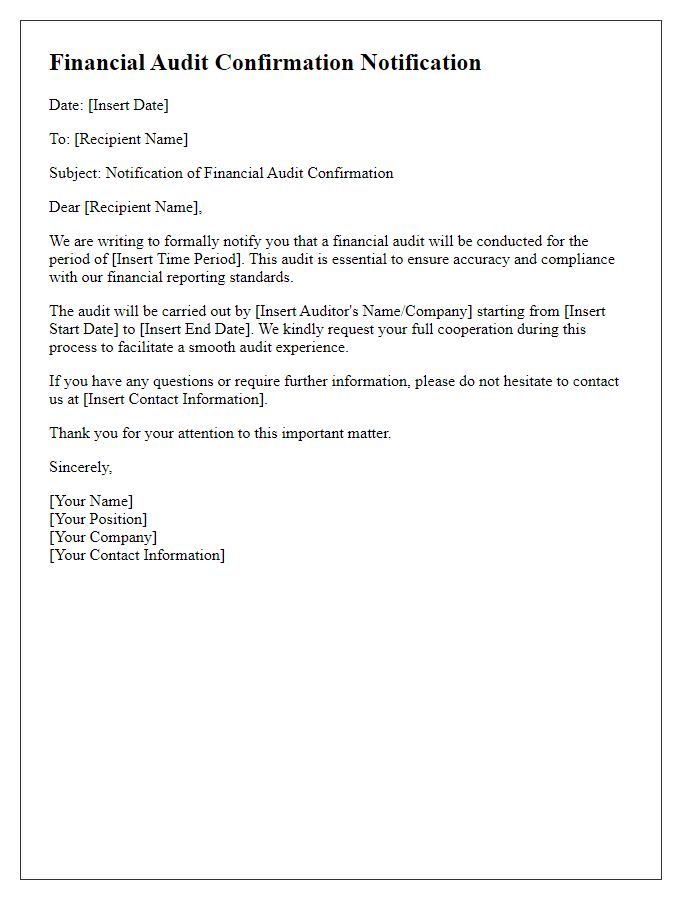

When it comes to external audits, communication is key, and a well-crafted letter for audit confirmation can make all the difference. This important document facilitates transparency between auditors and the entities being audited, ensuring that all parties are on the same page regarding financial statements and supporting documents. By providing clear and cogent information, it not only fosters trust but also streamlines the audit process. Ready to dive deeper into how to create an effective letter for external audit confirmation? Keep reading!

Audit Scope and Objectives

The external audit confirmation process is crucial for ensuring the accuracy and reliability of financial statements. Auditors primarily focus on verifying balances in accounts, such as cash, inventory, and receivables, while assessing compliance with relevant standards like Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Objectives include identifying misstatements, evaluating internal controls, and providing assurance on the financial health of the organization, located in regions with specific regulatory requirements, such as the United States or the European Union. The audit scope often extends to the review of procurement processes, transaction records, and revenue recognition methods. Additionally, any discrepancies uncovered during this process might lead to further investigation into financial practices and reporting integrity.

Financial Period Under Review

During the external audit confirmation process, the financial period under review, specifically for fiscal year 2022, requires meticulous scrutiny of financial statements and account balances that reflect the organization's fiscal activities. Key audit areas include revenue recognition practices within the month of December, accounts receivable aging analysis as of January 31, 2023, and inventory valuations reported on the annual financial report. Auditors (such as those from KPMG or Deloitte) will analyze transaction records, bank statements, and supporting documentation to ensure compliance with Generally Accepted Accounting Principles (GAAP). The confirmation letter also requests the verification of balances with external parties, such as suppliers or banks, ensuring that all discrepancies are addressed promptly for accurate financial reporting.

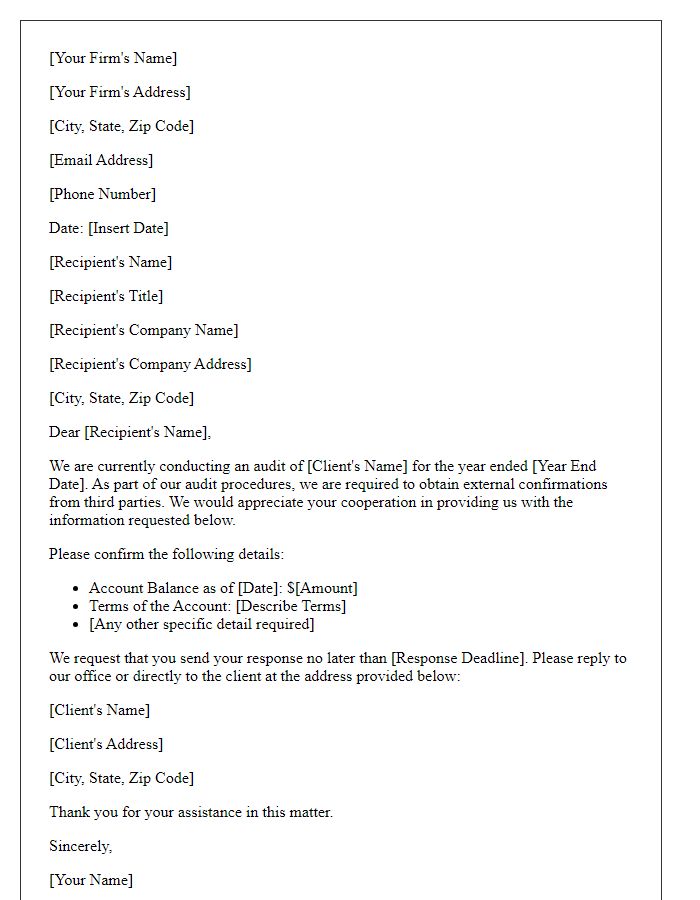

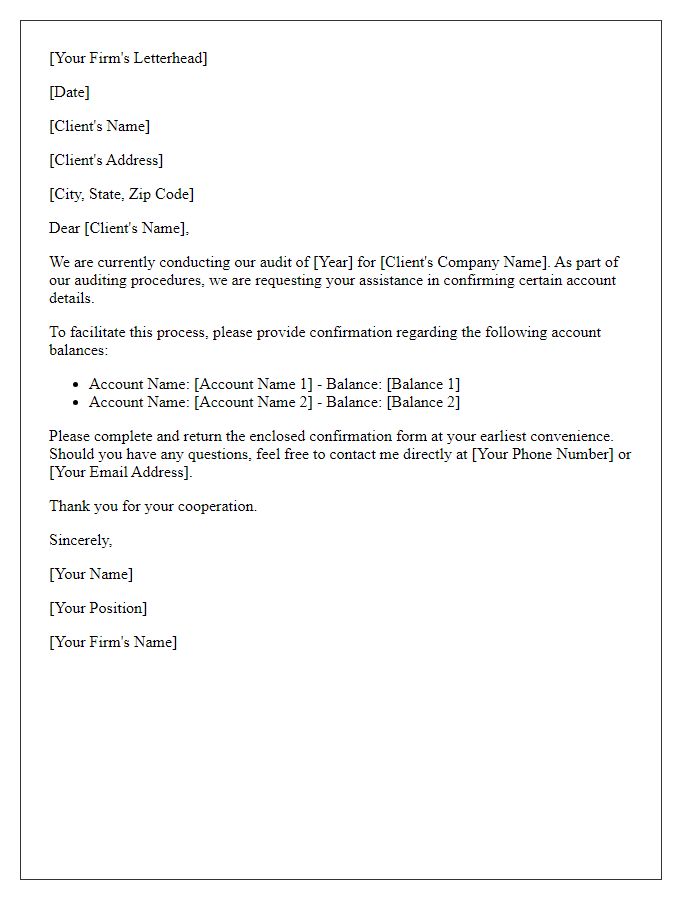

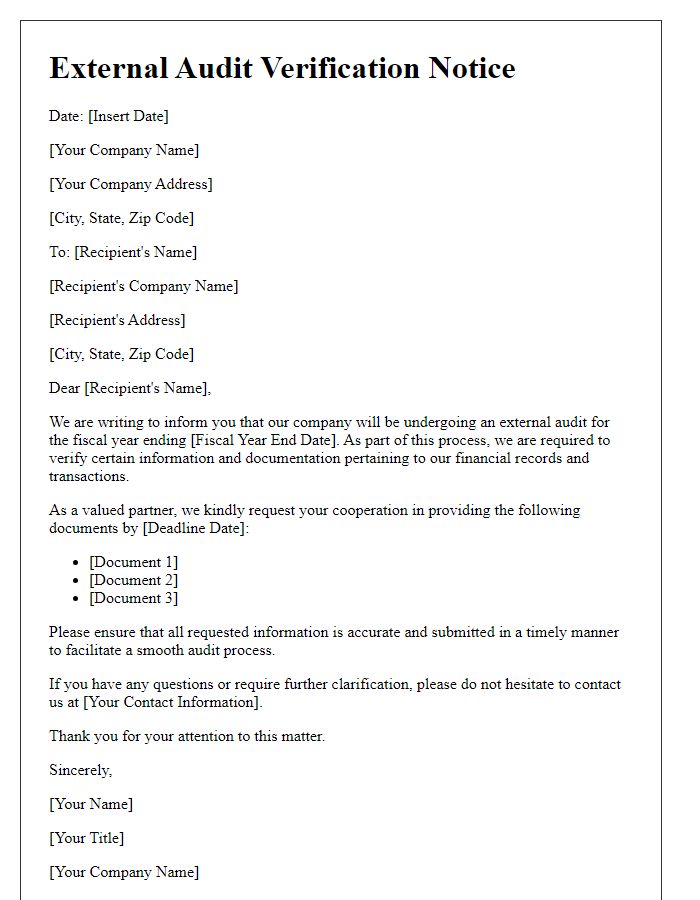

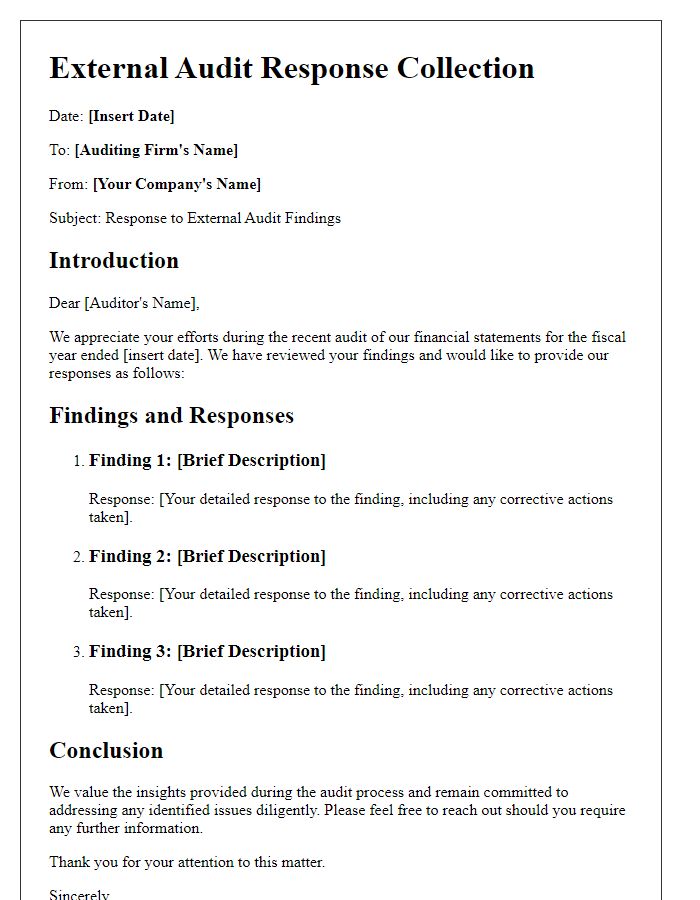

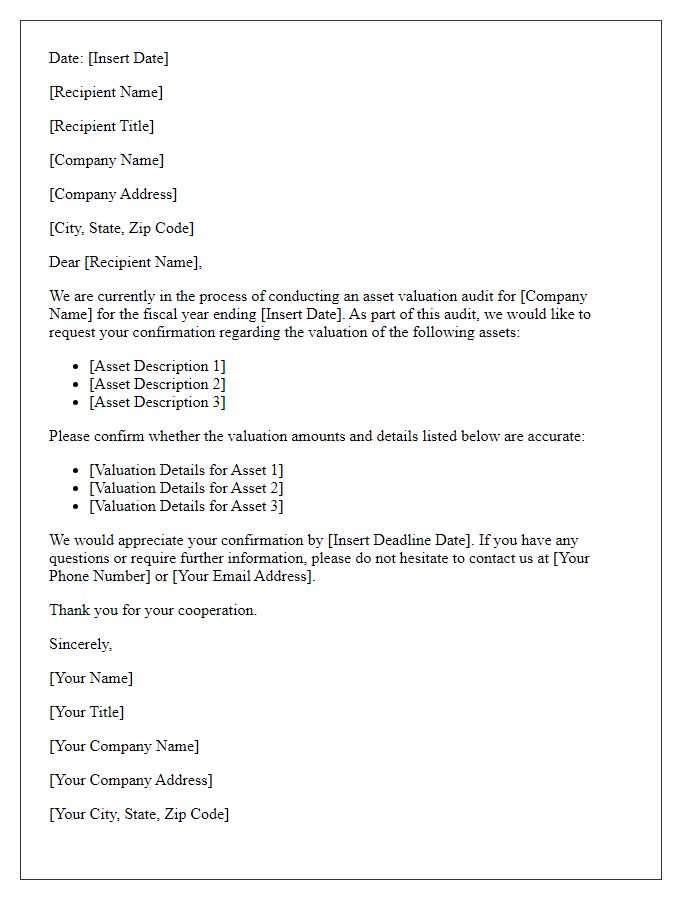

Confirmation of Transactions

External audits often require confirmation of financial transactions to ensure accuracy and compliance. Confirmation requests, typically addressed to banks, suppliers, or clients, seek verification of specific account balances, transactions, or outstanding debts. These confirmations serve as critical evidence supporting financial statements prepared in accordance with International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Auditors may specify the date of the transactions, amounts, and any relevant contract numbers in their requests to ensure precise verification. This process enhances transparency, reinforces trust in financial reporting, and mitigates risks associated with fraud or errors in accounting records.

Authorized Signatures and Contacts

External audit confirmations serve as a vital tool to verify financial statements and account balances with external parties. These confirmations necessitate authorized signatures from both the auditing firm and the client organization, typically accounting for figures such as cash balances, receivables, or payables. Key contacts involve designated representatives from both the client's financial department and the external auditing firm, ensuring clear communication throughout the confirmation process. This meticulous coordination helps maintain the integrity of financial reporting, essential for stakeholders such as investors and regulatory bodies. Proper documentation including verification dates enhances the audit trail, reinforcing trust and transparency in financial practices.

Response Deadline and Instructions

External audit confirmation responses require clarity regarding deadlines and instructions to ensure compliance and accuracy. Entities should aim to submit their confirmation responses by the specified deadline, often set between 14 to 30 days from the date of the request. Clear instructions detailing the preferred communication method (email, fax, or postal) and required documentation should accompany the request. This includes the legal entity's details, such as name and address, account numbers, and specific queries regarding balances or transactions. Accurate and timely submissions are crucial for effective audit procedures, facilitating transparency and accountability in financial reporting.

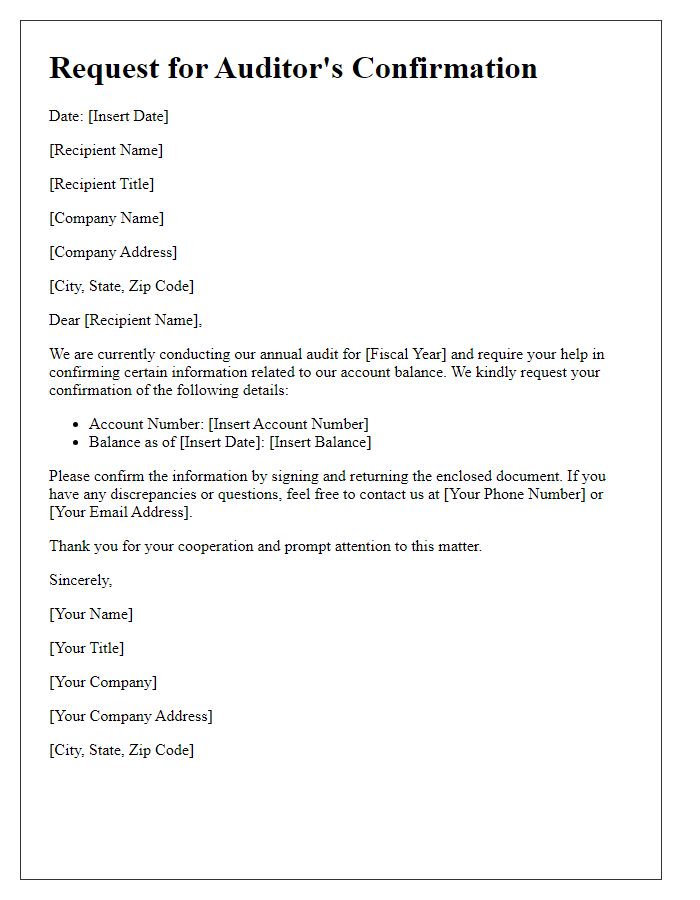

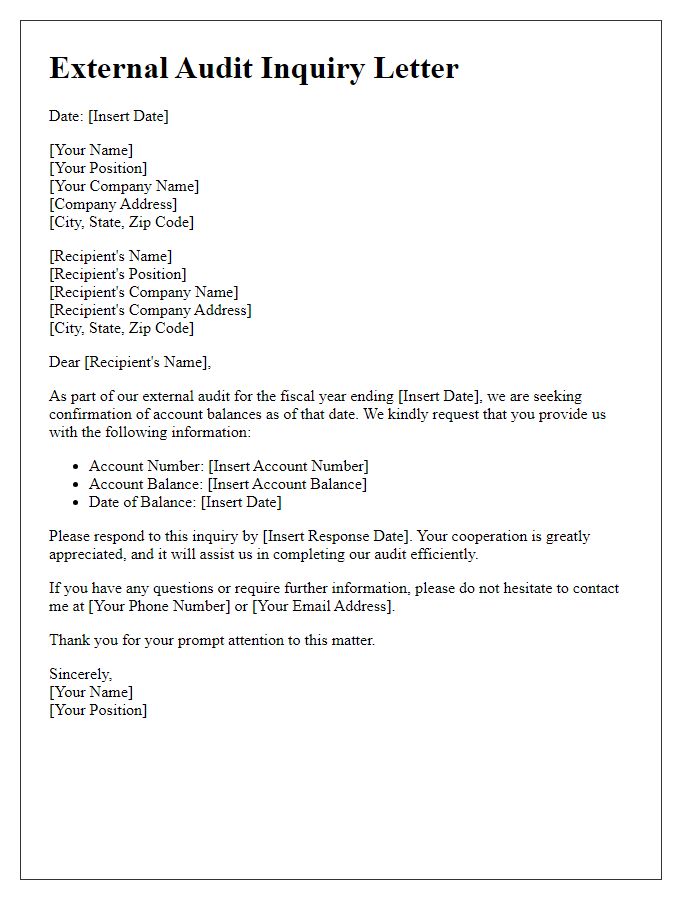

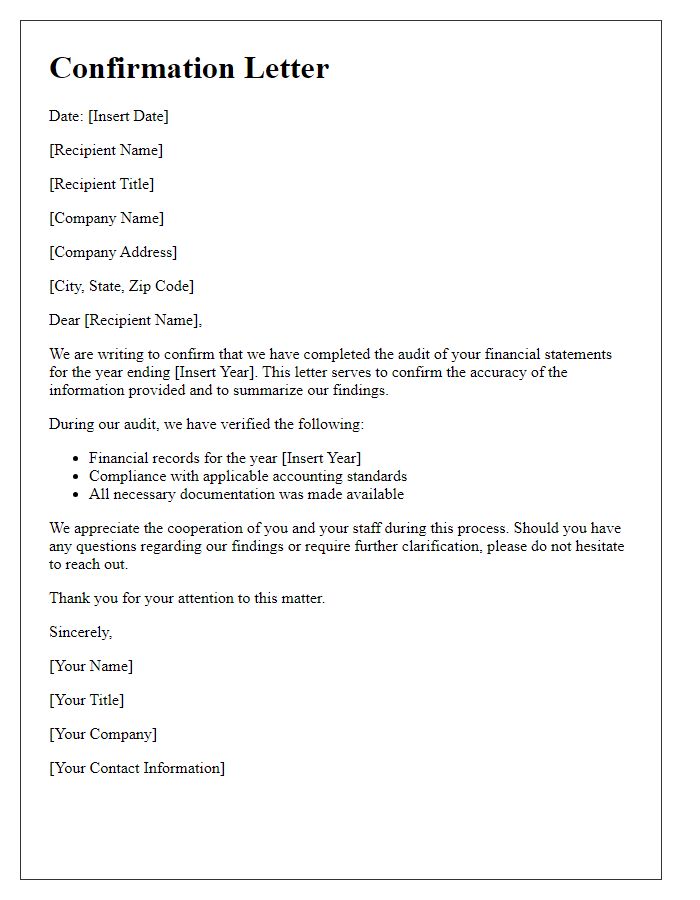

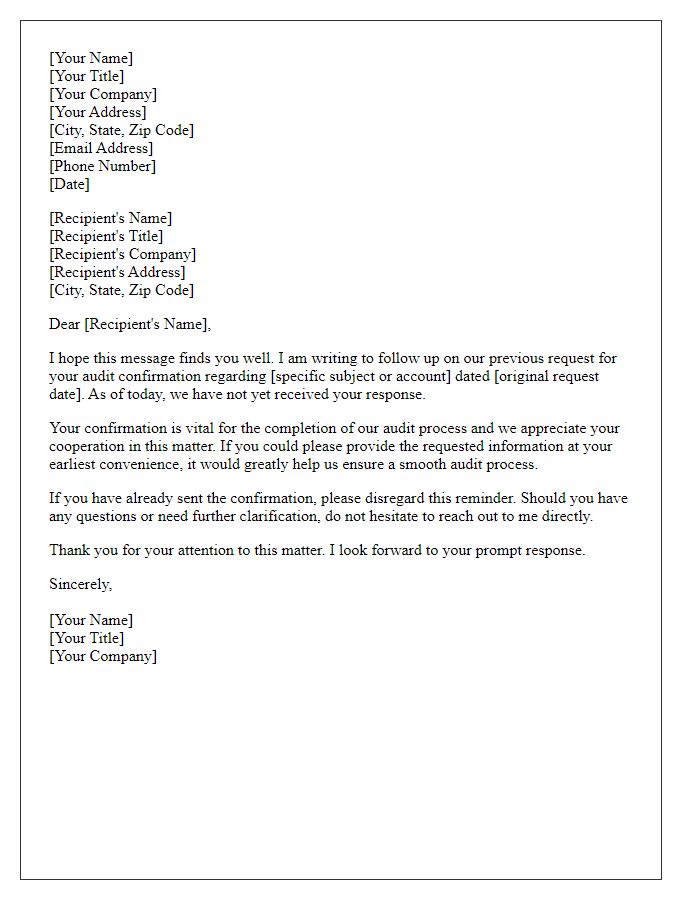

Letter Template For External Audit Confirmation Samples

Letter template of external auditor confirmation letter to third parties

Comments