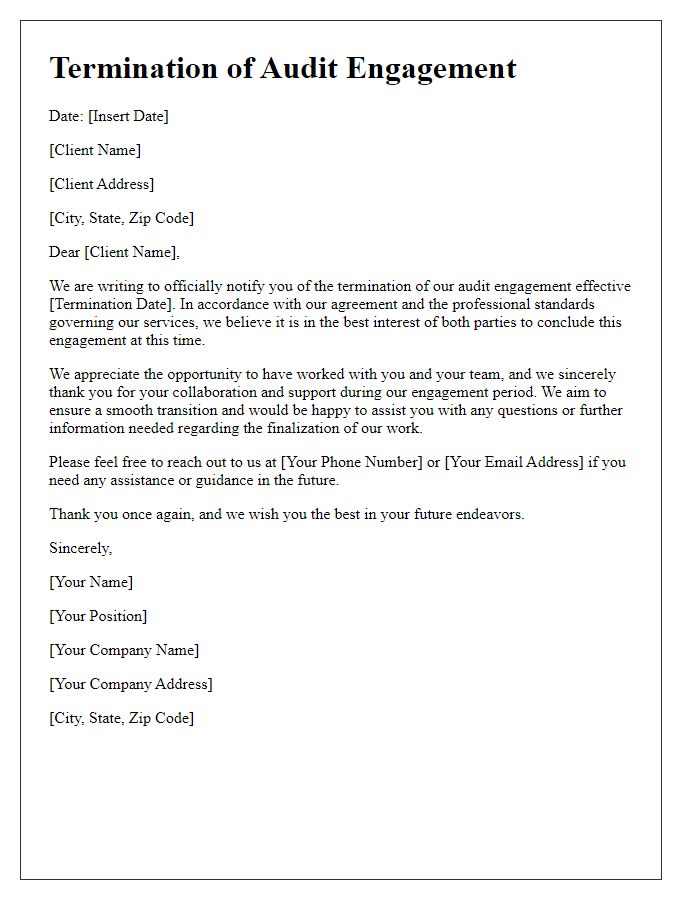

Are you considering ending an audit engagement and unsure how to communicate that effectively? It's crucial to approach this sensitive topic with clarity and professionalism, ensuring that all parties understand the reasoning behind the decision. Crafting a well-structured letter can help maintain good relationships while protecting your interests. Let's dive deeper into the essential elements of an audit engagement termination letter and how to frame it appropriatelyâread on for more insights!

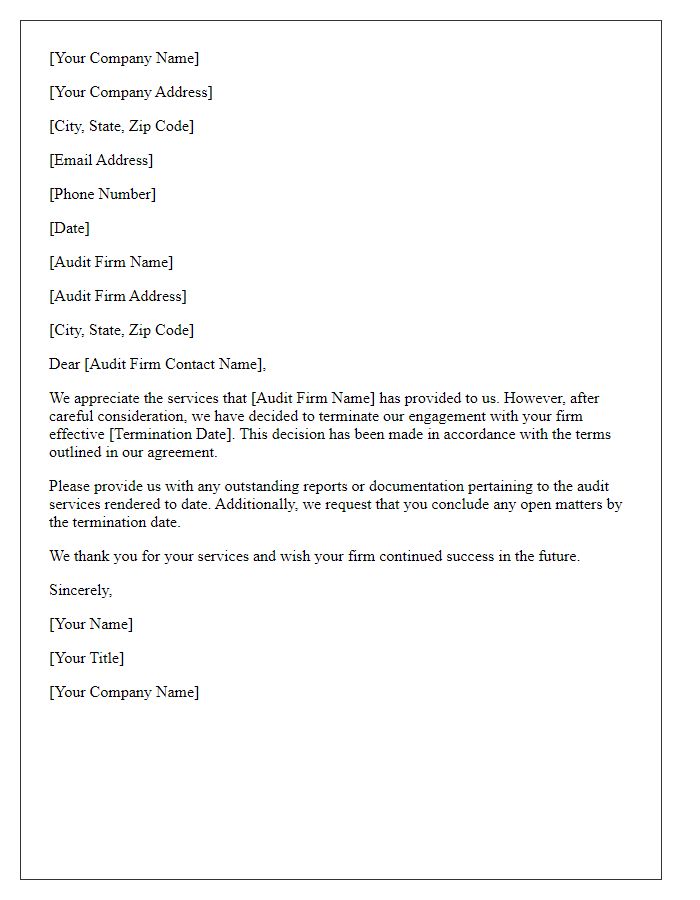

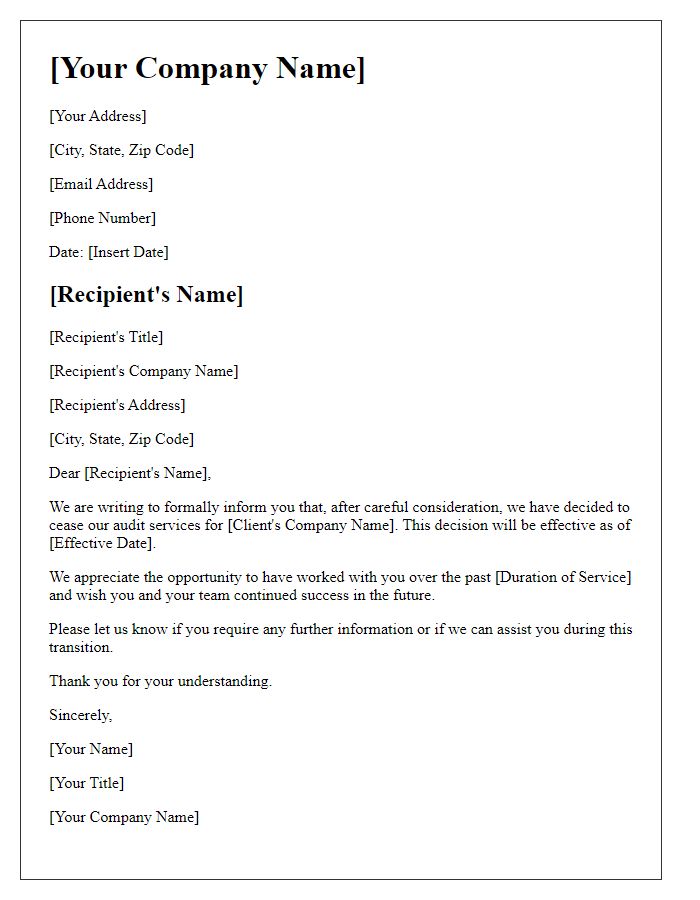

Clear Reason for Termination

Termination of audit engagements often arises due to factors such as lack of communication, insufficient access to necessary documentation, or a fundamental breakdown in trust. When an audit firm, such as Deloitte, decides to discontinue its services for a client, like Company X, it may do so to maintain integrity and adherence to ethical standards in financial reporting. Specific triggers for this action may include repeated late submissions of financial records or failure to address identified risks during the audit process. Documentation supporting these reasons, including timelines and prior correspondence, must be gathered to ensure a clear and justified termination process. Each factor must be meticulously outlined to convey transparency and uphold professional standards.

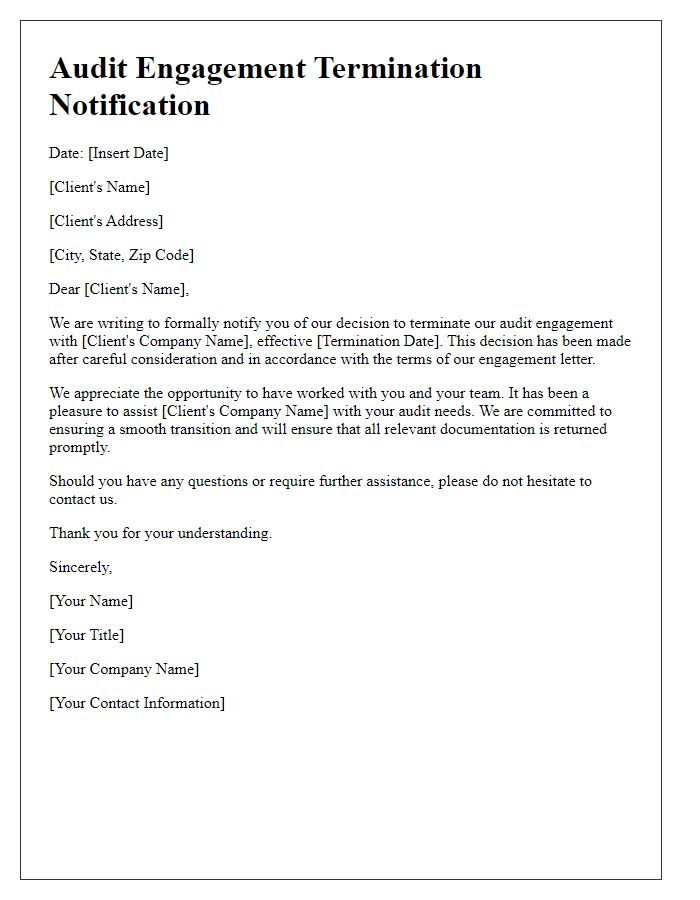

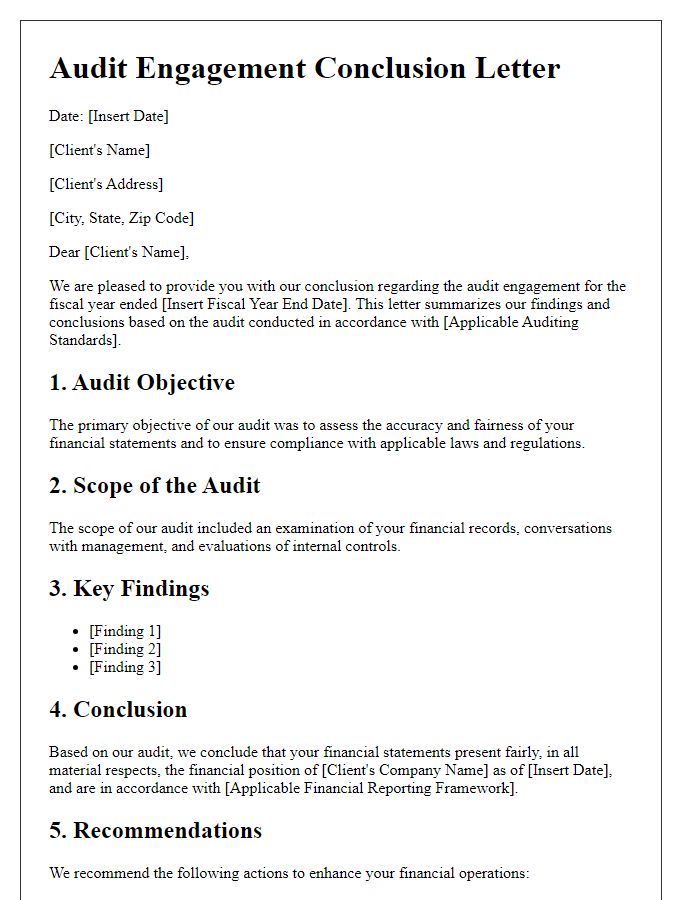

Reference to Original Agreement

An audit engagement termination refers to the process of formally concluding a professional relationship between an auditor and a client, typically guided by the terms detailed in the original agreement. Significant aspects of the original agreement include the scope of work defined, duration of the audit engagement, fees, and procedures for termination, which are essential to ensure compliance and mutual understanding. A termination notice should reference specific sections of the original agreement, emphasizing the basis for termination, whether it be due to completion of the audit, client decision, or other circumstances. Additionally, final deliverables, such as financial statements or audit reports, must be outlined to ensure all parties are aware of outstanding obligations. A professional and respectful tone in the termination communication is vital to maintain goodwill and pave the way for potential future engagements.

Specific Termination Date

An audit engagement termination requires a formal approach to ensure clarity and professionalism. A structured communication should outline the specific termination date, ensuring all parties understand the timeline involved. This engagement, often tied to compliance with standards set by the American Institute of CPAs (AICPA) or similar regulatory bodies, necessitates addressing all previously established terms. Stakeholders must be informed about the conclusion of services, along with documentation that reflects the financial reporting period's end. Timely notification (typically 30 days in advance) is crucial to enable a smooth transition without disrupting ongoing operations or financial integrity. Furthermore, preparation for final settlement of fees ensures complete closure of the engagement, promoting a professional relationship for potential future collaborations.

Professional Tone and Language

Termination of audit engagements often stems from various considerations, such as client behavior, compliance issues, or professional judgment. Key aspects include the audit period (often annual) and the professional standards set forth by organizations like the AICPA (American Institute of Certified Public Accountants). A precise methodology for termination notification should encompass a formal letter to the client, detailing reasons for the termination while adhering to ethical guidelines. Communication should emphasize the necessity for a smooth transition, assisting in the transfer of relevant financial records and documents. Additionally, offering guidance on securing a new auditor may be prudent, ensuring the continued integrity of the financial reporting process.

Offer of Assistance for Transition

In an audit engagement termination scenario, offering assistance for the transition can help maintain professional relationships and ensure a smooth handover process. Key aspects include outlining support services during the transition, specifying the potential impact of the audit termination on financial reporting and compliance, and emphasizing a commitment to uphold ethical standards and confidentiality throughout the handover process. Highlighting the audit firm's previous experience and expertise in facilitating similar transitions can reinforce trust and confidence. Providing a clear timeline for the transition, detailing necessary documentation or deliverables, and inviting open communication are essential to foster collaboration for an effective conclusion of the engagement. A firm's reputation hinges on executing a graceful exit while ensuring stakeholders are adequately supported during this pivotal change.

Comments