Are you looking to streamline your audit action plans while maintaining clarity and professionalism? Crafting an effective letter template is essential for communicating your objectives and ensuring all key stakeholders are aligned. By utilizing a structured approach, you can highlight critical findings, outline necessary actions, and set clear deadlines, ultimately fostering collaboration within your team. Join us as we explore the essential components of an audit action plan letter template that will set you up for success!

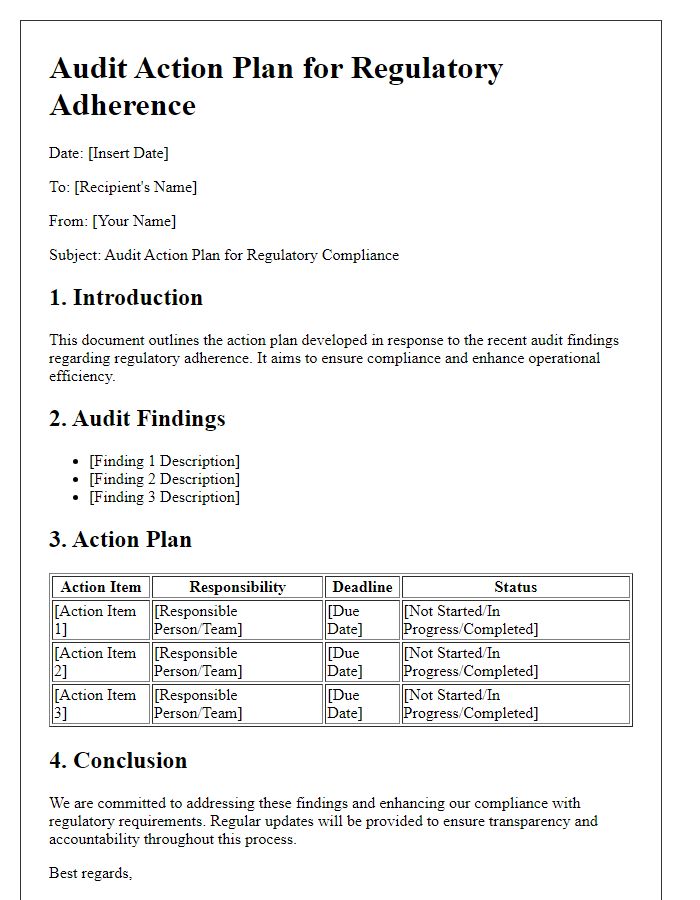

Purpose and scope of the audit action plan

An audit action plan outlines the strategic approach taken to address findings from an audit, ensuring compliance and operational efficiency. The purpose focuses on identifying weaknesses or areas of non-compliance within organizational processes, with specific emphasis on financial statements, internal controls, and regulatory adherence. The scope encompasses all departments affected by the audit, including finance, operations, and human resources, and may include a review of relevant documentation and stakeholder interviews. The plan aims to prioritize identified issues, set deadlines, assign responsibilities, and create measurable outcomes to enhance future performance and mitigate risks. Regular follow-up assessments are integral to ensuring sustained improvement and accountability across the organization.

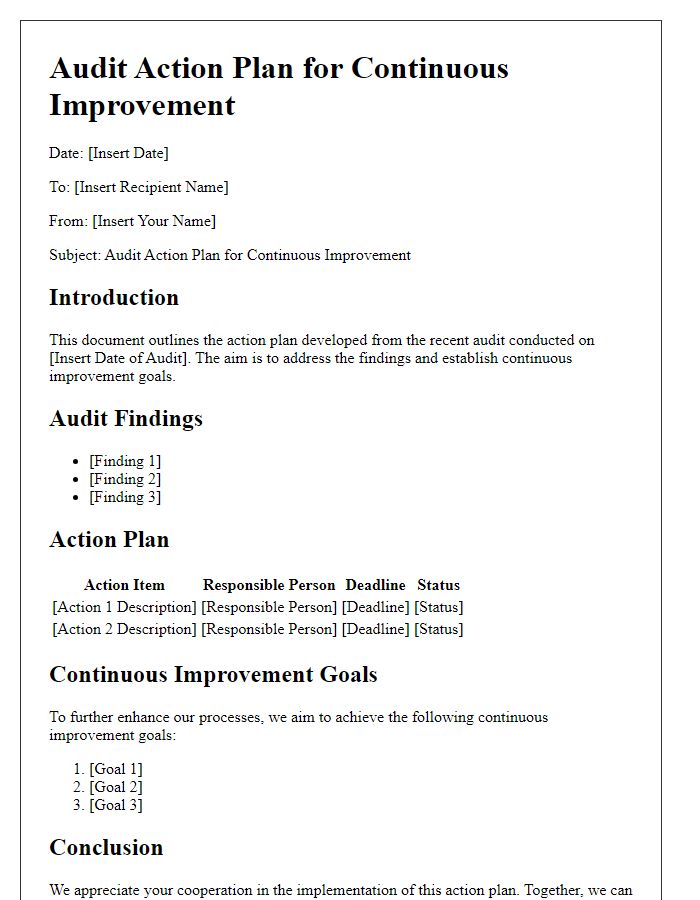

Summary of audit findings and issues

The recent audit conducted at ABC Corporation highlighted several critical findings that require immediate attention to enhance operational efficiency and compliance. Key issues identified include non-compliance with internal controls related to financial reporting, where discrepancies were noted in transaction documentation (affecting 25% of sampled transactions). Additionally, a lack of proper inventory management systems was observed, resulting in a 15% overage in supply costs for the last quarter. Finally, employee training on data protection policies was found inadequate, with only 40% of staff receiving updated training within the last year, increasing the risk of potential data breaches. Addressing these findings through targeted action plans will be essential to ensure adherence to regulatory requirements and improve overall business processes.

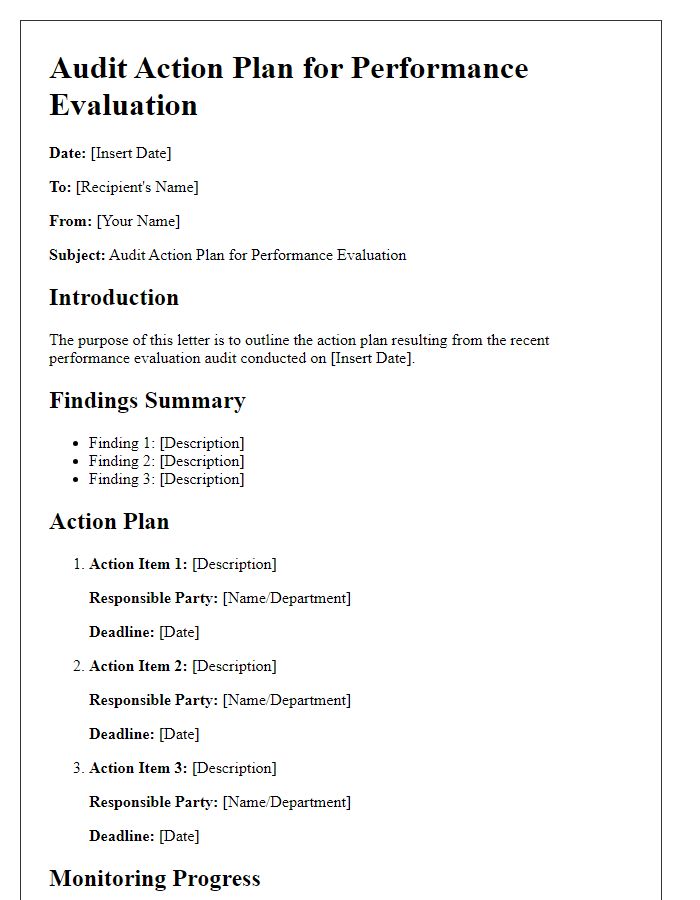

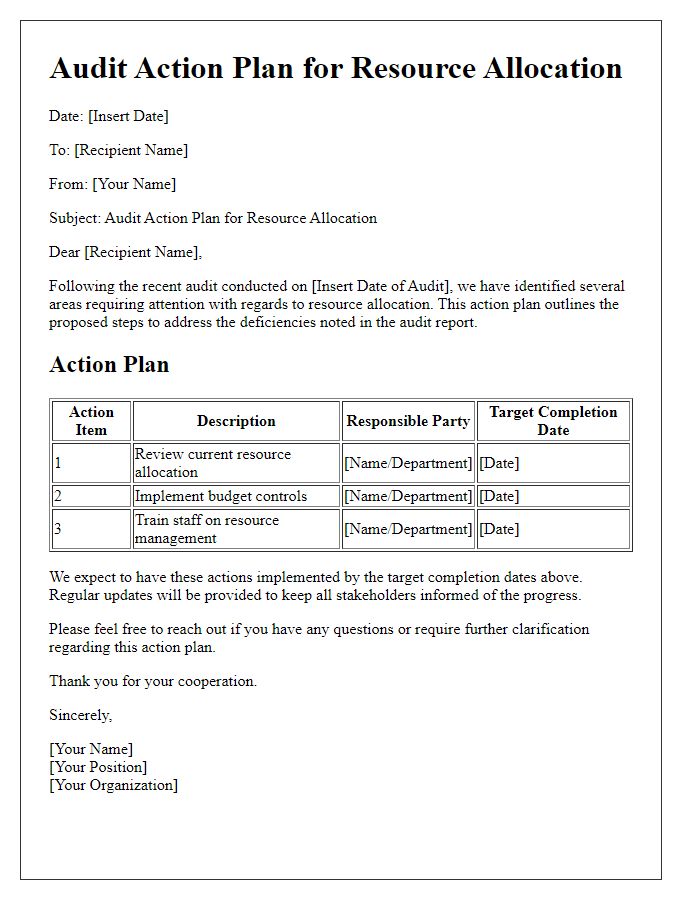

Detailed action items with deadlines

An effective audit action plan incorporates structured tasks designed to address findings from the audit process. Detailed action items include conducting a root cause analysis by July 15, 2023, to identify underlying issues for non-compliance. Implementing training programs for staff will be necessary to ensure proper understanding of regulatory requirements, targeting completion by August 1, 2023. An updated compliance policy must be reviewed and approved by upper management by September 10, 2023, to enhance adherence to standards. Regular progress reviews scheduled bi-weekly starting June 1, 2023, will track the implementation of these actions and ensure accountability. Moreover, a final audit reassessment should be conducted by October 30, 2023, to evaluate the effectiveness of corrective measures and compliance improvements achieved.

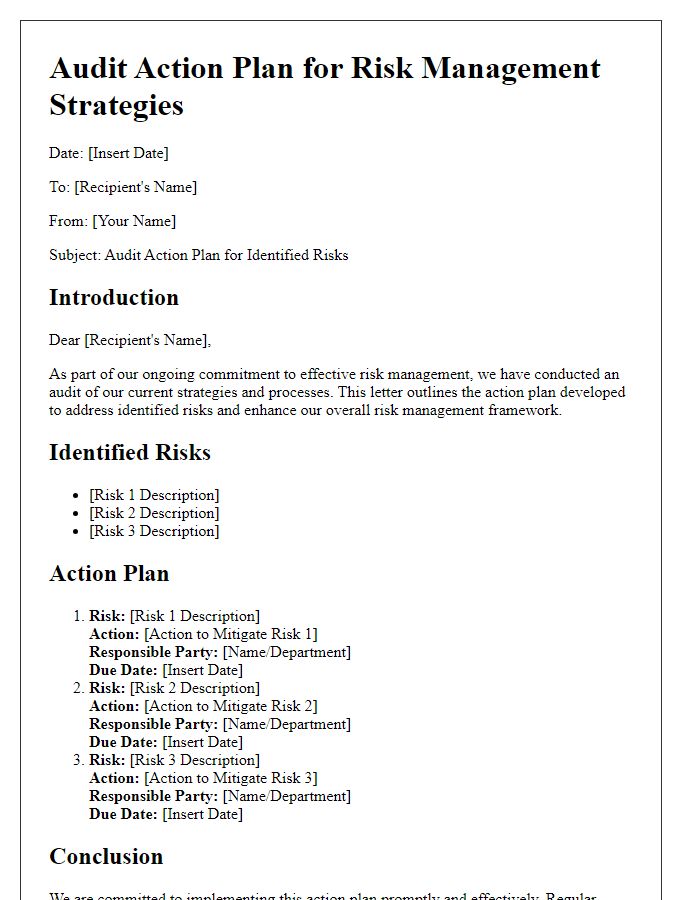

Assigned responsibilities for implementation

Creating an effective audit action plan necessitates clearly assigning responsibilities for each task to ensure accountability and timely completion. Each assigned individual or team must understand their specific roles, including implementing recommended actions based on audit findings. For instance, the finance department could be responsible for reassessing internal controls related to revenue recognition, while the IT department could oversee the enhancement of cybersecurity measures in accordance with audit recommendations. Specific deadlines should accompany each assigned responsibility to track progress effectively. Regular follow-ups and progress reports can ensure that each team stays aligned with the overall objectives of the audit action plan, promoting transparency and facilitating smoother operations throughout the organization. This structured approach fosters diligent execution, contributing to improved compliance and operational efficiency.

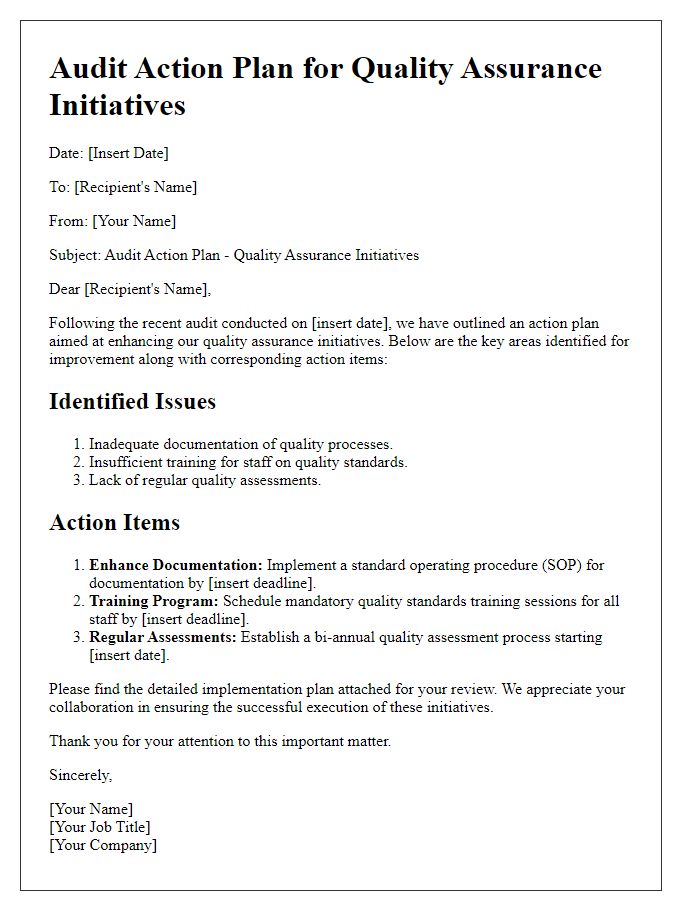

Monitoring and follow-up procedures

A comprehensive audit action plan includes detailed monitoring and follow-up procedures to ensure accountability and continuous improvement. Establishing a timeline (e.g., quarterly reviews) helps track the implementation of corrective measures identified during the audit. Assigning specific personnel, such as compliance officers or team leaders, ensures responsibilities are clear. Documentation of progress (including reports and feedback) is crucial for transparency. Utilizing software tools like project management applications enhances tracking efficiency. Regular meetings with stakeholders facilitate discussion on challenges faced and adjustments needed. Such rigorous monitoring reinforces commitment to compliance and operational excellence.

Comments