Are you feeling uneasy about a potentially fraudulent situation? It's crucial to take immediate action and gather the necessary information to protect yourself and your interests. In this article, we'll provide you with a comprehensive template for requesting a fraud investigation, ensuring you include all essential details for a thorough review. Ready to learn how to safeguard your rights effectively? Read on to discover our step-by-step guide!

Clear Subject Line

Fraud investigations are critical for maintaining integrity in financial systems, particularly in organizations such as banks or insurance companies. When a suspected fraudulent activity occurs, a formal request is essential to initiate an inquiry. The request should include specific details regarding the incident, highlighting the date (for example, November 15, 2023), the involved parties (such as John Doe or ABC Insurance Corporation), and the nature of the suspected fraud (like identity theft or funds misappropriation). Associating relevant documentation, such as transaction records or communication logs, enhances the request's validity. Furthermore, providing a clear subject line--like "Urgent Fraud Investigation Request for November 2023 Incident"--ensures prompt attention and prioritization by the responsible investigation team.

Formal Salutation

Fraudulent transactions significantly disrupt financial stability and security for individuals and organizations. Fraud investigations typically involve detailed examination of financial records, accounting statements, and transaction histories in order to uncover discrepancies. Agencies such as the Federal Bureau of Investigation (FBI) and local law enforcement collaborate to identify patterns indicative of fraudulent activity, which can include identity theft, credit card fraud, or corporate embezzlement. Specialized investigators employ techniques such as forensic accounting and data analysis to compile evidence necessary for legal proceedings. Timeliness is crucial, as evidence can become less reliable over time and may hinder the pursuit of justice.

Detailed Incident Description

Fraud investigation requests often require precise incident descriptions to facilitate thorough evaluations. An incident report should include critical details such as the date (e.g., August 15, 2023), time (e.g., 2:30 PM), and location (e.g., 123 Main Street, Anytown, USA). The report must specify the nature of the alleged fraud, whether it involves credit card misuse, identity theft, or phishing schemes targeting customers. Identifiable parties should be documented, including the names of suspects (if known) and victims affected, alongside any relevant account numbers or transaction IDs. Supporting documentation, such as screenshots of fraudulent activity, email correspondences, and police report references, enhances the investigation process. Finally, noting any immediate action taken to prevent further loss, such as freezing accounts or notifying financial institutions, provides investigators with a comprehensive view of the incident's scope and severity.

Specific Evidence or Documentation

Fraud investigations often require specific and detailed evidence or documentation to ensure a thorough analysis. This includes transaction records, such as bank statements or credit card charges, which can provide insight into suspicious activity. Additionally, communication logs, including emails or text messages, can be crucial in understanding the context of the alleged fraud. Video surveillance footage from locations involved in the incident, such as retail stores or ATMs, can further substantiate claims. Other pertinent documents might involve identity verification records, contracts, and any relevant correspondence with financial institutions or other parties. Gathering all these elements creates a comprehensive foundation for the investigation to progress effectively.

Request for Action and Response Timeframe

Fraud investigations require structured communication to ensure clarity and urgency. The detailed request outlines the need for immediate action regarding suspected fraudulent activities involving financial transactions. Specific instances, such as dates of contested transactions (for example, October 1, 2023), account numbers, and parties involved, must be specified to provide context. A clear timeframe for a response, typically within 14 days, promotes prompt attention. Additionally, contact information for follow-up questions facilitates effective communication between parties and supports expedited resolution of the investigation.

Letter Template For Fraud Investigation Request Samples

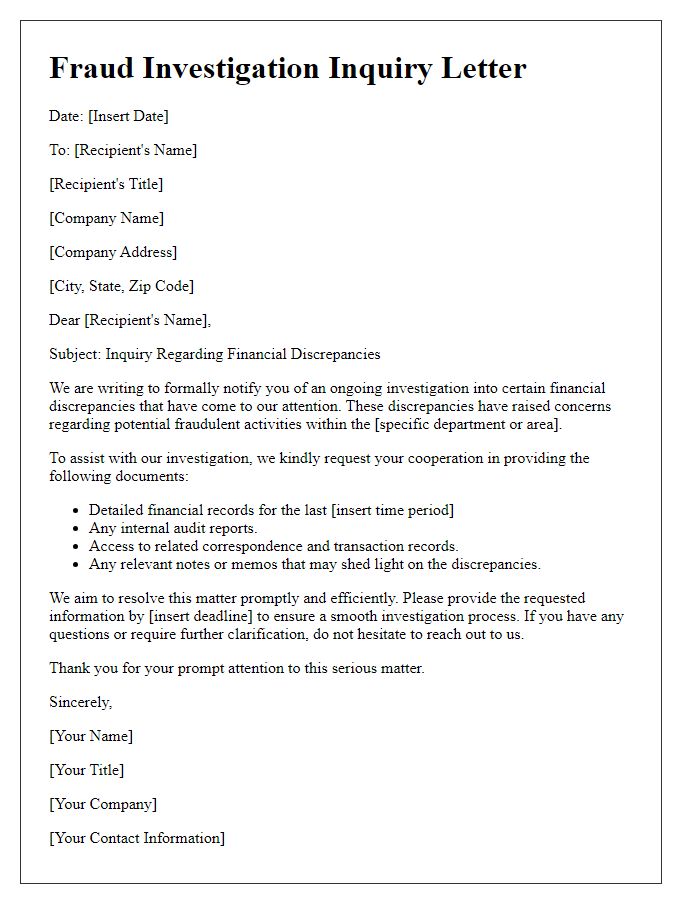

Letter template of fraud investigation inquiry for financial discrepancies.

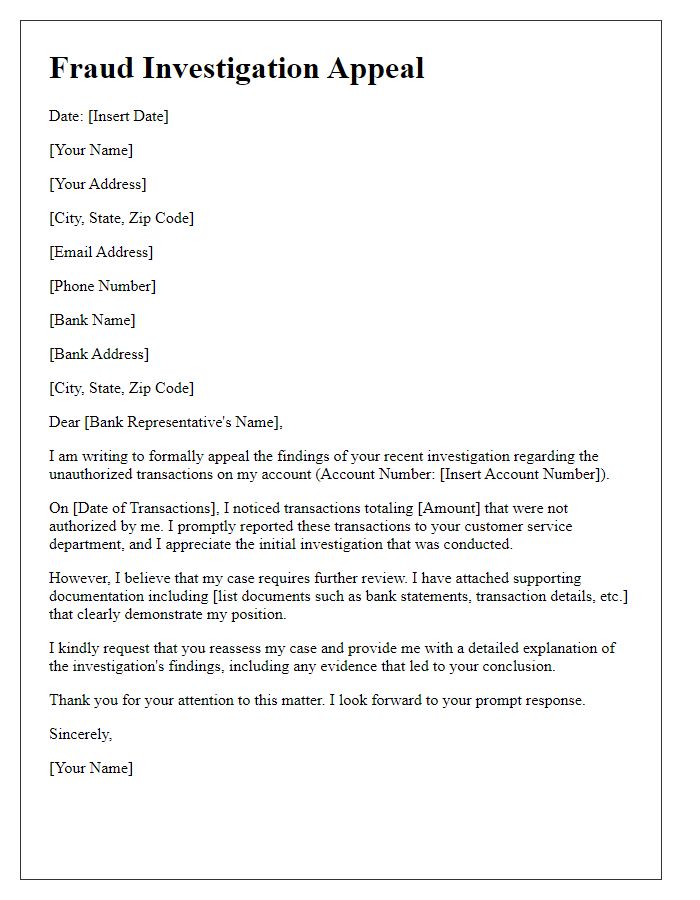

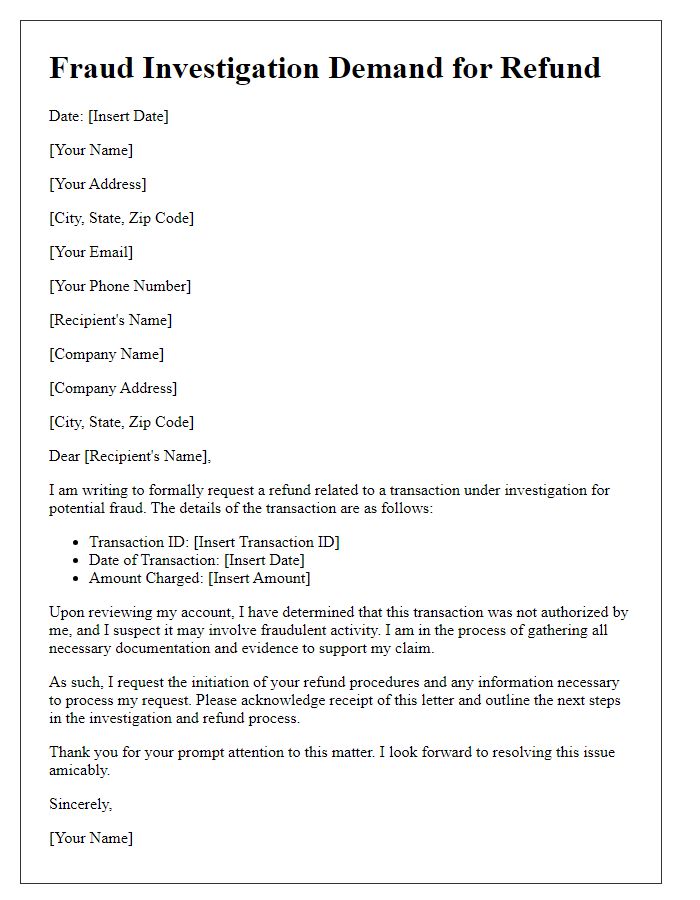

Letter template of fraud investigation appeal for unauthorized transactions.

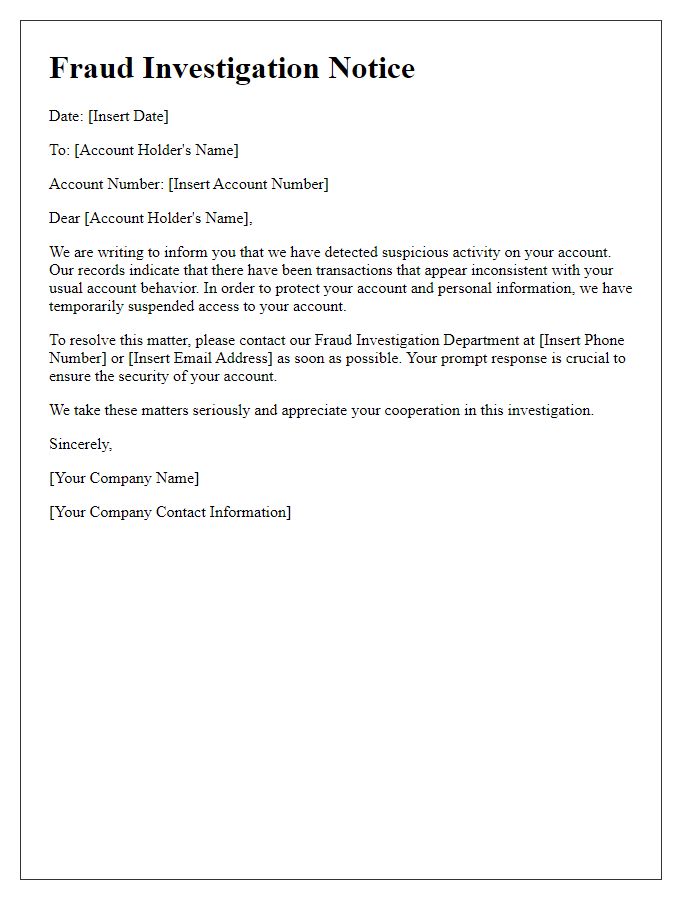

Letter template of fraud investigation notice for suspicious account activity.

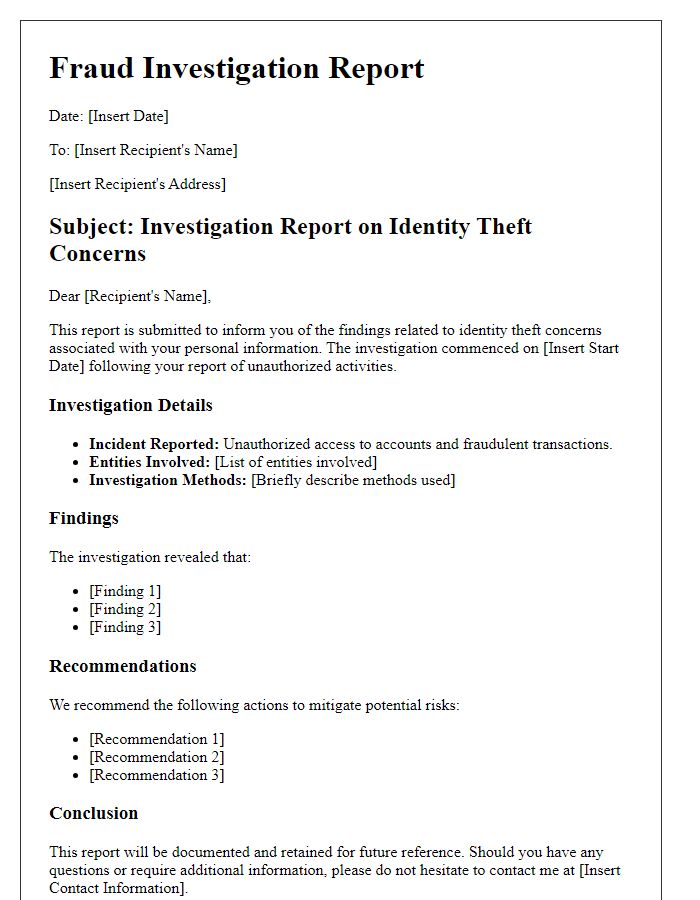

Letter template of fraud investigation report for identity theft concerns.

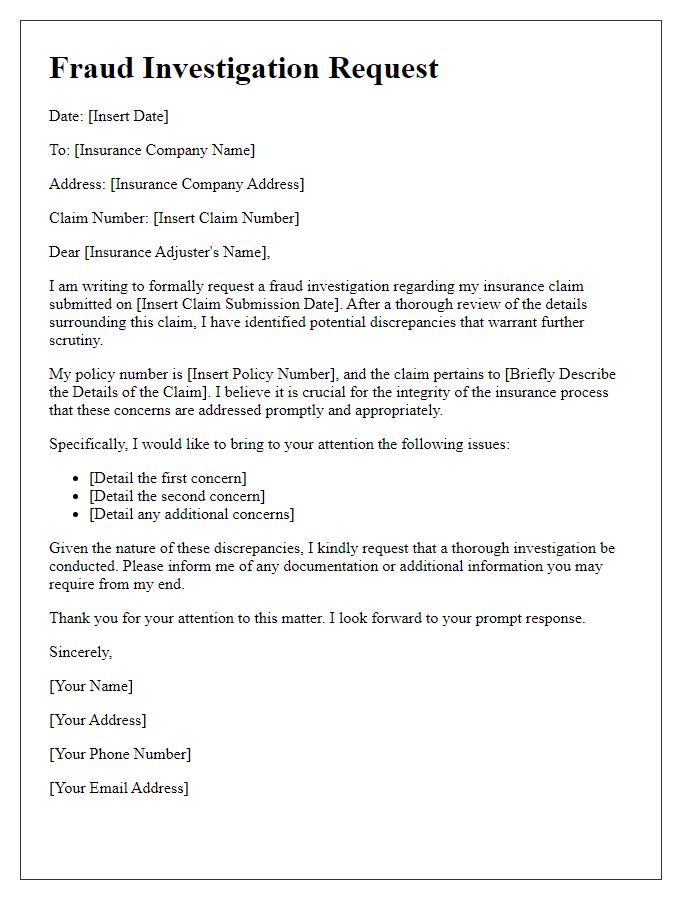

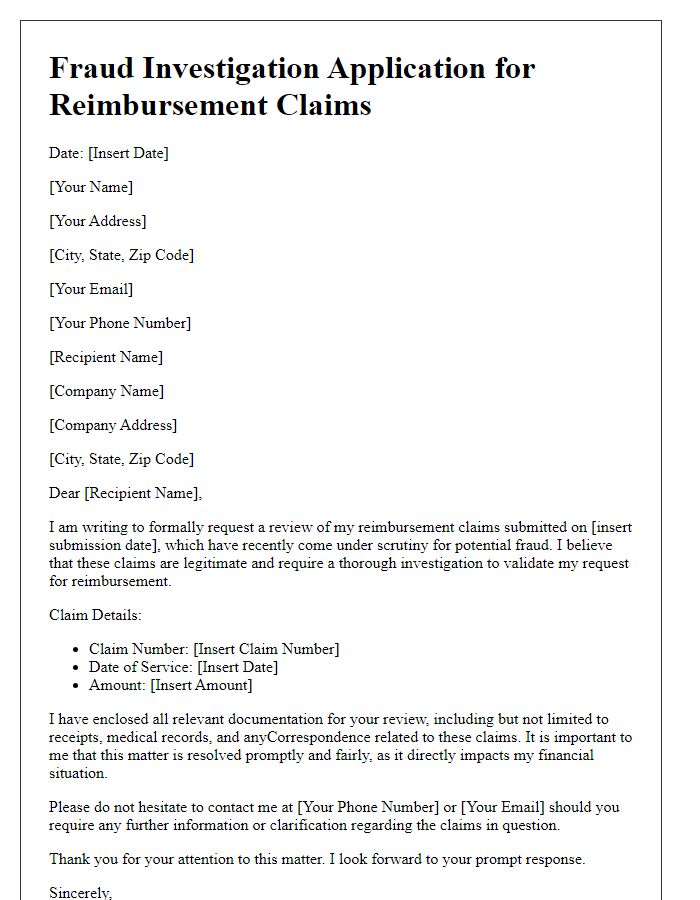

Letter template of fraud investigation request for insurance claim review.

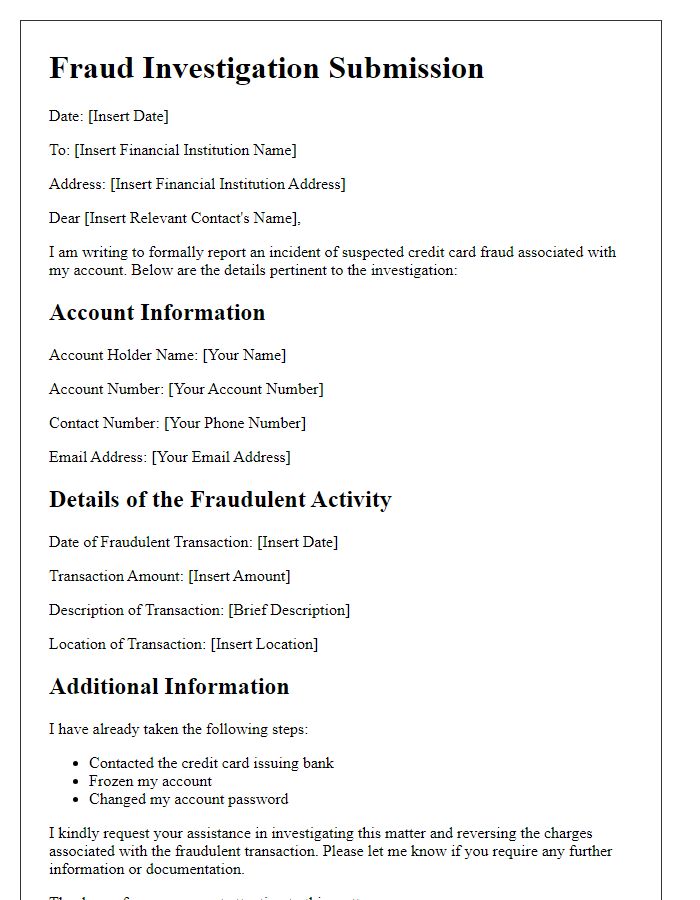

Letter template of fraud investigation submission for credit card fraud.

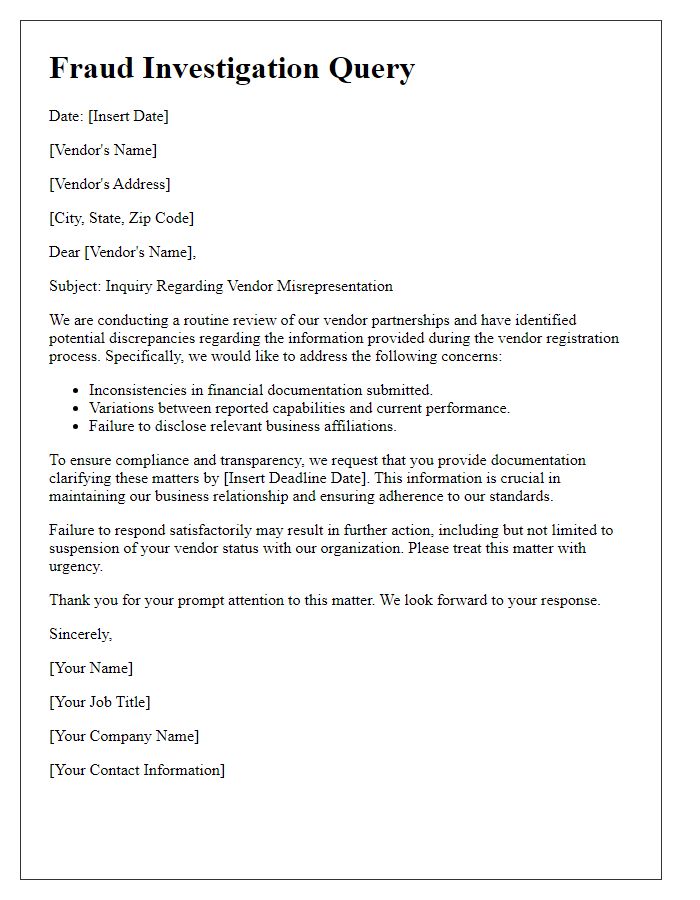

Letter template of fraud investigation query for vendor misrepresentation.

Comments