When it comes to audits, scope limitations can present unique challenges that require clear communication. Whether you're addressing a specific area of concern or clarifying the extent of your audit findings, crafting the right letter is crucial. In this article, we'll explore an effective letter template that outlines the parameters of an audit with limited scope, ensuring that your message is both professional and understandable. So, let's dive in and discover how to navigate these complexities together!

Purpose of the Letter

The purpose of this letter is to formally communicate the limitations encountered during the audit process of [Company Name], conducted for the fiscal year ending [Date]. Key challenges arose due to the restricted access to essential records and information, specifically pertaining to [specific area such as inventory, financial statements, or compliance documents], which are critical for a thorough analysis of the company's financial health. The unavailability of certain documentation, including [specific documents like supplier contracts, transaction records, or internal memos], hindered our ability to confirm the completeness and accuracy of reported figures. This limitation may impact the reliability of our audit findings and conclusions regarding the overall financial integrity of [Company Name]. It is crucial for stakeholders to understand these constraints, as they bear significance in evaluating the firm's operational effectiveness and financial transparency. Proper documentation retrieval and cooperation from [relevant departments or personnel] are essential for future engagements.

Description of the Limitation

Audit scope limitations often arise due to restrictions in access to essential documents or inadequate communication from certain stakeholders. For instance, a company's financial records may lack complete transaction details from its accounting software, leading to uncertainty in revenue recognition practices. Additionally, external parties, such as suppliers or customers, might not provide requested confirmations regarding outstanding balances, which can hinder the auditor's ability to verify accuracy. In certain situations, time constraints imposed by the audit client's operational schedule may further limit inquiry depth, preventing thorough testing of internal controls or substantive procedures. Such limitations can ultimately impact the audit's conclusions, potentially leading to qualified opinions regarding the financial statements' reliability.

Impact on the Audit Process

Scope limitations in audits can significantly affect overall audit processes and outcomes. For instance, when auditors lack access to essential documents such as invoices or contracts within specific organizations, it can lead to incomplete assessments and potential misstatements in financial reports. Such situations may arise during financial audits in large corporations like General Electric or modest nonprofits. Limitations can result in drawing conclusions based on inadequate data, impacting key areas such as revenue recognition or expense verification. Consequently, audit opinions may be modified, with a higher risk of financial discrepancies emerging in final reports, especially in high-stakes industries like pharmaceutical or technology where precise financial accuracy is critical.

Actions Taken to Address the Issue

Audit scope limitations can arise when access to critical data or personnel is restricted, impacting the thoroughness of an audit. To address this issue, auditors often implement specific actions such as increasing communication with management to clarify the reasons for the limitations. Additionally, a risk assessment may be conducted to identify areas of concern based on available information. Where access is restricted, alternative procedures, such as analytical reviews of financial statements, can be employed to gather insights from different sources. Auditors may also document the limitations in their report, detailing how these constraints might affect the overall audit findings, ensuring transparency and accountability. Regular follow-ups with the audit committee can help ensure that these issues are resolved timely, restoring access for future audits.

Request for Additional Information or Cooperation

When conducting financial audits, auditors may face scope limitations that can restrict their ability to obtain sufficient evidence for accurate reporting. Such limitations often arise from incomplete records, restricted access to necessary documents, or insufficient cooperation from relevant parties. For instance, when reviewing a company's financial practices in 2023, limited availability of transaction data from the third quarter can hinder the assessment of compliance with Generally Accepted Accounting Principles (GAAP). Additionally, lack of responses from key personnel during interviews can impede the understanding of internal controls and risk management practices. These challenges underscore the necessity for entities to promptly provide additional information or foster a collaborative environment to facilitate thorough investigations and ensure the integrity of financial reporting processes.

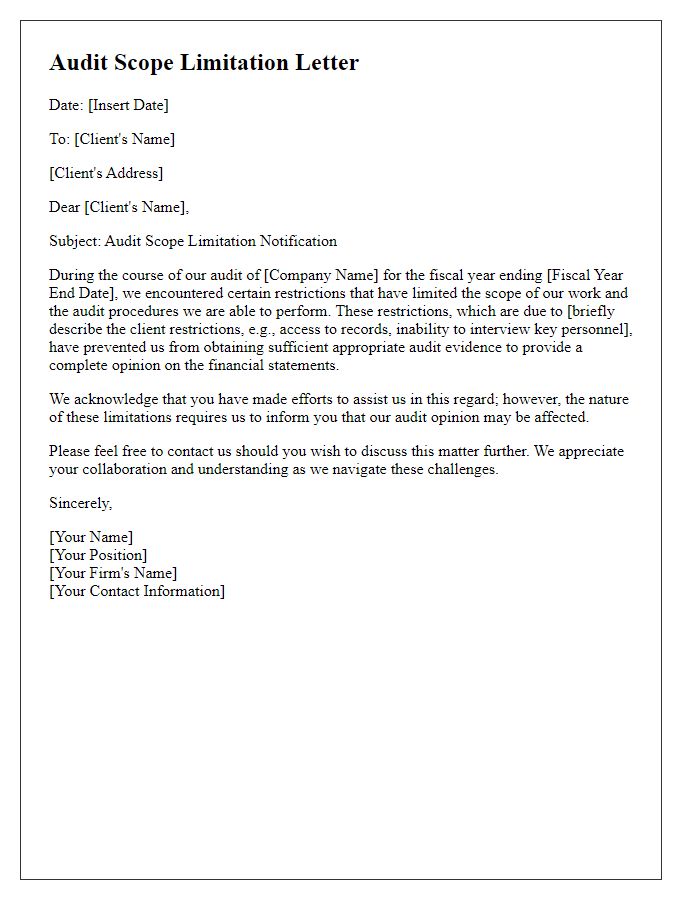

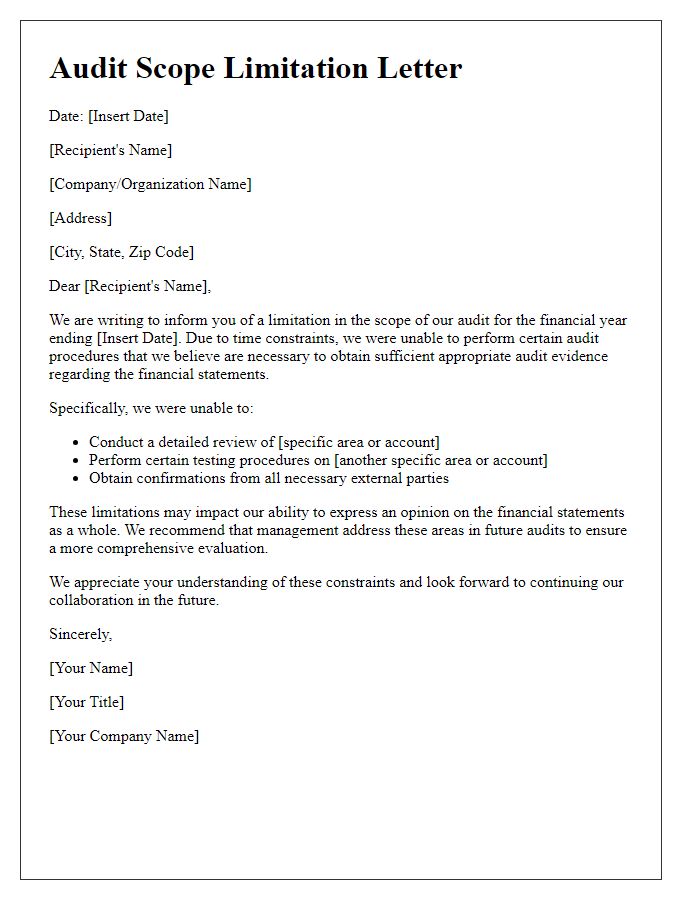

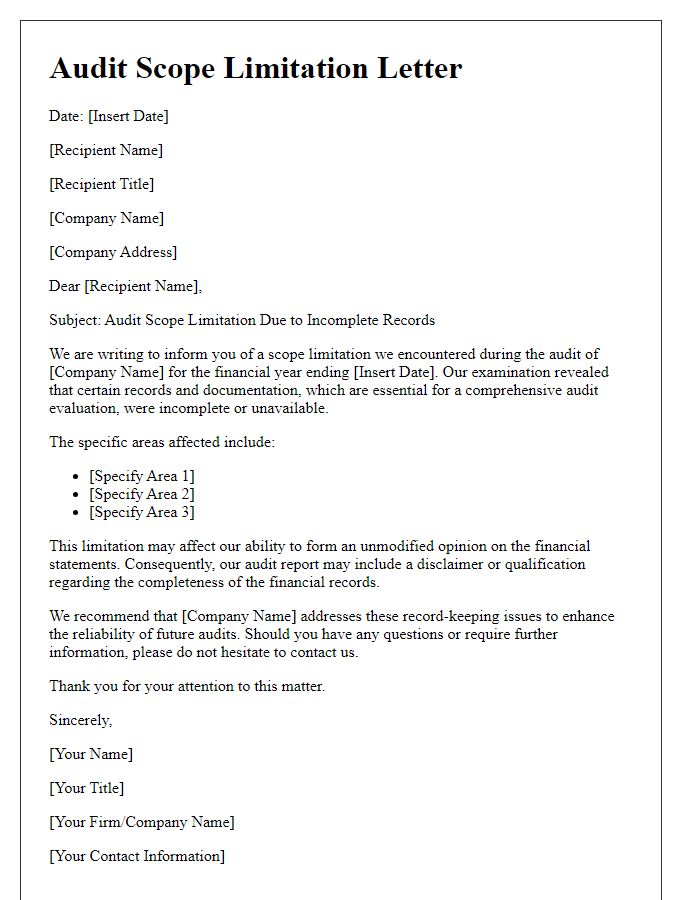

Letter Template For Audit Scope Limitation Samples

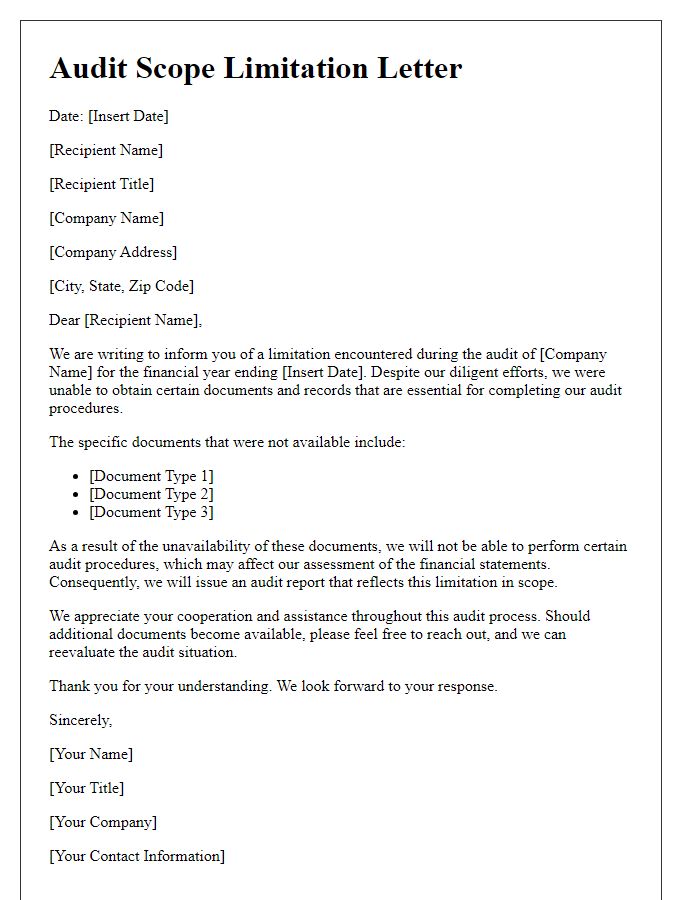

Letter template of audit scope limitation caused by unavailable documents.

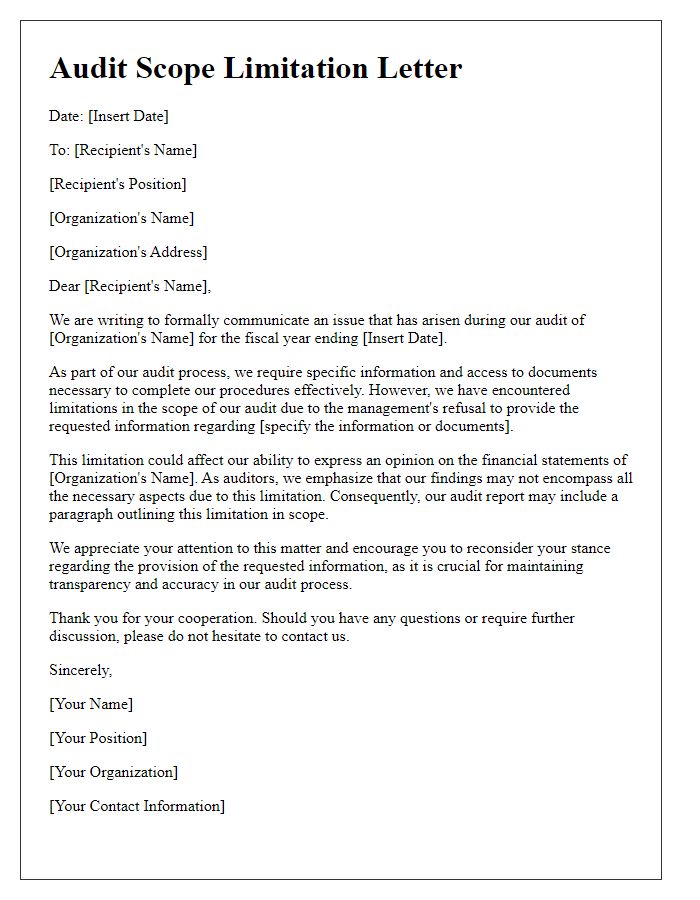

Letter template of audit scope limitation from management's refusal to provide information.

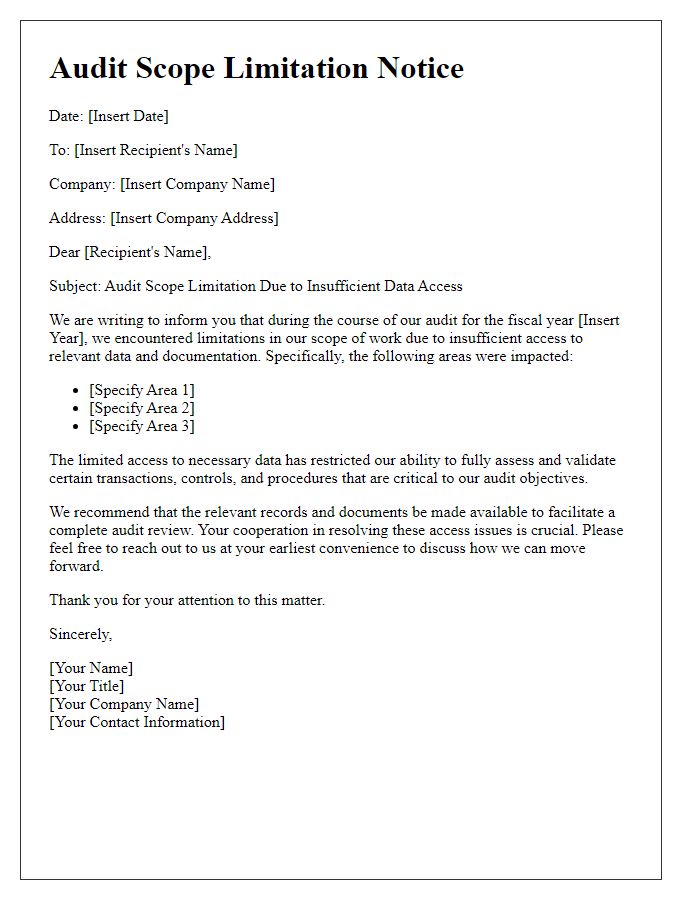

Letter template of audit scope limitation because of insufficient data access.

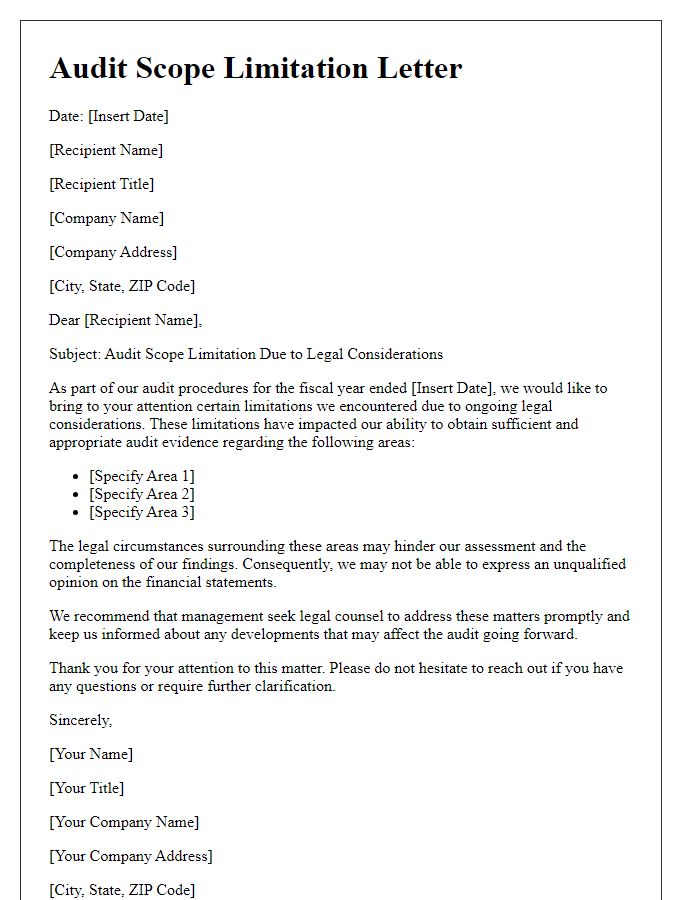

Letter template of audit scope limitation arising from legal considerations.

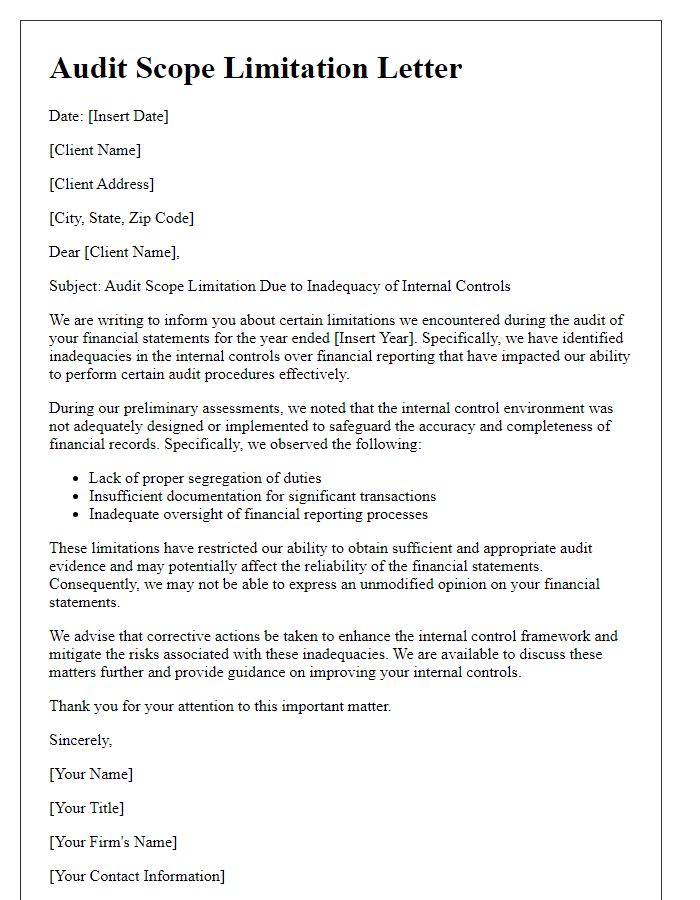

Letter template of audit scope limitation related to internal controls inadequacy.

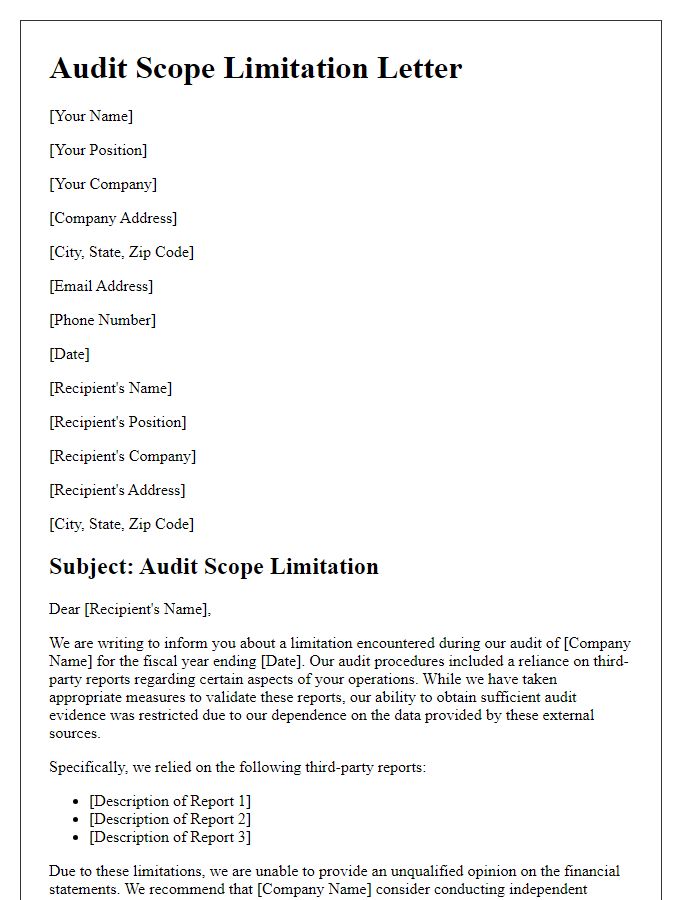

Letter template of audit scope limitation due to reliance on third-party reports.

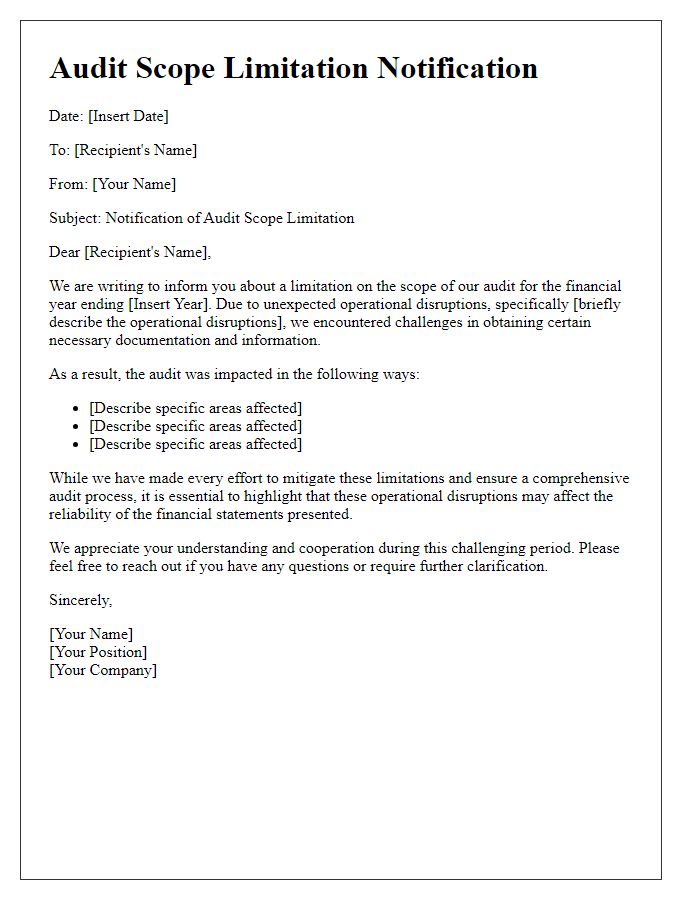

Letter template of audit scope limitation influenced by operational disruptions.

Comments