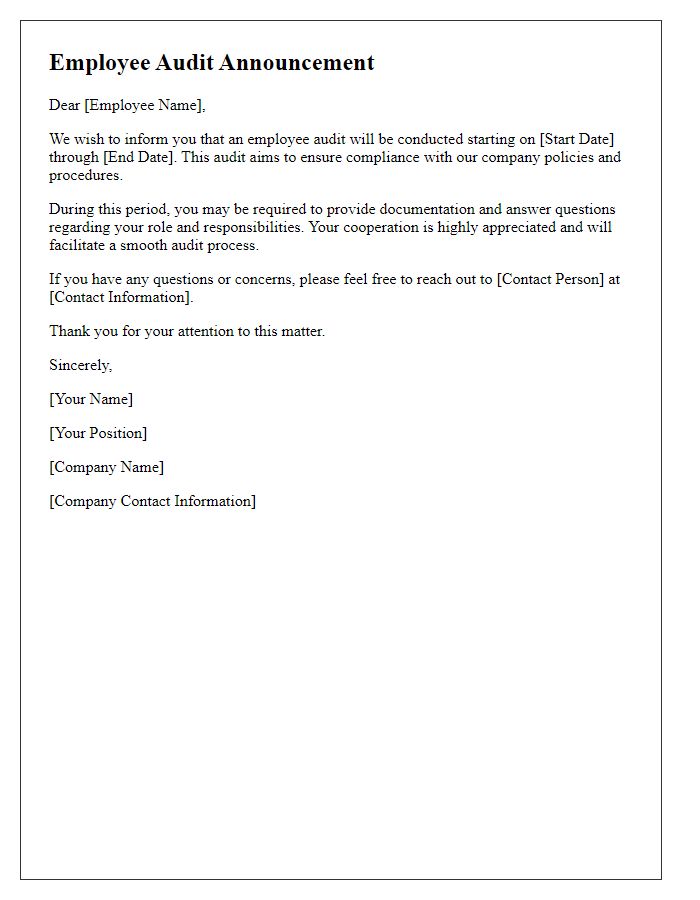

When it comes to employee audits, clear communication is key to ensuring a smooth process. This letter serves to inform you about the upcoming audit, which is an important part of maintaining our organizational standards and compliance. We understand that audits may raise questions and concerns, so we're here to provide all the necessary information to ease your mind. Stay tuned as we delve into the details of what you can expect during this upcoming audit process!

Opening Greeting

Employee audits serve as crucial assessments of organizational integrity, performance, and compliance. Notifications regarding these audits employ clear communication to stress importance and expectations. Audits may cover various aspects, including financial records, adherence to regulations, or operational efficiency, often scheduled quarterly or annually. The notification process typically involves direct emails or memos from management to inform employees about timelines, required documentation, and potential impacts on daily tasks. A professional tone is maintained throughout to ensure employees understand the significance of the audit while fostering transparency and cooperation.

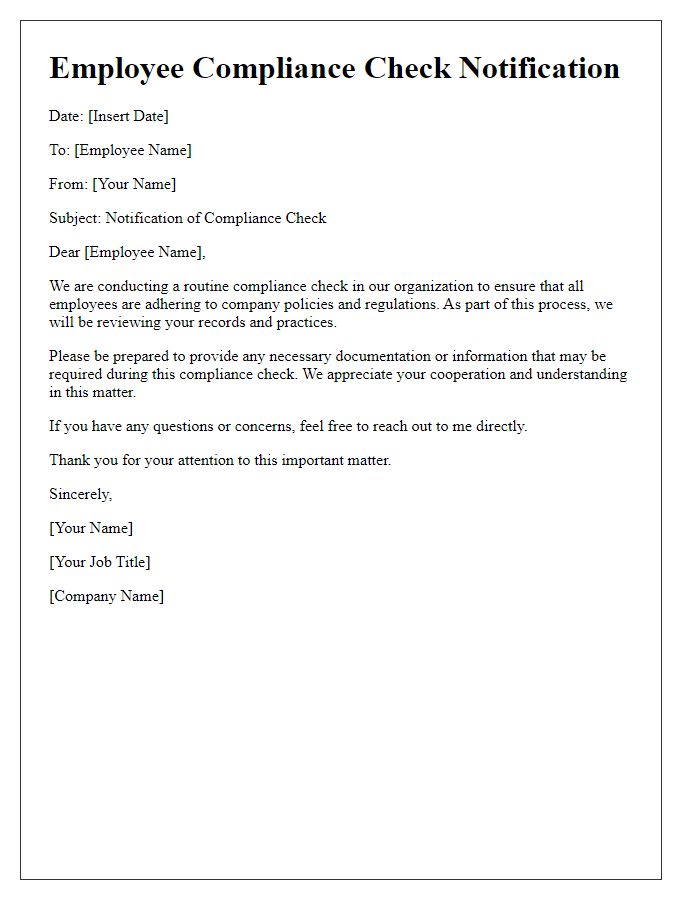

Purpose of the Audit

An employee audit serves as a critical assessment tool for organizations to evaluate compliance with internal policies and regulations, along with the effectiveness of operational processes. The primary purpose of this audit includes ensuring adherence to labor laws, such as the Fair Labor Standards Act (FLSA), and assessing the accuracy of employee records, including payroll, benefits, and performance evaluations. Conducting this audit can identify areas for improvement in human resources practices, enhance employee satisfaction, maintain organizational integrity, and reduce the risk of potential legal issues, thus fostering a more productive workplace environment. Furthermore, insights gained from the audit can inform strategic decisions that align with the company's goals and enhance overall operational efficiency.

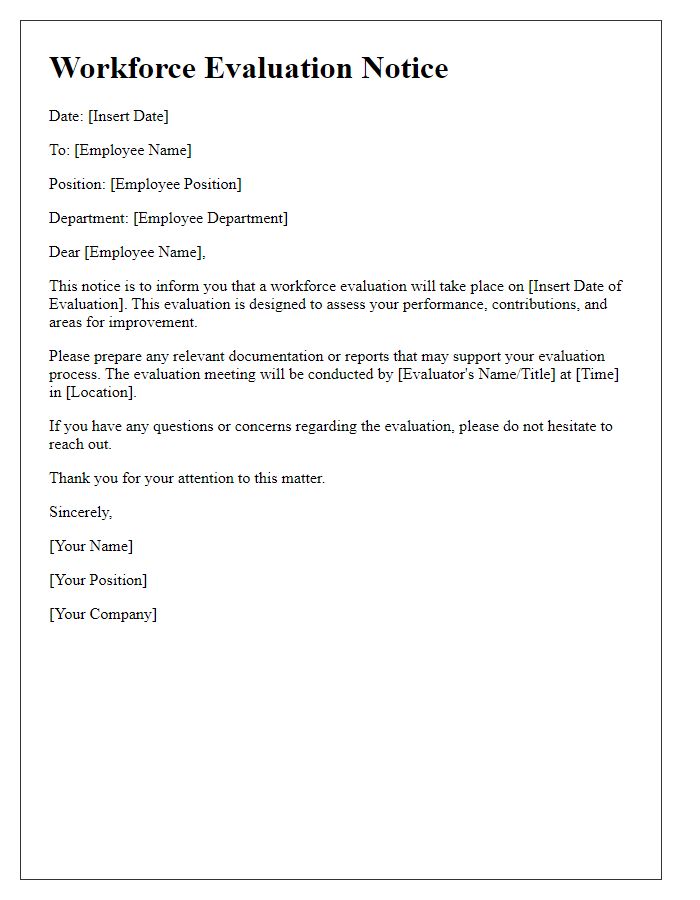

Audit Scope and Criteria

The employee audit notification outlines crucial aspects of the evaluation process within an organization. This audit focuses on compliance and operational efficiency, examining areas such as personnel records, employee conduct, and adherence to internal policies. Criteria for evaluation will include adherence to labor laws, employee training completion rates, and accuracy of payroll records. The audit will take place across various departments including Human Resources and Finance, aiming to ensure organizational integrity and optimize performance. Notifications will be disseminated to all relevant staff members, providing them with timelines and expectations for cooperation during the audit process, with scheduled audits set to commence in early December 2023.

Confidentiality Assurance

Confidentiality assurance during employee audits is crucial for maintaining trust and safeguarding sensitive information. An audit, often conducted by an internal or external team, assesses compliance with company policies and legal requirements. During this process, employee data, financial records, and operational details may be examined, emphasizing the importance of confidentiality protocols. Personal identification information (PII), such as Social Security numbers and performance evaluations, must remain protected to prevent unauthorized access. Furthermore, clear communication regarding audit procedures, timelines, and the handling of findings reinforces transparency and assures employees of their privacy during the audit process.

Contact Information for Inquiries

During an employee audit, timely communication is vital to ensure smooth operations and address any inquiries. Relevant contact information should be provided clearly, stating a designated point of contact within the Human Resources department, such as a specific HR manager or audit coordinator. Including their full name, job title, email address (e.g., hr_auditor@company.com), and direct phone line (such as +1-555-123-4567) creates easier access for employees needing assistance or clarification throughout the audit process. Ensuring that office hours (e.g., Monday through Friday, 9 AM to 5 PM) are included reinforces availability and readiness to support employees during this crucial time.

Comments