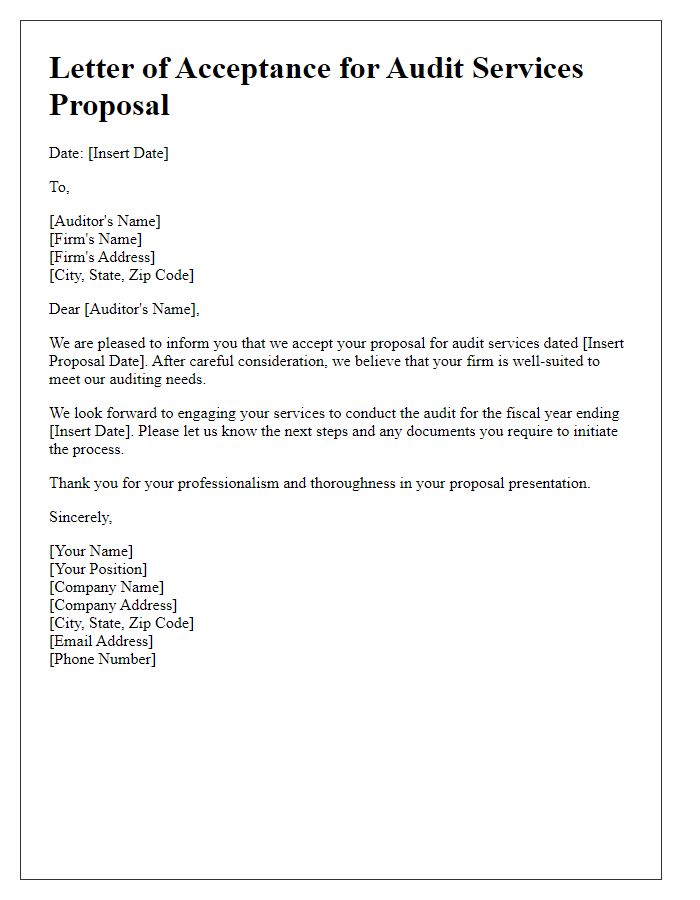

Are you considering bringing on audit services for your business but unsure where to start? A well-crafted letter can serve as the foundation for a successful audit services agreement, laying out key terms and expectations with clarity. This essential document not only establishes a professional relationship but also ensures that all parties are aligned on objectives and deliverables. Dive into our guide for tips and a template that can help you draft the perfect letter for your audit services agreement!

Clear Scope of Services

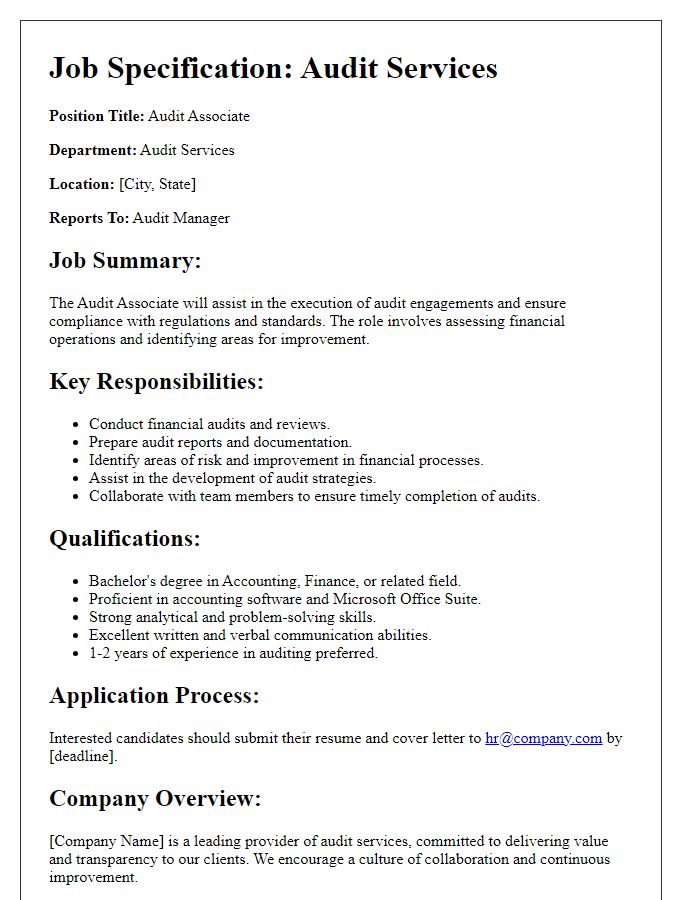

An audit services agreement outlines the precise scope of services provided by accounting firms, including detailed expectations for financial examination, compliance auditing, and internal control evaluations. Such agreements typically reference specific standards, such as Generally Accepted Auditing Standards (GAAS) established by the American Institute of Certified Public Accountants (AICPA). The document delineates the roles of each party involved, such as the auditor, who executes the examination, and the client, who supplies necessary documents and access to information. Additionally, timelines for report delivery, confidentiality clauses regarding sensitive financial data, and terms for determining the fees based on complexity and duration of the audit, typically referenced in hours. Clarity in defining objectives and deliverables promotes a transparent working relationship, minimizing risks of misunderstandings or disputes during the auditing process.

Billing and Payment Terms

Billing and payment terms serve as a crucial aspect of audit services agreements, defining the financial parameters of the engagement between the audit firm and the client organization. Typically outlined in detail, these terms specify essential components such as the fee structure, payment schedules, and conditions for invoicing. For instance, the audit firm may charge an hourly rate of $150 for each auditor, with an estimated total of 80 hours required to complete the audit process for the fiscal year ending December 31, 2023. In addition, payment terms often stipulate that invoices are issued bi-weekly, with payments due within 30 days of receipt. Late payments may incur a penalty of 1.5% per month, ensuring timely compensation for services rendered. Clear communication regarding these terms enhances transparency and fosters a professional relationship between the audit firm and the client organization.

Confidentiality Agreements

Confidentiality agreements are crucial in audit services agreements to protect sensitive financial information and proprietary data shared between parties. Specifically, these contracts include clauses that ensure information such as bank statements, tax returns, and internal control assessments remain confidential during audits. Unique identifiers, like company tax identification numbers (EINs), help safeguard corporate identities and mitigate the risk of data breaches. Additionally, the jurisdiction specified in the agreement, such as California or New York, influences the enforcement of confidentiality laws. Violating these agreements can lead to legal repercussions, including damages or injunctions, thus emphasizing the importance of clear terms and obligations within the contractual framework.

Termination Clauses

Termination clauses in audit services agreements outline specific conditions under which either party may terminate the contract, ensuring compliance with legal and operational standards. For instance, one key clause may stipulate a 30-day written notice requirement for termination without cause, safeguarding both parties' interests. Breach clauses could detail scenarios where immediate termination is possible, such as failure to adhere to accounting principles or regulatory requirements. Additionally, the agreement might specify obligations for the return of confidential information, ensuring sensitive client data remains protected post-termination. Consideration of applicable laws or industry regulations affecting termination clauses ensures legal soundness and clarity in the provisions.

Legal and Regulatory Compliance

An audit services agreement ensures legal and regulatory compliance for businesses, particularly in high-stakes industries like finance or healthcare. These agreements often outline the responsibilities of auditors, such as verifying compliance with regulations like the Sarbanes-Oxley Act in the United States. Auditors typically assess financial statements, ensuring conformity with International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Compliance audits occur annually and focus on adherence to laws, such as the Health Insurance Portability and Accountability Act (HIPAA) for healthcare providers. The agreement also specifies the consequences of noncompliance, which could lead to fines or legal action, emphasizing the importance of accuracy and transparency in financial practices.

Comments