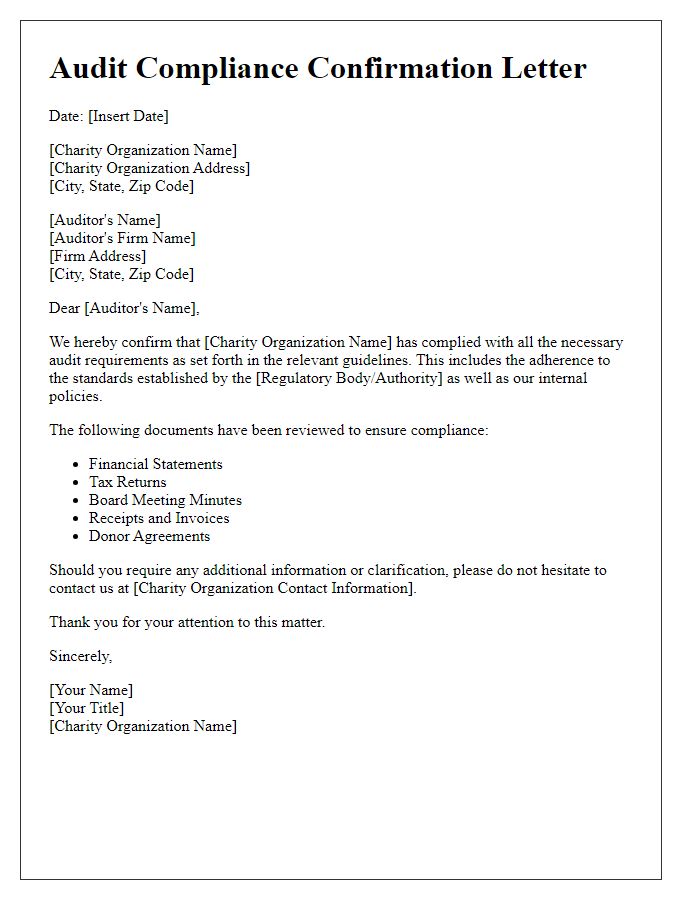

Contact Information

Contact information for a charity organization audit typically includes key elements such as the organization's legal name, registered address, and phone number. The organization may have a specific contact person for audits, including their name and title, to facilitate communication. Additionally, an email address dedicated to audit inquiries is essential for timely correspondence. Important financial details such as the fiscal year-end date, and the charity's registration number with relevant authorities can also be included to enhance credibility and transparency during the audit process.

Comments