Are you looking to streamline your audit processes with effective joint cooperation? Collaborating on audits can significantly enhance transparency and accountability, making the entire process smoother for everyone involved. In this article, we'll explore the key elements of a successful joint audit partnership, highlighting best practices and strategies to foster collaboration. Ready to dive deeper into the world of joint audits? Let's get started!

Purpose and Scope

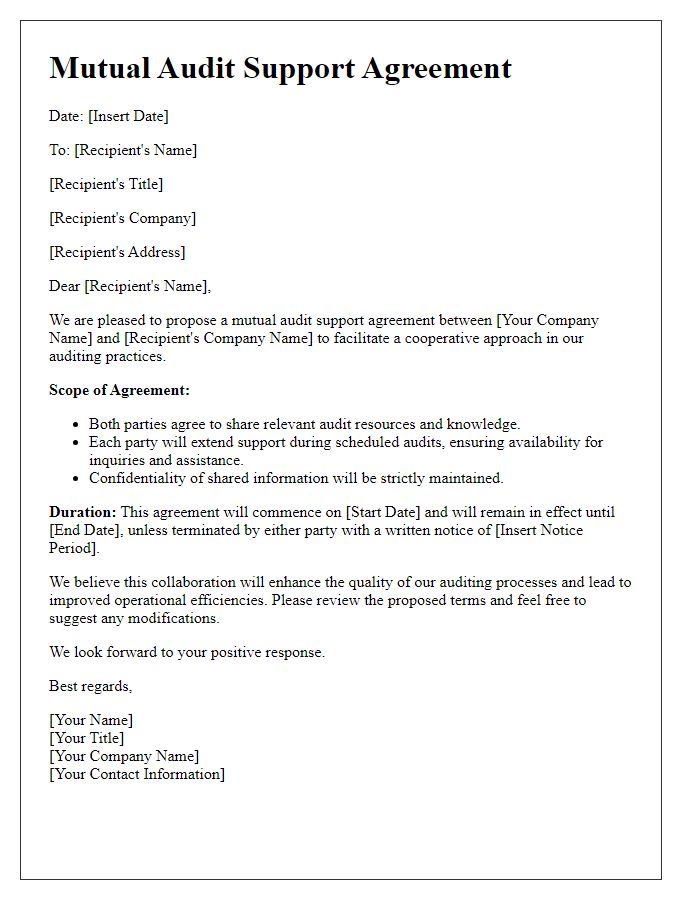

Joint audits, conducted by multiple independent auditing firms, enhance transparency and accountability among organizations. The primary purpose involves sharing resources, expertise, and knowledge to achieve a thorough examination of financial statements, ensuring compliance with regulations such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). The scope includes evaluating internal controls, assessing risk management processes, and verifying the accuracy of financial records across various departments, including finance, operations, and IT systems. This collaborative approach fosters a comprehensive understanding of an organization's financial health and operational efficiency, ultimately promoting greater stakeholder trust.

Roles and Responsibilities

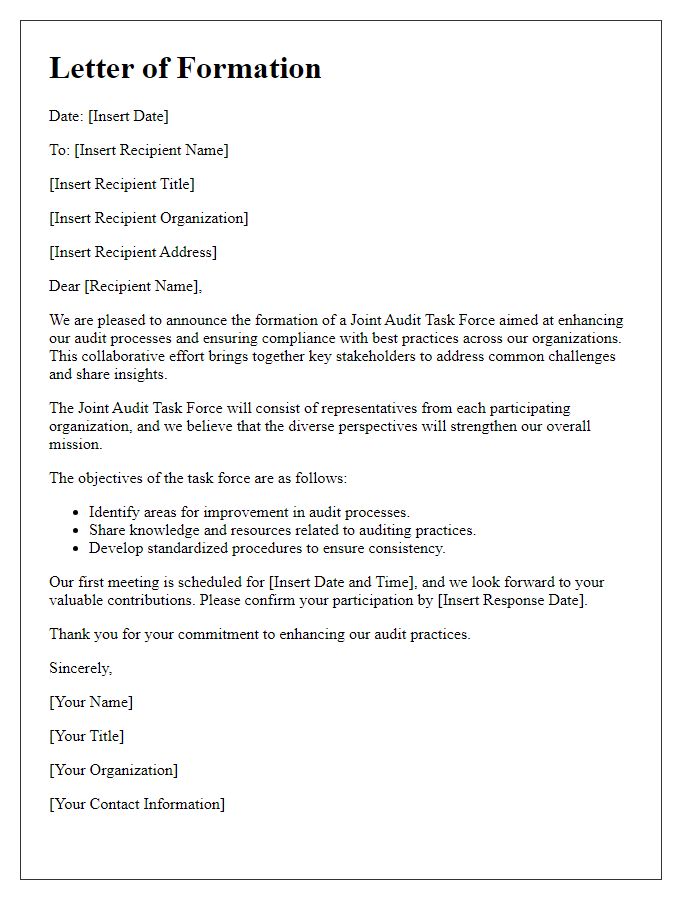

The joint audit cooperation framework outlines the specific roles and responsibilities of participating entities, ensuring a comprehensive evaluation of financial practices. Financial auditors from firms such as Deloitte and Ernst & Young will coordinate their efforts to assess the financial statements of corporations within the retail sector, specifically examining top players like Walmart and Target. Responsibilities will include the collection of financial records, such as balance sheets and income statements, adhering to International Financial Reporting Standards (IFRS) guidelines. Each auditor will be tasked with evaluating internal controls, compliance with regulatory requirements, and identifying areas of risk, particularly focusing on mitigating fraud within the supply chain. Regular communication will be established through bi-weekly meetings to discuss findings and ensure alignment on audit goals, thereby fostering transparency and accountability throughout the audit process.

Audit Objectives and Methodology

Joint audits, involving multiple organizations or stakeholders, focus on enhancing transparency and effectiveness in financial and operational assessments. Core objectives include ensuring compliance with regulatory standards, identifying potential risks, and benchmarking best practices across participating entities. Methodology encompasses a systematic approach involving comprehensive data collection, including financial records and operational processes, stakeholder interviews, and analytical procedures to assess performance and potential areas of improvement. Utilizing integrated platforms, such as data analytics tools, fosters real-time collaboration and results sharing, ultimately leading to more informed decision-making for all parties involved.

Confidentiality and Data Security

Confidentiality and data security are paramount in joint audit cooperation. Organizations involved, such as multinational corporations and regulatory bodies, must establish strict protocols to safeguard sensitive information. This includes implementing secure data transmission methods, like encryption, to prevent unauthorized access. Defined roles and responsibilities should be outlined among auditors, ensuring that access to confidential documents, financial records, and operational data is limited. Regular security audits and compliance checks should also be conducted to ensure adherence to standards such as GDPR (General Data Protection Regulation) and ISO/IEC 27001. Training programs must be provided to all participants, emphasizing the importance of confidentiality agreements and data protection measures.

Timeline and Reporting

Efficient joint audit cooperation requires a structured timeline and clear reporting mechanisms. An initial planning phase of 4 weeks is essential, allowing for the agreement on audit objectives, scope, and methodologies among all participating entities, such as corporate partners or regulatory bodies. Documentation collection should follow, ideally taking 2 weeks, where financial records, compliance documents, and operational data from the last fiscal year are gathered for review. The actual fieldwork period, spanning approximately 6 weeks, is crucial for verifying data accuracy and conducting interviews with relevant personnel. Reporting must then be consolidated; first drafts should be prepared within 3 weeks post-fieldwork, ensuring that all findings, observations, and recommendations are articulated clearly. A final report, including an executive summary and detailed analysis, should be delivered within 1 week after feedback incorporation, concluding the cycle of the joint audit process. Continuous communication channels must remain open throughout these phases to address any issues promptly and facilitate efficient collaboration among all stakeholders involved.

Comments