Are you looking for an effective way to streamline your audit staff scheduling process? A well-crafted letter template can save you time and ensure clear communication among team members. By establishing a reliable schedule, you can enhance productivity and keep everyone on the same page. So, grab this opportunity to learn more about creating your ideal audit staff scheduling letter template!

Staff availability and preferences

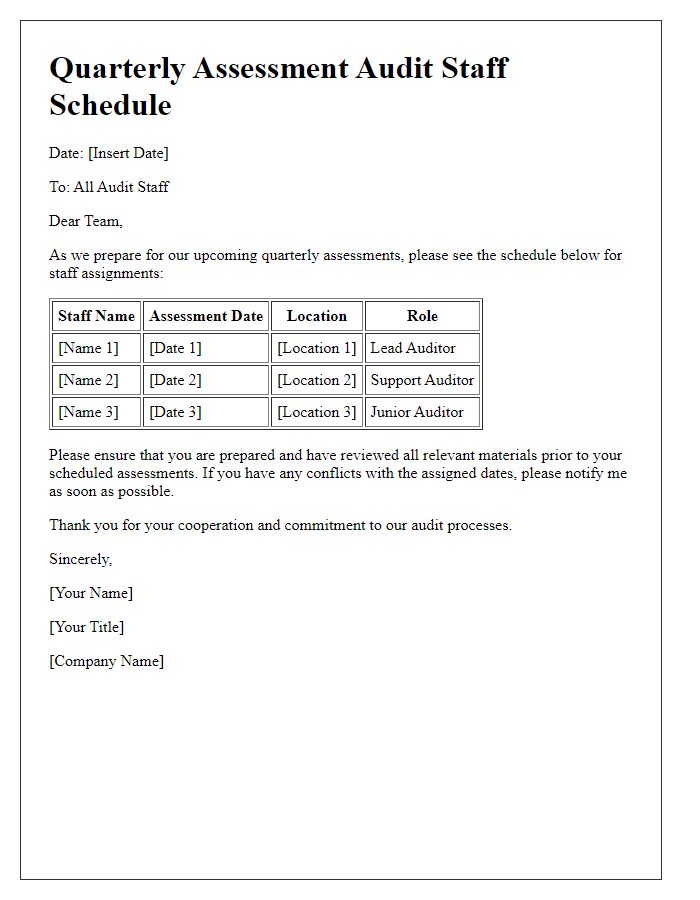

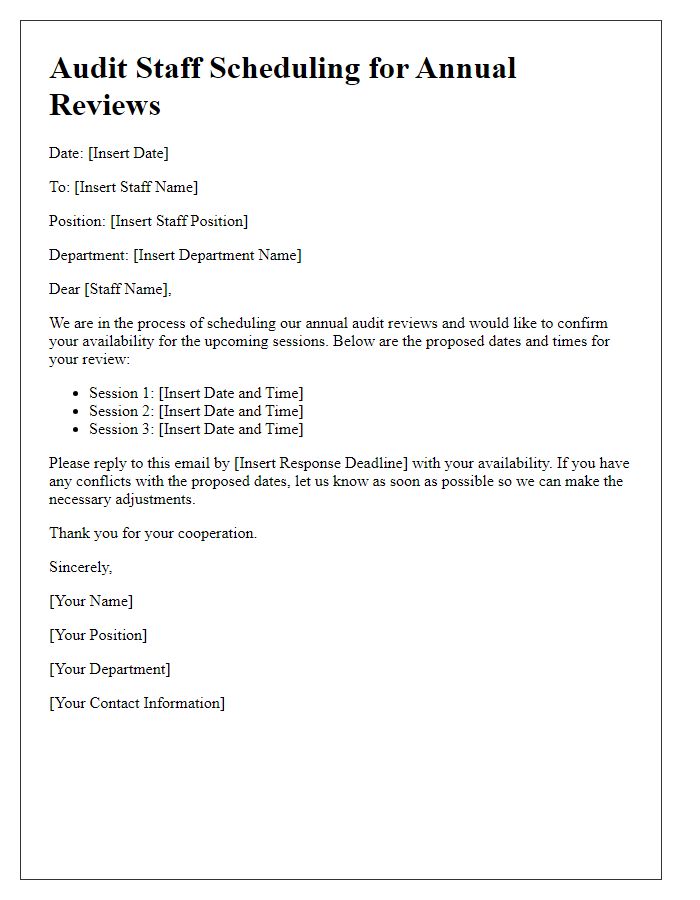

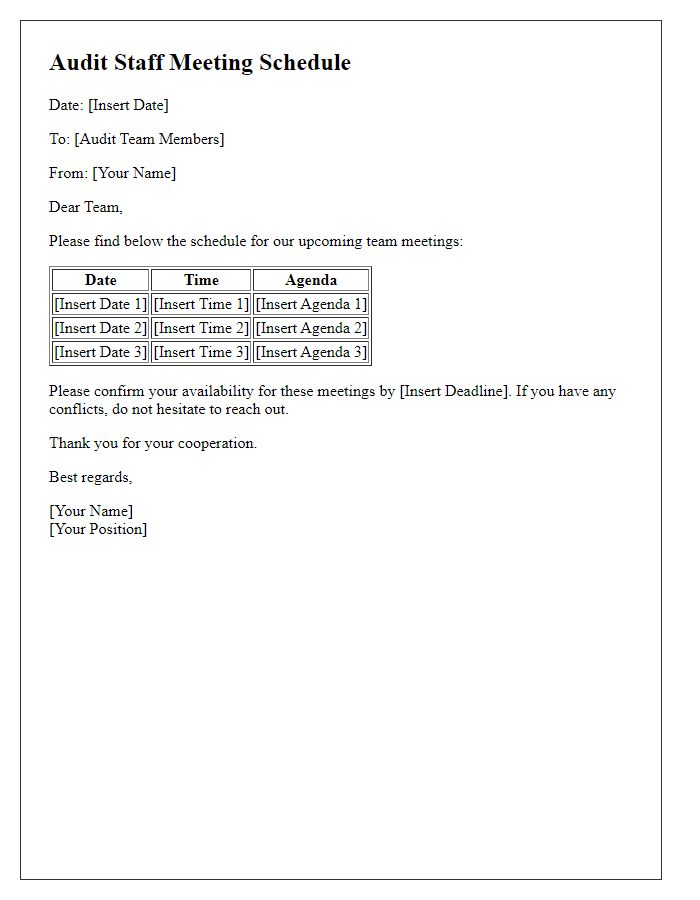

Effective audit staff scheduling requires careful consideration of staff availability and preferences to optimize team productivity and project success. Many audit teams consist of certified professionals, such as CPAs (Certified Public Accountants) and internal auditors, who possess varying degrees of expertise, with members often juggling multiple responsibilities across different client audits. Ideally, the scheduling process incorporates individual work schedules, professional development commitments, and personal preferences for certain projects or clients. Recognizing peak audit seasons, like year-end fiscal reviews in December or quarterly assessments in April, is essential in ensuring an equitable distribution of workload. This strategy enhances team morale and maximizes efficiency, leading to successful audit outcomes that benefit both the firm and its clients.

Audit project requirements and deadlines

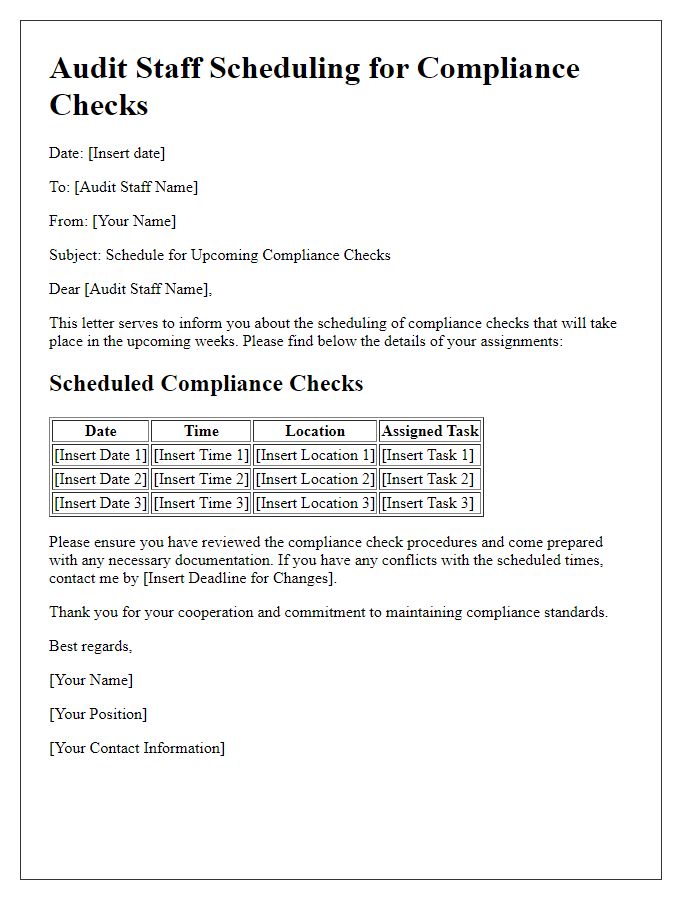

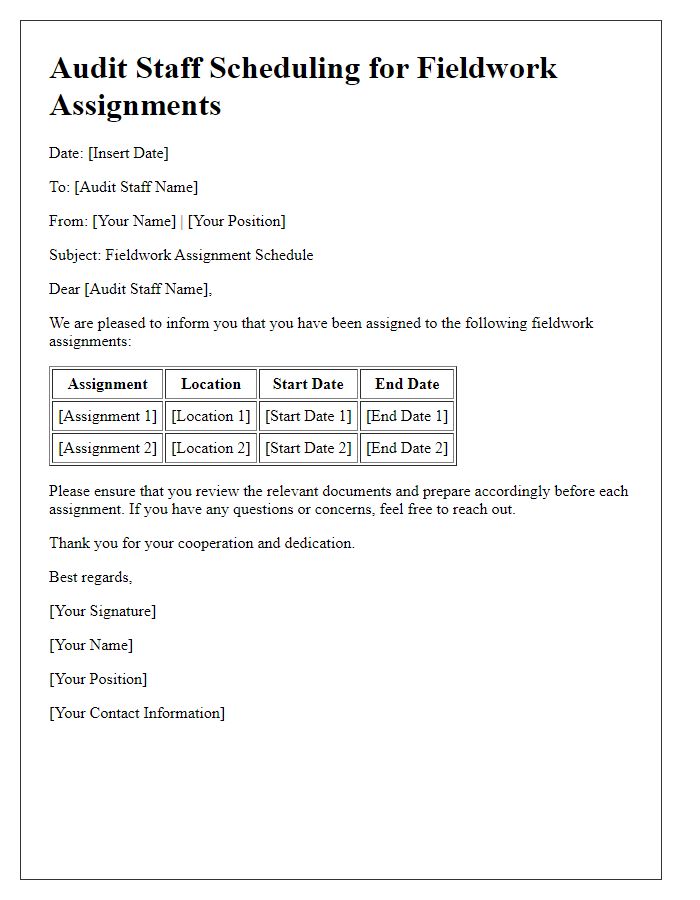

Audit project scheduling requires precise management to meet stringent deadlines and ensure comprehensive compliance with regulatory frameworks. Each project may involve key milestones, such as planning meetings (scheduled 30 days before the audit's commencement), fieldwork (conducted over a two-week period at the client's site), and report submission (typically due within three weeks post-fieldwork). Team assignment should consider expertise in areas such as tax regulations, internal controls, and financial statement analysis. Regular updates (weekly team briefings) on progress and challenges can enhance collaboration and maintain alignment with the project timeline. Adhering to these structured timescales is crucial for fulfilling stakeholder expectations and meeting the set audit standards of organizations like the International Auditing and Assurance Standards Board (IAASB).

Skill sets and expertise alignment

Effective audit staff scheduling requires careful alignment of skill sets and expertise with specific project demands. For instance, when managing an audit for a multinational corporation, skill sets may include proficiency in International Financial Reporting Standards (IFRS), experience in risk assessment methodologies, and knowledge of industry-specific regulations such as Sarbanes-Oxley. Each audit team member's expertise, whether in tax compliance, forensic accounting, or information technology auditing, should be matched with the audit objectives, enhancing team efficiency. Additionally, incorporating tools like Gantt charts (visual project scheduling tools) helps in visualizing timelines and resource allocation, ensuring that each aspect of the audit is adequately addressed. Ultimately, the right alignment fosters a seamless audit process, leading to thorough and accurate financial assessments.

Resource allocation and workload distribution

Effective audit staff scheduling requires meticulous resource allocation and equitable workload distribution. Audit teams typically comprise professionals with diverse expertise, such as Certified Public Accountants (CPAs) and Internal Auditors, each bringing specific skill sets to the project. The workload must reflect the complexity of tasks, which can range from financial statement analysis to compliance testing, impacting staff hours and productivity. For example, a mid-sized corporation's audit might demand a 12-week schedule, with key deadlines set for interim reviews and final reports. Balancing the team's availability against peak periods, such as fiscal year-end or regulatory reporting deadlines, ensures optimal resource utilization. Identifying individual strengths, like forensic accounting or information systems auditing, allows for tailored assignments, maximizing efficiency. Additionally, utilizing software tools, such as Microsoft Excel or specialized audit management systems, can streamline the scheduling process, facilitating updates and adjustments as project dynamics change.

Compliance with organizational policies and procedures

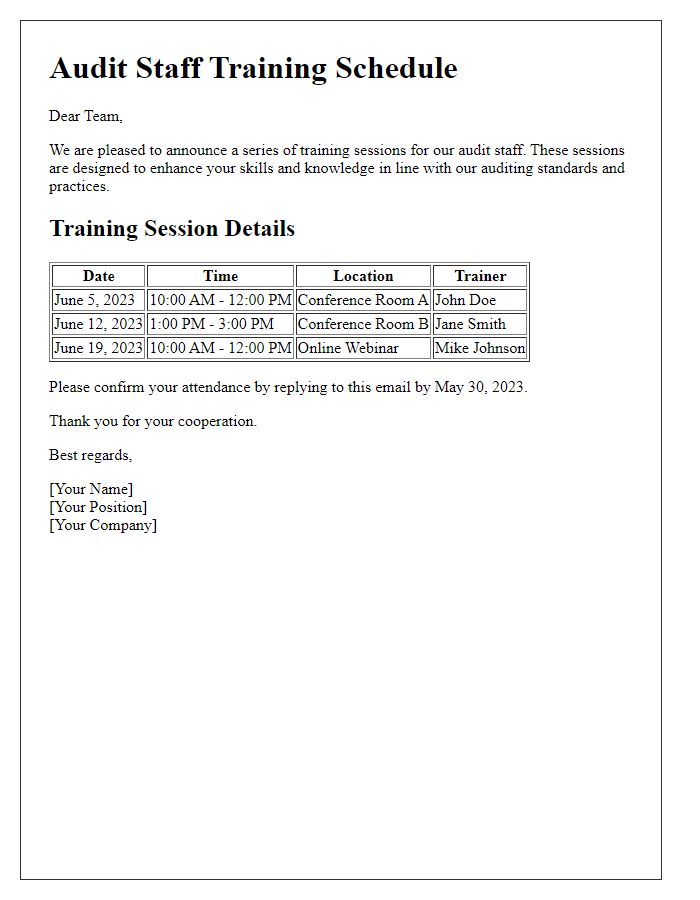

Effective audit staff scheduling ensures compliance with organizational policies and procedures. Accurate allocation of resources is vital in meeting audit deadlines, such as the quarterly reviews mandated by the Sarbanes-Oxley Act (SOX). Assigning staff members with specialized training in areas like financial reporting or internal controls ensures adherence to standards. Utilize management software to optimize scheduling while factoring in staff availability, project timelines, and regulatory requirements. Continuous communication with team members promotes understanding of compliance expectations and enhances overall audit integrity. Regular training sessions on evolving policies may also improve compliance adherence among audit staff.

Comments