Are you looking to enhance your audit processes and monitor key performance indicators (KPIs) effectively? Many organizations struggle with how to structure their audit letters, making it challenging to communicate results clearly. In this article, we're diving into a simple yet powerful letter template specifically designed for reporting audit KPIs. So, let's explore how you can streamline your communication and ensure impactful resultsâread on to discover the details!

Clarity and Specificity

Clarity and specificity are essential attributes when defining Key Performance Indicators (KPIs) for effective auditing. Clearly articulated KPIs facilitate understanding across various stakeholders in organizations, ensuring alignment with strategic goals. Specificity in KPIs allows for measurable and precise evaluation, reducing ambiguity. Each KPI should possess distinct parameters such as numerical targets, time frames, and defined responsibilities, providing a clear roadmap for performance tracking. For instance, a KPI for sales growth might state a target increase of 10% within the fiscal year, enabling accurate assessment of progress. This approach not only enhances transparency but also drives accountability, as team members clearly understand their roles in achieving the set objectives. Maintaining clarity and specificity will significantly improve the overall effectiveness of performance audits.

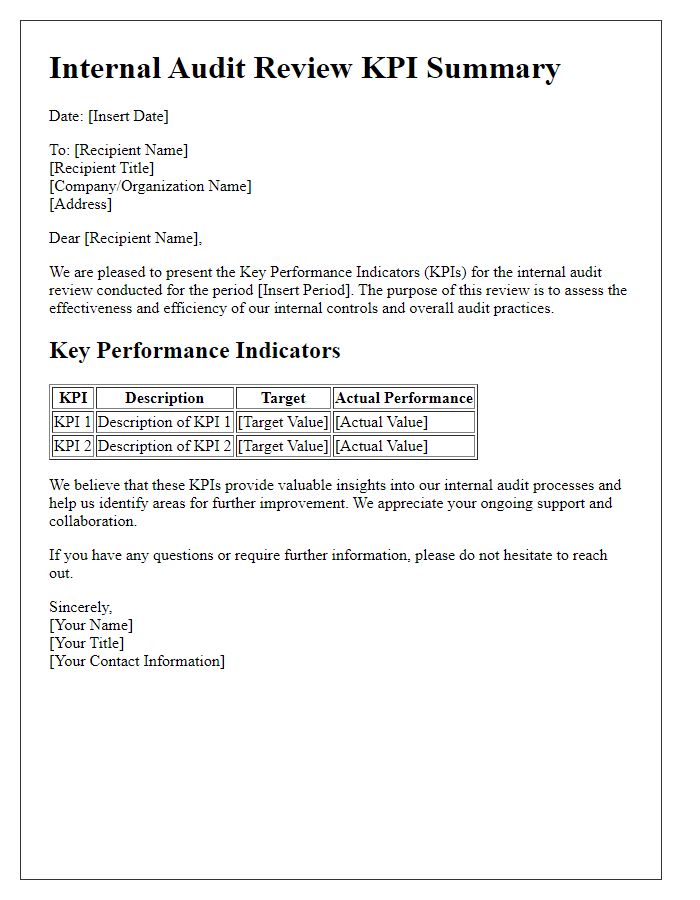

Alignment with Objectives

The alignment of key performance indicators (KPIs) with organizational objectives is vital for effective auditing processes. For instance, a retail company like Walmart implements KPIs such as inventory turnover ratio, measuring the efficiency of stock management. This indicator directly aligns with the objective of maximizing sales while minimizing excess inventory costs. Furthermore, companies often assess customer satisfaction scores, utilizing metrics from surveys conducted quarterly, which support the strategic goal of enhancing customer experiences. Additionally, financial figures such as a 15% increase in year-over-year revenue reflect progress toward overarching growth objectives. Regular reviews of these KPIs ensure continuous improvement and adherence to corporate mission statements.

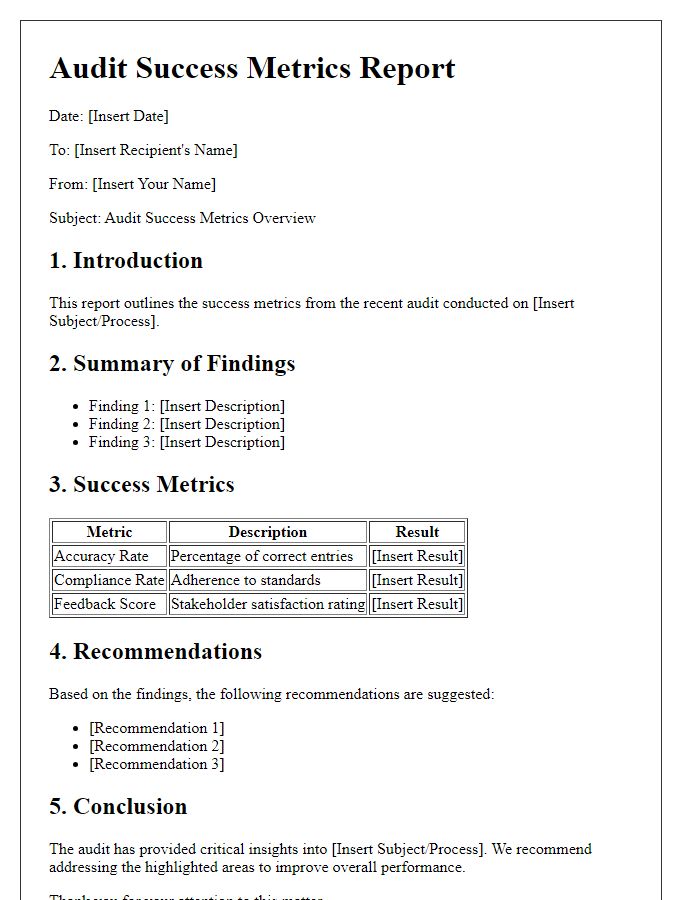

Measurable Metrics

Key performance indicators (KPIs) serve as essential measurable metrics in evaluating business success and operational efficiency. Specific KPIs such as net profit margin (reflecting profitability, ideally exceeding 20% for growth), customer satisfaction score (typically measured on a scale from 1 to 10, with a target of 8 or higher), and employee turnover rate (with optimal retention below 10% annually) provide critical insights into performance levels. Regular audits of these measurable metrics can highlight trends, identify areas for improvement, and ensure alignment with strategic objectives, ultimately fostering a culture of accountability and continuous improvement within organizations. Comprehensive analysis of these KPIs, conducted monthly or quarterly, can guide decision-making processes and drive organizational excellence.

Time-bound Goals

Effective time-bound goals for key performance indicators (KPIs) ensure that organizations achieve specific outcomes within defined periods. Organizations often set quarterly performance targets for financial metrics like revenue growth, aiming for a 15% increase within the next three months. Monitoring operational efficiency, companies may implement timelines for reducing production cycle times by 20% over the next six months. Customer satisfaction KPIs often involve tracking response times, with goals set to improve average response rates to customer inquiries within 48 hours by the end of the fiscal year. Regular evaluations of these time-bound goals enable businesses to adapt strategies, ensuring alignment with market conditions and overall business objectives. The clear deadline fosters accountability and keeps teams focused on achieving their desired results efficiently.

Regular Review Frequency

Regular reviews of key performance indicators (KPIs) in audit processes enhance operational efficiency and ensure compliance with regulations. A structured schedule, such as quarterly assessments, aligns with best practices in corporate governance. This timeframe allows organizations to track progress against established benchmarks, such as financial ratios or compliance metrics. Key entities like internal audit teams and external regulatory bodies benefit from these insights, fostering accountability and transparency. By analyzing performance data, organizations can identify trends, address potential risks, and implement corrective actions. Furthermore, integrating technology tools such as dashboards simplifies data visualization, enabling quicker decision-making for stakeholders.

Comments