When it comes to conducting an audit risk assessment, it's crucial to approach the process with clarity and precision. This letter template serves as a valuable tool to streamline communication and ensure all necessary elements are covered effectively. By outlining the purpose, scope, and expectations, you can pave the way for a thorough and systematic audit. Ready to enhance your audit process? Dive in and discover how our template can simplify your risk assessment journey!

Purpose and Scope of Audit

Audit risk assessment involves evaluating potential risks that could affect the accuracy of financial statements and overall operations within an organization, such as a corporation or nonprofit entity. The primary purpose includes identifying areas vulnerable to misstatement or fraud and ensuring compliance with relevant regulations such as the Sarbanes-Oxley Act in the United States. The scope of the audit typically encompasses examining financial records, internal controls, and operational processes across various departments, including procurement, revenue recognition, and payroll. Specific attention is also directed toward areas of high risk, like revenue streams from significant contracts and transactions above predetermined thresholds (e.g., $100,000), as well as any significant estimates or judgments made in financial reporting, such as allowance for doubtful accounts or inventory valuation methods. This thorough assessment aims to provide stakeholders with reliable insights and instill confidence in financial disclosures.

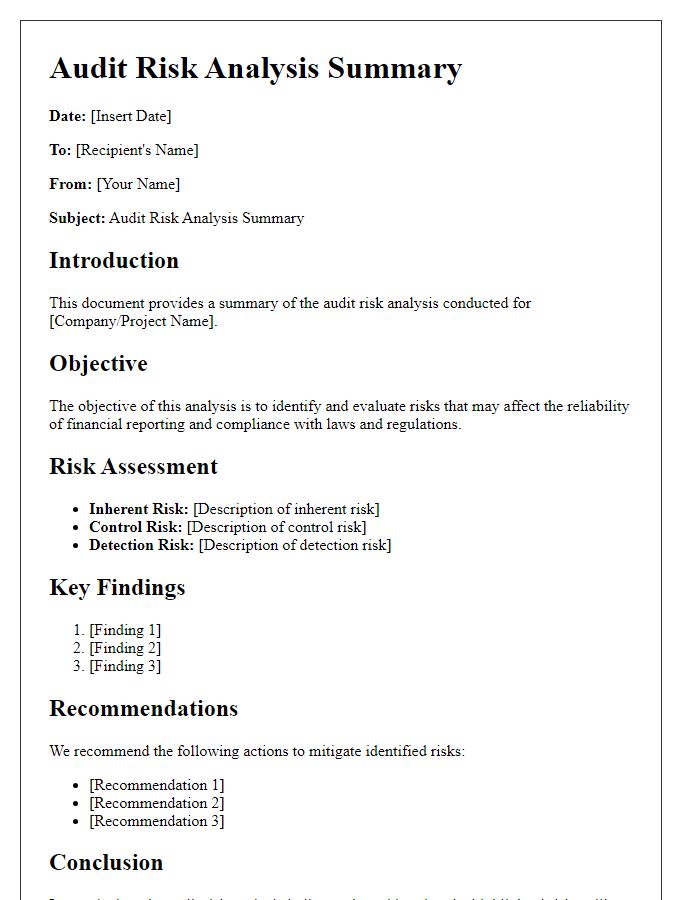

Identification of Key Risks

Identification of key risks in audit assessments involves recognizing significant factors that may compromise financial integrity and operational effectiveness. Common risks include fraud, often involving dishonest financial reporting or asset misappropriation, which can lead to material misstatements. Regulatory compliance failures, particularly regarding the Sarbanes-Oxley Act of 2002, may result in severe penalties and reputational damage. IT system vulnerabilities, such as outdated software or inadequate security measures, may expose sensitive data to breaches and cyber-attacks. Economic factors, including a decline in market demand or supply chain disruptions, can impact revenue forecasts and operational budgets. Additionally, management override of controls poses a threat to the reliability of financial information, highlighting the importance of establishing a strong internal control environment to mitigate these risks effectively.

Assessment Methodology

The audit risk assessment methodology involves a systematic approach for identifying and evaluating potential risks within an organization's financial reporting processes. This process typically includes five steps: first, the identification of significant accounts and assertions, which might include areas such as revenue recognition exceeding $1 million or inventory valuation over $500,000; second, the assessment of inherent risk, considering factors such as industry conditions, regulatory environment, and historical financial data over the past three years; third, the evaluation of control risk, focusing on the effectiveness of internal controls and procedures in mitigating risks; fourth, the determination of audit risk, calculated by combining inherent risk and control risk to ascertain an acceptable level of risk for the audit; and finally, the development of an audit plan tailored to address identified risks, including specific test procedures and timelines to ensure compliance with standards such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Regular updates and reviews of this methodology are vital, especially in dynamic sectors such as technology or healthcare, where regulatory changes occur frequently.

Control Measures and Recommendations

Control measures for audit risk assessment play a crucial role in maintaining financial integrity and operational efficiency. Effective internal controls, such as segregation of duties, help prevent fraudulent activities by ensuring that no employee has unilateral control over significant transactions. Regular training programs are essential to enhance employee awareness regarding compliance with industry regulations, particularly in sectors such as finance and healthcare. Periodic audits, typically conducted annually by external firms, assess the robustness of these controls and highlight areas for improvement. Utilizing advanced data analytics tools can also identify anomalies in transaction patterns, leading to timely interventions. Establishing a clear reporting framework ensures that findings are communicated effectively to senior management, fostering a culture of transparency and accountability within organizations. Proper documentation and follow-up on audit recommendations are vital for ensuring that control measures adapt to evolving risks and regulatory requirements.

Contact Information for Queries and Clarifications

The audit risk assessment process involves comprehensive analysis and evaluation of financial data and internal controls. For clarity and enhanced communication, audit teams should provide contact information for queries and clarifications. This includes names of designated auditors or compliance officers along with their respective email addresses and phone numbers for immediate assistance. Timely responses to inquiries can facilitate understanding of complex audit paradigms, ensuring stakeholders grasp potential risk factors such as fraud (intentional misrepresentation leading to financial misstatement), non-compliance (failure to adhere to applicable laws and regulations), or material misstatement (significant inaccuracies in financial reporting). A streamlined communication process can ultimately enhance the efficacy of the audit and increase confidence in the financial statements of the organization.

Comments