Welcome to our guide on crafting the perfect letter template for audit management responses! In the world of audits, clear communication is key to addressing findings and implementing changes effectively. This article will walk you through essential components to include in your response, ensuring that you convey your insights and corrective actions accurately. So, let's dive in and explore how to create a compelling audit management response that resonates with your stakeholders!

Acknowledgment of Audit Findings

Acknowledgment of audit findings is a critical aspect of effective audit management, reflecting a commitment to transparency and continuous improvement in organizational processes. This acknowledgment typically identifies specific audit findings, such as identified control weaknesses (e.g., deficiencies in internal controls for financial reporting), and outlines initial responses for each issue. For instance, findings related to compliance with the Sarbanes-Oxley Act (SOX) may necessitate a review of existing financial reporting practices and the implementation of improved internal controls. Furthermore, the response may highlight specific actions to be taken, such as scheduled training programs for staff or a timeline for corrective action plans. The acknowledgment serves not merely as recognition but sets the stage for accountability and progress tracking during subsequent audits.

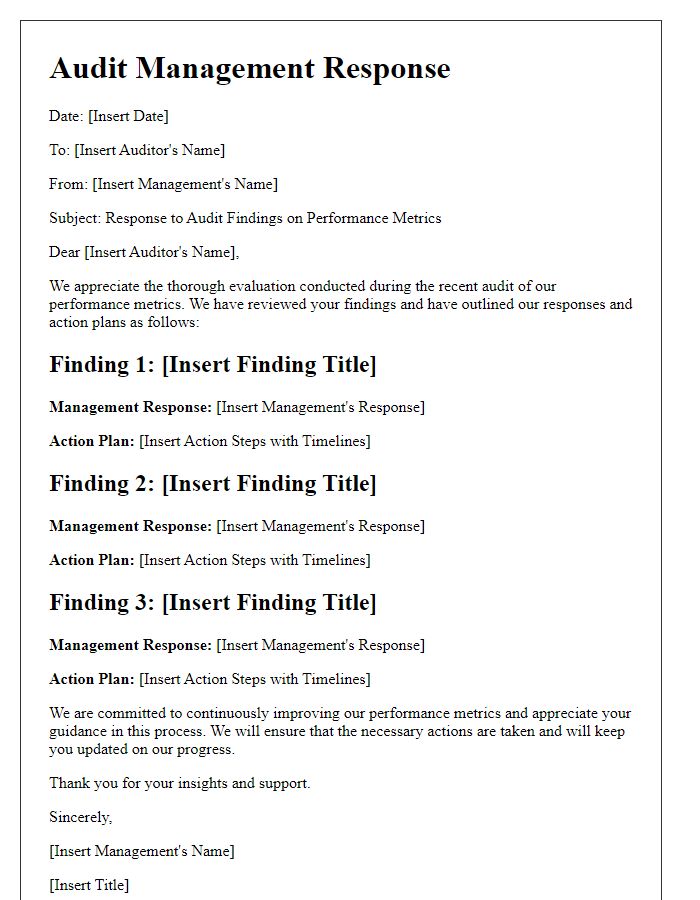

Detailed Response to Each Finding

An effective audit management response highlights key findings, such as compliance lapses, inefficiencies, and risk exposures identified in the fiscal assessment period. Each finding deserves careful attention--risk assessment findings pinpoint areas such as internal controls, financial misstatements, or regulatory violations. For instance, a significant finding regarding non-compliance with Federal Accounting Standards (FAS) may require a specific action plan consisting of staff training sessions scheduled in the next quarter, alongside a detailed timeline for implementing revised procedures. Additionally, findings related to data integrity breaches emphasize the necessity for upgrading cybersecurity infrastructure, including software updates and vulnerability assessments within 60 days, to safeguard sensitive information. By addressing each finding systematically, organizations strengthen their governance frameworks and enhance operational effectiveness.

Proposed Corrective Actions

Proposed corrective actions for audit management often involve detailed plans designed to address identified deficiencies in business operations or financial reporting. These actions might include implementing new internal controls, such as segregation of duties, to enhance accountability and reduce the risk of errors or fraud. Training programs could be established for staff, especially in areas like compliance and financial reporting, to ensure that all employees understand regulatory requirements and organizational policies. Additionally, technology upgrades may be proposed, such as the introduction of advanced accounting software with built-in error detection features, to streamline processes and increase accuracy. Regular monitoring and evaluation processes should be scheduled, perhaps quarterly, to assess the effectiveness of these corrective actions and ensure continuous improvement.

Timelines for Implementation

Timelines for implementation play a crucial role in audit management responses, ensuring accountability and progress tracking in organizations. Specific timelines can delineate the expected completion dates for recommendations identified during the audit process, such as the financial audit conducted by Deloitte in Q2 2023. For instance, a management response might outline that corrective actions related to internal controls will be completed within 60 days post-audit report issuance, while broader policy changes may take up to six months to finalize. Each timeline must clearly indicate responsible parties and expected milestones to facilitate effective monitoring. Additionally, regular status updates, such as bi-weekly progress reports, can help maintain transparency and engage stakeholders throughout the implementation phase, driving successful outcomes.

Contact Information for Follow-Up

Effective audit management response processes require clear contact information for follow-up inquiries. Key stakeholders, such as auditors, compliance officers, and department heads, should provide their full names, job titles, and direct phone numbers for immediate communication. Email addresses must be professional and easily accessible, allowing for documentation of all correspondence. Additionally, including the preferred contact method ensures timely responses, while establishing a specific timeframe for follow-up (preferably within 72 hours) can enhance accountability in addressing audit findings. Clear delineation of responsibilities assigned to each contact person can also facilitate smoother communication channels during the audit process.

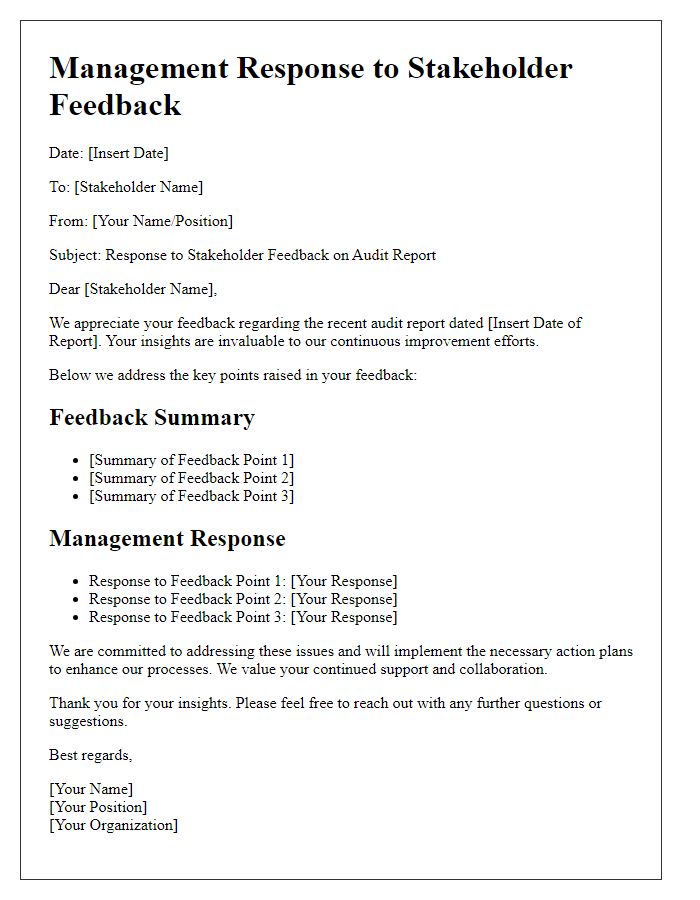

Letter Template For Audit Management Response Samples

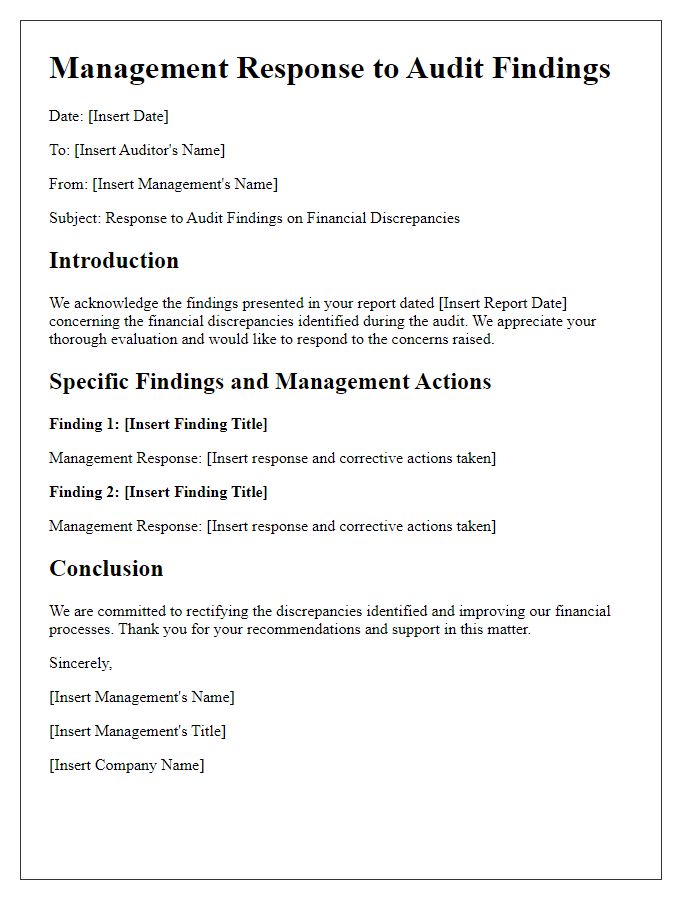

Letter template of audit management response for financial discrepancies.

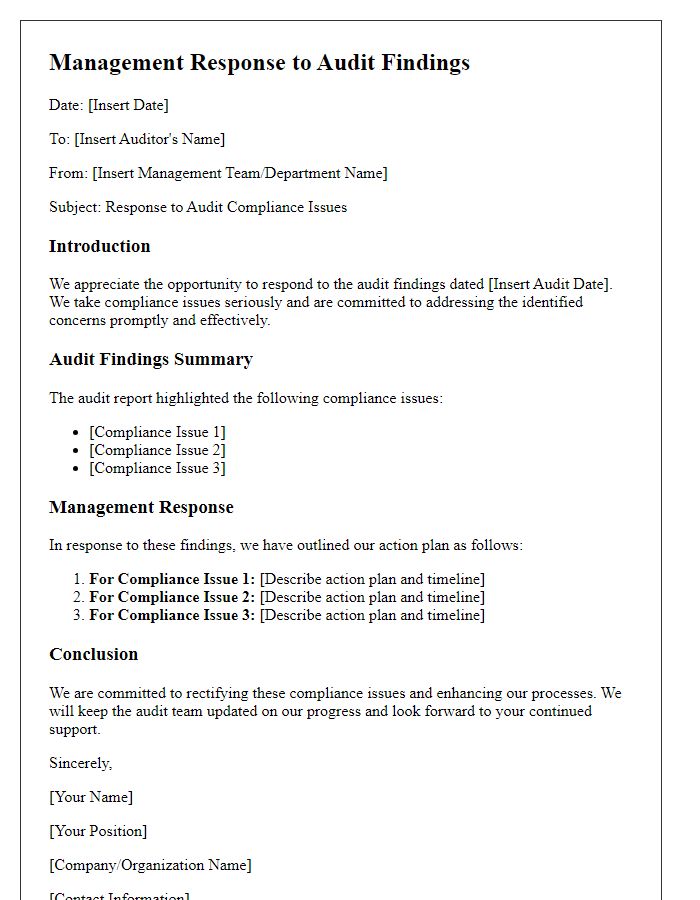

Letter template of audit management response addressing compliance issues.

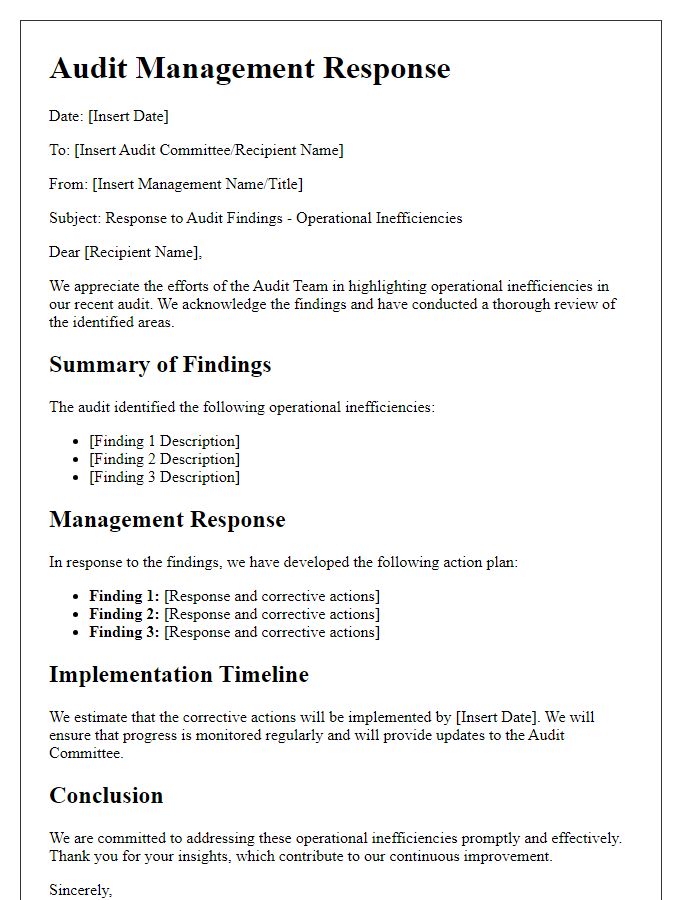

Letter template of audit management response regarding operational inefficiencies.

Letter template of audit management response for risk assessment findings.

Letter template of audit management response to internal control weaknesses.

Letter template of audit management response to external audit findings.

Letter template of audit management response concerning regulatory compliance.

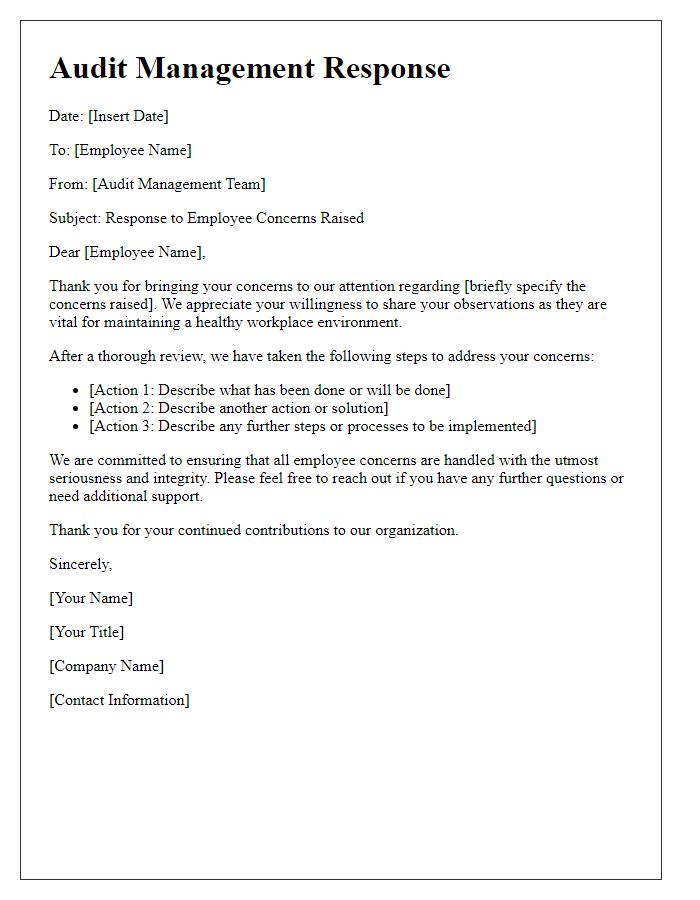

Letter template of audit management response for employee concerns raised.

Comments