Preparing an audit checklist can feel overwhelming, but it doesn't have to be! Whether you're a seasoned professional or a newcomer to the auditing world, having a well-structured checklist can simplify the process and ensure nothing important slips through the cracks. In this article, we'll walk you through the essential elements of an effective audit checklist, providing tips and insights to streamline your preparation. So, grab a cup of coffee and let's dive in to make your audit process smoother and more efficient!

Purpose and Scope of the Audit

The purpose of an audit is to systematically assess the financial statements and compliance processes of an organization, ensuring accuracy and adherence to regulatory standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). This comprehensive evaluation typically encompasses key areas including accounting records, operational efficiency, and internal controls. The scope of the audit may include various activities, such as examining transactions over the fiscal year, evaluating the effectiveness of risk management strategies, and verifying the completeness and accuracy of financial documents. Specific focus might be placed on significant accounts, such as revenue recognition, inventory valuation, and liabilities assessment. The overall goal is to enhance the reliability of financial reporting and protect stakeholder interests, ultimately contributing to improved governance and operational effectiveness within the organization.

Key Areas of Focus

The audit checklist preparation emphasizes critical areas such as financial compliance (ensuring adherence to national laws and regulations, particularly the Sarbanes-Oxley Act in the United States), operational efficiency (addressing processes that impact productivity, particularly within industries like manufacturing), risk management (identifying and mitigating financial risks, often highlighted in frameworks like COSO), and internal controls (evaluating processes aimed at preventing fraud, including segregation of duties). Important metrics also include audit frequency (determining quarterly or annual reviews), scope of audit (defining departmental audits versus comprehensive organization-wide assessments), and stakeholder awareness (engaging with departments like finance, HR, and IT for holistic insights). Furthermore, adhering to documented standards (such as International Standards on Auditing, ISA) ensures systematic reviews, fostering accountability and transparency throughout the organization.

Compliance Standards and Regulations

Preparing an audit checklist for compliance standards and regulations is essential for ensuring organizational adherence to legal requirements and industry standards. This checklist should include key areas such as financial reporting, data protection (like GDPR), environmental regulations, and workplace safety (OSHA guidelines). Specific sections could involve verifying documentation accuracy, employee training records, and procedures for handling confidential information. Additionally, including metrics for assessing compliance levels, such as the frequency of risk assessments and the status of previous audit findings, enhances the checklist's effectiveness. Regular updates based on changes in regulations (e.g., annually or after significant legislative amendments) are necessary to maintain relevance and thoroughness in compliance efforts.

Timeline and Schedule

Creating an effective audit checklist requires careful planning and adherence to a structured timeline. First, outline the key phases of the audit process, including preparation, fieldwork, and reporting. Typically, allocate 2 weeks for checklist preparation, ensuring stakeholders have enough time for review and input. Next, establish a schedule for audit activities, including a kickoff meeting at the beginning (Week 1), followed by data collection and onsite visits during Weeks 2 to 4. Clearly define deadlines for each section, ensuring they align with the overall audit timeline. Incorporate training sessions for audit team members on checklist usage during Week 3. Lastly, schedule a debriefing session one week before the final report is due, allowing time for any adjustments or additional findings to be integrated into the final checklist, enhancing overall effectiveness.

Contact Information and Support

Creating an audit checklist for Contact Information and Support is essential for maintaining effective communication channels within an organization. Key elements include listing all relevant departments (such as Customer Service, Technical Support, and IT Helpdesk) along with their contact numbers (e.g., Customer Service: +1-800-555-0199, Technical Support: +1-800-555-0123), email addresses (e.g., support@company.com), and office hours (e.g., Monday to Friday, 9 AM to 5 PM). Including escalation procedures ensures timely resolutions for critical issues, outlining hierarchies of support personnel. Additionally, verification of response times (e.g., initial response within 24 hours) can be a parameter in assessing support effectiveness. Keeping a comprehensive record within a centralized database (like a customer relationship management system) promotes accountability and accessibility for stakeholders.

Letter Template For Audit Checklist Preparation Samples

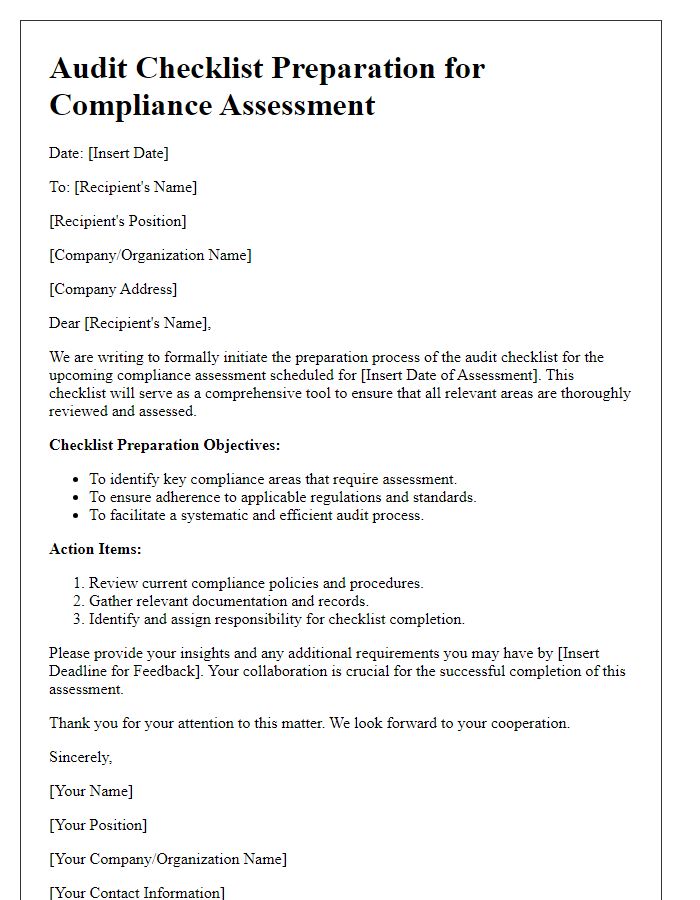

Letter template of audit checklist preparation for compliance assessment.

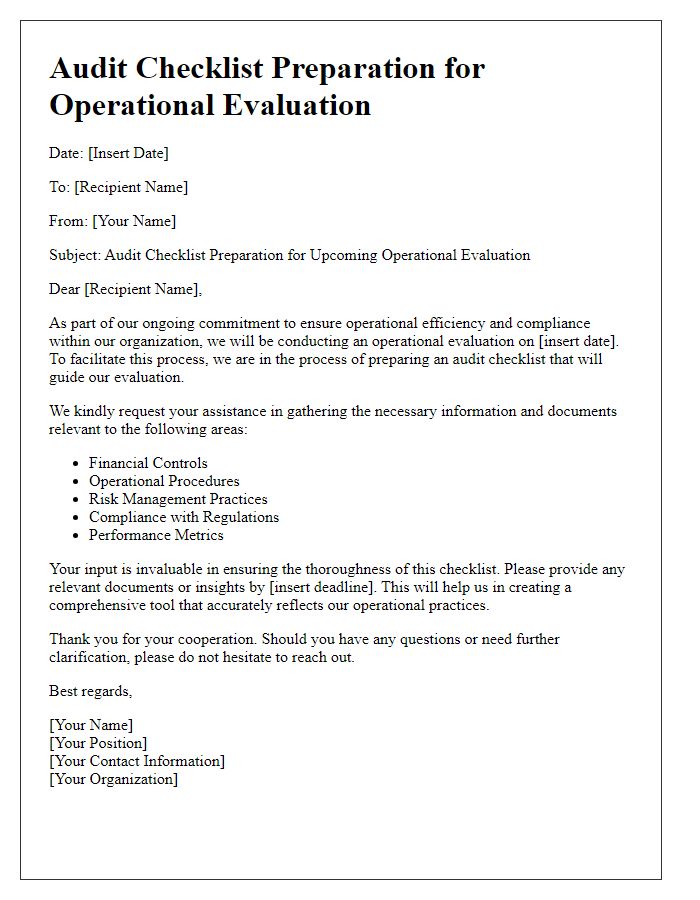

Letter template of audit checklist preparation for operational evaluation.

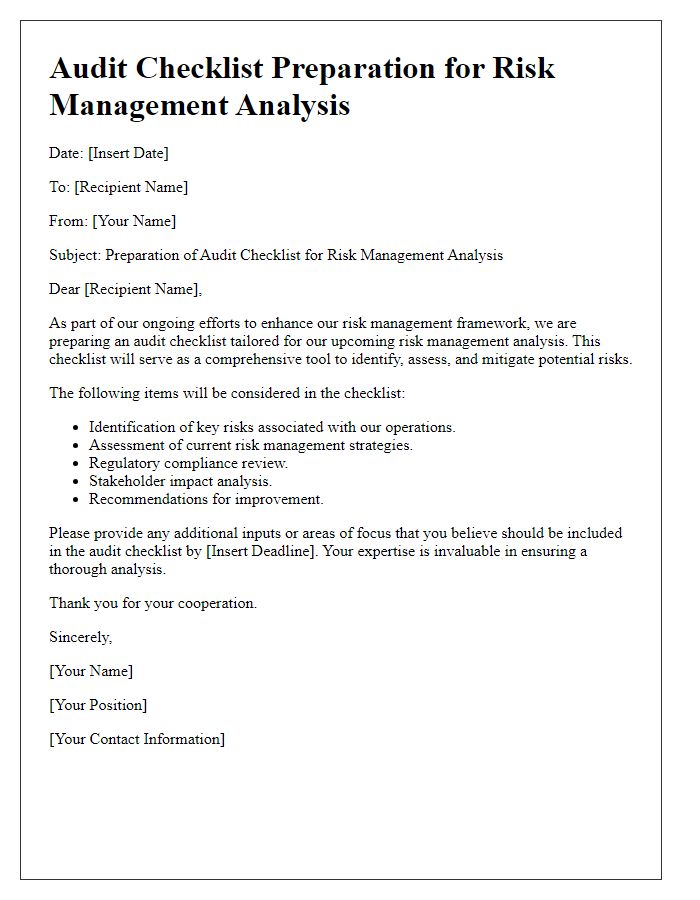

Letter template of audit checklist preparation for risk management analysis.

Letter template of audit checklist preparation for internal control assessment.

Letter template of audit checklist preparation for regulatory compliance audit.

Comments